Complaint Review: Wachovia Bank - Stockbridge Georgia

- Wachovia Bank 5000 N. Henry Boulevard, Stockbridge, GA Stockbridge, Georgia United States of America

- Phone: 8009224684

- Web:

- Category: Banks

Wachovia Bank EXCESSIVE OVERDRAFT FEES Stockbridge, Georgia

*Consumer Comment: Thank you Teresa...

*General Comment: Ronny is so right

*Consumer Comment: Angelia

*Consumer Comment: To the Soldier that filed the report

*Consumer Comment: Oh.one more reply for "IamBaffoon"...

*Consumer Comment: IamTHEfool does like getting debunked !!!!

*General Comment: Runny Nose

*Consumer Comment: The Infamous Unanswered Ripoff Question

*Consumer Comment: IamGood apparently likes getting debunked.

*General Comment: Runnie Nose

*Consumer Comment: Hey..Iamgood..or should I say Youarestupid???

*Consumer Comment: No one "got" anyone Robert...

*Consumer Comment: It seems as though the "FLAW" that Alan Greenspan found in "the way the world should work" was putting it a bit....

*Consumer Comment: Correction..

*Consumer Comment: In Defense of the advise..

*General Comment: 8000 in fees?

*General Comment: 8000 in fees?

*Consumer Comment: Write your Representative & Senator!

*Consumer Comment: This is the key..AND the lock..

*Consumer Suggestion: This is the key.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have been back and forth with Wachovia on their methods of compiling overdraft fees for the past months and I am so highly upset right now, I can blow. I sat down with two employees today for several minutes and they still could not tell me to my satisfaction why I have $385 in overdraft fees today when the last time I used my card, my account was in the positive and it has not been touched since. They say that if I look at my account online, it is not a true balance because some things on hold may be sent back because the merchant takes too long to send it through (not my problem); they say that what I hear on the phone may not be a true number because if I purchased gas in the past few days, it is not going to show up as a debit for several days, not even as a hold (still not my problem); they say that after Friday, Sat, Sun they look at all transactions over the weekend and enter the largest one in first thinking those are more important (didn't ask them to). They say if there are four transactions over the weekend, they will enter the largest first and the other three will incur an overdraft fee so that is $105 in od fees, instead of entering them in the order in which I charged them that when if I am cutting it close on my balance, would only make me have one od fee. Not until I saw on the news that other people are experiencing the same thing did it make me even madder. I thought I was just a lousy keeper of my finances because I don't write every transaction down in my ledger. I downloaded all my bank statements from about a year and a half ago and to date, I have been charged just under $8,000 in overdraft fees. I am a single mother in the military trying to make ends meet, I don't have $8,000 to just give away. I don't have a dollar to give away. I asked the branch manager to add up my deposits since 1 Oct to present then subtract what purchases I made and she told me that I would still have $179 remaining in my account but due to their method of fees I am $496 overdrawn. I am so so so mad and at wit's end. If jobs did not require you to have direct deposit, I would get a paper check and handle my own finances. Urrgghh

This report was posted on Ripoff Report on 10/14/2009 02:30 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/stockbridge-georgia-/wachovia-bank-excessive-overdraft-fees-stockbridge-georgia-509277. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#20 Consumer Comment

Thank you Teresa...

AUTHOR: Ronny g - (USA)

SUBMITTED: Thursday, October 29, 2009

I used to teach at a school and wrote a textbook. I have written for a few publications and a home study course but I have not chosen writing as a profession. As far as ever running for office..I don't think it's for me..I would never get "with the system"..and they would chew me up. Perhaps in the future if "ethics" become more important then greed I will have a place.

I do recommend looking into any candidates that are Libertarian...or have those principles. Granted..many of them would not be as hard on the Banks as I am, but they will believe in common sense governing..and smaller government. I am a firm believer that we only NEED the government for 2 main reasons....One is to protect us from enemy attacks..and two is to protect the honest hard working taxpayers from corporate greed,,and not allowing financial and other necessary institutions from having too much power..kind of the exact opposite of what is going on now..and we can all witness the result.

#19 General Comment

Ronny is so right

AUTHOR: Teresa - (U.S.A.)

SUBMITTED: Thursday, October 29, 2009

Ronny G I loved everything you wrote. Do you write professionally?

I live in California...We need a new Governor. Have you considered running?

I would vote for you.

#18 Consumer Comment

Angelia

AUTHOR: SSG Jason - (USA)

SUBMITTED: Wednesday, October 28, 2009

When I was a Private in the Army, I incurred around a $1000 in overdraft fees from Columbus Bank and Trust in Ft. Benning, GA. I was not aware at how they managed to legally take that much from me when I too thought I only overdrew a few times. I have since gotten alot smarter with my finances and how banks work. A great bank that I use now is USAA. They offer a deposit at home service, free online bill pay, reimburse atm fees to a point, have great customer service and can provide auto and home insurance as well. I switched from Bank of America to USAA and have been completely satisfied.

