Complaint Review: World Financial Group - Nationwide

- World Financial Group Nationwide USA

- Phone: 770-246-9889

- Web: http://www.worldfinancialgroup.com/

- Category: Insurance Agencies

World Financial Group WFG,Transamerica, World System Builder, WSB Plan to live long? Will your FFIUL--WFG’s “top” product--FAIL and leave you with NOTHING? Here's the MATH. Johns Creek, Georgia Nationwide

*General Comment: Explanation of IUL Fees & Net Risk & How To Offset Rising COI

*UPDATE Employee: FFIUL

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Did an WFG agent sell you Transamerica’s FFIUL? Did this agent reassure you that “your cash value will grow to cover your all your premiums?” Did he even tell you “you’ll pay it off in ‘20’ or ‘25’ years?” How can you know for sure? I show you how here!

You’ll pay $100,000, $200,000 and more into your FFIUL over your life. You’ll want to verify your agent’s claims. You have a *right* to understand the numbers in your policy.

The great news: You *can* understand the numbers. The FFIUL math is much easier than you think.

But first, here’s a quick reality check to tell you why you really NEED understand the FFIUL numbers:

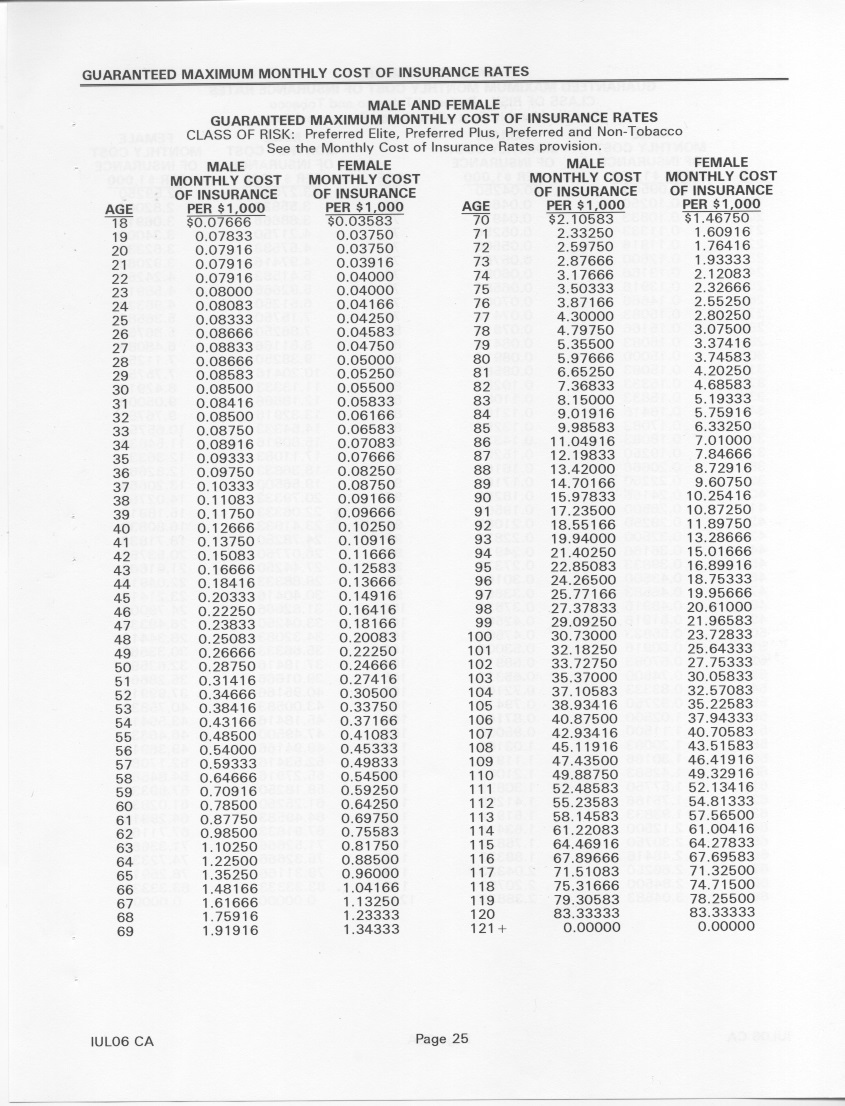

If you already bought the FFIUL, go to the Cost of Insurance (COI) on page ~25 of the FFIUL policy. Don’t let the agent tell you “don’t worry, you don’t have to pay those COI charges.” Please remember folks: This policy is a CONTRACT between you and Transamerica. Please know those COI numbers shown in your contract are the ones YOU AGREE TO PAY when you sign on the dotted line. You are *legally bound* to pay COI charges as high as those listed in the chart in your contract. If you haven’t yet bought the policy, ask your WFG to print out a copy of the policy *you will sign* and use the numbers from that COI chart.

Above all gentlepeople, please do NOT let the agent give you data based ONLY on his illustration software. You MUST make sure use the numbers you find printed on your contract and ONLY those numbers. Those are the ONLY valid numbers that apply to you!

One more note. Going forward in this review, I’ll use ACTUAL data from a copy of a *real* FFIUL policy that a FFIUL policyholder who kindly lent to me and who bought this policy in early 2016.

OK, now that we’re clear on all that, let’s proceed with the reality check :-)

Use a calculator--most phones have this--to add up all the COI multipliers on or near page 25. Let’s say you are a 35yo non-smoker male buying a $500k FFIUL. For you, those multipliers are, or close to, $0.09333 for age 35, $0.0975 for age 36, etc. All they way up to $9.98583 for age 85. Add up those multipliers you find on your COI chart. E.g. from age 35 to 85, these add up to $102.38.

