Complaint Review: Bank of America -

- Bank of America United States

- Phone: 800-421-2110

- Web: http://www.bankofamerica.com

- Category: Banking, banking - debit card company

Bank of America BOA Bank of America Debit/CC/ATM $1.50 Charge. Baseless Charges

*Author of original report: Not sure what you mean, but....

*Consumer Comment: You wrote a lot but...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

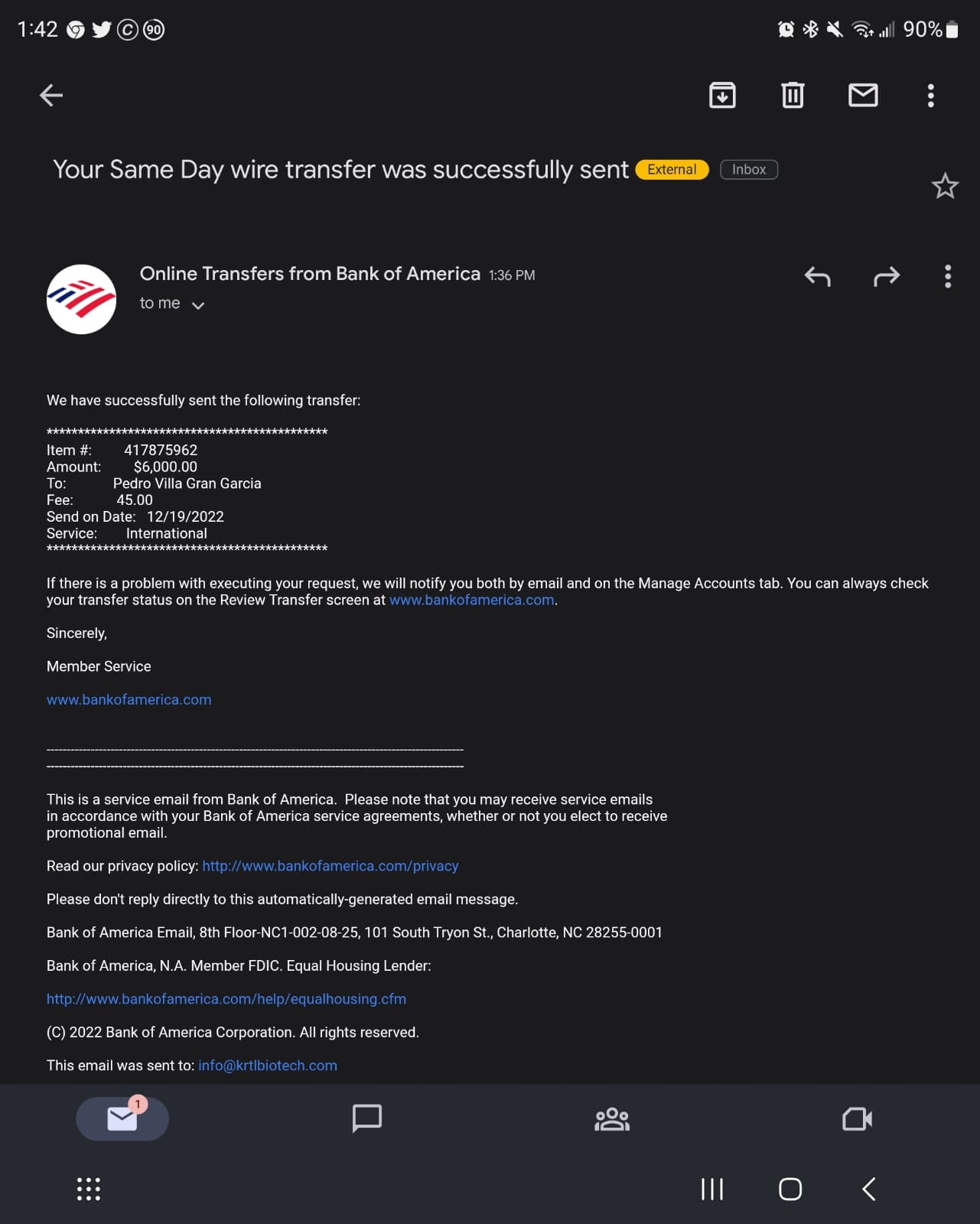

11/2021, I took out a balance transfer to save a lot of money. The transaction fee was paid and the transaction completed. The debit/cc itself had a zero balance.

