Complaint Review: SYNCHRONY BANK/CARE CREDIT - Orlando Florida

- SYNCHRONY BANK/CARE CREDIT PO Box 900061 Orlando, Florida United States

- Phone: 1-866-893-7864

- Web: Carecredit.com

- Category: Credit & Debt Services

SYNCHRONY BANK/CARE CREDIT SYNCHRONY BANK Dropped my credit limit after 3 years of flawless payment history. Orlando Florida

*Consumer Comment: They Have That Right

*Consumer Comment: Sure, They Just Decided To Pixk On You!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

The only reason I got the Care Credit card through Synchrony Bank 3 years ago, was because my dog was starting to get old and having health issues, and I knew it would come in handy in case of emergencies for her. so I applied, got approved for $8000 line of credit.

Over the course of the last 3 years I have had to use the card for a few instances that have come up with her health issues that have occured, the last one being this past August where I had to make the decision to let my girl go.

Over the course of these three years the bills have totaled a little over $5000, a few of the charges I have chosen the deferred payment options, I have been making the payments, more than the minium on most. One of the things that has me very confused is, Why aren't these payments going toward paying off the amounts towards the deferred promotions?

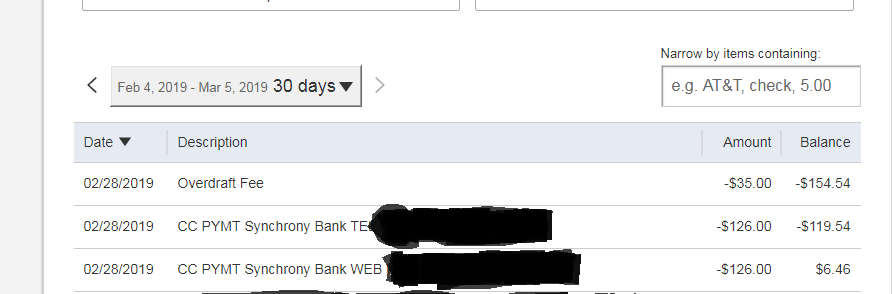

For a few months I've had a $78.00 outstanding amount on one of the deferred promotions have made $200 payments. and the $78.00 deferred promotion amount is still showing sitting there, same way with a $13.00 one. Why aren't these payments going to paying those off?

I have a couple others that are evern highter that the payments arent even touching that I know I will get slapped with outrageous interest. I'm sure that's their point. This is how they make their money.

I went online to make my payment last month, first thing I noticed was my available credit was much lower than it was, so I checked my credit limit, it had been lowered to $6000, which makes my balance just under my credit limit, it also raised my credit utilization percentage.

last week I finally get a letter in the mail from Synchrony Bank an explaination as to why they lowered my credit limit, they state in they letter they periodically pull your credit report, and according to my credit report "Not Enough listed Realestate " on my credit report. they feel im a credit risk?

So I don't own a house I'm a credit risk? I didn't own one 3 years ago either when I was approved for the $8000 credit limit. I think it's just a Bullsh*t excuse to drop the credit limit and a way to screw people's credit. I have had a flawless payment history with Care Credit/Synchrony Bank for the last 3 years. Never missed a payment. or was never late. and this is the way they treat their customers????

This report was posted on Ripoff Report on 12/03/2019 11:18 PM and is a permanent record located here: https://www.ripoffreport.com/report/synchrony-bankcare-credit/orlando-florida-bank-dropped-1488580. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

They Have That Right

AUTHOR: Jim - (United States)

SUBMITTED: Monday, December 09, 2019

You'll find very few people who love this company, yet your complaint would have nothing to do with why people don't like this company. As you point out, this company makes money (and a lot of it) when people choose not to pay off their balances timely. There is no blame associated with that - life happens. BUT, the company, like most others, does periodically review the credit of their customers. You agreed to that when you signed up for the account.

I guess for starters, they can issue, lower or increase your credit for any reason - the fact they gave you a reason for the change in your credit limit, is at least interesting, but not particularly relevant. If you are concerned about such things as your credit utilization, or your overall credit score, you would do well to not rely on this account for either of these things, simply because of the company's aggressive nature of increasing or lowering limits. You would be better off simply getting rid of the credit limit and building your credit through other means.

Insofar as the deferred promotions, I would simply call and ask them those questions; they are certainly not perfect and I know people who have needed to deal with them on improper payment applications before, and they were pretty good about fixing errors on their end.

#1 Consumer Comment

Sure, They Just Decided To Pixk On You!

AUTHOR: Momo - (United States)

SUBMITTED: Sunday, December 08, 2019

EVERYBODY KNOWS credit card companies make money from interest. If somebody had an $8000 balance, they will make more money in interest than somebody who has a $5000 balance. What you're expecting people to believe is out of the clear blue sky and for absolutely no reason, they decided to not make more money from your account, right?

Not only that, they singled you out to make your credit score lower, after all, they have a special department which looks for devious ways to "get" people! Just how stupid do you think we are? For whatever reason, they thought you are not as good a credit risk as you were when you received the card.

Be it other accounts you may have, changes in other financial conditions, they didn't want to trust you with an $8000 limit. It happens all the time and if you would of READ your agreement, you would have been told in advance this could happen and no, I don't work for them.

Advertisers above have met our

strict standards for business conduct.