Complaint Review: Afni Collections, - Bloomington Illinois

- Afni Collections, PO Box 3427 Bloomington, Illinois U.S.A.

- Phone: 888-879-6810

- Web:

- Category: Collection Agency's

Afni Collections, Collection on an 11-year old Verizon , GTE phone number! Bloomington Illinois

*Consumer Comment: Need to respond to the Validation recieved by AFNI

*Author of original report: Sample of letter I sent...successfully resolving my issue!

*Consumer Suggestion: ERIN the address for AFNI Listed

*Author of original report: R in Torrance - Address to send a letter to...

*Consumer Suggestion: ERIN HELP ME PLEASE

*Consumer Comment: AFNI part 2

*Consumer Comment: Congratulations

*Author of original report: Resolution at last! I WON!

*Author of original report: Resolution at last! I WON!

*Author of original report: Resolution at last! I WON!

*Author of original report: Resolution at last! I WON!

*Consumer Suggestion: Vincent - Newport Beach, California - Excellent distinction between ATTEMPTING to collect and being able to SUE TO OBTAIN MONEY

*Consumer Suggestion: Time-Barred debts and Collecting

*Consumer Suggestion: Vincent - Newport Beach, California - you need to post this info on another thread regarding Diebold

*Consumer Suggestion: Time-barred Debts

*Consumer Suggestion: AFNI INFO..THE SOL HAS EXPIRED..STAY OFF THE PHONE

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I too received a collection notice on a Verizon phone number I haven't had in more than 10 years. Up until 2004, I had continual service with them and they never mentioned anything about unpaid bills. The address they show for me doesn't even match the billing address when I had the phone number, and I haven't lived at that address for almost 9 years!

I have been calling Afni for the last week, and every time I call I get "due to unusual call volume and waits in excess of 30 minutes, we cannot assist you at this time". Yeah right, why would I willingly wait 30 minutes for THEM to tell ME I might owe them money?

I paid this debt. My credit record is spotless and I am meticulous on printing my reports every year. The letter was addressed to my maiden name and I have been happily married for 8 years! I called Verizon, and they don't have records that far back, but coincentally enough, they show the EXACT same phone number being sent to collection in 5 other people's names (one of them mine).

I called Afni, and their rep said this had been in collection since 1996. Funny, why have I NEVER received anything in the mail? I have lived in California my whole life (37 years). I am now sending a letter today to dispute the debt. Would love to know of other people's experience. I would LOVE to know what the term "time-barred debt" really means, and what the SOL is in California.

Erin

fountain valley, California

U.S.A.

This report was posted on Ripoff Report on 01/30/2007 12:08 PM and is a permanent record located here: https://www.ripoffreport.com/reports/afni-collections/bloomington-illinois-61702-3427/afni-collections-collection-on-an-11-year-old-verizon-gte-phone-number-bloomington-ill-233543. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