Then multiply that sum by 6,000 (500 x 12). It’s 6,000 because the listed COI factors are for each $1,000 of Death Benefit and for each month of the year. Thus “500” for your $500,000 policy and “12” because 12 months in the year.

Your final result: $102.38 x 6,000 = **$614,289** Guess what?--That’s more than your Death Bennie!" And that’s just your COI charges. Add in the other monthly fees for that same 50-year stretch. Your total comes to well over *$700,000.*

But wait, it gets worse. MUCH worse. Take it forward just another five years higher, to age 90. That spikes your total policy costs costs to over **1.2 million dollars.** More than twice your Death Bennie.

This stark reality check should make you ask: Does the FFIUL EVEN MAKE SENSE? Especially if you come from a family of long-living people.

Folks, WFG agents have at least two incentives to sell FFIULs. First they earn fat commissions on them--$3,000, $5,000, and more. Second, WFG’s compensation plan favors selling Transamerica products. But is the FFIUL a good deal for you as it is for them? More to the point, will you be able to afford to pay the premiums until you die? Or will the rapidly accelerating late-life Cost of Insurance (COI) charges exhaust your policy’s cash value and force you to drop this FFIUL when you’re in your 70s or 80s? Causing you to LOSE all the money you faithfully fed into it? Leaving your heirs with NOTHING?

At the very least, please demand your WFG agent show you the actual math--again using a CALCULATOR, NOT his illustration software--to *prove* to you that your cash will cover your all your premiums.

But before you ask him for CALCULATOR-derived math, please get ready and do your OWN math first. This way, you can double-check your agent's figures. Here I show you how to do this math. BY LAW, your FFIUL policy and its issuers MUST supply you with all the DATA you need to let you calculate and understand all the math in your own FFIUL.

You can even calculate how old you’ll be when skyrocketing late-life Cost of Insurance (COI) charges will exhaust your policy’s cash value. This is very important because, as shown in the reality check above, once you reach your 70s and 80s, your COI charges will be prohibitively high, quite possibly forcing you to LOSE your policy. For example a healthy non-smoking man at age 75 will pay **over $21,000** that year just in COI charges. You can experiment with different premium levels to learn in advance how long you can expect your policy to last.

So grab your calculator and let’s go! If you know how to use a spreadsheet, so much the better--you’ll make short work of this task and put a very fine point on the math. You can use Google Sheets for free to make your spreadsheet. However you crunch the numbers, you’ll *know* the real score with your FFIUL.

I first show you how to do the math. Then I give you an example.

