Complaint Review: Certegy Check Services - St Petersburg Florida

- Certegy Check Services St. Petersburg, Florida St Petersburg, Florida U.S.A.

- Phone:

- Web:

- Category: ORGANIZED CRIME

Certegy Check Services ALERT! NATIONWIDE BOYCOTT!! Certegy Check Services performs Profiling with AI to determine if you have a bad check. You have to sign up for membership to prevent this. BAD COMPANY BOYCOTT!!! St. Petersburg Florida

*Consumer Comment: The truth about CERTEGY

*Consumer Comment: Certegy

*Consumer Comment: Certegy is a Scam

*UPDATE EX-employee responds: Reply

*Consumer Comment: Why even use checks?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Went to Target. Have a good checking account (+1,000$) was told I couldn't write a check there, but they accepted my debit card (!!! which I can cancel the transaction on if I wanted.)

Called Certegy was told my check matched "certain criteria" and made it a "risk" because (get this) "I haven't payed with a check at any of their vendors in the past" therefore, I cannot use a check at all, unless I sign up for their "Gold Status" membership.

BEFORE YOU SIGN UP FOR GOLD STATUS, PLEASE READ THIS ARTICE AND PAY ATTENTION TO THE LAST PARAGRAPH ON THE FIRST PAGE!!!

The article states:

Certegy Gold applicants have to provide detailed information about themselves, their employers, and their bank, including a voided check. Gold status doesn't cost anything, but members agree to pay a service fee to Certegy each time they write a "dishonored check."

Why do I have to provide them with all the information my Financial Institution already has on file? What would happen if someone would hack into their system? I'm sorry, but the less people that have access to my personal information, the better. Another red flag was the agreement to pay a service fee to Certegy each time a check is dishonored. Hello? Why would I want to give them approval to charge me service fee whenever they decide to "dishonor" my next check? They are the one's that decide to honor or dishonor checks and that's money in their pocket at my expense.

This is a disgusting form of discrimination and it needs to stop.

I am calling for a Boycott of all the merchants that use certegy check systems, including;

Target

Home Depot

Sears

Bed Bath and Beyond

K-Mart

Helzberg Diamonds

Sally's Beauty Supply

Game Stop

Aeropostle

Walgreens

Staples

Piggly Wiggly

TJ MAXX

NTB

Kohls

Macys

Dillards

Best Buy

Circuit City

Albertsons

Goodys

Home Depot

Radio Shack

Petsmart

Garden Ridge

Amazon.com

Wal-Mart

...

Please add to this list

Yahtheyscrewedme

ann arbor, Michigan

U.S.A.

This report was posted on Ripoff Report on 06/14/2009 07:42 AM and is a permanent record located here: https://www.ripoffreport.com/reports/certegy-check-services/st-petersburg-florida/certegy-check-services-alert-nationwide-boycott-certegy-check-services-performs-profi-461560. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Comment

The truth about CERTEGY

AUTHOR: ewest305 - (United States of America)

SUBMITTED: Saturday, March 10, 2012

Certegy advertises that they decline between 2-5% of the millions of transactions attempted each year. This 2-5% is more like a quota and does not accurately depict the number of fraudulent attempts. The quotas are used on reports and brochures to clients in order to promote their service as viable and necessary.

As less people rely on checks and check cashing services, Certegy services become less needed. It is only though their 'proprietary fraud model' that they are able to convince big named corporations like Wal-Mart to continue using their system.

This proprietary fraud detection model is written to convince big corporations that 'something is being done to prevent fraud'. In reality, the models goal is to meet the 2-5% quota that their brochures and reports advertise. This means that even if customers are law-abiding citizens who have no intention of committing fraud, they can fall within Certegy's 'proprietary fraud detection model' algorithm.