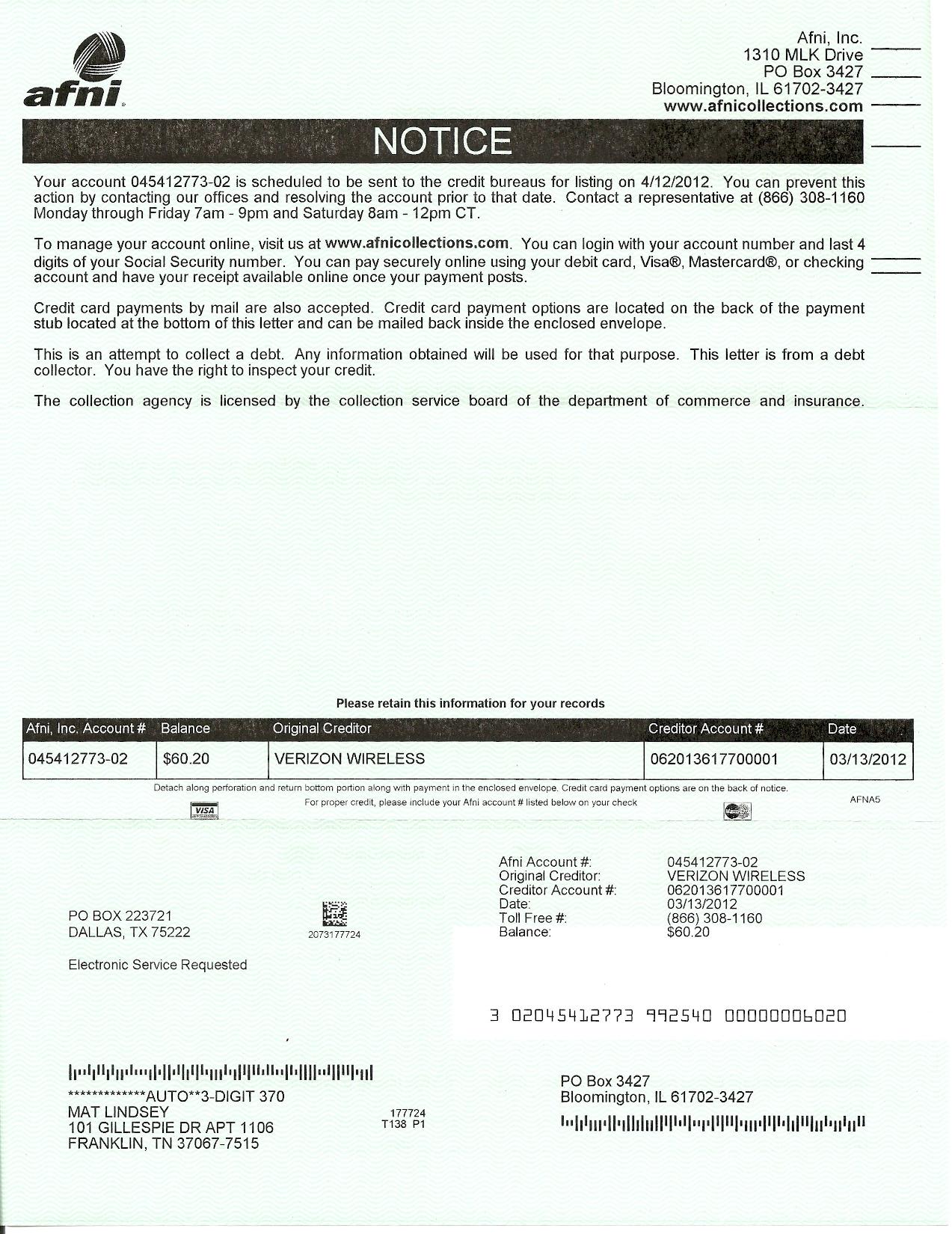

#16 Consumer Comment

Need to respond to the Validation recieved by AFNI

AUTHOR: R - (U.S.A.)

SUBMITTED: Sunday, April 29, 2007

Dear Erin,

As suggested by the forum i did send in a validation request to AFNI.

They sent me a VERIZON bill with my name on it and my old address in New Jersey. I have told them that i was in CA at that time period.

The invoice is from July 2000 has the SOL expired??

What should i send them as they refuse to listen to my please that i had BELL ATLANTIC IN NJ not Verizon and that it had been disconnected.

Will these people bully me to pay somepne else's bill.

Help.

R

#15 Author of original report

Sample of letter I sent...successfully resolving my issue!

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Saturday, March 31, 2007

Here is the text of the letter I sent to AFNI. I received their response within a few weeks stating they were removing my account from collection. I know, I know...people have already warned me and I am cautiously optimistic at best! Good luck! Feel free to use my letter verbatim if you like.

February 9, 2007

Afni, Inc.

Corporate Headquarters

404 Brock Dr.

Bloomington IL 61702-3097

RE: Afni, Inc. Account #

Sent certified, return receipt requested #

Dear Sirs,

I am writing in regards to the above mentioned account number for an alleged collection account with Verizon Communications, Inc. I take issue with this letter for many reasons, but the number one reason this cannot be collected is that it is over 11 years old! In the state of California, the statute of limitations is 4 years.

I spoke to Verizon Communications on January 23rd and again on January 30th and the representatives (Sherri and Michelle, respectfully) both stated that their system does not go back this far. Michelle also stated that she has been inundated with calls of the exact same scenario as mine. I spoke to Josh at your customer service number and he stated this account had been in collection with two other agencies. In the past 11 years I have NEVER received any communication regarding this account because I DON'T OWE IT.

Under the provisions of the FDCPA I hereby request full validation of this alleged debt. I need to see the signed original contract that created the alleged debt as well as a full account history and itemization of charges.

I also need proof that you are legally entitled to collect on said debt AND licensed to collect in my state.

Furthermore, if you own the debt, I need to see the purchase contract, proof of payment and full chain of title.

I demand you remove this from your records. I do not owe it, and am not going to pay one penny.

