Complaint Review: Bank of America - Internet

- Bank of America www.bankofamerica.com Internet United States of America

- Phone:

- Web:

- Category: Banks

Bank of America ruined my credit score and sent me to collections for an account I was never informed of! Internet

*Consumer Comment: Many banks don't really "protect" us...

*Consumer Comment: Michelle, Unfortunately the United States of America is now a country whose foundation is solidly built on- LIES, DECEPTION, FRAUD, MANIPULATION, GREED, TRICKERY, EVIL, DEEP CORRUPTION, & the....

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

July 2008

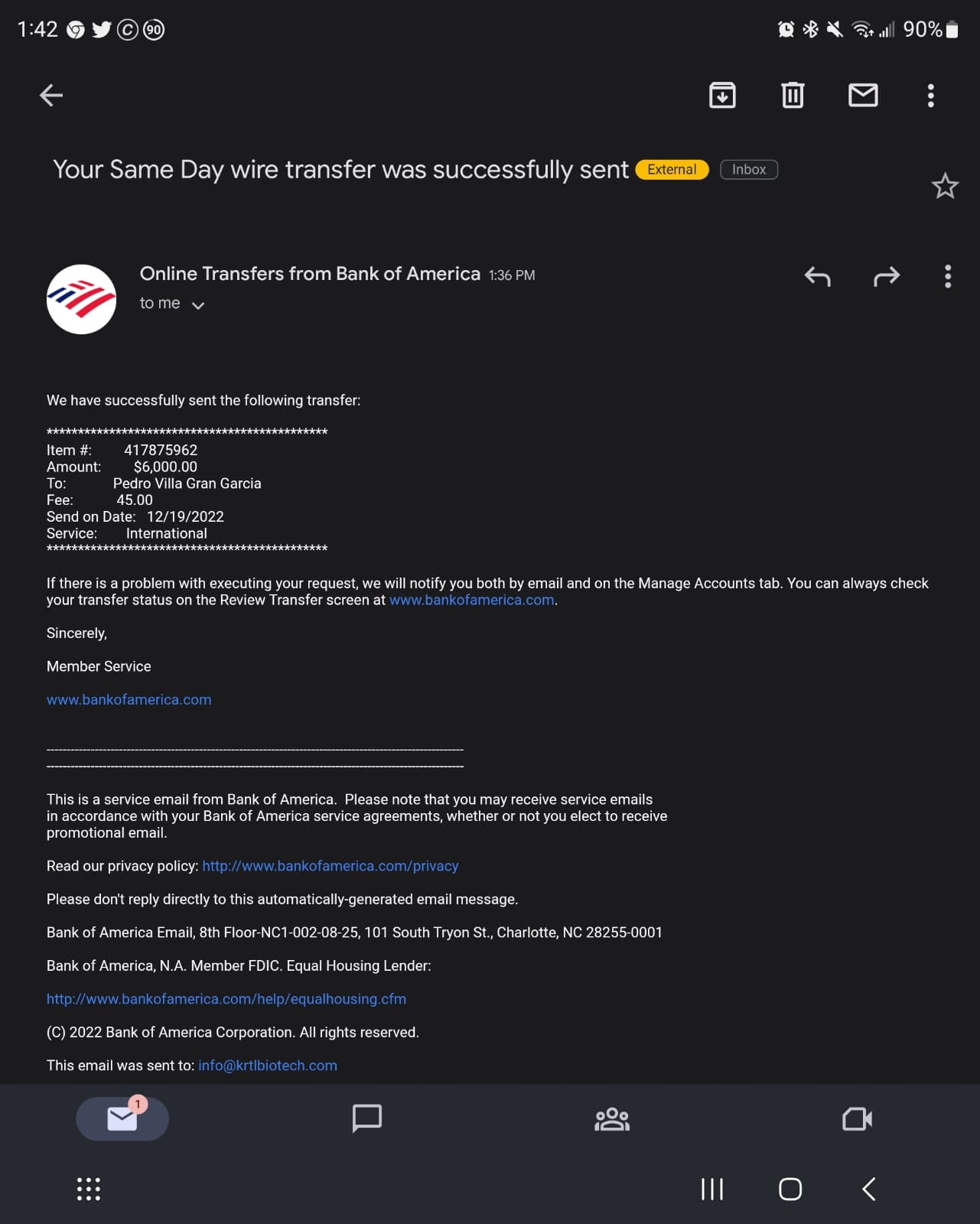

I went to my local Bank of America branch (at the time it was on University Ave. in Seattle) to deposit my paycheck. I had just incurred an overdraft fee of $30-35 for overdrawing by $2 a few days prior so the teller told me about overdraft protection. At the time, I had several friends, including my roommate, who had overdraft protection on their accounts and everyone seemed to love it. They were all able to view it on their online banking and manage their accounts very easily. So, I signed a slip allowing them to run my credit report and see if I qualified, and the teller told me I would receive a phone call within 3-5 business days to notify me if I was approved. I never heard from them, so naturally, I forgot about it.

Now, I should mention that I was a college student at the time, and had my parents linked to my bank account so they could deposit money directly into my account if my financial situation became dire. I frequently received $100 deposits from account numbers other than my own as, being a college student trying to afford $800 rent payments and maintain a high GPA, my financial situation required a lot of assistance.