It may look complex but your FFIUL boils down to seven financial elements--two credit inputs and five expenses. You can deal with them all with basic math. Your FFIUL’s two credits are the monthly premium you pay and the interest that Transamerica credits to your Index Account once per year. Your FFIUL pays five monthly expenses. These expenses are the COI charge, Premium Expense Charge, Policy Fee, Policy Monthly Expense Charge (aka Face Value/Death Benefit Charge), and Index Account Charge. The two biggies here are your Premiums and the COI charges. Where you’re younger, your net cash inflow exceeds total expenses and your Cash Value grows. As you get older, your COIs start to catapult higher, causing your Cash Value growth to peak out and then to start to fall, ever faster, often plunging to zero as you hit your late 70s/early 80s, forcing you to pay huge monthly premiums or LOSE your policy.

Here’s what to do, in seven steps:

1) GATHER YOUR DATA. What you need:

a) Your monthly premium amount.

b) Your Face Value (aka Death Benefit) amount. E.g. $500,000. You can find this near the front of your Illustration.

c) Your age when you bought your policy.

d) Your monthly Premium Expense Charge. E.g. 6% of your premium payment. You can find this in the first few pages of your policy.

e) Your monthly Policy Fee. E.g. $12. You can find this in the first few pages of your policy.

f) Your monthly Policy Monthly Expense Charge (aka Face Value Charge aka Death Benefit Charge). E.g. $0.24 per $1,000. You can find this in the first few pages of your policy.

g) Your COI (Cost of Insurance aka Mortality Charges) chart that’s tucked away in the back of your policy. That’s the dense chart full of small low-value numbers, but which grow huge when you multiply them by your month and Death Benefit factors. E.g. If you buy a $500,000 Death Benefit, you multiply the monthly COI charges by 6,000 to learn the COI you’ll pay that year. That’s 500 times 12. 500 for every thousand dollars of death benefit multiplied by 12 month in a year. For example, that healthy non-smoking 75yo man we discussed above? If you look on page 25 of your policy, you’ll find a modest-looking monthly COI factor of only $3.50333 or similar number. But when you multiply that by the 6,000 number we figured earlier, all of a sudden you get that huge $21,000+ annual COI charge I gave above.

2) CALC THE # OF MONTHS OVER WHICH YOU WANT TO ANALYZE YOUR POLICY. For example, you bought the FFIUL at 35 and you want to know its financial health when you’re 80. For this, you subtract 35 from 80 and multiply the result by 12. I.e. 80 - 35 = 45 years. 45 years x 12 = 540 months.

3) CALC YOUR MONTHLY NET CREDIT. Subtract from your monthly premium:

a) Your monthly Premium Expense Charge (e.g. 6% of your premium payment).

b) Your monthly Policy Fee (e.g. $12).

c) Your monthly Face Value (aka Death Benefit) charge. (e.g. $0.24 per $1,000).

“Wait,” you say, “That’s only three charges, not five like you said earlier!” Right you are. I leave out the COI and Index Account Charge (IAC) at this stage. We’ll account for the all-important COI further down. The IAC constantly varies and is too small to bother to include here. You’ll get the point of this exercise even without this minor fee.

4) CALC THE FUTURE VALUE OF YOUR *NET* MONTHLY CREDITS. For this you can use this formula: future value = (rate, number of periods, payment amount, present value) ** the is the only “slightly-above-basic” formula you use here.** You can use Google Sheets for free to enter the above formula as “=fv(rate, number of periods, payment amount, present value).” Avoid using the completely unrealistic 8% rate that WFGers often illustrate. Instead, go with the more realistic 5% average rate of return.

5) CALC YOUR YEARLY COIs FOR THE SAME STRETCH OF YEARS OVER WHICH YOU ANALYZE YOUR POLICY and add up all those paid COIs. E.g. for a $500k policy, your yearly COI at age 35 = $0.077 x 500 x 12 = $460. Forty five years later, for the same $500k Death Benefit at age 80 your yearly COI = $5.98 x 500 x 12 = **$35,860**. Calculate your yearly COIs for all the years in between, in this case for ages 36 through 79 and then add them all up from age 35 through age 80.

6) SUBTRACT YOUR RESULT IN 5) FROM YOUR RESULT IN 4). If you get a negative number, you have negative Cash Value and **YOUR FFIUL ALREADY CROAKED :-( **. If you get a positive result but it’s low (Cash Value of $30,000 or less) your FFIUL is on its death bed gasping its last breaths.

