Complaint Review: AFLAC - Columbus Georgia

- AFLAC Columbus, Georgia USA

- Phone: 18009923522

- Web: www.aflac.com

- Category: Consumer Services

AFLAC...NOT THERE WHEN YOU NEED THEM Columbus Georgia

*Consumer Comment: Overuse is NOT an injury

*REBUTTAL Owner of company: I do not belive you

*Consumer Comment: Don't lie.

*Consumer Comment: Your post in FALSE

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Recently renewed my AFLAC policy on February 22, 2013 but added short-term disability. Visited my physician on February 25 for a sick-call visit and was out sick from the 25th to the March 4th. I was referred to a Gynecologist based on ultrasound reports and was finally seen on April 4th. Surgery was scheduled and completed.

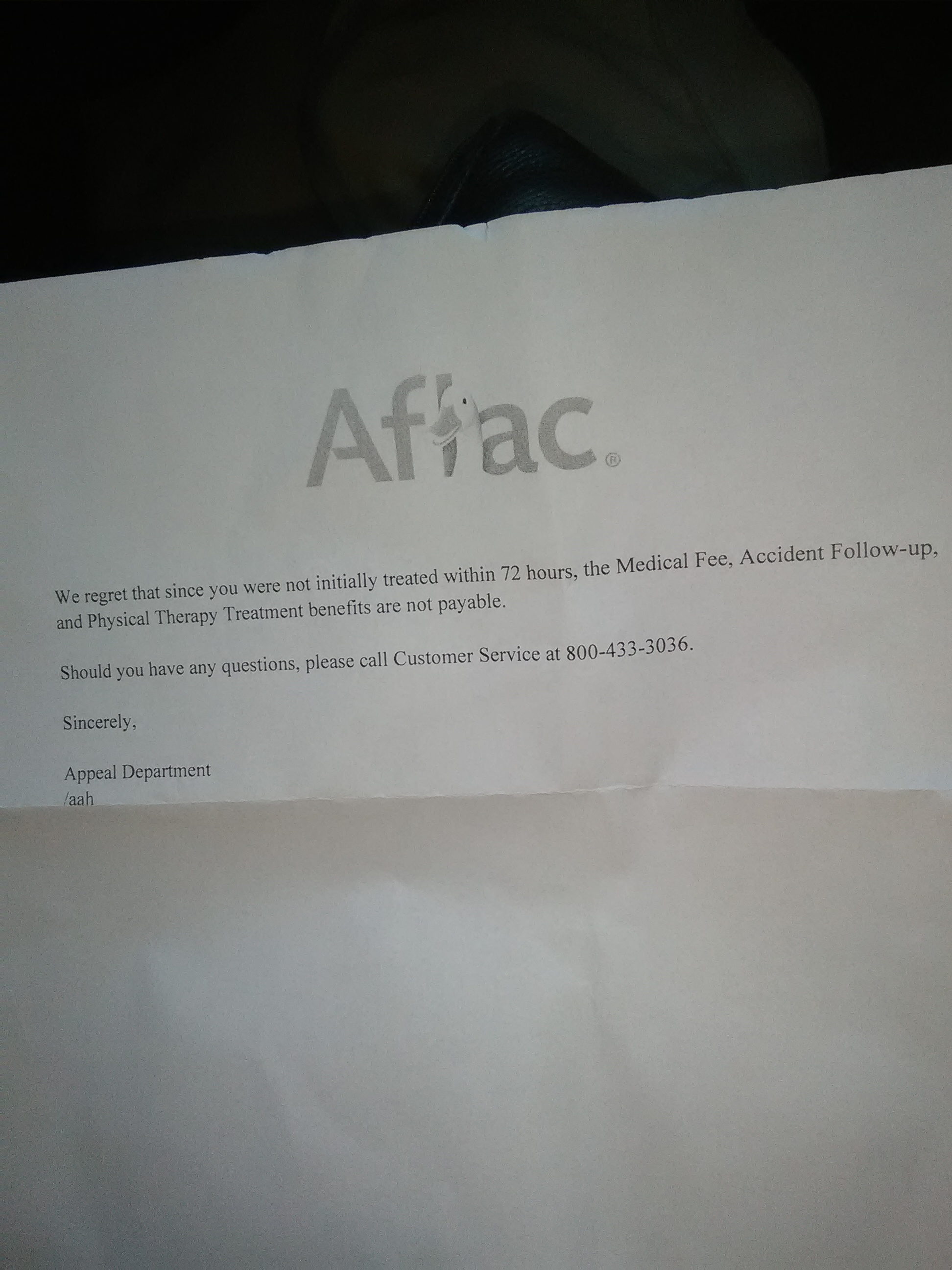

Only after repeated phone calls and following up with numerous staff and a supervisor was i told my claim was denied. It only took AFLAC from the 16th of August until the 9th of September to determine that although i signed the new policy on the 22nd of Februry was seen by a Gynecologist who treated and diagnosed the condition following ultrasounds on April 8th that the effective date of the policy wasn't until March 1st.

