Complaint Review: Geico - Fredicksburg Virginia

- Geico One GEICO Boulevard Fredicksburg, Virginia U.S.A.

- Phone: 301-986-2500

- Web:

- Category: Car Insurance

Geico Geico Insurance Company is fraut with lies and deceit Ripoff Fredicksburg Virginia

*UPDATE EX-employee responds: Some facts you should get straight

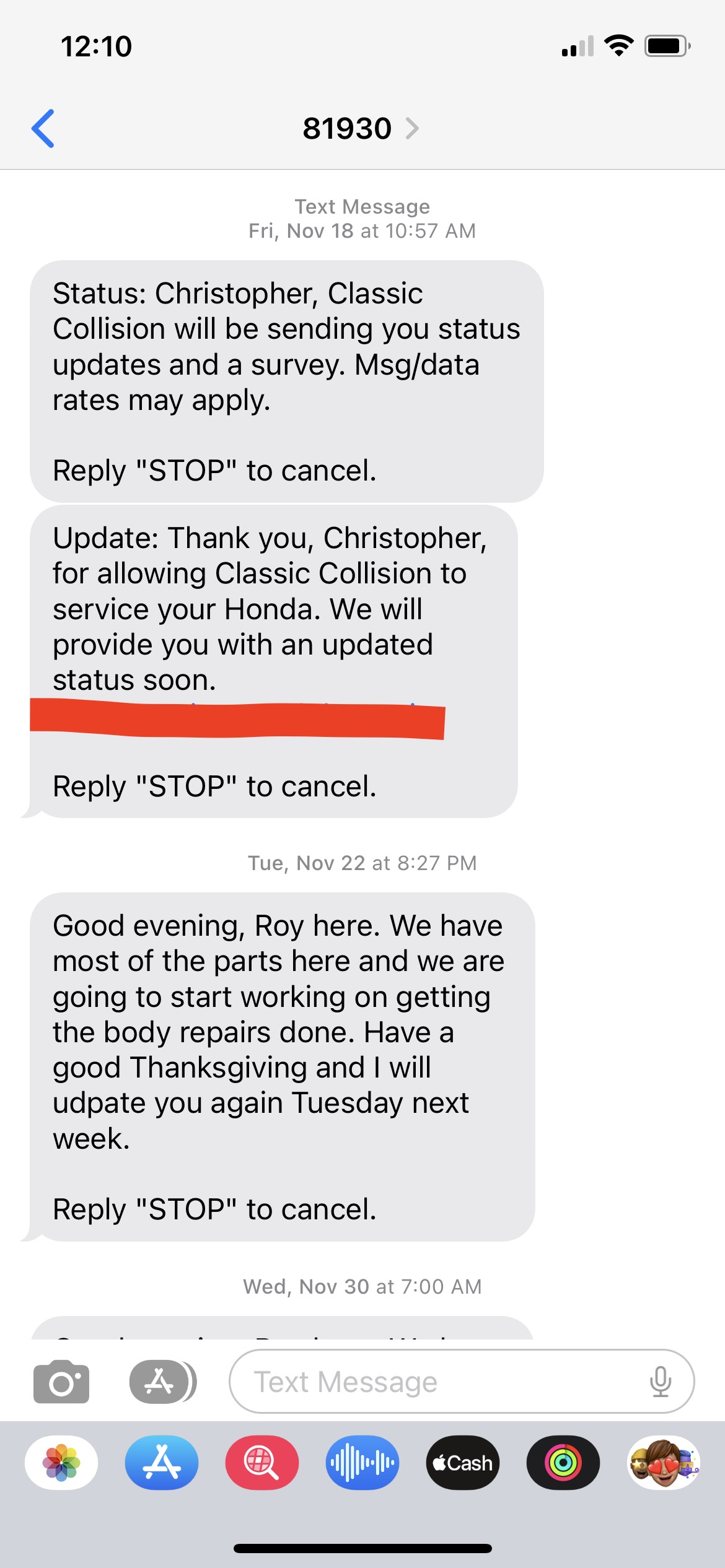

*Consumer Comment: I got the letters and it was told to me by the agent

*Consumer Suggestion: its legal!!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