7) REPEAT STEPS 2), 4), 5) and 6) FOR DIFF TARGET AGES, e.g. 75, 85, 90, to find out when your FFIUL goes belly-up.

A final note. Some policies will change and terminate charges according to specified schedules. E.g. premium expense charge sometimes change between from 2% and 6% depending on the policy year, and some policies terminate Policy Monthly Expense Charges after a specified time, e.g. after 10 years. Please make sure you read your policy carefully to find these data and adjust your math accordingly.

Ready for an example? Here we go!

You are a man in great health and you don’t smoke, which earns you Preferred status. At age 35, you buy an FFIUL policy with a $500k death benefit. Your premium is $350/month. You want to know: Will I still have enough Cash Value in my policy at 80? At 85?

Let’s look at the first target age. 80 - 35 = 45 years = 540 months. From your $350 premium we subtract your Premium Expense Charge of $21.00 ($350 x 6%), your Policy Fee of $12.00, and your Death Benefit Charge of $120.00 ($0.24 per $1,000 of DB x 500). Thus, $350.00 - $21.00 - $12.00 - $120.00 = $197.00. **Again, please note I leave out the all-important COI charge. We’ll add that in later, to make our math simpler.

The above math leaves us with a net credit of $197 per month, starting at age 35, to put in your index account so you can earn interest on it. We use the Future Value formula to calc what your steady monthly payments will have grown to when you are 80. Future Value = fv((5/12)% monthly interest rate, 540 months, $197 *net* monthly payment amount, $0 starting balance) = $399,208 Cash Value. For Google Sheets, that exact formula looks like this: =fv(0.0042,540,197,0). Remember we’re dealing with monthly figures, so we have to convert the annual 5% interest rate by 12 (5%/12 = 0.05/12 = 0.0042) to get the monthly interest rate in decimal form.

“Wow,” you say “I have almost $400k in the Index Account. That’s a lot! This thing is great!” But what about your COIs? When you add up your yearly COIs from ages 35 through 80, that comes to $367,234. “Wow,” you think “Those cumulative COIs are higher than I thought! But gee, my Cash Value’s still $399,208 - $367,234 = $31,974. That’s still plenty right?”

Is it? Let’s see. Let’s bump up your target age to 81. In that case, your Cash Value comes to $422,051 and cumulative COIs come to $407,149. Your Cash Value’s still ahead of Cumulative COIs, but now the gap narrowed to only $14,902. Your policy expenses are catching up fast! Gosh, how did that happen? That’s because, just for being 81 years old, you paid a shocking **$44,210** in COI charges.

Gulp. Now let’s bump up your target age to 82. In that case, your Cash Value comes to $446,063. But this time, your cumulative COIs *exceed* that, totalling a staggering $451,359. At this point, Transamerica demands from you an immediate infusion of $5,296 just to keep your policy alive. Then, in your 83rd year, with your Cash Value completely depleted, you have to pay out-of-pocket a staggering $4,075 per month in premiums. At this time, unless your rich 105-year-old uncle kicks the bucket and leaves you a fortune, you’ll have no choice but to give up this FFIUL.

Almost a half-century and $200k of premiums later, you’re left with NOTHING.

Folks, the true math picture is even worse, for at least two reasons. First, to make the math easier, we simply summed up all the yearly COI charges to subtract from your cash amount. The reality though is that Transamerica pulls out the monthly COI charge every month starting way back when you bought the policy. Thus the net monthly cash contribution to your index account is really *lower* than what we calculated here, causing you to lose more Cash Value growth than what we calculated. You suffer a big "opportunity cost" from all that lost compounding. The second reason: We compounded *monthly* the credit Transamerica makes to your Index Accounts--again to make the calcs easier for us. In reality TA credits your index accounts only once per year, making you lose out on monthly compounding. This year instead of monthly compounding causes you to suffer still more "opportunity cost." That adds up to a lot of lost earning for you over the 30, 40, 50 years you hold on to this policy.

All this means that, in the example above, you may have lost the policy *earlier,* by 81, by 80, maybe by an even earlier age. If you’re good with spreadsheets, you’ll need just a few hours to set it up to calculate exactly how old you are when your FFIUL runs out of cash value.

