Complaint Review: Windham Professionals - Salem, New Hampshire Nationwide

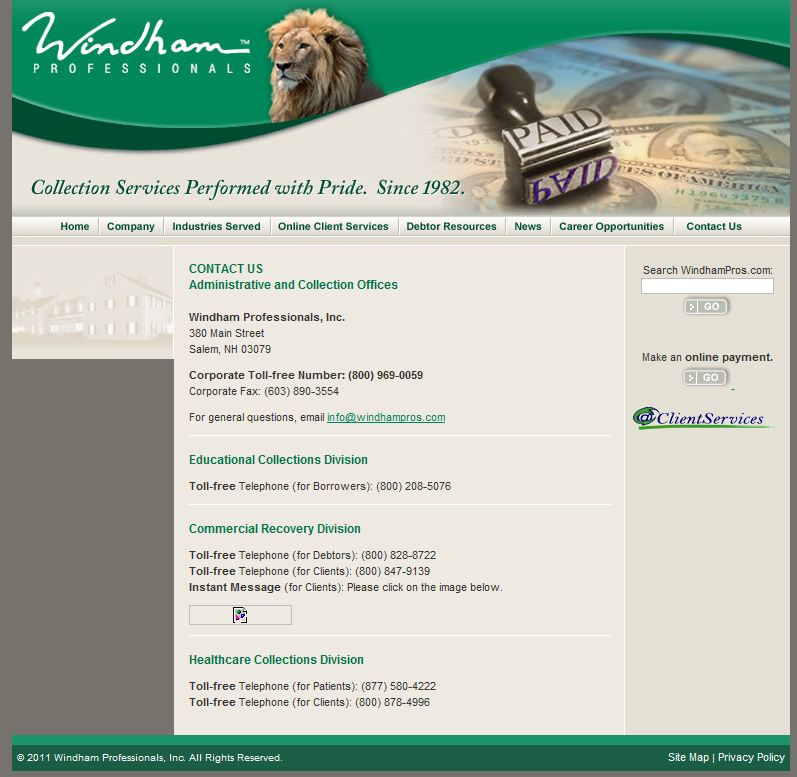

- Windham Professionals 380 Main St Nationwide U.S.A.

- Phone: (80-969-0059

- Web:

- Category: Collection Agency's

Windham Professionals Windham Pros - student loan repayment. Fraudulent Salem New Hampshire

*REBUTTAL Owner of company: Clearly written by a Windham employee

*UPDATE Employee: typical attitudes towards collection agencies

*Consumer Comment: RE:

*Consumer Comment: RE:

*Consumer Comment: RE:

*Consumer Comment: RE:

*Consumer Comment: Suggestion..

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have approx 20K in student loans in default.

I hadn't had any correspondence from the collection agency who now owns my debt, Windham Professionals, in several years.

Out of the blue, I receive a call from a Windham rep (again, 3 or 4 years since any contact) asking me to pay the loan in full. I negotiated a payment of $125/month. This negotiation came with some amount of hassle. I asked to fill out an Income & Expenses form - they denied me that, saying it was unnecessary and kept insisting on their unreasonable payment. Finally, when push came to shove and I basically told them to accept my offer or begin the garnishment process which I will in turn challenge through the appropriate channels, the agreed to my terms.

I then asked for a and EFT (Electronic Funds Transfer authorization document) and the rep told me that they do not operate this way - they operate on verbal authorization, which I gave, albeit with some amount of reservation.

Now, a month later, after Windham has already made the first of the scheduled monthly withdrawals of $125.00, the same Windham rep just left me a voice mail telling me that we really need to get this thing squared away or the wage garnishment process will begin.

What gives? I have been reading volumes of complaints about this collection agency on the internet, people accusing their collection attempts of being scams, etc.

What should I/can I do now to ensure that I have not stepped into some sort of a scam, and that I am truly paying toward my student loan.

Is this collection agency authorized to garnish my wages to collect on these defaulted federal (EdFund) loans? Should I be wary of this situation?

Chris h.

Huntington Beac, California

U.S.A.

This report was posted on Ripoff Report on 01/13/2009 03:45 PM and is a permanent record located here: https://www.ripoffreport.com/reports/windham-professionals/nationwide/windham-professionals-windham-pros-student-loan-repayment-fraudulent-salem-new-hampshi-411673. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 REBUTTAL Owner of company

Clearly written by a Windham employee

AUTHOR: Class Action Lawsuit Windham Professionals - ()

SUBMITTED: Saturday, March 15, 2014

Another lie that has obviously been written a Windham employee, I can tell because I recognise the altitude, the snide comments and scarcasim. I've been dealing with reps at Windham and I can attest to the fact that they do NOT offer "multiple Programs" as stated. They do not "work with you" to set a reasonable payment. They, however will tell you how much you will pay and if you don't pay that amount, they will garnish your wages....Plain and Simple. This is their apparent protocol for student loan collection because they get away with an administrative wage garnishment which has No over-site and doesn't require a court order. With this much power , they have no incentive to "Work with you". They garnished my wages despite lack of Credible documentation that the debt is valid. How they were awarded a Contract with the DOE is a frightening mystery.