The only advice I can give you is to make sure you are living within your means,which I believe you are trying to do, watch where your money goes, go to ACS (Army Community Service) and talk to their financial advisors, check with AER (Army Emergency Relief) and see if they can give you a grant to help with your bills (the grant is free money to help with hardships), and also try to negotiate with the bank. More than likely you will have to pay back some money but every little bit that you get reduced will help in the long run. Banks don't like to negotiate but I know they will. Good Luck.

#17 Consumer Comment

To the Soldier that filed the report

AUTHOR: SSG Jason - (USA)

SUBMITTED: Wednesday, October 28, 2009

When I was a Private in the Army, I incurred around a $1000 in overdraft fees from Columbus Bank and Trust in Ft. Benning, GA. I was not aware at how they managed to legally take that much from me when I too thought I only overdrew a few times. I have since gotten alot smarter with my finances and how banks work. A great bank that I use now is USAA. They offer a deposit at home service, free online bill pay, reimburse atm fees to a point, have great customer service and can provide auto and home insurance as well. I switched from Bank of America to USAA and have been completely satisfied.

The only advice I can give you is to make sure you are living within your means,which I believe you are trying to do, watch where your money goes, go to ACS (Army Community Service) and talk to their financial advisors, check with AER (Army Emergency Relief) and see if they can give you a grant to help with your bills (the grant is free money to help with hardships), and also try to negotiate with the bank. More than likely you will have to pay back a huge sum of money but every little bit that you get reduced will help in the long run. Banks don't like to negotiate but I know they will.

#16 Consumer Comment

Oh.one more reply for "IamBaffoon"...

AUTHOR: Ronny g - (USA)

SUBMITTED: Wednesday, October 28, 2009

I can't believe I almost missed this one..but be prepared for the debunking of a lifetime...

YOU stated and I quote..."

"I asked BOA why they changed their policy, and their response was that sometimes customers do bounce the occassional check due to their own bookkeeping errors, so they are reaching out to help that customeer."

Okay..then explain this. We know..because even you posted the changes that Rape Of America is making...and one of the changes is they are for the first time going to allow customers to opt out of courtesy overdraft protection service..

Now as you so clearly stated..by a customer opting out of this service..they may be charged an NSF fee since the check will not be covered if it bounces..and possibly subjected to another fee if the check is returned...correct...you stated the bank told you this ..since even though this has been going on since the beginning of time..for some reason you..the "bank expert"..had to call and ask the bank...

So...if by what YOU posted..the bank is "reaching out" to help that customer...the one I guess that will bounce an "occasional" check due to a book keeping error..how is the policy change helping this customer in any way?

If they are opted out...it will be worse for this customer (2 fees remember you said it (NSF and returned))..versus only one fee for covering the overdraft the way it was always done before the policy change...so..

Please explain...as YOU posted....the bank is reaching out to help this customer by any policy change. Seems according to the bank..and you...that this policy change is WORSE for the dinosaurs that still use checks.

So again..what are you talking about out of your a*s again??? Strike 50,000!!! You are OUT !!!

Maybe this can finally end the "check" defense..as I already said..this has nothing to do with checks. If someone bounces a check by their own fault they get a fee..as always..so what is the revelation in the bank defenders stating of this known fact over and over....it is not an issue in these arguments. NON ISSUE..clear enough !!!!

Now you are not obligated to reply again and risk further verbal beatings..but if you wish to..kindly try to answer the question as asked...if you think you can. No need to call the bank..if what you stated is true..they lied..so someone is lying. Can we get a truthful logical answer please..it seems so apparent to Edward and I..why can't a bank defender say it?

#15 Consumer Comment

IamTHEfool does like getting debunked !!!!

AUTHOR: Ronny g - (USA)

SUBMITTED: Wednesday, October 28, 2009

Nice to see you are dropping "down" to my level..lets see how much sense you make..shall we??

"I am going to drop down to your level, and call you a dip sh*t!!!!!"

I will accept being called a dip s**t...if anything you stated makes sense...or bears any resemblance to what we are discussing....game on...

"Maybe you should divorce your first cousin, and marry someone who is not related to you."

I am not married.......STRIKE ONE !

"I called BOA and checked their policy. If you opt out of the Overdraft protection, and you bounce a check, and it is returned NSF, you will still be charged 35.00 Granted you will still be only charged 4 a day, but the items will still be returned."

Correct....but when did I ever say ANY customer who chooses to opt out of OD protection will not be subject to an NSF fee? Apparently you DO NOT read anything I post..or if you do...have a serious problem with comprehension. The purpose of opting out of overdraft protection is to PROTECT your debit card from being continually allowed to make transactions after the account is below zero...whether due to fraud, error, theft, carelessness...whatever...IF the account TRULY has no funds AVAILABLE...the transaction will be DECLINED at point of sale..and at an ATM..where the FDIC report clearly states this is where most overdrafts occur.

Now unless you can find ANYWHERE..that I EVER stated bouncing a check would be free...please post it as evidence...otherwise, we can consider this response...STRIKE TWO !!! next...

"The caveat to not having OD protection, if you are incapable of balancing your check book is that when the check is returned NSF to your vendor, then they will probably redeposit the check, and if you did not replinsh your account soon enough, the bank will charge another 35.00, and then you will also owe 35.00 to the vendor as well."