Finally dear reader, what if you DID have unlimited funds to feed the FFIUL? Does that even make sense for you to do? By age 84 you'll have paid $508,749--more than your Death Benefit. By age 90, make that a whopping **$1,026,864--more than twice your Death Benefit** Most folks want to *grow* their dollar over the decades, not bust it down to under 50 cents!

You want to leave your family the MOST most money possible when you die, right? Isn't that the point?

Fortunately you have a terrific option!

Instead of the FFIUL, you can get a 30-year term life policy to age 65. At termlife2go, you can buy a 30-year policy from age 35 to age 65. Even Transamerica offers that for only $40/month at TermLife2go. That’s at least 9x cheaper than the FFIUL with the same Death Bennie. Put your savings--in this case $310/mo--in an ultra-low-load ETF (e.g. VOO S&P 500 from Vanguard) in your Roth IRA. Start that Roth at 35 and by the time you’re 65, it’s worth almost $300k. Unlike a regular IRA, that Roth ETF keeps growing and you can keep contributing to it at any age. If you keep working and making the same contribution to age 75, your account is worth almost $575k. Even if you retire and stop adding in cash at that point and simply leave what you have in your Roth IRA until you’re 85, it’ll grow to over a **million dollars.**

If you already bought the FFIUL and you’re past the 30-day Look Period, not to worry. You can surrender it with no out-of-pocket costs. Don’t worry if your Cash Value is less than your Surrender Charges. Transamerica will take your current Cash Value and call it even. You'll have to write off the funds you already paid into the FFIUL. But you won’t owe anything extra.

If you haven’t yet bought the FFIUL and are still interested in it and need to run the numbers for yourself, then make sure you get all the policy fee data you need from your agent. Especially the COI chart. If he or she won’t give you all this data, **refuse to buy this policy.** If your agent DOES give you these documents and the FFIUL somehow checks out for you, make sure you match the sample docs to those in the policy you sign on--make sure the data in them are the same.

Once you’re comfortable with your own calculations, please sit down with your WFG agent and show him YOUR math and ask him to correct it where necessary and CLEARLY explain his corrections. Of course, you should verify your own FFIUL math with your WFG agent and/or Transamerica Inforce Policy Service at 800-PYRAMID (797-2643).

And people, again, VERY IMPORTANT: Please do NOT let your agent verify/refute your math ONLY with his illustration software! Insist he use a calculator! Why? Because you have no way to know if his illustration software contains the exact same policy data--especially the COI charges--that you find in your printed contract.

I repeat: The FFIUL math is SIMPLE ENOUGH you can check it with your phone’s calculator!

Remember, your agent earns a BIG commission from this policy. And you’ll pay hundreds of thousands of dollars into this policy over your life. Your agent should be happy to sit with you spend all the time you need to feel comfortable you made the right decision with CLEAR and OPEN math, done with CALCULATORS using YOUR exact policy data, NOT his illustration program. He’s earning big bucks selling this to you. This work is the very least he can do for you.

Any questions? Please ask.

This report was posted on Ripoff Report on 06/29/2016 11:26 AM and is a permanent record located here: https://www.ripoffreport.com/reports/world-financial-group/nationwide/world-financial-group-wfgtransamerica-world-system-builder-wsb-plan-to-live-long-will-1314196. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 General Comment

Explanation of IUL Fees & Net Risk & How To Offset Rising COI

AUTHOR: Jared - (United States)

SUBMITTED: Saturday, July 27, 2024

Wow - there's kind of a lot here. I'm going to constrain my comments to two discreet areas: Fees and COI.

IUL Fees Explained

1. Premium Charge – Analogous to a Merchant Fee for credit card transactions. Usually around 6% taken out of every premium payment.

2. Per Policy Expense – Analogous to a Membership Fee. Nominal fee charged every month for the life of the policy.

3. Per 1000 (Base)/Per Unit Charge – A fee charged usually for the first 10 years of a policy only and calculated from the initial Face Value of the policy. The Per Unit Charge varies by underwriting factors such as issue age, sex, face value band, and tobacco use of the insured. This is how the Insurance Company keeps the lights on and how Agency and Agent Commissions are paid. Important to note that this fee is baked in at policy inception, so mid-course face value adjustments up or down do not affect this fee. (Actually not sure about face value adjustments up, never tried to do that, it may very well initiate a recalc of Per Unit Charge).

