Complaint Review: AFNI - Bloomington Illinois

- AFNI www.afnicollections.com Bloomington, Illinois U.S.A.

- Phone:

- Web:

- Category: Collection Agency's

AFNI Another Fake Debt Collection Bloomington Illinois

*Consumer Comment: Advise...

*Consumer Comment: Advise...

*Consumer Comment: Advise...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Looks like I am the 365th post dealing with AFNI collections agency trying to collect an imaginary debt. First off why is this company still in existence!?

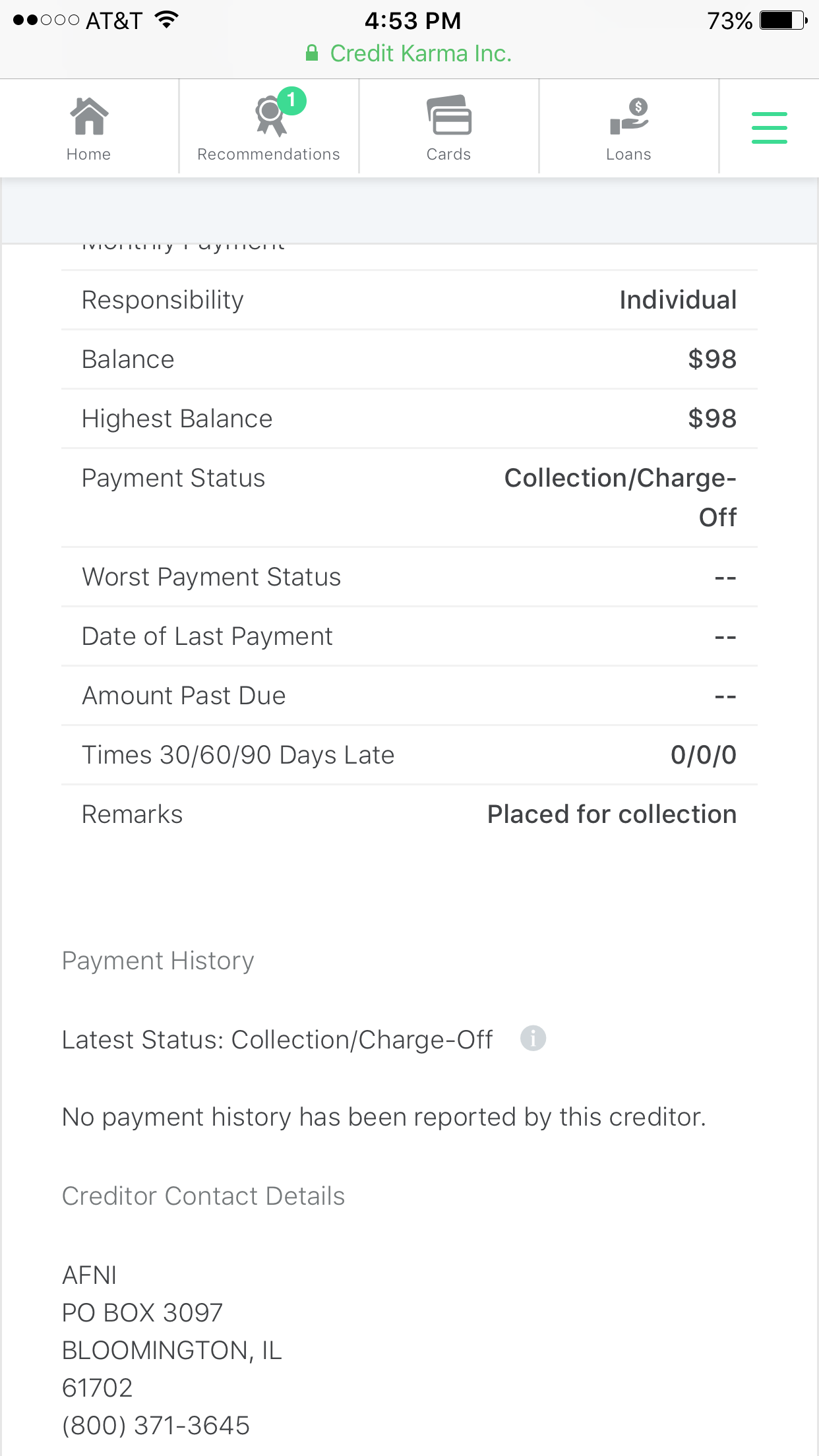

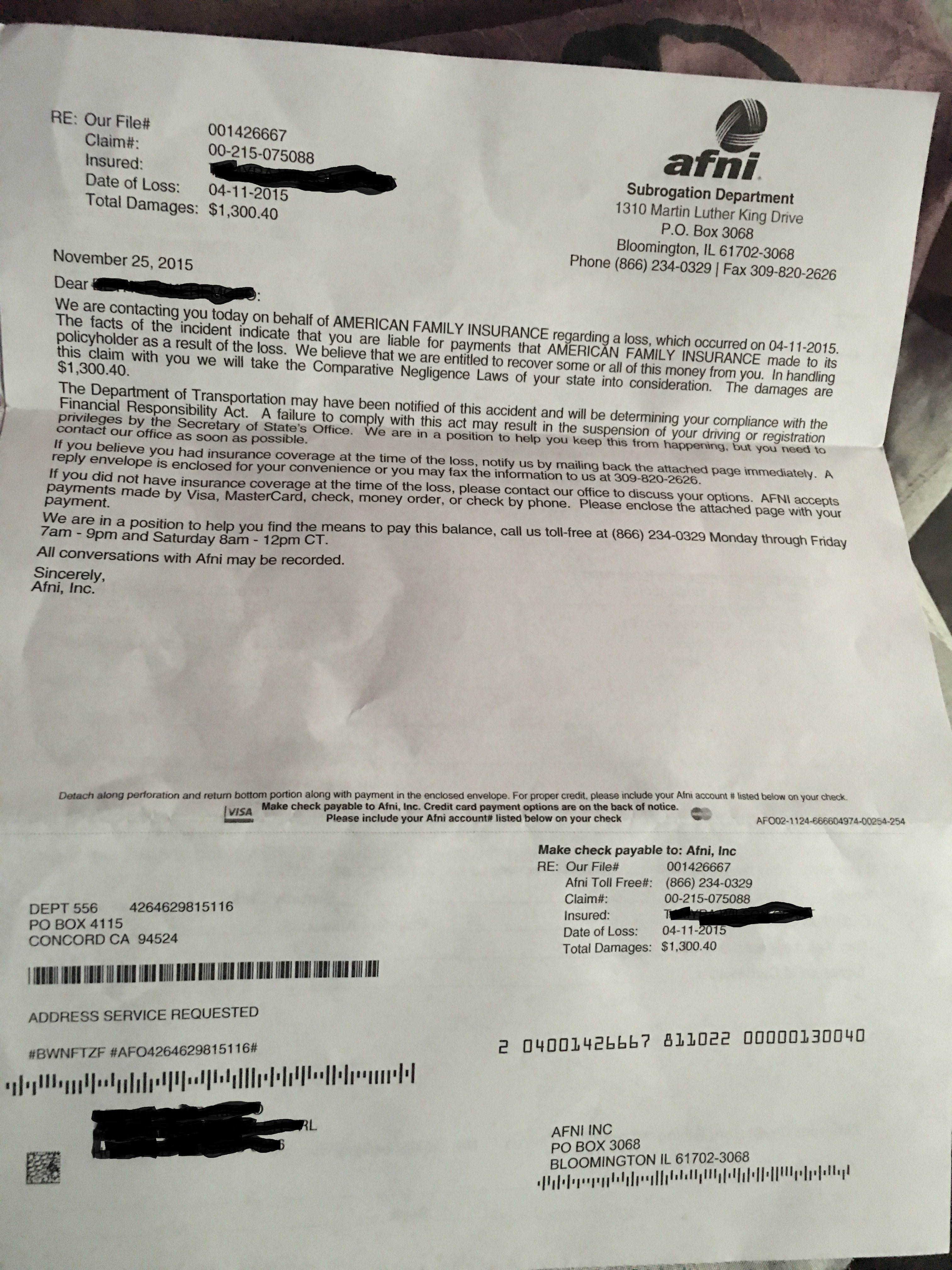

Today I tried to get a loan and unfortunately was denied due to a "$475 debt to AFNI collections agency". After 4 hours on the phone with both AFNI and Cingulair/AT&T I have only been able to verify that the good people at AT&T agree that I do not owe them money and that I have never had an account with my social security number turned over to any collections agency. Of course AFNI does not care what AT&T says, wish I would have read some of these other posts first.

It is absolutely correct when people advise not to call the collections agency. In the end (after a good hour of being on hold and talking to 5 different operators who could not find my account) I talked to some smug jackass who called himself "Josh". He offered to cut me a deal... "a one time offer to settle my debt for $275 instead of $475". It seemed a little odd to me that a collections agency would drop $200 off a debt when that seems to be the amount of money they go after people for. After I declined his "offer" to pay him money I don't owe, Josh "was sorry I didn't appreciate his generosity". At that point I cussed him out and hung up. Maybe not the smartest move but it felt great.

Anyway this is just another story of AFNI collections screwing someone's credit for a debt that isn't owed. When will someone step up and put an end to this?

another victim

Corvallis, Oregon

U.S.A.

This report was posted on Ripoff Report on 11/02/2007 08:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/afni/bloomington-illinois/afni-another-fake-debt-collection-bloomington-illinois-282651. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Advise...

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, November 02, 2007

When will someone step up and put an end to this?

Answer: The real problem lies with the big three credit bureaus, which are way more concerned with their profits than in the accuracy of the info they report...This creates opportunities for firms like AFNI to step in and post bogus negative info on credit reports to get money from you.

