Complaint Review: Racetrac Gas Station - Davie Florida

- Racetrac Gas Station Davie Road Extension Davie, Florida United States of America

- Phone:

- Web:

- Category: Oil Companies

Racetrac Gas Station Spent $15 and a hold was placed on my bank account for $65 Davie Florida

*General Comment: Also in FLA

*General Comment: Not A Ripoff

*Consumer Comment: Here it is..

*Consumer Comment: But is there a point??...

*Consumer Comment: Exactly..

*Consumer Comment: Why are there different holds for different gas stations?

*Consumer Comment: Response to Ronny G, must be a California thing!

*General Comment: Nope, not a clue...

*Consumer Comment: concluded?

*Consumer Comment: I have more then a "clue"..

*General Comment: Poor poor Ronny

*Consumer Comment: And even more to say..

*Consumer Comment: I should add..

*Consumer Comment: Wrong...and wronger...

*Consumer Suggestion: Simple soultion! Select "debit" and use your PIN#

*General Comment: Consent to the hold...

*Consumer Comment: I did notice...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

On Oct. 20, 2010 I purchased $14.27 worth of gas at the Racetrac station on Davie Road Extension, Davie, FL using my debit card at the pump. The transaction was reported on my account statement online as a pending transaction; however, an additional $65 hold was placed on my account without my knowledge that caused my account to become overdrawn and I have been unable to access my money for the past three days. No notice from the gas station was given that they were doing this. (I was unable to purchase groceries because I could not use my debit card.)

I was informed by my bank that this is a new law that went into effect about 6 weeks ago allowing gas stations to place holds up to $100 over the amount of purchase on your bank account. UNFAIR!!!

Gas Stations should be required to advise customers that unless they want a hold put on their bank account, they have to pay in cash. Also, some public notice should have been made in advance of this practice going into effect.

This report was posted on Ripoff Report on 10/23/2010 07:40 AM and is a permanent record located here: https://www.ripoffreport.com/reports/racetrac-gas-station/davie-florida-/racetrac-gas-station-spent-15-and-a-hold-was-placed-on-my-bank-account-for-65-davie-flo-654330. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#17 General Comment

Also in FLA

AUTHOR: Gride - (U.S.A.)

SUBMITTED: Tuesday, December 18, 2012

Just happened to me Dec 2012,,, but not at racetrack so odd name station, but it does happen and still happeneing in FLA,,, out $60 may the burn in their own oil. Working 2 jobs, for what!

#16 General Comment

Not A Ripoff

AUTHOR: scn.newman - (United States of America)

SUBMITTED: Friday, April 08, 2011

This is not the gas station ripping you off. BJ's Wholesale Club has a $75.00 hold and this is not uncommon, its actually the standard. Credit card companies are also part of the problem here as often a credit card company will also place holds that will drop off in a few days.

You are not getting ripped off, put it this way. You go to Applebee's and your credit card/debit card is not total for a few days, the tip you left on the card may take 3 days to tabulate.

Your debit card get a "hold" until the bill is considered settled at a gas station. Avoid this, pay cash. Or keep more money in your account so the hold does not really matter.

Steve

#15 Consumer Comment

Here it is..

AUTHOR: Ronny g - (USA)