Respectfully,

Cc: Federal Trade Commission

#14 Consumer Suggestion

ERIN the address for AFNI Listed

AUTHOR: R - (U.S.A.)

SUBMITTED: Saturday, March 31, 2007

Thank you. I had seen that the people who guided you had the corporate address for AFNI listed .

I think you should also post the address where you sent your letter . I was thinking of sending to the PO BOX listed in the letter and the Corporate.

Do let me know where you send the letter and a copy would be awesome for guidance.

Regards

#13 Author of original report

R in Torrance - Address to send a letter to...

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Friday, March 30, 2007

If you scroll thru all the entries above you will see a whole list of addresses and contact info. That's where I sent my letter. If you still don't see it, let me know. Maybe send me your email address and I will give you a copy of the letter I sent.

Erin - Fountain Valley

#12 Consumer Suggestion

ERIN HELP ME PLEASE

AUTHOR: R - (U.S.A.)

SUBMITTED: Thursday, March 29, 2007

ERIN

I HAVE A SIMILAR CASE IN CALIFORNIA.

In your case did you also follow up with a SOL letter.

I have already drafted a letter can you tell me which address you sent it to?

I only have the PO box from them.

Please advice on this site.

Thank You and Congratulations

Stressed R

#11 Consumer Comment

AFNI part 2

AUTHOR: Gloria - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

I have sent my letter of dispute asking them to verify just about everything. Now I live in Arizona debt is from California. They sent me a photocopy of a partial GTE phone bill but payable to Verizon in Dec. 1997. They didn't even become Verizon until June of 2001?

What was there proof?

1. The photocopy of a partial 1997 bill. It didn't list any phone charges other than the final amount.

Letter states:

2. No. Carolina Dept. Of insurance Permit Number 3080.

3. New York City Dept. of Consumer Affairs License 0920246.

4. This Collection Agency is licensed by the Minnesota Dept. of Commerce

Now is that funny or what!

I have generated a new letter.

In part I have written something like this. I still need to go over it and make some changes...

"You have failed to provide and comply with all the information that I have requested. The photo copy of a 1997 billing statement you sent from GTE is NOT considered proof or validation of the alleged debt. Spears v. Brennan, 745 N.E.2d 862, 878-79 (Ind. App. 2001) (a copy of the original debt instrument does not verify that there is an existing unpaid balance and does not satisfy the verification requirement of 1692g(b)).

You have also failed to provide: (2. the signed original contract that created the alleged debt. 3) full account history, 4) dates, 5) requesting assignment necessary to show title in under UCC 9-406, 810 ILCS 5/9-

I dispute the validity of this debt as it is not my debt. The SOL Statute of Limitations has expired. I have checked with the Arizona State Attorney General , the California State Attorney General and the Illinois State Attorney General and verified that the Statute of Limitations for enforcing this type of debt through the courts has expired.

I am fully aware of my rights as per the provisions of the FDCPA and the FCRA. Therefore, should you decide to pursue this matter in court I intend to inform the court of my dispute of this debt and that the "statute of limitations" has expired.

Be advised that I consider any contact not in accordance with the Fair Debt Collection Practices Act a serious violation of the law and will immediately report any violations to my State Attorney General, to the Federal Trade Commission and, if necessary, take whatever legal action is necessary to protect myself. Edelman, Combs, Latturner & Goodwin, LLC in Chicago is already looking into your affairs as a Junk Buyer. "

Anyway I am asking that since they were unable to validate the debt to cease all further communication. The debt is not mine. The Statute of Limitations has expired.

These guys are relentless.

I also wrote down news from the Consumer Affairs website that states info about Camco. I'm just putting a blurb here.

CAMCO, which was permanently closed by the court-appointed receiver in December 2004, was a "debt buyer" -- a company that buys old debts well past the statute of limitations and attempts to collect them. Most of the debts are unenforceable in court and beyond the reporting periods allowed under the Fair Credit Reporting Act.

Debt Collector Settles Abusive Practices Charges

March 13, 2007

The final defendant in a case that brought a $1 million settlement with the Federal Trade Commission in December for illegal debt collection practices has agreed to settle FTC charges that he threatened and harassed consumers to get them to pay old, unenforceable debts or debts they did not owe.

Don't let these bully's get to you. It's not your debt to pay an the statute of limitations has expired.

#10 Consumer Comment

Congratulations

AUTHOR: Elaine - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

But don't throw that letter our. I'm not a trusting sort, and I don't think that AFNI would honor a letter the owner's MOTHER wrote.

