Complaint Review: Amerisave Mortgage - Atlanta Georgia

- Amerisave Mortgage www.amerisave.com Atlanta, Georgia U.S.A.

- Phone: 404-563.7129

- Web:

- Category: Mortgage Companies

Amerisave Mortgage Unauthorized charge on credit card Atlanta Georgia

*UPDATE EX-employee responds: Typical Amerisave Blame the customer

*UPDATE EX-employee responds: Former employee...

* : COMMUNICATION IS GOOD

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

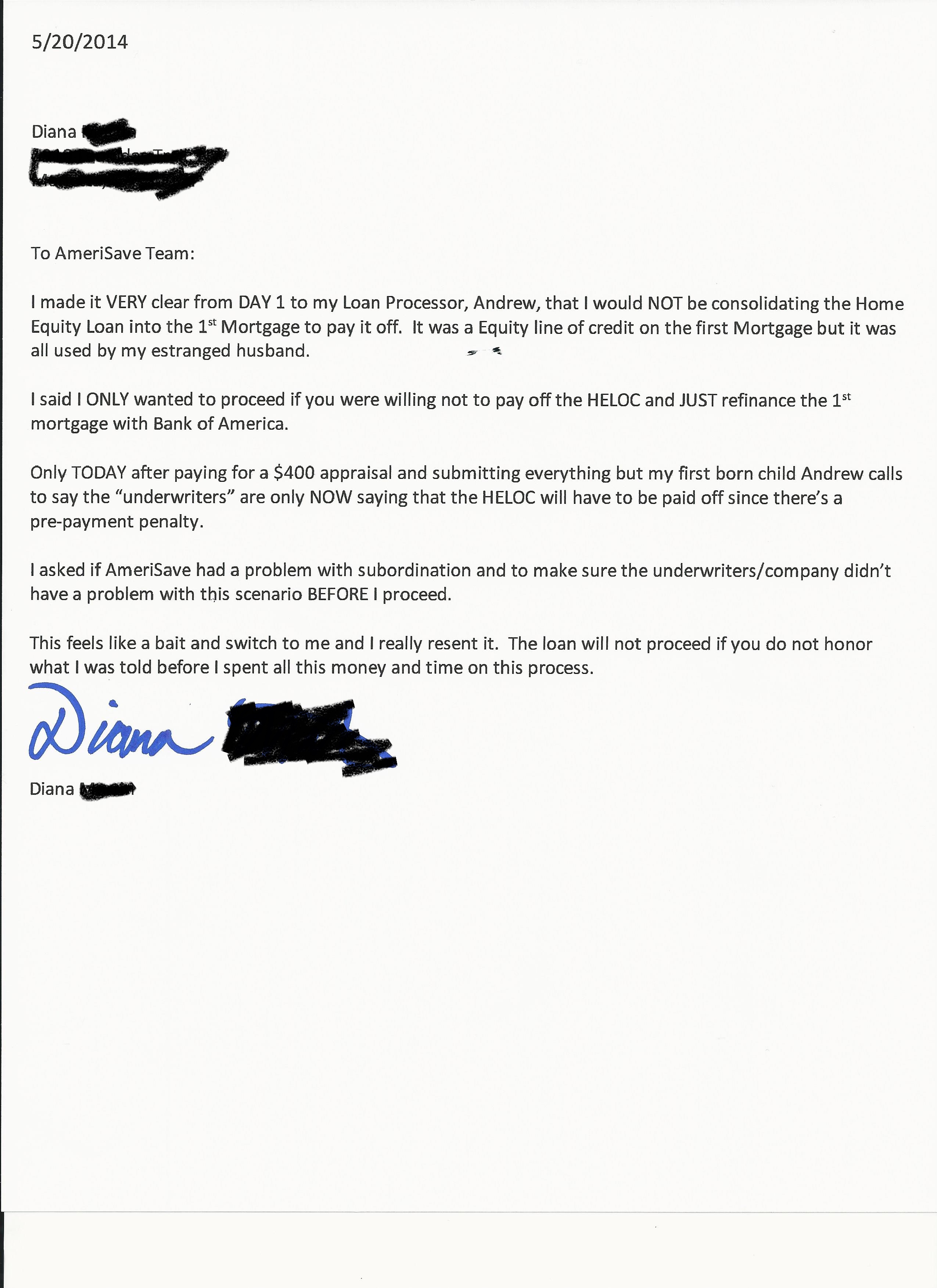

Amerisave made an unauthorized charge of 500.00 on my Discover card on August 6, 2009. I was going to use them for a mortgage and gave them my card number to charge 35.00 for the application fee and 350.00 for the appraisal. I gave approval via the Internet for them use for both services.