I won't count this one as a strike..but I should. You are simply stating fact that everyone already knows. You somehow get the impression that this whole argument..and this whole issue with the law suits and complaints and legislation and the media attention has ANYTHING to do with checks..

As a matter of fact....DUE to the fact that most people do not even use checks anymore..is one of the reasons the banks no longer need to re-sequence most customers transactions..they can simply process them in the correct chronological order in which they come in...and it won;t make any difference to anyone..other then legitimate transactions can no longer be charges OVERDRAFT fees. And...the fact that most people no longer use checks..and all their complaints have been due to one overdraft causing so many additional fees...or the customer not understanding why the card was not declined if there were no funds..is all the more reason many customers can benefit by NOW being allowed to opt out...and/or the bank no longer "automatically" enrolling EVERY customer into a service they did not want to begin with.

Granted..and I have discussed this ENDLESS times with other BANK DEFENDERS..because they always bring up the check issue..which is futile...but I am well aware..and have stated on at LEAST a dozen other posts..the a bounced check can incur an NSF fee...and be returned which can cause a second fee. This is simple fact. I don't use checks since I am not a dinosaur....but even if I was silly enough to still use checks in the times of instant electronic paperless transactions..I would MUCH prefer the chance of being charged 70 dollars for a LEGITIMATE bounced check...by my own fault...and pay the fees without complaint....then find due to many of the banks past and current tactics..that due to one overdraft...were charged hundreds and hundreds of dollars in fees...and all but ONE due to the banks manipulations..were legit. And THIS is what I find is happeneing in many of the complaints...and why my advice..and the BANKS making these changes BY THEIR OWN DECISION...may be a good thing for some customers...so hard to understand??? Next...

"I asked BOA why they changed their policy, and their response was that sometimes customers do bounce the occassional check due to their own bookkeeping errors, so they are reaching out to help that customeer."

Why did you have to ask them anything? I thought you were some kind of bank expert or something you said you were? Many banks are changing my friend..not just BofA..and they all will follow suit...just watch.

I already explained..the changes have nothing to do with checks...if you continue to argue about something I never was even talking about..you are going to give up the last STRIKE by default.... Next...

"But in the original poster's message, she has over 8000.00 worth of Overdraft fees in a year? She is not the customer they are interested in helping. With customers like her, who needs enemies?"

So...the bank collected $8000.00 in fees from this customer..and the bank still kept her around....hmm...guess they kind of like this kind of "enemy". Your logic is so a*s backwards..and ...I am holding back saying any more insults..no point..you do it to yourself....big STRIKE THREE !!!!! Is there more??? Next....

"BTW I LOVE BOA, I called them to ask about fees, and you know what they did. They refunded 200.00 worth of ATM fees from other banks, without me even having to ask them."

So what? Why would I care what BofA gave you? Maybe one day when they start ripping you off..I will be here coming to YOUR defense...we will see.

"Any of you ROR viewers that can handle a checkbook responsibily, put your money in BOA. "

Yep...go ahead...it's a great bank...just "google" it. anyone can.

"You Ronnie G (oops i mean JackAss), should bury your money in a hole outside of your house, because you HATE BANKS."

Nope..I do not "hate" banks....nor do I hate you or the other bank defenders. I just expose what some of these banks have been doing to the hardest hit customers during a ressecion...and apparently..the banks must understand as well..since they are starting to make the EXACT changes Edward and I have been beliving they should all along....

So do you still care to answer the question? Or keep replying with information about checks that are obsolete...like frim the 1950's I think. Yes..I saw a check at the smithstonian once...looks like a little paper you write stuff on and it can be cahed by anyone..and lost? Does anyone trust those these days? I hear the banks don't even trust their own checks from some of these reports..and actually place holds on them for 7-10 days...I wonder why? Can you tell us? Or better yet..call Stankass of America and ask them why they do this.

"Remember without banks, Small Business would not have a chance, because who would loan them money to get started. Ife it wasnt for Banks, no one except the rich would own a home, because there would be no one to lend the common man money to buy the house."

What planet are you living on? Have you ever read a newspaper or a statistic? Can you even watch the news....are you aware of how many "common men" are in foreclosure these days? Thanks in part to the banks..with their rippoff interest only mortgages and fraud and schemes...do some research..you are talking out your AS* again. STRIKE FOUR !! Just google that contains the words "bank" and any of the following "mortgage scam, fraud, tactic, foreclosure, rape, fleece, hurt, steal etc"

and since you are SO SO SO misinformed..plenty of rich people have been screwed as well..I live in Hollywood..plenty of multimillion dollar homes are now vacant...google it..I am not making up any of this..if is a fact Jack.

Regardless..I am not here to discuss the mortgage debacle with you...I am here to respond to your silliness..which is really really silly..and to continue to EXPOSE what the banks are doing. Oh..you can also google "Madoff Ponzie scheme bank executive caught in foreclosed home"..and find out how a bank executive from Wells Fargo was BUSTED by neighbors living it up in a multi million dollar foreclosed home..right near me in Malibu California...a house now rightfully owned by the stock holders..I bet they were impressed.