SUBMITTED: Thursday, October 28, 2010

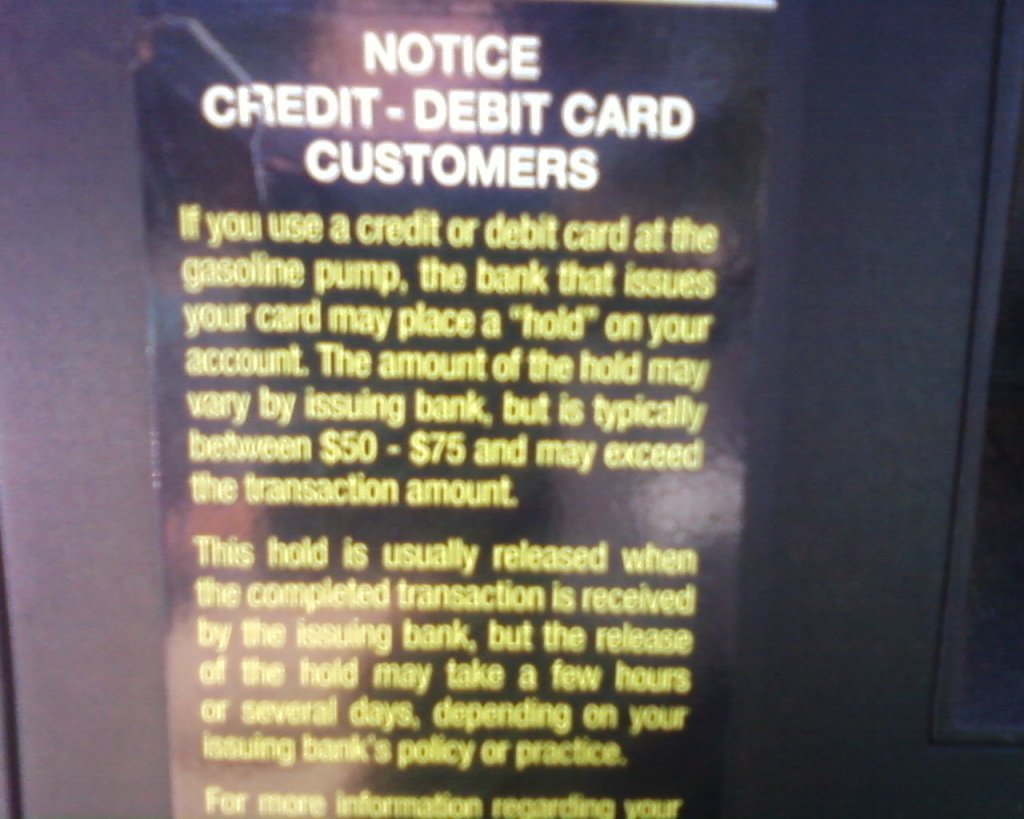

If anyone has trouble reading it I will type it here as best I can make out from the phone picture.

IF YOU USE A CREDIT OR DEBIT CARD AT THE GASOLINE PUMP THE BANK THAT ISSUES YOUR CARD MAY PLACE A "HOLD" ON YOUR ACCOUNT. THE AMOUNT OF THE HOLD MAY VARY BY ISSUING BANK , BUT IS TYPICALLY BETWEEN $50-$75 AND MAY EXCEED THE TRANSACTION AMOUNT.

THE HOLD IS USUALLY RELEASED WHEN THE COMPLETED TRANSACTION IS RECEIVED BY THE ISSUING BANK, BUT THE RELEASE OF THE HOLD MAY TAKE A FEW HOURS OR SEVERAL DAYS, DEPENDING ON YOUR ISSUING BANK'S POLICY OR PRACTICE.

So, either this is a blatant lie, deception and fraud, or it can be concluded that...

The bank places the hold.

The amount of the hold varies by bank.

The length of time of the hold depends upon the banks policy or practice.

What also can be observed, is some "may" (the word "may" is used 4 times), "but", "usually" and a "typically" thrown in for good measure. Is this the best way for consumers to keep track? Granted, as long as this warning is clearly visible to the consumer you can't really be surprised if you experience this type of hold, but regardless...this decal is placing 100% of the hold, the hold amount, and the hold time on the bank..and it states this hold can be applied to a credit or DEBIT card. Plain English..with a lot of "may" with a dash of "but" and "usually".

#14 Consumer Comment

But is there a point??...

AUTHOR: Ronny g - (USA)

SUBMITTED: Wednesday, October 27, 2010

..to any of this banter?

This is how I see the bottom line.

I can not yet post the picture of the gas pump decal on the pump from the local gas station (66) I use because I used a cell phone cam and my cell service is down. (surprise ATT in Southern CA.) I will post it in the near future.

But for the sake of this report I have carefully read the decal.

It is small and not something you would notice unless looking for it..but it states whether you chose debit or credit, a hold of 50-75 dollars "may" be placed on the account for up to 3 days. It also states this is due to the bank. So what else can I say? Maybe the gas station is lying and it is fraudulent information on the decal?

All I can say for sure..and I posted the examples, is this has been going on for YEARS, it is nothing new and nothing due to recent banking customers who complained about fees and were simply irresponsible to keep a register so everyone else must now suffer.

It is due to human nature as it always is, was and will be...and banking greed.