#9 Author of original report

Resolution at last! I WON!

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

I sent a letter via certified return receipt within the 30-day window stating I did not owe them the money they say I owed, nor was I going to send them one thin dime unless they could verify that I in fact owed the money. I used some of the GREAT advice in the many postings about what to ask for, even quoting a letter someone else had posted. I just received a letter from AFNI, Inc. stating that they were removing me from their collection records and notifying all the credit bureaus of the same. Even though it was a PIA to jump thru their hoops, it was worth opening that letter and realizing that I had been vindicated! Hopefully, they didn't just sell it to another junk-debt collector! Thanks everyone for all the advice!

#8 Author of original report

Resolution at last! I WON!

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

I sent a letter via certified return receipt within the 30-day window stating I did not owe them the money they say I owed, nor was I going to send them one thin dime unless they could verify that I in fact owed the money. I used some of the GREAT advice in the many postings about what to ask for, even quoting a letter someone else had posted. I just received a letter from AFNI, Inc. stating that they were removing me from their collection records and notifying all the credit bureaus of the same. Even though it was a PIA to jump thru their hoops, it was worth opening that letter and realizing that I had been vindicated! Hopefully, they didn't just sell it to another junk-debt collector! Thanks everyone for all the advice!

#7 Author of original report

Resolution at last! I WON!

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

I sent a letter via certified return receipt within the 30-day window stating I did not owe them the money they say I owed, nor was I going to send them one thin dime unless they could verify that I in fact owed the money. I used some of the GREAT advice in the many postings about what to ask for, even quoting a letter someone else had posted. I just received a letter from AFNI, Inc. stating that they were removing me from their collection records and notifying all the credit bureaus of the same. Even though it was a PIA to jump thru their hoops, it was worth opening that letter and realizing that I had been vindicated! Hopefully, they didn't just sell it to another junk-debt collector! Thanks everyone for all the advice!

#6 Author of original report

Resolution at last! I WON!

AUTHOR: Erin - (U.S.A.)

SUBMITTED: Thursday, March 15, 2007

I sent a letter via certified return receipt within the 30-day window stating I did not owe them the money they say I owed, nor was I going to send them one thin dime unless they could verify that I in fact owed the money. I used some of the GREAT advice in the many postings about what to ask for, even quoting a letter someone else had posted. I just received a letter from AFNI, Inc. stating that they were removing me from their collection records and notifying all the credit bureaus of the same. Even though it was a PIA to jump thru their hoops, it was worth opening that letter and realizing that I had been vindicated! Hopefully, they didn't just sell it to another junk-debt collector! Thanks everyone for all the advice!

#5 Consumer Suggestion

Vincent - Newport Beach, California - Excellent distinction between ATTEMPTING to collect and being able to SUE TO OBTAIN MONEY

AUTHOR: P - (U.S.A.)

SUBMITTED: Wednesday, January 31, 2007

This is an important difference especially when the collection agencies tell you they are going to sue on a time barred debt ....

#4 Consumer Suggestion

Time-Barred debts and Collecting

AUTHOR: Vincent - (U.S.A.)

SUBMITTED: Wednesday, January 31, 2007

P-Dallas; unfortunately colledctors can legally ATTEMPT to collect on a Time-Barred Debt regardless of how old it is, they are just unable to sue or state that it is their intent to sue. I would do just what you suggest, dispute the debt in writing, chances are with a debt that old they will have no abillity to validate the debt even if they can they are not able to take the debtor to court.

#3 Consumer Suggestion

Vincent - Newport Beach, California - you need to post this info on another thread regarding Diebold

AUTHOR: P - (U.S.A.)

SUBMITTED: Wednesday, January 31, 2007

There seems to be a question regarding statute of limitations by one poster who believes the debt is collectable FOREVER ..

#2 Consumer Suggestion

Time-barred Debts

AUTHOR: Vincent - (U.S.A.)

SUBMITTED: Tuesday, January 30, 2007

A Time-Barred debt is a debt that is so old that it is beyond the point that a creditor or debt collector can sue you to collect. Meaning that it is beyond the Statute of Limitations for your state. Most state's SOL is between 3 and 10 years. To find your Stste's SOL go to your state AG's web site. You can find your state's AG web site at www.naag.org then search for "collection statute of limitations.

The courts have found that the FDCPA does not prohibit debt collectors from trying to collect Time-Barred Debts as long as they do not sue or say they intend to sue.