"Our economy would be much smaller than it is, because the consumer would be forced to save money before they bought anything. This would mean less Jobs, and there would only be 2 classes of people, The Rich, and The Poor. Our economy would find it impossible to support the number of peeople in this nation without banks."

Well wake up there buddy..what do you think IS happening now. Do you live in a cage or something? I see things as such. Economies are known to go through cycles. Albeit, this is not as bad as the great depression of the 1930's..yet..but it is statistically the worst recession in recorded history. We the Hard working American taxpayers help bail out these FAILING LOSER LOSING banks with 700 BILLION (that's Billion with a "B") in Tarp funds..and what do the hardest hit customer ask for in return? Maybe a little leniency? A little fairness if they have a financial problem..you know during a recession that businesses close...or down size..people are laid off...have to read lately what the projected unemployment rate is? probably not..everyone is a deadbeat in your eyes so I can't really teach you anything..it's like taking to wood...except wood would actually more reasonable..and MUCH smarter. STRIKE ONE THOUSAND !!!

"Banks rely on fees to stay in business, they dont just give people a safe place to store money for nothing. "

This is apparent. But I always thought the way banks were supposed to make a profit was from fair lending. Perhaps that was a myth? Anyhow..I believe this is true..that the banks have failed heavily at making a profit ethically..and can not come up with a business plan to make a profit without fleecing their customers with fees...all well and good....which leads back to my original question which NO bank defender seems to be able to answer...

Why are banks changing policies which will obviously cut down on the fees they can take in..by their OWN decision. Think about it...I smell the wood burning...come on..you must be able to figure it out...can you?

And why you are pondering that...ponder this..what do YOU think the banks are going to start doing to make up for the lost revenue they won't be taking in anymore nearly as much from all these so called "deadbeats"...is there a chance they may start attacking the "good" customers as well? Perhaps you should read up a little more...and you may find this is ALREADY IN PROGRESS. Sorry to say..it does not make me happy..but it is a fact..and you we can only blame the banks..after all it is THEIR polices..right? YOU signed a "contract" with the bank..right? If you don't like it..you can just leave that bank..right? Stick around...you will see the light if you do not already.

"So keep all this in mind, the next time you bash a bank"

Will do...if the banks give no reason to bash them..I will not bash them..you have my word.

"By the way you are a loser, and a dip s**t!!!! Now i need to go home and take a bath, because now i have dove into the same pool of s**t you live in on a daily basis."

Uhh okay..get personal and you don't even know me. That's fine. I am not angry at all. Now if you were in my face and said that..you'd probably be tasting knuckles about now..but you are a weak a*s coward so I don't expect you would dare to face me in person. Anyone who gets their jollies by bashing bank VICTIMS who come here to lodge their report..needs to grow a pe**s. So..if you ever grow one...then you can talk.

And judging by the "fleecing" and debunking I just dished out to you...it seems apparent who the real loser is. Now go take your bath..and come back for more..I am here waiting.

And maybe next time you can just simply answer my simple question so we can stop this idiocy?

#14 General Comment

Runny Nose

AUTHOR: IamGood - (USA)

SUBMITTED: Wednesday, October 28, 2009

Hey Ronnie:

I am going to drop down to your level, and call you a dip s**t!!!!!

Maybe you should divorce your first cousin, and marry someone who is not related to you.

I called BOA and checked their policy. If you opt out of the Overdraft protection, and you bounce a check, and it is returned NSF, you will still be charged 35.00 Granted you will still be only charged 4 a day, but the items will still be returned.

The caveat to not having OD protection, if you are incapable of balancing your check book is that when the check is returned NSF to your vendor, then they will probably redeposit the check, and if you did not replinsh your account soon enough, the bank will charge another 35.00, and then you will also owe 35.00 to the vendor as well.

If you have Overdraft protection, then the check will be paid, and you will pay a fee which is less than the 35.00, and you will have to pay the bank back within 5 business days, or you will be assessed another 35.00 fee.

I asked BOA why they changed their policy, and their response was that sometimes customers do bounce the occassional check due to their own bookkeeping errors, so they are reaching out to help that customeer.

But in the original poster's message, she has over 8000.00 worth of Overdraft fees in a year? She is not the customer they are interested in helping. With customers like her, who needs enemies?

BTW I LOVE BOA, I called them to ask about fees, and you know what they did. They refunded 200.00 worth of ATM fees from other banks, without me even having to ask them.

Any of you ROR viewers that can handle a checkbook responsibily, put your money in BOA.

You Ronnie G (oops i mean JackAss), should bury your money in a hole outside of your house, because you HATE BANKS.

Remember without banks, Small Business would not have a chance, because who would loan them money to get started. Ife it wasnt for Banks, no one except the rich would own a home, because there would be no one to lend the common man money to buy the house.

Our economy would be much smaller than it is, because the consumer would be forced to save money before they bought anything. This would mean less Jobs, and there would only be 2 classes of people, The Rich, and The Poor. Our economy would find it impossible to support the number of peeople in this nation without banks.

Banks rely on fees to stay in business, they dont just give people a safe place to store money for nothing.