Yes, the bank should protect itself. Yes, the merchant wants assurance it will get paid. Yes, some customers will put in more gas then the account can cover.

But, if overdrafts were such a bad thing for the banks, why did they go through all the tactics and "engineering" and encouraging to overdraft..and the current encouraging to opt into overdraft protection if they really had anything to lose? On the contrary, it is evident they did/do not lose, but make out quite handsomely.

I again state, some or perhaps even many customers were careless, irresponsible, did not keep a register etc...but that is not a crime. What the banks did is apparently a crime or they would not be LOSING lawsuits, nor would any lawsuits even make it to trial.

If the banks had simply played fair, nothing would have had to change, and no one who overdrafted due to negligence or error would have a legitimate complaint.

All the banks had to do was properly disclose the overdraft protection policies regarding the DEBIT card, not "decide" with malice at the risk they new d**n well could land them in a lawsuit, and hurt customers to re-sequencing debit card transactions from highest amount to lowest amount, manipulate statements,and not "commingle" or use the "secret shadow line" to cause the proverbial $35.00 cup of coffee.

If they just played fair, I certainly would not be on this side of the debate..I think most of you who know me..know that is the truth.

The reason the banks are placing the holds at the pump, is most likely due to the gas companies requesting or demanding this. The bank would MUCH prefer the overdraft...that is OBVIOUS. So I change my point of view in hindsight regarding these holds. However, I believe a future class action lawsuit against the banking industry, will be failure to properly disclose these types of holds and the hardship/inconvenience/fees it caused loyal customers. Mark my words. Double mark my words. If it turns out this was not the banks fault, then others will be facing trial. Not due to the holds themselves mind you..but due to not properly disclosing which in my opinion and many others, is indefensibly a form and/or degree of THEFT.

#13 Consumer Comment

Exactly..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, October 26, 2010

Wouldn't it be a consistent amount held for a consistent period of time if the bank was the party that initiated the hold?

- BINGO we have a winner. You see the bank does "techically" hold the money, but they hold it at the request of the Gas Station.

The amount of the hold does appear to vary, as I have had different experiences with different gas stations, than other people have reported. Regardless of how I pay at the pump, the actual amount generally(but not always) gets posted by the next business day. I haven't gotten crazy enough(yet) to go pump some gas and immediatly check my on-line account to see what is happening. So I can't say if a PIN based transaction at different gas stations immediatly post the full and correct amount or get caught in some hold.

If you attempt to call the bank and say that you want them to release the hold they will tell you that they can not. Why? Because the Gas station has requested the money to be held so they have to be the one to release it. It would be similar(as similar as we can get) of you calling up to reserve a table at a resturant only to find out when you arrive that someone else called and canceled your reservation.

A hold can generally be released in one of 3 ways. A)The Merchant releases the hold with no purchase, B)The merchant completes the sale and release the hold, C)The hold expires and is released automatically by the bank. Unfortunatly most Employees have no clue how to release the hold, and I doubt that most even would have the authority to do so even if they did know.

So if you want to avoid the possibility of any unneeded holds go inside to pay. If you want to make any complaints about the "hold" and not being notified, complain to the station owner.

#12 Consumer Comment

Why are there different holds for different gas stations?

AUTHOR: MovingForward - (United States of America)

SUBMITTED: Tuesday, October 26, 2010

Ronnie I read the sticker you posted. It did say to contact your financial institution and not the local gas station. What confuses me is why would my bank hold different amounts from different gas stations?

I find it difficult to believe that the bank has a separate contract with each individual gas station on the amount of the hold and the length of the hold. Yet, some gas stations have zero hold - they only take out what you actually use. Others take out the amount you use + $75 (in separate fees) and hold the $75 for 3 days, or more. There are different hold amounts posted all over this board. In this original post it was $65. Why would the bank/financial institution have different hold policies for different gas stations? Wouldn't it be a consistent amount held for a consistent period of time if the bank was the party that initiated the hold?

So, although the sticker you posted said "check with your financial institution", how do you (or anyone else) explain the different hold amounts that vary by each individual gas station?

#11 Consumer Comment

Response to Ronny G, must be a California thing!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, October 26, 2010

Ronny G, Well, I buy gas almost daily at a variety of different gas stations here in FLORIDA. I always pay at the pump, and always use my debit card, and always input my pin.