When I cancelled my application after I received their closing quote which was 8500.00 more than my local mortgage company was charging, I cancelled my application via email to their representative I had been talking with.

On August 10, I received notice from Discover that I had a large purchase on my credit card. When I looked at my account, I saw a 500.00 charge on my card for Amerisave. I gave no permission, either verbally or via Internet for the 500.00 charge. I immediately tried to contact the rep and sent him an email telling him to remove the charge. I also called my credit card company to remove the charge and investigate. I am also going to contact the BBB about the practice.

The scary thing is they now have carte blance with my card, or anyones' cards for that matter to make unauthorized charges. This is a totally unethical way of doing business.

Carol

Winter Garden, Florida

U.S.A.

This report was posted on Ripoff Report on 08/11/2009 02:09 PM and is a permanent record located here: https://www.ripoffreport.com/reports/amerisave-mortgage/atlanta-georgia/amerisave-mortgage-unauthorized-charge-on-credit-card-atlanta-georgia-478527. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE EX-employee responds

Typical Amerisave Blame the customer

AUTHOR: Former Amerisave Employee - (United States of America)

SUBMITTED: Monday, June 13, 2011

Ex Employee or should we call you Current Employee. Your way of tring to save Amerisave's image is great. Keep on writing rebutals like this one and Amerisave will hopefully soon be out of business.

Ameisave's E signing system doesn't show you all that you are signing. And when you try to download the docs to view what you have just signed you have a 50/50 chance of being able to download them.

To the client Just because when you were filling out your application and you clicked Request you rate lock doesn't mean your rate was actually locked. As i'm sure ex employee will point out the word request doesn't mean your rate is locked. In fact it is very difficult to lock a rate with Amerisave. First you have to e mail or fax them your docs. and once a manager has reviewed them (this may take a few days depending on the amount of volume the manager is dealing with) they may lock your rate. Unless your loan to Value is over 75%. Then you have to wait for the appraisal to come back. Rates and fees change everyday. So the great rate you thought you had will most likely not be the one you get. The rep you speak to on the phone might tell you this but he can't. He or She is not licensed and leegaly cant discuss rates, fees or monthly payments with you. But Again according to Ex Employee the customer is at fault for this.

Client most states do not allow these charges. Even worse most likley your rate was not locked. Cantact your State Dept. of Banking.

Now, If anyone else reads this and chooses to go with an unlicensed Amerisave loan rep. Well then I can agree with ex employee. you should have done some research first.

#2 UPDATE EX-employee responds

Former employee...

AUTHOR: marketleader - (USA)

SUBMITTED: Saturday, June 11, 2011

Amerisave has a Lock Cancellation Fee of $500 but only if you voluntarily cancel your loan in process which you would have had to do on your own. When locking your rate with Amerisave you signed that Lock Cancellation Agreement for them to charge the $500 if you canceled. When locking your rate you are essentially committing to the loan process and Amerisave. They charge this cancellation fee in order to cover any costs association with the process up to that point such as titile charges they are fronting for you, underwriting and processing, etc. It's basically a charge for wasting their time which you did.

In other words you did authorize it. You just didn't read what you were signing so that's your fault for not doing your part. Not to mention you had to sign a form agreeing that you understood that fact after locking your rate with them. They will have a that form on file stating you agree and allow them to charge that $500 plain and simple.

Lastly, they allow you at 2 seperate points during the application process to select and confirm the loan option you are wanting. You only sign the agreement after that fact as your committment. They gave you 3 seperate occassions or opportunities to verify and confirm that you understand what you were doing and you still managed to screw it up.

On top of all of this, just as the previous reply mentioned all you had to do at that point was have them allow you to change your loan option selected which they do allow you to do if you find a competing offer during the process.

You're supposed to shop around and then lock in and commit to a lender to start the process. What you did was committed to Amerisave and then started shopping around. This can only end in you losing money to multiple lenders and wasting everybody's time.

Good job! Next time don't be ignorant and do your homework and due deligence! Amerisave is not to blame here. Ignorance on behalf of the customer is to blame which is almost always the case on these reports unfortunately.

#1

COMMUNICATION IS GOOD

AUTHOR: MORTGAGE MIND - (USA)

SUBMITTED: Monday, September 14, 2009

To start, Amerisave gave me a great loan.

You get to pick your closing costs and rate.

You probably picked a very low rate and thus higher closing costs (which they show you before you even apply). Your local bank probably charged you less but gave you a higher interest rate.

Amerisave lets you know everything from inception. Closing costs are higher on lower rates. If you took a higher rate, of course your costs are less. Hope this makes it easier for you to understand, you just need to educate yourself more when it comes to loans and rates and fees. When you let amerisave know about your other offer, I am sure they could have beat it. Did they?

Advertisers above have met our

strict standards for business conduct.