So keep all this in mind, the next time you bash a bank

By the way you are a loser, and a dip s**t!!!! Now i need to go home and take a bath, because now i have dove into the same pool of s**t you live in on a daily basis.

#13 Consumer Comment

The Infamous Unanswered Ripoff Question

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Wednesday, October 28, 2009

Hey Iamgood, let's see how good you really are, you know since you're a former Bank Official, with your degree in Finance/Accounting, and all. After you're done answering Ronny g's questions, can you please answer this question for me, which no one else has ever dared to touch:

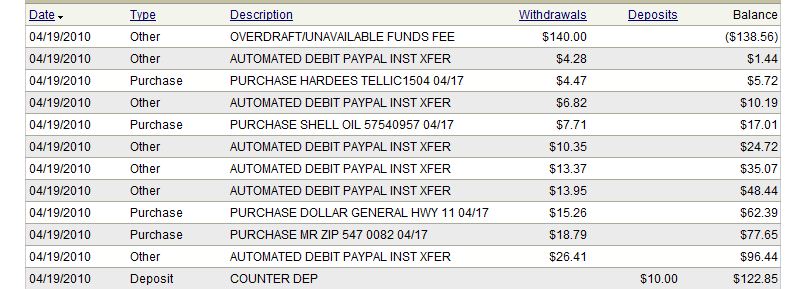

A customer has a $500 Posted Account Balance. They have four pending debit holds of $25 each, totaling $100, leaving them with an Available Balance of $400. The customer proceeds to Walmart where he swipes his card for a purchase of $300, leaving him with an available balance of $100. Lastly, the next day the customer proceeds to Home Depot where he swipes his card for a $200 purchase, leaving him now with a negative balance of ($100). This is the last purchase this customer makes. This final purchase at Home Depot overdrew his Available Balance and a fee will be charged for it. No Problem. The customer understands and accepts this ONE FEE, same as all of the authors of these Ripoff Reports.

But here's where the fun (Ripoff) begins. While the Home Depot transaction is still PENDING or ON HOLD, the other transactions made beforehand come in and post. Remember none of them overdrew the Available Balance when they were made. Also remember the Posted Account Balance is $500. Thanks to Re-sequencing, the $300 Walmart transaction posts first, leaving a Posted Account Balance of $200. Then the four $25 debits post, leaving a Posted Account Balance of $100. Nightly Processing is now complete and the customer ends up with a POSITIVE Posted Account Balance of $100. Free and Clear, right? Wrong.

Thanks to the Unavailable Funds Fee, because those four $25 debits and the Walmart $300 all post while the Available Balance is negative because of the pending Home Depot Hold, ALL FIVE of those transactions are charged a $35 fee. None of these transactions overdrew the Available Balance when they were made. None of these transactions overdrew the Posted Account Balance when they posted. Yet ALL FIVE are charged a fee.

That's the Ripoff here, which has never been explained. Now let's see if a former Bank Official with a Finance/Accounting degree would care to enlighten us.

#12 Consumer Comment

IamGood apparently likes getting debunked.

AUTHOR: Ronny g - (USA)

SUBMITTED: Tuesday, October 27, 2009

I have been to all the sites..and read the articles. I have stated before that BofA is changing their overdraft policies..and that is what is happening NOW. They may not have chosen on their own to stop re sequencing..but after the lawsuits and legislation..and continued complaints...they will..mark my words. Other banks are stopping it..and s***k of Amereica WILL follow suit eventually..most likely some time early next year. The tactic of re-sequencing is no longer nessecary for most debit card users..as been explianed over and over again in detail by Edward and myself. The ONLY reason the bank keeps the policy..is to gouge and maximize fees..it has been EXPOSED..and it WILL be delt with in time..I would bet my car on it in without batting an eye.

There is not ONE single item you stated that either I have not posted before..or have said a zillion times. But IamTHEjackass will not give up...so I will continue to make a fool of him.

The only nose that will be runny is yours..once your interest rates suck..and maybe they will cancel your credit cards..or raise your interest rates to 29.99%..who knows what the banks will do next?...but they will be doing something not good for any of us to make up for all the loss in fees they will be getting much less of. It's unfortunate..but true. If you do not believe that the banks are attacking "good" customers..and not just the so called "deadbeats"..you have been living in some kind of vacuum..yes...the vacuum of bank defender ignorance.

So you don't need to send me to any of the informative sites that I have already left examples for you to go to...I am already aware the banks are voluntarily making changes on their own...I am already aware that by opting out of OD protection you can get an NSF fee if the check is returned. Can you please tell us something that may actually be of interest???

Like my original question that I asked and am still waiting for an answer??

Why are the banks choosing to change overdraft policies on their own?

I AGAIN await the answer with much anticipation.

Since you chose to single out B of A..and I was talking banks in general...let us list the changes B of A is making for NOW..on their own...and have IamGood tell us why they are doing this BEFORE they are forced to?

Oh..and I do not "resort" to profanity to make a point about the issue..I use profanity to describe what you act like in a language you can understand..since logic and reasoning seem to be futile with many bank defenders.

Bank of Americas list of current changes....