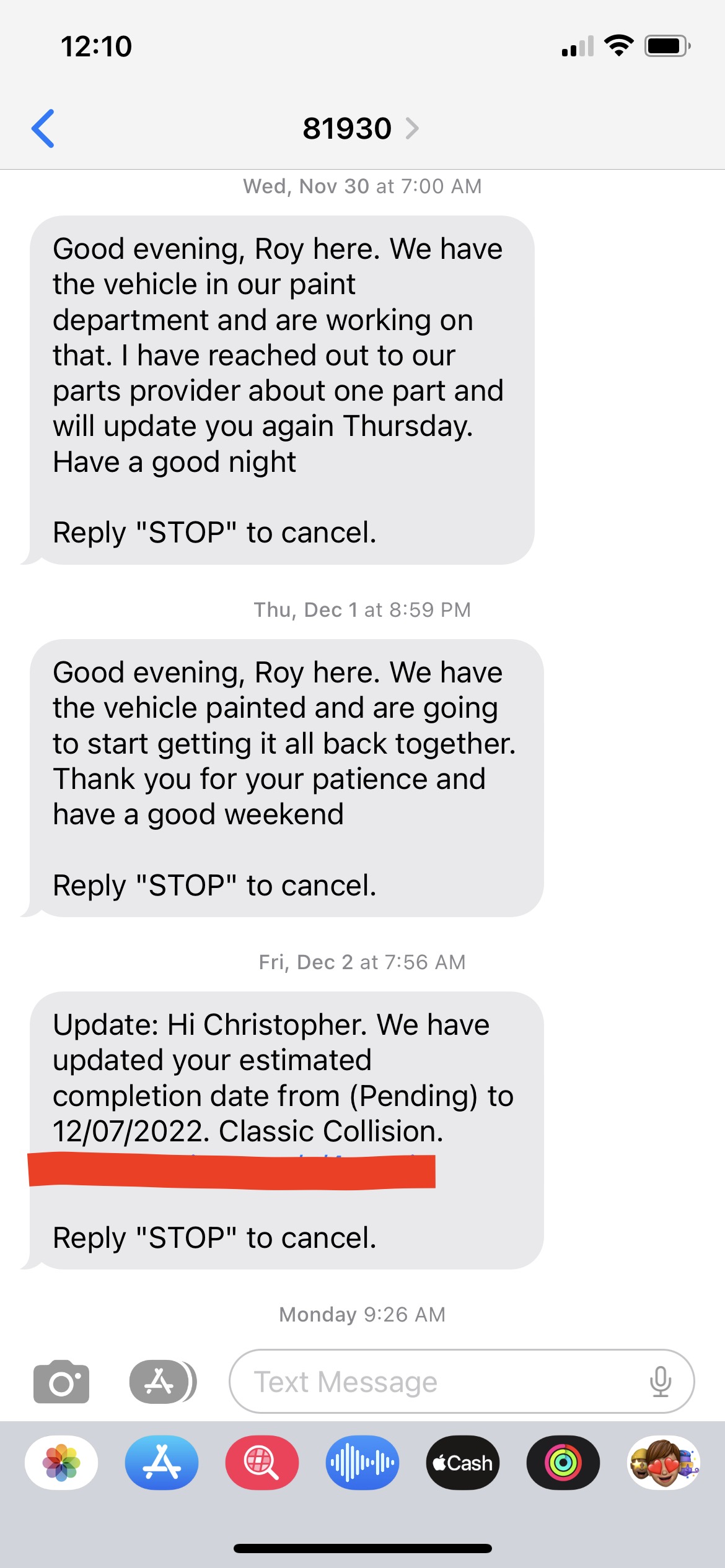

I had a small accident in my 1994 Ford Explorer. When I called Geico to report the accident and make arrangements to have the work done to fix my Explorer I was informed that I only had liability coverage. I let them know that I never reduced my insurance to liability. They then told me that 2 years ago, while I was still paying for the vehicle, that they dropped me down to liability. They then told me that the reason for this was that it was a policy for the company to request a used car be inspected for the insurance company for them to continue to cover it with full coverage. I told them that I did not recieve any type of communication letting me know that they were going to do this. I was told a letter had been sent out. I never received a letter like the one they were describing. I asked if an e-mail had been sent out and was told no. I do all of my business with Geico on the computer. All bills are paid on line and any changes of address or other personal informtion are done on line. I told them I could not understand why they would not send e-mail notification for this matter. They had no answer to that. I was also told that when I made the initial call to obtain insurance through their company that the rep was supposed to let me know of this policy to have used cars inspected. I was never told this. Because I did not respond to the letter about the inspection they automatically dropped full coverage. It is illegal in the Md. not to have full coverage while a lein is on the car. They were breaking the law by just dropping the full coverage without notifying me first. Does any one know of any legal recourse that may be taken on behalf of this matter.

Allen

Pocomoke City, Maryland

U.S.A.

This report was posted on Ripoff Report on 07/31/2007 06:49 PM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/fredicksburg-virginia-22412/geico-geico-insurance-company-is-fraut-with-lies-and-deceit-ripoff-fredicksburg-virginia-264452. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE EX-employee responds

Some facts you should get straight

AUTHOR: Ldeit3tk - (U.S.A.)

SUBMITTED: Friday, August 03, 2007

1. It is not illegal to carry only liability on a car with a lien in any state - your auto finance company may require it, but it is not illegal

2. Your lienholder would have been notified that you no longer had full coverage (asuming you told GEICO you had a lienholder) and probably made you get cover through them as many finance companies do

3. All GEICO mail is certified by the USPS, so if you did not receive your mail it was handed over to the USPS who signed that they were taking custody of it when it left GEICO property and if you had aquired a letter from the post office stating it was their fault you did not receive your mail, GEICO may have considered backdating coverage....however

4. because you would have received a new policy contract every 6 months and you waited 2 years to notice you were carrying liability only - it seems to me the burden lies on you - if you had taken the time to READ YOUR POLICY every 6 MONTHS, you would have noticed what coverage you had

as a side note, did you ever notice your auto loan rate increase?? Usually if you do not provide proof of full coverage, the loan company will automatically add their insurance policy - which you pay interest on - to your loan.

#2 Consumer Comment

I got the letters and it was told to me by the agent

AUTHOR: Dave - (U.S.A.)

SUBMITTED: Wednesday, August 01, 2007

However, setting that aside, didn't you notice the change in price? They quoted you one price, but you paid a substantially lower price. That alone should've told you something was amiss. But you didn't care, because you thought they made a mistake and you were getting a 'deal'. Well, now take all that money you saved and fix your SUV. Simple.

#1 Consumer Suggestion

its legal!!

AUTHOR: Justme821 - (U.S.A.)

SUBMITTED: Wednesday, August 01, 2007

its not just geico that requires inspections! If it was done in your state then YES ITS LEGAL!! Some states it is wavied by state law but other states its not. If you dont agree with it, don't blame geico. blame your state insurance laws. it is the STATE that requires photo inspections not the insurance company. Also, the STATE is the one that says coverage issues must be sent by snail mail not email. so again, have a problem with it...take it to your state insurance commisioner

Advertisers above have met our

strict standards for business conduct.