==============================================

FAQ: What to do if AFNI places bogus negative info on your credit report:

Send a letter to all three credit bureaus (preferably Registered Mail with Return Receipt) with the following request:

I do not recognized this alleged debt. Per the Fair Credit Reporting Act I am requesting that you validate this alleged debt. To speed things up, include a photocopy of your driver's license and social security card with each letter. If you don't include these items, the credit bureaus may write back and request this information, delaying your request by around a month

Under normal circumstances the credit bureaus should remove the negative notations. If they don't and write back that the debt has been validated, you have a fight on your hands.

If AFNI has placed bogus negative information on your credit files and one (or all) credit bureaus have come back claiming that this alleged debt has been validated as legitimate, you should:

#1) Send a Registered Mail with Return Receipt directly to AFNI, stating the following:

This debt is not mine and AFNI is in violation of the Fair Credit Reporting Act in reporting erroneous negative information to the credit bureaus that I owe this debt. If this erroneous entry is not removed from my credit file within thirty days, I plan to file official charges against AFNI with the Illinois Attorney General [note: AFNI is located in Illinois, so complaints would be filed in Illinois] as well as take other actions per my rights under the Fair Credit Reporting Act

#2) Send a Registered Letter with Return Receipt to any (all) credit bureaus still reporting this bogus negative information with the following request:

I am requesting the written communication between your firm and AFNI that led to validation of this.

#3) Keep your fingers crossed and hope this works. If the negative information is STILL on your credit files after these efforts, it's time to see an attorney who specializes in Fair Credit Reporting Act violations.

#2 Consumer Comment

Advise...

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, November 02, 2007

When will someone step up and put an end to this?

Answer: The real problem lies with the big three credit bureaus, which are way more concerned with their profits than in the accuracy of the info they report...This creates opportunities for firms like AFNI to step in and post bogus negative info on credit reports to get money from you.

==============================================

FAQ: What to do if AFNI places bogus negative info on your credit report:

Send a letter to all three credit bureaus (preferably Registered Mail with Return Receipt) with the following request:

I do not recognized this alleged debt. Per the Fair Credit Reporting Act I am requesting that you validate this alleged debt. To speed things up, include a photocopy of your driver's license and social security card with each letter. If you don't include these items, the credit bureaus may write back and request this information, delaying your request by around a month

Under normal circumstances the credit bureaus should remove the negative notations. If they don't and write back that the debt has been validated, you have a fight on your hands.

If AFNI has placed bogus negative information on your credit files and one (or all) credit bureaus have come back claiming that this alleged debt has been validated as legitimate, you should:

#1) Send a Registered Mail with Return Receipt directly to AFNI, stating the following:

This debt is not mine and AFNI is in violation of the Fair Credit Reporting Act in reporting erroneous negative information to the credit bureaus that I owe this debt. If this erroneous entry is not removed from my credit file within thirty days, I plan to file official charges against AFNI with the Illinois Attorney General [note: AFNI is located in Illinois, so complaints would be filed in Illinois] as well as take other actions per my rights under the Fair Credit Reporting Act

#2) Send a Registered Letter with Return Receipt to any (all) credit bureaus still reporting this bogus negative information with the following request:

I am requesting the written communication between your firm and AFNI that led to validation of this.

#3) Keep your fingers crossed and hope this works. If the negative information is STILL on your credit files after these efforts, it's time to see an attorney who specializes in Fair Credit Reporting Act violations.

#1 Consumer Comment

Advise...

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, November 02, 2007

When will someone step up and put an end to this?

Answer: The real problem lies with the big three credit bureaus, which are way more concerned with their profits than in the accuracy of the info they report...This creates opportunities for firms like AFNI to step in and post bogus negative info on credit reports to get money from you.

==============================================

FAQ: What to do if AFNI places bogus negative info on your credit report:

Send a letter to all three credit bureaus (preferably Registered Mail with Return Receipt) with the following request:

I do not recognized this alleged debt. Per the Fair Credit Reporting Act I am requesting that you validate this alleged debt. To speed things up, include a photocopy of your driver's license and social security card with each letter. If you don't include these items, the credit bureaus may write back and request this information, delaying your request by around a month

Under normal circumstances the credit bureaus should remove the negative notations. If they don't and write back that the debt has been validated, you have a fight on your hands.

If AFNI has placed bogus negative information on your credit files and one (or all) credit bureaus have come back claiming that this alleged debt has been validated as legitimate, you should:

#1) Send a Registered Mail with Return Receipt directly to AFNI, stating the following:

This debt is not mine and AFNI is in violation of the Fair Credit Reporting Act in reporting erroneous negative information to the credit bureaus that I owe this debt. If this erroneous entry is not removed from my credit file within thirty days, I plan to file official charges against AFNI with the Illinois Attorney General [note: AFNI is located in Illinois, so complaints would be filed in Illinois] as well as take other actions per my rights under the Fair Credit Reporting Act

#2) Send a Registered Letter with Return Receipt to any (all) credit bureaus still reporting this bogus negative information with the following request:

I am requesting the written communication between your firm and AFNI that led to validation of this.

#3) Keep your fingers crossed and hope this works. If the negative information is STILL on your credit files after these efforts, it's time to see an attorney who specializes in Fair Credit Reporting Act violations.

Advertisers above have met our

strict standards for business conduct.