Guess what? I have NEVER experienced any kind of long hold as you guys described. Not once. Therefore, I wasn't giving advice, I was just telling you all how it works, HERE, FOR ME.

Must be a California thing in your case. And, I don't need "overdaraft protection" for 2 reasons. The first is that I keep an accurate checkbook register, and the second is that I have PLENTY of money!

#10 General Comment

Nope, not a clue...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Monday, October 25, 2010

Because you feel that everything that goes wrong when a bank is involved is the bank's fault. Some times it is. Most times it's not. (Oooops, there I go again, defending the bank.)

The hold request comes from the gas station, NOT the bank. If the bank did it then one bank may place the hold and another not. If the station requests the hold, based on how they present the information to the bank, they request the hold for any bank used.

The only part that's decided by the bank is the length of the hold. All banks that I know of the hold is for 3 business days.

Have I checked every gas pump to look for the sticker, no. But I've seen the sticker on every gas pump that I use. If I find a station that requests the hold, I either pay cash or don't use that station. But if I see the sticker and continue the purchase then I am agreeing that the gas station can place the hold.

We all know you dislike banks but really, it's bad form to highjack reports and make them about something that has nothing to do with the OP.

#9 Consumer Comment

concluded?

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 25, 2010

I found some online but will also post the actual one from my local station later on. The decal on the pump I use is more detailed...but this one also clearly states the hold is a result of selecting DEBIT, the hold is placed by the financial institution SPECIFICALLY(NOT the gas station or gas company), and that the hold may exceed the purchase amount. The decal I will take the actual picture of states the time frame (up to 3 days) and amounts from 50 to 75 dollars. The writing is also much smaller, I hope it is readable when I post it, I am using a cell phone cam and it does not do closeups well.

I had to leave a link address since this site seems to have a glitch and would not allow me to post the pic.

http://www.my3cents.com/review_images/78337.jpg

#8 Consumer Comment

I have more then a "clue"..

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 25, 2010

And I did not have to use name calling, I chose to. sometimes the name fits.

It's simple. There's a tag posted on the gas pump that says there may be a hold. If you continue to pump the gas you are agreeing to the placement of the hold. Which is at the request of the gas station not the "evil" banks. But using the card as debit will result in only the amount paid for being held.

Oh I agree it is simple. Except for the fact that we do not know for sure that every pump has the decal. We also know (well I know) that the "warning" if on the pump, is so small that I did not notice it until I looked for it. I also know what it says. It says that if you select debit and use a PIN, that there will be a hold from 50 to 75 dollars DEPENDING ON YOUR BANK, and the hold can last for up to 3 days DEPENDING ON YOUR BANK. I will even goes as far as posting a picture of the decal. I need gas in the morning and if I remember I will post it here when I get home from work.

I can say I have not noticed any fees to be held for 3 days for paying debit at the pump..but I can say I have noticed it happens. Perhaps this varies state to state but either way it is a safeguard to prevent overdrafting and as long as the customer is properly notified of the possible hold, I see nothing wrong with it at this point in time.

This also does not explain how other merchants can place holds (bars, restaurants, hotels, rentals etc) and not inform the customer. I know this happens because it happened to me more then once. Now since I did not know about the holds, neither the amount or length of time, it could cause an overdraft (well at least in before the reg changes) and there would be nothing my register would have told me to stop it. This was something I have stated time and time again when arguing the register defense. I know you bank defenders love to find any possible reason to blame a bank customer when they are victim to the banks tactics and circumstance..but these are FACTS..not defenses.

But then again this goes against your mantra of "banks are evil and no one has any personal responsibilty" so I guess you won't understand this either.

As I have also stated to Robert on previous posts, I do not recall any specific times I called the banks evil, but nonetheless what they have done to many customers certainly qualifies as evil in many senses of the term.

As far as the claim that I ever stated or implied no one has any personal responsibility I call shenanigans. Look at any older bank overdraft scam reports and find ANYWHERE on ANYONE of them where I ever stated or implied no one has any personal responsibility, or that no one should take responsibility.

What I do know I have stated and implied in the past, is that the banks as well need to take personal responsibility, or they as is already in effect to wit, will be forced to. By anyone defending these banks knowing well and good what they have done, and continue to do..is essentially supporting a known rip off.