If you do get sued for a Time-Barred debt you can get the suit dismissed by letting the Judge know that it is a Time-Barred Debt.

debts that have been delinquent for seven years or more can not appear on your credit.

The statute of limitations in California is 4 years from the breach.

#1 Consumer Suggestion

AFNI INFO..THE SOL HAS EXPIRED..STAY OFF THE PHONE

AUTHOR: P - (U.S.A.)

SUBMITTED: Tuesday, January 30, 2007

Corporate Headquarters

404 Brock Drive

Bloomington, IL 61702-3097

800.767-2364

Afni, Inc.

404 Brock Drive

Bloomington, IL 61702 USA

Contact: Jim Hess, Director, Business Development

Phone: 800-767-2364, ext. 3321

Fax: 309-820-2632

Email: jimhess@afninet.com Afni, Inc. IL 309-663-4510 Jim Hess

Website: afninet.com

President and COO:

RONALD L GREENE

404 BROCK DRIVE

BLOOMINGTON 61701

Secretary: GREGORY J DONOVAN same address

Bruce F. Griffin

Chairman and Chief Executive Officer

Ronald L. Greene

President and Chief Operating Officer

Greg Donovan, CPA

Vice President of Employee Services

Stenia Dziadiw

Vice President of Sales & Business Development

Michael D. Garner

Vice President of Call Center Services

John Mobley, Jr.

Vice President, Information Technology Services and

Chief Information Officer

John O'Donnell

Vice President of Credit & Collections Services

Organization Number 0491821

Name AFNI, INC.

Profit or Non-Profit P - Profit

Company Type FCO - Foreign Corporation *****

Status A - Active

Standing G - Good

State IL

File Date 3/27/2000

Authority Date 3/27/2000

Last Annual Report 5/1/2006

Principal Office 404 BROCK DRIVE

BLOOMINGTON, IL 61701

Registered Agent C T CORPORATION SYSTEM

KENTUCKY HOME LIFE BLDG

LOUISVILLE, KY 40202

Current Officers

President Ronald L. Greene

Vice President Gregory J. Donovan

Secretary Gregory J. Donovan

Treasurer V. Curtis Oyer

Director Bruce F. Griffin

Director Ronald L. Greene

This organization has no assumed names

Previous Names

previous company names:

06/24/1986 - CREDIT CHECK INC.

06/29/2000 - ANDERSON FINANCIAL NETWORK, INC.

For collection-related inquiries, contact our Recovery Team at 1.800.371.3645, by mail at Afni, Inc. PO Box 3517, Bloomington, IL 61701 or email at: recoveryteam@afninet.com.

To handle your collections account on the internet, visit the collections website at AfniCollections.com

Important Note Regarding Collection-Related Inquiries:

If you choose to communicate via email, please remember that no matter how many measures Afni takes to ensure the confidentiality of your email, the Internet may be a non-secure medium for communication. If you choose to communicate your collection-related inquiry via email, Afni cannot be responsible for any possible disclosure of an account to a third party

COLLECTIONS PORTION OF THE COMPANY URL APPEARS TO BE AFNINET.COM

Anderson Financial Network, Inc.

404 Brock Drive

Bloomington, IL 61701

Administrative Contact:

Girard, Chris g@AFNINET.COM

Afni

404 Brock Dr

Bloomington, IL 61701

(309) 828-5226 fax: (309) 820-2610

Technical Contact:

Anderson Financial Network, Inc. oktober_isbell@HOTMAIL.COM

404 BROCK DR

BLOOMINGTON, IL 61701-2654

US

309.828.5226 fax: 123 123 1234

GENERAL INFORMATION FROM VARIOUS SITES ON DEALING WITH COLLECTION AGENCY'S

Tell them to validate by

. What the money you say I owe is for;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show me that you are licensed to collect in my state

Provide me with your license numbers and Registered Agent

1. NEVER talk to a collection agency on the phone. Period.

2. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

3. Send all correspondence via registered mail, receipt requested and put the registered mail number ON THE LETTER. DO NOT SIGN THE LETTER TYPE YOUR NAME

4. Keep a copy of every letter you send.

5. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees. This is illegal, every state has usery laws (which dictate the maximum interests allowed to be charged. That is except North Dakota. There are no such laws which is why most credit card companies incorporate there.) Junk debt buyer pay anywhere from 1 cent to 7 cents on the dollar, there is no way there is this much interest.

6. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention or until the SOL runs out ..

Advertisers above have met our

strict standards for business conduct.