July 2009

I received a letter in the mail announcing that I had an account that owed a little over $400 and having been delinquent on payments, was being sent to a collections agency. I thought it had to be a mistake, and initially googled the name of the collections agency to ensure it wasn't a scam. Several scams using the same name came up, so I chose to call my bank first to verify that my accounts were all in good standing. Upon calling, the customer service representative pulled up my account, viewed all of my open accounts with Bank of America, and verified to me over the phone that I was in good standing with all of my accounts, just as I had thought.

On a whim, I called the number on the letter I'd received from the collections agency. I was hoping to figure out how the scam worked so that I could better inform others to beware of it. However, upon giving them the case number listed on the letter, they were more than willing to give me the account number of the delinquent account. I told them that it couldn't be me, since I had already verified with my bank that I was fine. I had the case flagged as fraud and called my bank back.

This time, I was getting a little concerned. I gave Bank of America the account number given to me by collections, and they pulled up that account which was, in fact, in my name. Apparently, the overdraft account had been opened and the bank had chosen to never inform me. In September 2008, I had overdrawn (again, by about $2-3) and the overdraft account I never knew existed had deposited $100 in my checking account and accrued substantial interest fees since.

I never received statements, notifications, phone calls, nor the actual credit card corresponding with this account. I also never received the phone call telling me it had actually been opened. It never appeared on my online banking as it had with all of my other friends who had enrolled in overdraft protection. I hadn't been unaware of the $100 deposit; I just assumed it was another deposit from my parents because my account had been low. I had no reason to suspect it was coming from this phantom account.

To make matters worse, the customer service rep I spoke with at Bank of America was incredibly rude and claimed that they had investigated my case and tried every conceivable method of reaching me. This was a lie, and infuriated me. A simple phone call would have kept this entire situation from escalating.

Luckily, the collections agency was very understanding and dropped the cost to only about $150, which just covered their minimum costs. I was told that in my case, I should take the letter I would receive stating that the case had been closed to everybody's satisfaction back to my bank and demand it be taken off my credit report as the collections agent seemed to agree that I had been taken advantage of. I did this, but the bank told me there was nothing they could do. They tried to send me back to the collections agency to have an agent there "fix" it, but I knew this wasn't within their power.

So, now I'm stuck with a terrible credit score (bottom 30% percentile, from being in the top 30% percentile) thanks to Bank of America's shady business practices and terrible customer service. This entire situation could have been avoided with a simple phone call, letter, or email. It's not like they didn't have all of my current contact information. Anyone who was considering opening an account with Bank of America, I highly recommend US Bank or Wells Fargo, two banks I have never had any problems with.

This report was posted on Ripoff Report on 09/25/2009 02:29 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bank-of-america/internet/bank-of-america-ruined-my-credit-score-and-sent-me-to-collections-for-an-account-i-was-nev-500542. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Many banks don't really "protect" us...

AUTHOR: Ronny g - (USA)

SUBMITTED: Saturday, September 26, 2009

I notice if I am using any of my other debit cards and credits cards..I occasionally get a phone call it they even suspect anything unusual..they will ask me about specific recent transactions and make sure I am aware of them.

Now the banks never seem to do this..even when an overdraft occurs..how do they know it is not due to fraudulent activity??? I can answer that..they do not care..as long as the overdraft is allowed to occur..they make a bundle and are more then happy to cover it.

Now you stated your friends have some kind of overdraft protection that they "love?"

You have to be careful...typically "overdraft protection" is a term used for a courtesy service they provide..which as you have discovered..really didn't protect anything..did it not? If you had NOT had this type of overdraft protection..the transaction that caused it would have been declined..since if the funds were not available..you would have TRULY been "protected" from any fraud or error..do you understand now?

The type of overdraft protections your friends have..that you wanted is (well my bank refers to it) as "transfer overdraft service"..which still cost a fee to cover an overdraft..but only 12 dollars. If the savings account it is linked to has over $10,000 balance..overdrafts are covered free of charge. A good deal..but then again how many people with 10 grand in their savings account are apt to overdraft? Not many I would reasonably conclude. Now students such as yourself that keep a low balance are a prime target for the excessive fees brought on by overdrafting..so not only do you need to be extra cautious..which you seem to be..but make sure the bank does not force you to enroll in any courtesy overdraft protection service. Ask if you can opt out.

If they do not allow you to..don't worry, the banks recently have decided to allow you to opt out (BofA was one of the few that made OD protection mandatory..and why not?? The banks collected over 38 BILLION dollars in fees in 09)..I believe the banks came to their senses due to the countless complaints and eminent lawsuits and pending legislation...well they basically "decided" all of a sudden this was the right thing to do to actually provide a little protection of our money during a crisis..and afterall...isn't that an important part of the banks responsibility?..to help protect our money? Otherwise we might as well keep it in a cookie jar.

Good luck with everything.

#1 Consumer Comment

Michelle, Unfortunately the United States of America is now a country whose foundation is solidly built on- LIES, DECEPTION, FRAUD, MANIPULATION, GREED, TRICKERY, EVIL, DEEP CORRUPTION, & the....

AUTHOR: Karl - (U.S.A.)

SUBMITTED: Friday, September 25, 2009

CONSTANT PURSUIT TO FINANCIALLY INJURE THE INNOCENT PEOPLE LIVING IN AMERICA, & the INNOCENT PEOPLE LIVING ALL OVER THE WORLD.

Advertisers above have met our

strict standards for business conduct.