I have posted time and time what I believed the banks were doing. The lawsuit in California against Wells Fargo proved it that case. The rest will follow. What else have they done wrong??

Exploiting regulations designed to save customers money, in order to scam money from customers

To this day, using many and any deceptive means as possible to encourage customers with "urgency" to sign up for overdraft protection. I wonder how the customers will feel the first time they go over at the pump after the bank convinced them how much they need this service, only to find it cost them in the maximum amount in fees the bank can charge per day? That ought to make some interesting reports.

The banks telling us to use "credit" instead of debit to prevent unauthorized use. Well then explain...why if someone gets a hold of my card and uses credit it will work? The bank does not care one bit about the safety factor. What they care about is the consequences of selecting credit with a debit card. Which is longer time before posting, and greater chance of overdrafting at the pump (it only checks with a dollar when credit is used, which seems to be the default setting unless you select debit PIN at the pump, or if the gas station does not take credit).

I could go on and on..but if my point isn't proven by now to some, it never will be...just an exercise in futility. The banks EARNED the mistrust they have now, and the bad reputation they have now. Sure some customers were careless and some are not the brightest. But did they commit ethical or seemingly criminal activity? Did they conduct fraud and schemes to rip the bank off? No, they did not. Who did? Ask the plaintiffs, their attorneys and the Judges. Will the end result in this possibly cause others to have to pay more for something? Possibly. But there is no one to blame for this but the banks and their greed. If they were not swindling customers (regardless if the customers were careless), there would be no reason for regulation changes, and no grounds for the law suits.

Now THAT is simple.

#7 General Comment

Poor poor Ronny

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Monday, October 25, 2010

Doesn't have a clue about the real world and has to use name calling.

It's simple. There's a tag posted on the gas pump that says there may be a hold. If you continue to pump the gas you are agreeing to the placement of the hold. Which is at the request of the gas station not the "evil" banks. But using the card as debit will result in only the amount paid for being held.

But then again this goes against your mantra of "banks are evil and no one has any personal responsibilty" so I guess you won't understand this either.

#6 Consumer Comment

And even more to say..

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 25, 2010

..I imagine it appears I was harsh in my response to Striderqs reply.

But here is why..

"You consent to the hold when you decide to go through with the purchase."

Says who? This is not anything new. I personally have been subject to potential overdraft fees (before any of the recent regulation changes and lawsuit winnings mind you) due to merchant holds I was 100% unaware of... as I am sure many many others have as well. Most of the times I caught them on my online statement before it could cause an overdraft but the best possible defense to this scheme since it renders the register useless, is to not sign up for overdraft protection. Now we have the choice, before most of us did not.

"If you don't want the hold: use cash or pay inside using the card as

debit where the exact amount of purchase will be held. This is the

result of the few who couldn't keep a register complaining and now

causing problems for the many who never had problems before.

"

Now this is the arrogant presumptuous self righteous statement that pisses me off.

This is another example of a typical bank defender attempting to blame anyone but the banks for the problems the BANKS have caused in reality, and is continuing to be proven in courts of law. The so called "few" complaining may not have had to complain or sue the banks if the banks had done nothing wrong to begin with.

I guess Striderq implies it was less of a problem that the banks fleeced BILLIONS of dollars by their self admitted "engineering" and scamming tactics, then the few people who will complain about an unknown hold at the gas pump. The thing is, these holds were occurring before the regulation changes as well....but no one noticed since the banks would authorize the charges.... overdraft or not...

I would think the hold amounts have increased due to the new regulations but the regulation changes were forced onto the banks not because a "few" complained..but because it was concluded what the banks were doing (which included failure to properly disclose), was morally, ethically and apparently legally WRONG.

The difference the way I see it, is I see both sides. I know many have overdrafted on their accounts because they did not keep accurate track of their accounts. The thing is on just about every report I read regarding unjust overdraft fees (which these complaints have essentially ended since the regulation changes went into effect), is the customers were taking responsibility for the legitimate overdrafts and willing to pay the fee amount as agreed. Where the complaints had merit, is any additional fees that were the result of being automatically enrolled into overdraft coverage on the debit card, combined with the re-sequencing of transactions and the "secret shadow line". Most banks now limit the number of OD fees they will charge a day to 3, but there was a time when many banks could turn one legitimate overdraft into as many as 10.It was found that around 25% of the banks were conducting these tactics. I am sure most low balance consumers would prefer a hold at the pump, then one overdraft caused by an honest mistake leading to hundreds of dollars in fees.