To avoid paying the claim they finally determined the routine sick visit would be considered pre-existing condition.

WOW!! and customers think they are covered. My opinion is you are, until they find a loop hole not to pay the claim but to keep collecting premiums. Moral....Duck or not, they are not there when you need them.. Shame on you AFLAC!!!!!!

This report was posted on Ripoff Report on 09/09/2013 11:02 AM and is a permanent record located here: https://www.ripoffreport.com/reports/aflac/columbus-georgia-31999/aflacnot-there-when-you-need-them-columbus-georgia-1082950. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Overuse is NOT an injury

AUTHOR: HedgeFundMgr - ()

SUBMITTED: Sunday, April 13, 2014

Trigger finger from overuse is NOT an accidental injury.

An accidental injury is an event that is unforeseen. Yours was totally predictable. I do not know what kind of work you do, but obviously it involved the use of your hands. Trigger finger is a commonly accepted "side-effect" of certain types of work. I looked it up on WebMD (I've got some time to kill waiting for a taxi to take me to the airport.)

CAUSES OF TRIGGER FINGER (from webmd.com/osteoarthritis/guide/trigger-finger)

Trigger finger can be caused by a repeated movement or forceful use of the finger or thumb. Rheumatoid arthritis, gout, and diabetes also can cause trigger finger. So can grasping something, such as a power tool, with a firm grip for a long time.

Farmers, industrial workers, and musicians often get trigger finger since they repeat finger and thumb movements a lot. Even smokers can get trigger thumb from repeated use of a lighter, for example. Trigger finger is more common in women than men and tends to happen most often in people who are 40 to 60 years old.

Your claim decision was not based on a "tricky loophole." It is basic medical fact. You had 7 days deducted from your claim because it was deternined to be an illness, disease, or disorder, NOT caused from an ACCIDENT.

Also, I'd like to comment on your vulgarity. Using obscenity in any written correspondence makes you appear very low class. It is vitally important that an insurance company have "deep poclets." Let me expalin what that actually means, since I honestly think you do not know.

Companies are requried to keep cash reserves. The greater the amount of policies in force, the greater amount of cash reserves they must keep. It is akin to rules that many states have in which gambling in legal. In Las Vegas, for example, a casino is required to have, on hand, enough money to cover every bet on the floor at any given moment in time. The likeliehood of this happening is slim to none, but nonetheless it is a requirement.

Another example: Companies that, as a requisite for financing or credit, must maintain a large amount of life/disability insurance on each Board Member (often called"key-man insurance") will sometimes have a clause that stipulates that all board members CANNOT fly on the same plane. The reasoning is obvious; if there were a crash, the amount of money paid out would have a severe financial impact on the insurance company that wrote the policies to begin with.

I'm sorry that you missed 7 days of disability because of your trigger finger. I'm sure this didn't bankrupt you. If you are so angry about how insurance works, here's a suggestion: DON'T BUY IT. Or better yet, why dont' YOU start an insurance company, so you can show us all how to do it "the right way."

You're very cocky and arrogant; convinced you are 100% right. Go open your own business; see how what it REALLY takes to develop a product or service, price it, market it, sell it and maintain it.

Sorry if my words seem harsh, but your attitude is terrible. The next time you purchase insurance (if you ever do) take the time to READ THE POLICY THOROUGHLY AND COMPLETELY. Never, ever, EVER buy anything unless you understand it backwards and forwards.

I don't expect a gracious reply from you, but I do with you peace and luck.

#3 Consumer Comment

Don't lie.

