Complaint Review: World Financial Group - Nationwide

- World Financial Group Nationwide USA

- Phone:

- Web: www.financialrevolution.com

- Category: Financial Services

World Financial Group, Financial Revolution SCAM misleading financial advice, sell high commission, low yield products Los Angeles, CA Nationwide

*Consumer Suggestion: No growth for 10 years, now you complain!

*Author of original report: Response

*General Comment: Opinion and Question

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Please avoid these folks. I didn't fall for the pyramid "multi-layer marketing" part of the scam, but did invest my retirement per their recommendations. This was a very regrettable decision on my part. The products they sold had almost no growth over almost a decade, and severe penalties for withdrawing. I wasn't informed of the commission structure until I saw mortgage-related credit report showing that for one of the products, I was paying out $35/month. This was shown nowhere! Not on the paperwork, not on the quarterly performance reports, and since it came from the invested principle, I wasn't aware of it. These guys make their money by recruiting more and more "business owners" from whom they take a cut of their high commissions. They sell their company as financial education, but it is really pitching products. Please, please don't fall for the high pressure, seemingly helpful tactics. There are a number of notable established financial investment companies that have low commissions, transparent information, and give you control over your investments.

This report was posted on Ripoff Report on 02/14/2015 09:24 AM and is a permanent record located here: https://www.ripoffreport.com/reports/world-financial-group/nationwide/world-financial-group-financial-revolution-scam-misleading-financial-advice-sell-high-c-1209082. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Suggestion

No growth for 10 years, now you complain!

AUTHOR: Sam - (USA)

SUBMITTED: Tuesday, November 03, 2015

i am really curious to find out what product the arthur has for 10 years with no growth....

big penalty to withdraw, $35/month fee? What is it?...and he waited 10 years to write a complaint?

#2 Author of original report

Response

AUTHOR: - ()

SUBMITTED: Monday, April 06, 2015

Please see my comments to your rebuttal in brackets after yours below:

Hi

I am a licensed Agent with WFG. First of all, WFG is an agency that market multiple insurance companies' product/program with solid high rate financial standing grade. [A high financial grade does not mean that it is a good way to invest your retirement money. With regard to your licensing, it take very little effort to get that kind of licensing - it's meaningless]