But regardless...I have been staunchly against these holds if they are not properly disclosed to the customer at the time of the transaction. It always had the potential to cause problems..before the regulation changes and now apparently after. Only difference is before the changes this would often end up costing the customer a butt load in fees which only made the banks richer. And trying to figure this out using the online statement or calling the bank often lead to further confusion and no resolution. The register can not record a hold if the consumer is unaware it came and went.

An inconvenience to pay inside? Perhaps..but much better then getting scammed by the bank and it cost no fees or holds.

#5 Consumer Comment

I should add..

AUTHOR: Ronny g - (USA)

SUBMITTED: Sunday, October 24, 2010

Steve's advice is correct..IF you are paying at the counter. If you are paying at the pump and select debit and use a PIN...expect a hold for up to 3 days (the dollar amounts possible should be posted on a decal affixed to the pump near the screen). It clearly states this happens if you select "debit".

Although I have never encountered a gas pump hold longer then several hours (the longest once was from 7pm to around 5am), I imagine these holds can last up to 3 days as posted. I have had restaurants and other merchants that seem to place holds until confronted (as long as a week)..but as far as the gas pump it is really no different then it ever was..if you pump in more then you can pay for and the bank covers it..you will get an overdraft fee.

However, if you have not signed up for overdraft coverage, the transaction will be declined at the pump if the hold amount is more then you have available. Yes you won't be able to pump..but you also will not get a fee. If you have anything in the account you can use that amount on the card and pay inside where no hold will be placed.

As well if you are not opted into OD protection, transactions will no longer be approved with the debit card until a deposit is made in the event you overdraft at the pump. If you have signed up for overdraft protection (coverage) with the debit card..you risk transactions being approved at 35 dollars or so a pop since transactions will be approved when the account is depleted. No difference really other then the bank can no longer force you to have the coverage, or automatically enroll you into the service without your signature confirmation on a specific contract.

Simple really and not much to debate.

What is up for debate and requires investigation as far as myself and others are concerned, are holds that are placed on the account where the card holder is not effectively or properly notified. Any holds placed where a consumer is not notified should be outlawed as it apparently can cause hardship and overdrafts. And the most accurate register keeper on Earth has no way of knowing a hold is placed against the account unless they are properly notified..I hope anyone with an ounce of common sense and decency can agree.

#4 Consumer Comment

Wrong...and wronger...

AUTHOR: Ronny g - (USA)

SUBMITTED: Sunday, October 24, 2010

First in response to Striderq...

Uhh...what good does this do if the customer if not aware that there is going to be a hold when the purchase if made??????????????????????? Perhaps if this happens to you it would be a different story? Typical ignorant one sided bank defending d****e bag you are.

Yes, the advice is good (as I left before you did), to use cash or pre pay..but this is only advice for those that are not aware a purchase with the debit card can be subject to a hold like this. And these types of holds are responsible for overdrafts that would not be recorded in the register..has how can someone record a dollar amount they are UNAWARE will be held against the account? Care to answer that one????

The changes were in part due to some perhaps who complained and should have kept a register...but lets look at the courts order in a recent lawsuit... not "settled"...but WON in California against Wells Fargo, and what many other banks are currently facing in Miami where all the unfair overdraft fee lawsuits have been consolidated.

A copy of the Court's order can be found here <---(click the link), but I will note some key points...

1)This action does not challenge the amount of a single overdraft fee (currently $35). That is accepted as a given. Rather, the essence of this case is that Wells Fargo has devised a bookkeeping device to turn what would ordinarily be one overdraft into as many as ten overdrafts.

2)The draconian impact of this bookkeeping device has then been exacerbated through closely allied practices specifically engineered as the bank put it to multiply the adverse impact of this bookkeeping device.

3)The bank went to considerable effort to hide these manipulations while constructing a facade of phony disclosure.

4)This changed in April 2001. Then, Wells Fargo did an about-face in California

and began posting debit-card purchases in highest-to-lowest order. The reversal of the banks previous low-to-high posting order had the immediate effect of maximizing the number of overdraft fees imposed on customers. This was exactly the reason that the bank made the switch.