AUTHOR: Mike M - ()

SUBMITTED: Wednesday, September 25, 2013

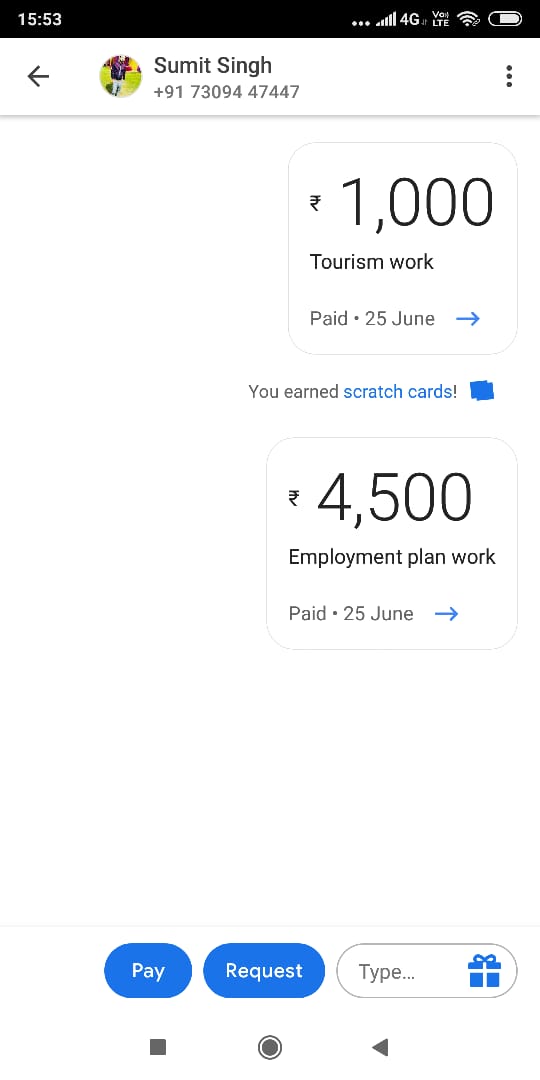

I was denied my aflac claim through a tricky loophole. Was out 7 days for an injury, not specific (trigger finger from overuse). Had to get cortizone shots in hand. Would have been covered if out for 8 days or if I had taken a brick and smashed my hand. Deep pockets my a*s. Keep making those stockholders happy and hurt the real working people. You're the one looking in the mirror every day.

#2 Consumer Comment

Your post in FALSE

AUTHOR: NoSoap - ()

SUBMITTED: Wednesday, September 11, 2013

Sorry, my friend, but you were not rippoed off by Aflac.

You bought a policy and didn't read it? How could you not know that your effective date was March 1? That is when you payroll deductions would have started...you didn't notice that MORE was coming out of your paycheck?

The policy would have arrived either digitally or in print (your choice) and it is YOUR responsiblity to read it and make sure you understand it. Failing to do so isn't Alfac's fault...it is YOURS.

1. The policy's effective date is clearly printed.

2. The pre-existing clause is listed under "limitiations and exclusions." On the brouchure you were given, the heading actually says "WHAT IS NOT COVERED"

Both clearly states that any medical advice, consultatation, treatement, or even the presence of symptoms that would CAUSE a "prudent person" to seek any of the above during the 12 months prior to the effective date is not covered for the first 12 months. This is pretty standard for a disabiloity policy.

3. Aflac is actually a very good company. Last year they paid over $2 Billion (that's right, Billion, not Million) in claims, and the average time to pay was 4 days.

4. Aflac, like ALL supplemental insurance companies, is FOR PROFIT...it is absolutely necessary to install limitations such as pre-existing condition clauses, or the company would never make money and therefore not have resources to pay claims.

There are things I like about Aflac and things I don't...one of the things I DON'T like is that their agents do not work within assigned territories, and therefore businesses end up getting called on over and over, by differnet agents who seem to rather uncoordinated. That, however, is a complaint about merketing.

What I LIKE about Aflac is that they have very deep pockets, and they pay legitimate claims very quickly. Astonishingly fast, actually, compared to others out there. The average time last year was 4 days.

Yours was not a legitimate claim. If you had read what you had bought, you would have known that.

#1 REBUTTAL Owner of company

I do not belive you

AUTHOR: NoSoap115 - ()

SUBMITTED: Wednesday, September 11, 2013

Sorry, my friend, no disrespecct, but I do not belive a word that you have written.

I have had several Alfac policies for over a decade now, plus my sister-in-law in an agent. I asked her, and there is NO WAY anyone from Aflac would tell that you that it will take 30 days to review documentation you have sent them.

Why have you not called your local Aflac ofice for help? Every state has a State Sales Coordinator; in fact, some of the larger states have 2 or 3. Look in the phone book, or you can even call Aflac, and they will give you the name and phone number of a manager you can call.

Good luck; I hope you get all the money you have coming, if in fact, you really do..

Advertisers above have met our

strict standards for business conduct.