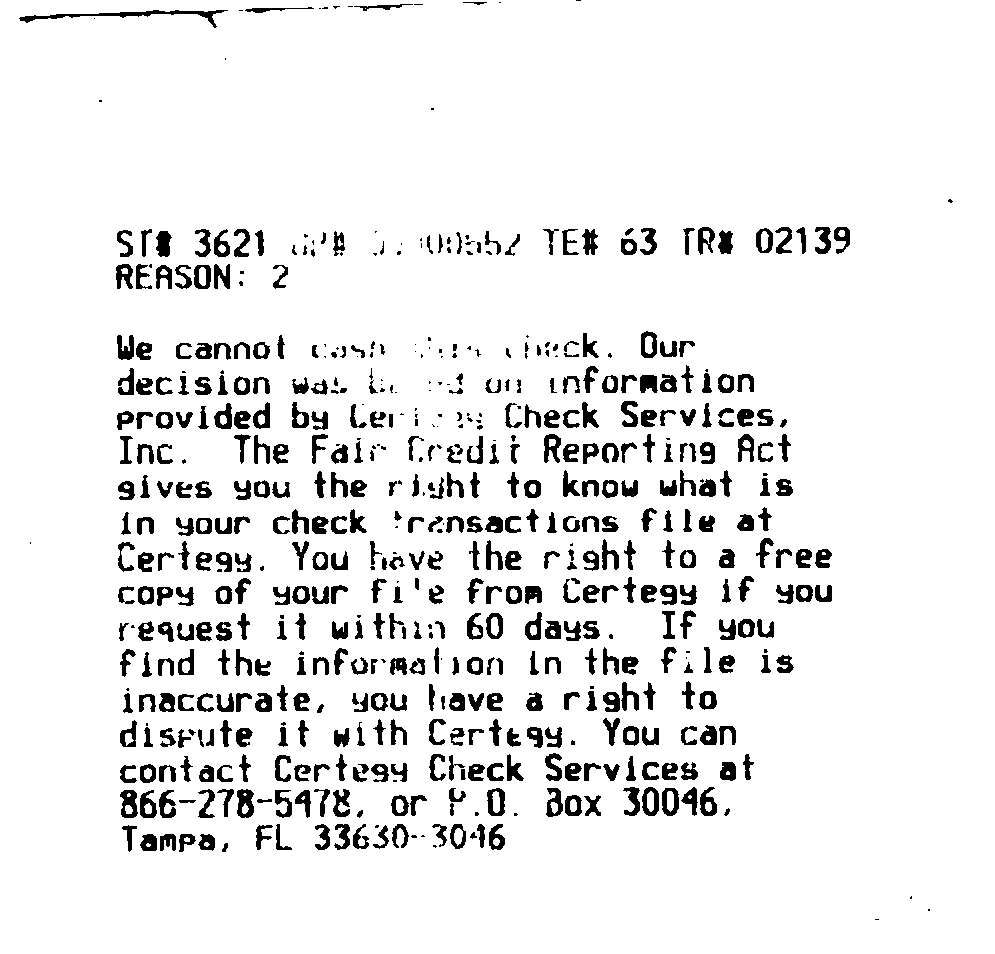

Certegy gets away with this because they can hide the reasons for check declines through codes. The codes limit the detail that prevent discovery of the algorithms. In essence, they can arbitrarily deny transactions based solely on the hidden algorithm and consumers have no right to know why they were declined.

In summary, your check was declined so Certegy can continue selling their product. You become a statistic that Certegy reports to their shareholders in order to justify the costs of the services.

This is a completely unethical way of doing business especially in the United States that has laws protecting credit and consumers. Certegy has managed to circumvent the laws. They understand fraudsters are finding other ways to steal from businesses and the fact that they sacrifice a few thousand innocent people per year, by denying legitimate transactions, is a small price for them pay.

Please continue to report them to FTC at FTC.gov. Also, please make sure you report them to the Tampa, Florida BBB. So far, at the BBB, they have over 500 complaints with around 300 that continue to go unresolved. Eventually, they will have an F business rating that we can use to demand our favorite stores stop using their unethical authorization services.

Feel free to copy and paste this as many places as you can.

#4 Consumer Comment

Certegy

AUTHOR: Frances - (United States of America)

SUBMITTED: Sunday, July 17, 2011

I was at Macy's today and wrote a check for less than $70, that was declined because of Certegy. I have written checks at several other places that do business with Certegy and had no problem in the past.

I haven't called them due to it being the weekend, but I will on Monday. I will probably get the same run around that everyone else is getting.

I don't see where they have the need for my checking account information or my driver's license number or most of the other personal information they seem to be requesting. It does seem to be a money-making scheme.

#3 Consumer Comment

Certegy is a Scam

AUTHOR: infiniti - (United States of America)

SUBMITTED: Thursday, November 19, 2009

I agree that Certegy does not discriminate they are an Equal Opportunity violator of the Fair Credit Act. White people, black people, Asian people, Hispanic people, Native American People, Foreign Nationals, poor people, rich people, middle-class people --- we have all been victims of Certegys ridiculous check authorization scam that strives to gain private financial information via their VIP or Gold programs? And for what purpose? So that they can once again allow some idiot to gain access to their un-encrypted systems and steal such information for the purpose of identity theft?