5)The switch in April 2001 to high-to-low posting in California was followed by two

closely allied practices, both intentionally engineered to use the banks own term at the time to amplify the overdraft-multiplying effect of high-to-low ordering: (1) a switch to commingling of debit-card purchases with checks and automated clearing house (ACH) transactions in December 2001, and (2) the deployment of a secret shadow line in May 2002 to authorize debit-card purchases into overdrafts.

For more info just click the link I left above and read the entire Courts Order.

Now in response to Steve who I think meant well..but left HORRIBLE advice...

If you use your debit card as a credit card..it generally only will run though one dollar to check the the account is good. In the case of this report that would have prevented the problem. HOWEVER it is specifically WHEN you select debit THAT is when is holds the huge amount. (although I am unaware if this differs from state to state).Typically it only holds the amount for a very short time..but it can depend. The decal on the pump states this length of time is entirely up to the bank..but you know what?...I do not trust the merchant, a sticker on the pump..nor ESPECIALLY the bank.

I do use my debit card at the pump when I know I have plenty in the account. When I am below a certain amount I use cash or walk inside and pre pay. The problem is really when the customer is opted into any kind of overdraft protection. If the customer pumps in more gas then the account can cover...and/or if the hold plus the amount of gas pumped depletes the account, this is where the trouble begins.

Now IF the customer is not aware of the overdraft...what happens as they use the card again throughout the day??? Overdraft after overdraft and 35 bucks a pop, plus added on fees due to bank manipulations. If the customer is NOT opted in and is unaware of an overdraft, the card is DECLINED the next time they try to use it.

Hence, they can NOT POSSIBLY get an overdraft fee, and can then check the account to determine why it is overdrafting. They will then see the reason was a hold they were unaware of, and have the opportunity to deal with it BEFORE the bank gets to rip them off. This to me seems more then fair.

Steve, if you really believe what you stated is true, I feel sorry for you when you are zinged by the bank. It will happen eventually. It is no less then financial Russian roulette.

#3 Consumer Suggestion

Simple soultion! Select "debit" and use your PIN#

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, October 24, 2010

I have encountered this problem myself and realized that it happened only if I used my debit card as "credit".

Always select "debit" and use your PIN#.

If you do this, ONLY the amount you see on the pump will be taken from your account.

#2 General Comment

Consent to the hold...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Sunday, October 24, 2010

You consent to the hold when you decide to go through with the purchase. If you don't want the hold: use cash or pay inside using the card as debit where the exact amount of purchase will be held. This is the result of the few who couldn't keep a register complaining and now causing problems for the many who never had problems before.

#1 Consumer Comment

I did notice...

AUTHOR: Ronny g - (USA)

SUBMITTED: Saturday, October 23, 2010

..a decal on the gas pumps in my area do warn of the hold. But it is really small, you have to look for it.

The best advice really is to pay inside (tell the attendant how much you want before pumping), or better yet as you stated use cash. The problem is happening because the banks can no longer automatically enroll debit card customers into overdraft protection..or force it on you. This is actually a good thing other then the gas pump situation. It can and has saved low balance customers hundreds of dollars in fees caused by an honest mistake or holds like this. The card will be declined once the account is depleted..which before the regulation changes the bank would allow the card to be used ad infinitum, and even though you were not aware you were overdrafting, the transactions would be approved, and you would suffer a $35.00 loss each and every time the card was used no matter how small the transaction..and then have more fees on top of those due to bank posting time manipulations and delays.

If they did not put the hold then some people with a low balance would pump in more gas then the account can cover, get an overdraft fee..and then complain that the bank "allowed" the overdraft even though the customer did not sign up for the protection. So far this seems to be how the banks are dealing with it.

I agree 100% that there should be a clear warning on the screen of the hold so the customer can choose to pay by other means if the hold will cause a hardship. This goes as well for restaurants, bars, hotels , rentals etc...no merchant or bank should ever be allowed to place any hold without the customers acknowledgment and consent. I am amazed there are no laws that forbid this practice.

The system is flawed bottom line and is supposedly being looked into. No telling how long it will take to fix or what they will do so we all have to be extra careful at the pump now if we keep a low balance.

Advertisers above have met our

strict standards for business conduct.