1) Customers whose accounts are overdrawn by less than $10 will not be charged overdraft fees as long as their accounts are brought current within five days.

2) A cap on the number of times accounts may be assessed an overdraft fee per day.

3) For the first time B of A will allow consumers to opt out of the courtesy overdraft protection service, eliminating the potential for paying overdraft fees.

So tell us IamLoser....why the decision now for the bank to make these changes? Tell us oh mighty wizard of banking procedure and policy. Do you think perhaps..a teeny tiny chance..that the banks have figured out that some of the previous policies were a tad unfair...think that is a possibility????...tell us...please...inquiring minds want to know...and would love to hear it from a notorious unreasonable ignorant banks defenders mouth.

#11 General Comment

Runnie Nose

AUTHOR: IamGood - (USA)

SUBMITTED: Tuesday, October 27, 2009

Runny Nose

go to this website. It is Bank of America's web page about NSF's and overdrafts.

It is very informative. You will note at the bottom of the page however, they are still resequencing checks, they also give a section or how to avoid overdraft fees.

http://factsaboutfees.bankofamerica.com/manage-banking-fees/overdraft-and-nsf-fees/ Almost all banks are going to follow this policy.

I would carefully read those policies,

1). The bank will process deposits first.

2). They will resequence the transactions by dollar amount (highest to lowest).

3). After all the transactions have been processed, if you have a negitive balance of 10.00 or more, you will be charged 35.00 for each transaction up to 140.00.

However if a paper or electronic check bounces, and you do not have overdraft protection, they will return the check to the vendor, and you will still incur a 35.00 fee for each check returned. Here is where OD protection came into play, the bank would pay the checks, if you had overdrawn, and you would be charged 35.00. If you dont have OD protection, you will still be charged a 35.00 fee per check, plus now you will owe a 30-50 fee to the person you wrote the check to. Also if the vendor redeposits the check, if that bounces again, BOA will hit you with another 35.00 fee per check. if I were you I would opt in for OD protection. But Runny Nose isnt smart enough to realize this.

I would follow the bank's suggestions on this web site for avoiding fees, and Runny Nose, I would suggest you go back to school. Not all of us rely on google to get our news from, and NO, I did not cut, and paste my instructions on how to reconcile a check book. I learned this is College where i got my degree in Finance/Accounting.

further more, I will restate that I do not resort to calling someone profane names when trying to make a point.

#10 Consumer Comment

Hey..Iamgood..or should I say Youarestupid???

AUTHOR: Ronny g - (USA)

SUBMITTED: Tuesday, October 27, 2009

I never needed to attended any banking 101 in school. I do not have a problem using a register..nor do I overdraft....well I can't get overdraft fees..almost impossible..I am opted out of the scam "service" the banks so loving call "courtesy overdraft protection service". So they can not "service" me..or allow transactions to continue when my balance reaches zero in the event of theft or fraud...no that is what I call "protection"..would you not agree?

Now you can post all the directions you want on how to use a register...but none of that takes away from anything regarding what the banks were doing to it's customers....

But don't take my word for it...look up the FDIC report....or read any recent article about the banks changing some policies before any of the pending lawsuits have closed...and before any legislation was passed...and then tell us Iamgood...

...tell us in all your infinite wisdom and banking knowledge that apparently YOU didn't memorize from school since to had to copy and paste if from someone else...but tell us please..so we know once and for all....

One simple question and see if you can give me a logical answer...

Why are the banks choosing to change overdraft policies on their own?

I await the answer with much anticipation.

Oh..if you know how..you can even google "banks change overdraft/re-sequencing policies" if you need any updates.

#9 Consumer Comment

No one "got" anyone Robert...

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 26, 2009

Well except the bank.

As far as the opting out of OD protection doing any good...I never implied it was fool proof...which is why I posted (copied and pasted verbatim from my above reply)...

".if the funds are truly unavailable..the transaction will be declined at point of sale or at an ATM swipe."

Since this is what is stated in the FDIC report as to where most of the fees occurred..it tells us in all logic that opting out will most likely cut down on fees..or the potential to incur fees.

Now to the person who stated they opted out with Wachovia and still had received OD fees....might want to find out how. Because it happened to me as well due to an authorization hold I did not know about.

I went to the bank fuming..and the bank manager realized it was an oversight by the bank and returned all fees..I had him draw up in writing that all transactions are to be declined if the funds are unavailable. I am no longer with that bank...but this is what it took at the time to truly be protected....the bank was reluctant to allow me to opt out...that you can believe...because I was first hand witness to them trying to not allow it..then telling me they did allow it..and negating.

#8 Consumer Comment

It seems as though the "FLAW" that Alan Greenspan found in "the way the world should work" was putting it a bit....

AUTHOR: Karl - (U.S.A.)

SUBMITTED: Monday, October 26, 2009

mildly, wouldn't everyone NOW agree?

#7 Consumer Comment

Correction..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, October 26, 2009

I mis-read the date of jenalaska. It did not state that they opted-out on the 24th, but that is when the fees were assessed. Just so no one thinks they "got me" and can call me out. As the rest of it hoping that they would post additional details would still be of interest.