Indeed they do use Artificial Intelligence in the form of algorithms to decide and determine when to authorize or decline checks when they are presented at a merchant. In this day and age, when technology is so advanced, there is no reason why there cant be a better method (and actually there is via the Bank Reform Act) of authorizing checks based on factual information rather than a pattern of risky check writing behavior perpetuated by others.

I had a pattern of consistent check writing at 7-11 for quite some time, when all of a sudden, Certegy denied acceptance of my check at 7-11 for no reason. I had no negative history on file, and was told it met the guidelines of a pattern of check writing that showed a possible risk to the merchant. I was embarrassed, angry and frustrated. In fact, I had written a check just 4 days earlier to 7-11 that had been accepted. Certegy gave me their song and dance about becoming a VIP member, which would give me a higher rate of check acceptance at most retailers, though not guarantee acceptance. I told them I did not want any part of their company to take all my information out of their system and keep out of my financial affairs completely. I even threatened legal action, and I am currently strongly considering speaking to an attorney about starting a class-action against them for this very issue. Apparently, I would have no problems getting people to join the class in suit.I am definitely participating in a boycott of all merchants who use Certegy, asking all my friends and relatives to participate in the boycott, and writing a letter to the CEOs of each company informing of the boycott and the reasoning behind it. I also plan to build a website that will invite others to join in the boycott, and I dont think I will have much trouble getting people to participate at all. In this economy, retailers really cannot afford to lose the small customer base that they have remaining, and we really need to hit them where it matters and let them know we will not deal with them as long as they continue to use Certegy.

Certegy is a shady company with questionable business practices and we all need to stand up and fight them and let them know we are not going to take it any longer.

#2 UPDATE EX-employee responds

Reply

AUTHOR: Marx2k - (U.S.A.)

SUBMITTED: Monday, June 15, 2009

"Certegy Check Services performs Profiling with AI to determine if you have a bad check. You have to sign up for membership to prevent this."

Certegy doesn't profile with AI to determine if you have a bad check. If you have a bad check, the AI is not needed. They use AI to decide whether or not to accept a check based on many factors, not one of them being if you have a bad check. If you have a bad check, they will tell you that you have a bad check.

"Went to Target. Have a good checking account (+1,000$) was told I couldn't write a check there, but they accepted my debit card (!!! which I can cancel the transaction on if I wanted.)"

I'm actually pretty sure that you can't cancel out a debit card transaction. if you know differently, please cite a source of some kind.

"Called Certegy was told my check matched "certain criteria" and made it a "risk" because (get this) "I haven't payed with a check at any of their vendors in the past" therefore, I cannot use a check at all, unless I sign up for their "Gold Status" membership."

If you have no known pattern of check writing, you have less of a chance of getting a check accepted by merchants that deal with Certegy. It's the same way you run the risk of a higher APR on a loan if you have no credit. As far as not being able to use a check at all unless you sign up for "gold status", that's not true. You don't have to have Certegy Gold status in order to have a check approved at any other of their merchants or even that one on the same day. It's crazy, I agree.

"Why do I have to provide them with all the information my Financial Institution already has on file?"

Because Certegy is not your financial institution and doesn't have that information on file.

"What would happen if someone would hack into their system?"

That's happened. By a former employee.

"Another red flag was the agreement to pay a service fee to Certegy each time a check is dishonored"

A returned check fee is nothing new. Whether dealing with a vendor directly or an intermediary, a returned check fee is standard.

"Why would I want to give them approval to charge me service fee whenever they decide to "dishonor" my next check?"

The service fee occurs if your check bounces, not if they dishonor it.

"They are the one's that decide to honor or dishonor checks and that's money in their pocket at my expense."

Your bank is the entity that chooses whether or not to honor a check. Certegy decides whether to accept your check or not at the point of sale.

"This is a disgusting form of discrimination and it needs to stop. "

I'm not sure why you feel you were discrimnated against. If you came to me and I didn't know you and you wrote a check to me for something, I'd either have a third party (like Certegy) guarantee that check or I may not accept it.

#1 Consumer Comment

Why even use checks?

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, June 14, 2009

If you have a debit card, use it. Unless of course you are trying to "float" the check, which is exactly what Certegy is trying to prevent.

Advertisers above have met our

strict standards for business conduct.