4. Base COI Charges – depends on several factors such as face amount, risk class, age, gender, and duration as well as Net Risk. Mid-course face value adjustments up or down will affect this fee.

5. Index Account Monthly Charge (IAMC) – This is equivalent to an Assets Under Management fee. Only in Transamerica that I’ve seen so far amongst my admitedly small data set of 4 companies. The charge is .72% annually of the Index Account Value, taken on the monthly policy date through age 120. Transamerica offers a guaranteed floor of .75% (usually 0% with other providers) which is credited when a segment gain is less than .75%. In those cases the .75% floor offsets the IAMC, but for all other cases the IAMC charge has a net negative effect on accumulation. Important to note that this type of fee can sometimes be incorporated into the Index Strategy itself. For example, Nationwide offers several Index Strategies which have a 1% Index Interest Strategy Charge Rate. This is equivalent to an Assets Under Management fee or IAMC for that Index Strategy.

Rider Charges – There are an assortment of riders offered by providers, such as Accelerated Surrender, Chronic/Critical/Terminal/LTC, No Lapse, etc. each with its associated cost. Too much variance and too numerous and too lazy to attempt to list here. I leave this as an exercise for the reader.

COI

Your dim view of IULs may be due, at least in part, to badly designed policies. Although badly designed IULs is an industry-wide problem, Transamerica as top IUL company and WFG as top IUL distributor together are assigned the majority of the blame. Please see my previous rebuttal titled "IUL: Life-Changing Wealth Builder or Soul-Crushing Money Destroyer?" for my thoughts on this.

In any case, you correctly identified the biggest downside and risk of an IUL, which is the rising COI as the Insured gets older. But you failed to mention how this problem is mitigated. I've attempted to correct that below.

NET RISK AND HOW TO OFFSET RISING COI IN AN IUL

Anatomy of Cash Value Life Insurance

CASH

NET RISK

NET DEATH BENEFIT

$0

$500K

$500K

$100K

$400K

$500K

$400K

$100K

$500K

$500K

($0 Net Risk not allowed, require 10% corridor)*

$0 -> $50K

$550K

- There are 3 components of a cash value life insurance policy: Cash, Net Risk, and Net Death Benefit.

- The biggest downside and risk of an IUL is rising cost of insurance (COI) every year as the Insured gets older.

- But the IRS allows you to use the cash value in an IUL to guarantee the Death Benefit which lowers Net Risk and lowers cost overall thereby maximizing cash accumulation. A properly designed IUL will take advantage of this allowance.

- So even though COI rises each year as the Insured gets older, the accumulating cash value offsets more of the Net Death Benefit each year which lowers the overall cost.

- Eventually when the Cash Value gets close to the Net Death Benefit and Net Risk gets close to $0 you hit something called a “Corridor”. The IRS requires insurance policies to have some Net Risk. Zero risk means investment and will get taxed accordingly. So to retain the IUL’s tax advantages the IRS forces a “Corridor”, which is a certain amount of Net Risk required, so the Net Death Benefit will automatically get increased based on the Corridor requirement.

- Even though Cost Of Insurance rises each year as the Insured gets older, the Corridor Requirement gets smaller each year, and the Cash Value offsets a larger portion of the Net Death Benefit each year, which together lowers the overall cost of insurance.

- So the moral of the story, Dearly Beloved, is that when an IUL is designed correctly, is funded properly, and performs well, the overall Cost of Insurance can get less expensive not more expensive as the insured gets older, and an IUL is the only life insurance policy that I’m aware of where this is possible.

* 10% is just for easy math in the example, not the actual corridor requirement

#1 UPDATE Employee

FFIUL

AUTHOR: Outtahere - (USA)

SUBMITTED: Friday, February 03, 2017

Let me tell you. One of the ladies in our office used a FFIUL to put her kid through college. You should never put all of your money in one product. That would not be smart. You can hate it. But act like it's a horrible product and isn't good for everyone is not sound business for anyone to listen to you.

Advertisers above have met our

strict standards for business conduct.