#6 Consumer Comment

In Defense of the advise..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, October 26, 2009

In Defense of the advise from Ronny and in response to Jenalaska. The "opt-ing" out apparently only applies to Electronic Transactions(ATM and Debit Card). It does not apply to Checks or other transfers. It also will only deny the transaction IF the balance is currently at or below $0. It would be good to see if there was anything signed as "proof" that you did opt-out, as well as when. Because the 24th was a Saturday and that is not only not enough time for them to process that as the first banking day would be the 26th, but you probably already had items "pending" that could not have been stopped. Although it would be good if you think it is a RipOff to post another report, as I am sure it will be responded too.

Also, writing Congress didn't do much before..they had PLENTY of opportunities to put legislation through and it never got out of committee. But now since the banks are changing their policies this gives Congress an "opt-out". As they now have an excuse as to why they don't need to do anything more.

As for the OP I agree with Flynrider. For them not to realize that they were at about $8,000 in OD fees until they took the time and looked at 1.5 years of statements, leads me to believe that a Debit Card may not be the best thing for them. Had they taken even a very small fraction of the time to write down their transactions and balance their account on a continuing basis. Not only would that total time probably have been less than this has taken, but they would have avoided a majority(perhaps all) of the fees.

#5 General Comment

8000 in fees?

AUTHOR: IamGood - (USA)

SUBMITTED: Monday, October 26, 2009

d**n Girl:

You should thank God for overdraft protection otherwise your 8000.00 in fees would have jumped to over 16,000.

Are you aware if the bank bounces a check you will be charged 35.00 it sends the check back to the vendor, and the vendor will redeposit the check again? If it bounces a 2nd time, there will be another 35.00 fee.

The vendor will then charge you 30.00 fee , so instead of a 35.00 fee, you will be hit with 105.00 fee + the cost of the check, and if you decide to ignore the vendor, and not pay the check, it will be sent to the sherrif, or police, and you will be hit with another 35.00 fee.

So you should do three things,

1).keep overdraft protection on your account,

2).learn to reconcile your check register DAILY.

3). Stop Listening to the Likes of RonnieG (A Bank Basher), his advice will only get you in trouble, because he is blaming the bank, instead of pointing out the errors of your way, in not keeping a accurate, and up to date check register.

Signed

A Former Bank Offiicial who dealt with Customers

PS this is how to reconcile your balance. *When I mention Checks, it also means Withdrawls at ATM's, and usage of your debit cards.

1). Go to your check register, look for any checks that have not yet shown clear on your check register.

2). Go to your on line banking center, and look for those checks that you found on your check register, and look to see if they cashed that day.

3). If any of the checks did cash, go and put some kind of indicator on the line for that check that it has cashed.

4). Look at the Available Balance on your On Line Statement, and subtract the total amount of UNCASHED checks on your register from the Available Balance on the On Line Statement. These 2 balances should be equal.

5). If the balances are equal, then you can go out and write checks in confidence. if the balances are not equal, there are checks you wrote, that may not be in your register, so you will need to look further at your register, until you find the transaction that is not recorded. Usually it will be some kind of bank fee, or a ATM transaction you forgot about.

Hey RonnieG this is consumer banking101, did you skip that class in home economics in High School, i think maybe you did.

#4 General Comment

8000 in fees?

AUTHOR: IamGood - (USA)

SUBMITTED: Monday, October 26, 2009

d**n Girl:

You should thank God for overdraft protection otherwise your 8000.00 in fees would have jumped to over 16,000.

Are you aware if the bank bounces a check you will be charged 35.00 it sends the check back to the vendor, and the vendor will redeposit the check again? If it bounces a 2nd time, there will be another 35.00 fee.

The vendor will then charge you 30.00 fee , so instead of a 35.00 fee, you will be hit with 105.00 fee + the cost of the check, and if you decide to ignore the vendor, and not pay the check, it will be sent to the sherrif, or police, and you will be hit with another 35.00 fee.

So you should do three things,

1).keep overdraft protection on your account,

2).learn to reconcile your check register DAILY.

3). Stop Listening to the Likes of RonnieG (A Bank Basher), his advice will only get you in trouble, because he is blaming the bank, instead of pointing out the errors of your way, in not keeping a accurate, and up to date check register.

Signed

A Former Bank Offiicial who dealt with Customers

#3 Consumer Comment

Write your Representative & Senator!

AUTHOR: Jenalaska - (USA)

SUBMITTED: Monday, October 26, 2009

Dear Single Military mom, October 26,2009

I would strongly encourage you to write your congressional delegation for wherever you live and cc the President of Wachovia Bank or vice versa. It is most effective to contact your own delegation but I usual add the Banking Chairs in the House & Senate too. Information on how to contact all of the above is below.

$8000 in fees is absolutely ridiculous and unreasonable on any planet. I myself got some relief from Bank of America by writing them and cc'ing my congressional delegation and the heads of the banking committees; and my complaint for $500 in interest that never should have been charged!