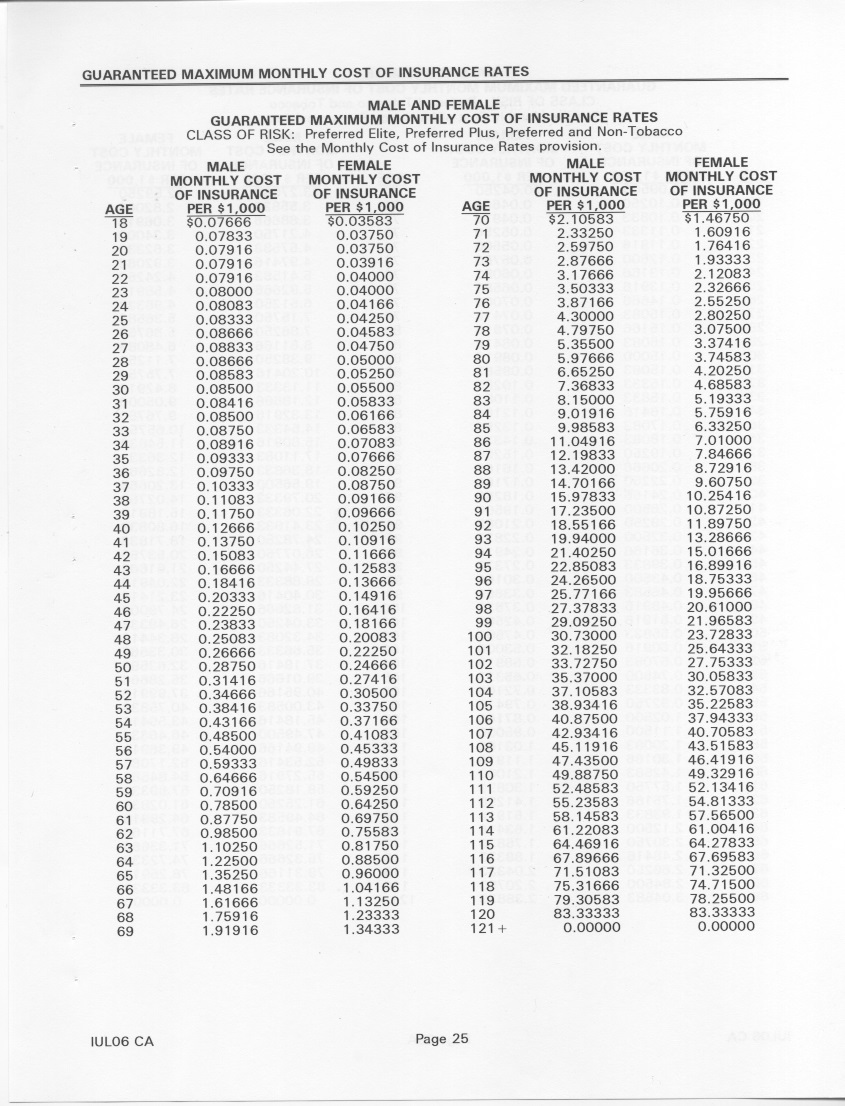

Regardless of which product you deal with, whether represented by WFG or not, many financial programs offer by insurance companies has early withdrawal penalties. This is an industry standard. [True, but whether these companies are a good way to invest is the real issue. WFG sells them because of the high commission, and the Insurance companies push them because they make a lot of money off of them.]

Can you please provide the full name of the product/program, and the issuing insurance company. [This is private information, but the two companies/products were Allianz, and Prudential annuities... both with good reputations, but their products are designed to make money for them primarilty, have slick (and somewhat misleading) marketing material. I was far to "trusting" in the WFG rep to know how to find out the true cost of these products. Someone at Fidelity early on said I should be careful with annuities, and I didn't listen, I believed the sell job from WFG. And to own my shortcoming, was too lazy to really try and research on my own]

What is that $35 per month for? [You got me! I was shocked to find out about it. It was subtracted from the investment directly, and didn't show up on the statements in a way that was understandable as a monthly fee. I'd even asked my WFG rep if there were ongoing fees, monthy, or for re-balancing investments, and she said no.]

Financial education comprises many charters of personal finance courses, and some explain how the plan works and some explain which program can do it. [Huh? Marketing materials are designed to sell your products, as is the "education" that you provide. It's all selling for WFG and the for the products WFG is selling to make money. You are not educating, you are selling under the guise of educating]

Any product offerings needs some education for you to understand how it works. [Yes the WTF rep "educated" me on all of the wonderful ways the product works and increases my retirement... graphs, charts for what I need for retirement, all of the stuff that is readily available on the internet]

Have you ever attend any bank/loan/investment that offers seminars that is not to educate consumer about their services and offering? [use the word sell, not educate. It's more honest. The "education" involves a lot of "hypothetical" positive scenarios, and downplays any the negative... just like McDonalds... "have fun! Tastes great! They don't tell you how it affects your health]

Many financial investment companies had collapsed after 2008. WFG is still standing after many decades. What would you say to those folks who loss their entire retirement life saving on those no longer existed financial investment companies? [I'm sad for the folks who lost their money. However, justifying yourself as the "lesser of the evils" is poor justification. And surviving the crash is a non sequitur. It just means that your business model can survive, it doesn't mean you provide any real value or good for the consumer. There is an endless list of companies that cause great damage in many forms (job loss, environemental, economic) that survive crashes, down-turns, etc.]

[I'll reitterate my initial plea... Folks, please don't fall for what WFG is selling. It's not education, it's marketing; it's hard sell, it does not have your best interest at heart regardless of what the rep says. The reps are convincing, and they probably bought the same speil lock-stock-and-barrel as well, which makes them even more insidious.]

#1 General Comment

Opinion and Question

AUTHOR: Freedom Navigator - (USA)

SUBMITTED: Sunday, April 05, 2015

Hi

I am a licensed Agent with WFG. First of all, WFG is an agency that market multiple insurance companies' product/program with solid high rate financial standing grade.

Regardless of which product you deal with, whether represented by WFG or not, many financial programs offer by insurance companies has early withdrawal penalties. This is an industry standard.

Can you please provide the full name of the product/program, and the issuing insurance company.

What is that $35 per month for?

Financial education comprises many charters of personal finance courses, and some explain how the plan works and some explain which program can do it.

Any product offerings needs some education for you to understand how it works.

Have you ever attend any bank/loan/investment that offers seminars that is not to educate consumer about their services and offering?

Many financial investment companies had collapsed after 2008. WFG is still standing after many decades. What would you say to those folks who loss their entire retirement life saving on those no longer existed financial investment companies?

Advertisers above have met our

strict standards for business conduct.