12/2021, I paid $1,000 more than the 'minimum due' before the due date.

01/03/2022, again I paid $1,000 more than the 'minimum due' and before the due date.

01/20/2022, I had a charge to the debit/cc and paid it off in full 4 days later.

02/01/2022, again I paid $1,000 more than the 'minimum due' before the due date.

02/03/2022, I had a <$20.00 charge to debit/cc.

02/05/2022, I was charged $1.50 fee without cause, on a zero balance due.

02/18/2022, I reported to BOA of the $1.50 charge via phone. He read the agreement and stated the charge was not disputable and non-refundable. I asked what was the charge actually for, not under what circumstances to which I can be charged. He looked and could not find an answer.

He then put me on hold and reported this incident to another department. He then stated the other department also could not find a reason for the $1.50 charge as I always carried a zero balance, paid a mininimum of $1,000 more than the minimum amount due, and nothing to account for a $1.50 charge.

He informed me the other department agreed to refund the $1.50, to which I was refunded the next business day. Bank of America debit/cc are making mint off of others not reporting this baseless charge. I will be reporting this to other agencies to investigate.

This report was posted on Ripoff Report on 02/22/2022 04:32 AM and is a permanent record located here: https://www.ripoffreport.com/report/bank-america/boa-debitccatm-charge-charges-1516283. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Not sure what you mean, but....

AUTHOR: Earnest - (United States)

SUBMITTED: Tuesday, February 22, 2022

I don't use this BOA debit/cc as my main card due to possible fraud issues connected to my bank account. Therefore, I've most always had a zero total balance, zero due, zero on the card, nada, nothing. I've only had 2 charges for 2022 and paid back both the charges on the card within a few days. Never, ever outside the 30-day grace period.

For example, charged on 01/20/22, paid back on 01/24/22. The monthly minimum due for the transfer is around $250/month. I pay it a few days early and around $1,300. This would cover the $250/month and also, if I had any sort of balance on the cc, it would more than cover it per BOA policy on fees. The debit/cc operator of BOA stated he did not know why the $1.50 interest/charge fee since I had absolutely ZERO on the cc and paid over $1,000 over the minimum due on the transfer. He brought up the issue to another department. They also did not know why the charged fee of $1.50, nor for what purpose. I was promptly refunded the next business day.

Thank you for your concern. However, if you cannot understand credit card basics, then I question your authenticity as being of genuine concern. Do I need to report your as a scammer?

#1 Consumer Comment

You wrote a lot but...

AUTHOR: Robert - (United States)

SUBMITTED: Tuesday, February 22, 2022

You wrote a lot but...didn't say anything worthwhile.

You said you were charged $1.50 on No Balance "DUE", but you didn't say you had a zero balance.

He then put me on hold and reported this incident to another department.

He then stated the other department also could not find a reason for the $1.50 charge as I always carried a zero balance, paid a mininimum of $1,000 more than the minimum amount due, and nothing to account for a $1.50 charge.

This is a contradictory statement and nothing more than a word salad. You can't say you always carried a zero balance and at the same time, you paid a minimum of $1,000 more than the minimum due. People that truly carry zero balances would not say they paid more than the minimum, they would say that they paid off the balance.

What is your statement's "Billing" Date, "Due Date", your exact running balance, exact payments?

The devil is in the details, and those answers will go a long way to what is going on. The $1.50 charge sounds like a "Minimum Finance Charge", that is if you have a balance subject to interest and that interest is less than $1.50 they will charge you $1.50.

Now, they did refund the $1.50 this time which is good. But if you don't change your credit/payment habits this will likely happen again. And the second time don't expect them to be as generous.

Advertisers above have met our

strict standards for business conduct.