Here is some information you & others may find helpful:

To find your federal level Representative:

https://writerep.house.gov/writerep/welcome.shtml

Find your Senator:

http://www.senate.gov/general/contact_information/senators_cfm.cfm

Mr. Robert Steel

Wachovia Bank

Office of the President

Mail Code NC0005

Wells Fargo Company, Corporate Offices

Mr. John Stumph, President & CEO

Senator Chris Dodd

Chair, Senate Banking Committee

448 Russell Building

HR 3126 Creates a new Federal Consumer Protection Agency.

It passed the House Committee Oct.22,2009 but needs support to pass the full House & Senate.

http://financialservices.house.gov/contact.html

Or by letter:

House Financial Services Committee

Democratic Staff

2129

And one comment about the person who said that if you "opt out" then Wachovia will not put through transactions when there are insufficient funds. I hate to tell you that that is NOT true. I myself opted out in early October of this year and on October 24th was assessed $105 in fees for, you guessed, insufficient funds available!!!!!

#2 Consumer Comment

This is the key..AND the lock..

AUTHOR: Ronny g - (USA)

SUBMITTED: Thursday, October 15, 2009

This is confusing to you because you have been hit with re-sequencing combined with courtesy overdraft protection. Regardless of what bank defenders may tell you or advise..it can't hurt to understand the banks part in this..unreasonable? And it can't hurt to take additional steps to prevent this besides the obvious..which to wit by all the reports...is not always working the same for everyone..and never will...

Now if the bank chooses to manipulate and re-order your transactions upside down and sideways from here to china...it would not have made a difference if... A) you never incur an overdraft...and/or B) you were not enrolled in courtesy overdraft protection. The bunk the bank told you about larger payments being more important..or so they assume..nonsense..how do they know which transaction is more important? Do they have some kind of sensor that tells them what transaction is more important to you? And regardless..since they are covering all your overdrafts apparently..what is re-sequencing them doing other then causing additional fees? Exactly..nada. Because by processing the largest transactions first regardless of when they come in...it leaves the greatest potnetial to wipe out the account..and then all the other things you purchase will be charged an overdraft fee..even though technically..and in every sense of reasoning..had the funds available at the time of said purchases. In other words..if the bank didn't play their little manipulation game..it would have been just as impossible for those transactions to have overdrafted,,has it would have been if you didn't have the original legitimate overdraft in the first place.

A little secret. Wachoiva did allow me to opt out of the overdraft protection service albeit it took a couple of tries and I had to get it in writing. Nothing to do with me not keeping a register..because I watch my spending to the penny...but situations occurred with me where a register did not help...and I was hit up with fees. So since I kept a low balance..and did not link to a savings account with a transfer service..and did not use paper checks...I felt my money would be a lot safer without the so called "courtesy" overdraft protection. At least for me it was peace of mind.

Want to know the beauty of opting out? No matter what the online statement says..no matter what the ATM machine says..no matter what the bank says when you call them...no matter what your register says...if the funds are truly unavailable..the transaction will be declined at point of sale or at an ATM swipe. The deceptions, manipulations and mistakes can no longer harm you...sounds good to me.

Can this cause embarrassment? Perhaps. Can this cause you to have to borrow money from a friend or family if you need diapers or cold medicine? Perhaps. Could this CHOICE to opt out have saved you potentially $8000 dollars that would have been food on your table..maybe a new car...a vacation?? Perhaps...so something to consider since whatever you have been doing..didn't work.

As a matter of fact...can you believe it??? Many banks are changing their policies...have or will be soon. The sham got exposed..and now due to all the complaints...pressure from congress...the media..pending law suits..it may end soon..or at least start to become an even playing field.

1) No more forced mandatory courtesy overdraft protection, and the customer has to be informed if they are enrolled

2) no more re-sequencing...transactions are to be processed as they are received..Just like WAMU and several others have been practicing..we call that fair.

B of A..one of the worst with complaints..has already decided to adopt this policy..a lot of changes coming by early next year.

Imagine that..and a few banks have done this voluntarily...never ceases to amaze me.

I only wish one more thing...a little less deception from the bank with the online statement...IE: using the word "available" when it is not true...

From the dictionary...

available adj.

1. Present and ready for use; at hand; accessible: kept a fire extinguisher available at all times.

2. Capable of being gotten; obtainable:

Now none of this excuses you from going through this again now that you understand the way this bank works....agreed??

#1 Consumer Suggestion

This is the key.

AUTHOR: Flynrider - (U.S.A.)

SUBMITTED: Wednesday, October 14, 2009

"I thought I was just a lousy keeper of my finances because I don't write every transaction down in my ledger."

The way that the bank employees explained the system is the way it works. Most banks also operate the same way. The key to avoiding these charges is not to overdraft in the first place. This can't be done using online or telephone banking, since those methods do not know what debits or checks you might have outstanding. The only reliable way to do this is to keep an accurate register. It really works and will save you a lot of money.

I'm sure this post will be accompanied by the usual comments about how evil and wrong the bank is, but the bottom line is that this is how the banking system works today and the most reliable method of avoiding fees is to be meticulous about your check register.

Additionally, since the debit system can multiply an accounting error into bigger fees, I recommend that you instead use cash for everyday purposes instead of your debit card.

Advertisers above have met our

strict standards for business conduct.