#6 UPDATE Employee

typical attitudes towards collection agencies

AUTHOR: RESPONSIBLEADULT - (United States of America)

SUBMITTED: Thursday, February 24, 2011

1st off it is not the collection agencies responsibilty to get in touch with you prior to the account being placed, therfore if the original lender doesnt place the account for 1,2,3+ yrs then you can not be upset that all of a sudden you start getting collection calls. It is the borrowers responsibilty to know what they have borrowed and the status of outstanding debt. 2nd Windham professionals is a very reputable collection agency and no matter how upstanding of a collection agency you are, no one is ever going to go online and write good/positive things. With that being said if you google any collection agency all you are going to find is negative statements. Windham can and will garnish debtors paychecks if they fail to pay back their federal loan obligations. This is a last resort however and is a much more expensive way to pay back your loan. We offer multiple programs to get borrowers back on their feet and actually in thousands upon thousands of borrowers take us up on these programs a year. It is human nature for someone who puts him/her self into a bad financial situation to get defensive and take it out on the people just doing there job. $125 a month on 20k is more than resonable. You tell me one bank that you could walk into and say let me borrow 20k and give me a monthly payment of $125, not happening. Trust me when i tell you this is not a scam. Windham professinals has been operating for 25+ years and continues to grow and is now contracted by the DOE.

Please remember one thing it is not the collection agency that put you in this place and if we didnt do our job abd do it sucessful than our children and their children may not get the educational funds to get the same education you did. If we just sat back and let everyone default on their loans and just say oh well dont worry about it you dont have to pay then what kind of world would we be in.... Oh wait what? we might already be in that world.

#5 Consumer Comment

Suggestion..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, January 13, 2009

The first thing to do is to STOP TALKING TO THEM ON THE PHONE, all communications must be in writing. This is your only proof of what was said and agreed to.

Send them a Certified Letter with Return Receipt requesting Debt Validation. This will prove that you owe the debt and that they are the company that has the legal right to collect on it. Once you get validation you need to send them an offer of your payment. This includes the total amount you are going to pay and the amount you will pay every month. Again send this by Certified Mail with Return Receipt, but do not sign it. They will send you back an agreement or a counter-offer. If you get something you can work with, then keep up your end. If they ever tried to take it to court this would be a solid defense for you. There are plenty of sites you can search for sample letters of both of these types of letters.

Now the bad news. Yours seems to be a government backed student loan and these do not have a Statute of Limitations, however since you agreed and made a payment this is a mute point anyways. This means that they can attempt to collect on it forever. You can also have your wages garnished in every state for Student Loan Debt. Normally they would have to get a judgment from a court first, however Student Loans have the ability to do an "administrative" garnishment where a judgment is not required before they start the process. You also have the possibility of having any Federal Tax Refund intercepted and put toward any Student Loan debt. On top of this Bankruptcy is not an option for you either to have the debt erased.

Some deeper reality for you. You are not going to get any company to agree to $125 a month on 20K debt, even with no interest that is over a 13 year payoff. Now, if you can truly only afford $125 a month, that is what they might award as the garnishment. But in some cases they can take up to 25% of your GROSS wages after taxes and they don't care what other debts you have. The only debts that take priority over Student Loans is Child/Spousal Support, or Back Taxes.

#4 Consumer Comment

RE:

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, January 13, 2009

Student loan debt has no statute of limitations...which gives these sleazy operators a license to harass people with defaulted loan debt.

If the situation becomes worse...Chapter 13 bankruptcy might be an option and you might even use that as a negotiation threat. Chapter 13 does NOT discharge debt...it's the version of BK where you pay back loans under a supervised repayment plan over 3-5 years. Student loans can be included in this form of BK....but NOT Chapter 7.

#3 Consumer Comment

RE:

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, January 13, 2009

Student loan debt has no statute of limitations...which gives these sleazy operators a license to harass people with defaulted loan debt.

If the situation becomes worse...Chapter 13 bankruptcy might be an option and you might even use that as a negotiation threat. Chapter 13 does NOT discharge debt...it's the version of BK where you pay back loans under a supervised repayment plan over 3-5 years. Student loans can be included in this form of BK....but NOT Chapter 7.

#2 Consumer Comment

RE:

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, January 13, 2009

Student loan debt has no statute of limitations...which gives these sleazy operators a license to harass people with defaulted loan debt.

If the situation becomes worse...Chapter 13 bankruptcy might be an option and you might even use that as a negotiation threat. Chapter 13 does NOT discharge debt...it's the version of BK where you pay back loans under a supervised repayment plan over 3-5 years. Student loans can be included in this form of BK....but NOT Chapter 7.

#1 Consumer Comment

RE:

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, January 13, 2009

Student loan debt has no statute of limitations...which gives these sleazy operators a license to harass people with defaulted loan debt.

If the situation becomes worse...Chapter 13 bankruptcy might be an option and you might even use that as a negotiation threat. Chapter 13 does NOT discharge debt...it's the version of BK where you pay back loans under a supervised repayment plan over 3-5 years. Student loans can be included in this form of BK....but NOT Chapter 7.

Advertisers above have met our

strict standards for business conduct.