Complaint Review: NCO Financial - Horsham Pennsylvania

- NCO Financial 507 Prudential Road Horsham, Pennsylvania U.S.A.

- Phone:

- Web:

- Category: Corrupt Companies

NCO Financial Harassment & abused me for no reason hateful to me for no reason falsely accused me for phone call harassment ripoff Horsham Pennsylvania

*Author of original report: nco

*Consumer Suggestion: Charles, please understand the difference here.

*Author of original report: I never paid nco a dime

*Consumer Comment: To Charles

*Author of original report: Jennifer powell had no right to threaten me

*Author of original report: Well I did not pay the extra interest

*Consumer Suggestion: They can charge you interest.

*Author of original report: Jennifer powel no longer with nco

*Consumer Suggestion: Of NCO & All debt collectors...

*Author of original report: Why are u defending these thugs

*Consumer Suggestion: Charles, they CAN legally charge interest.

*Author of original report: How is nco still in business

*Author of original report: NCO

*Consumer Suggestion: Charles...That's not the way it works..

*Author of original report: update from pa attorney general office pa resolved

*Consumer Suggestion: Start Filing Complaints

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

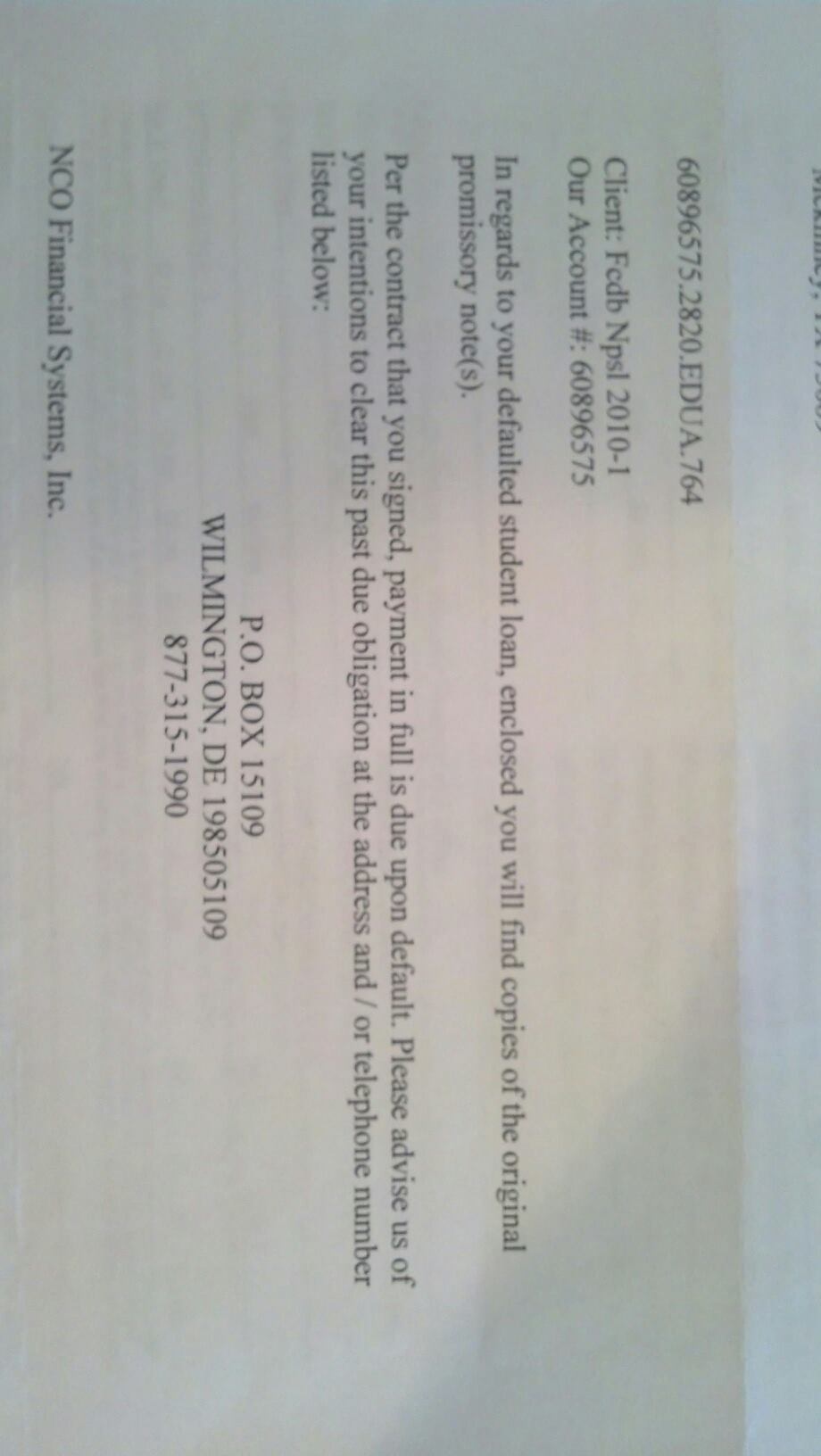

NCO harassed me for a credit card bill they claimed they purchased from citifinancial 10/04. I figure I need to get my complaint in has soon has possible. I called nco to make payment aggrangements jennifer powell answered the phone I questioned the interest they have added on which was $300 from what I have already paid on it they where charging me more then what the bill said I already owed. I told her they couldn't charge me no more then what the bill was. She rudely replied saying yes they can I told them no they can & she kept arguing & being hateful & abusive towards me. I told her I was not paying any interest & I hung up on her.

I then called back & talk to another nco rep. I made payment aggrangments with them & nco agreed for me to pay less then what the bill was. Jennifer Powell then called me back & left a very perveived threatening hostile abusive message on my voice maill accusing me of harassment. I only called them twice demanding I don't do that anymore & to talk directly to her to make payment agrrangements & to only talk to her directly.

I already made payment arrangments with someone else. I refuse to speak to her due to how hateful & abusive she spoke to me & falsely accusing me of harassment. Jennifer Powell was just mad because I hung the phone up in her face because of how hateful & abusive she spoke towards me.

I do not care if this has been 1 year ago. I filed a complaint with the better business bureau with their response they claimed they could not find an account, its amazing that the lies from these crooked people I filed this complaint. I haven't heard a word from nco sense 10/04, I could careless about this bill. I am not paying it so citibank lost of their money because of nco. They can blame nco for losing their money. They have no right to treat people so badly we are not deadbeats. I am unemployed & wasn't able to pay anymore. But collection agencies don't care about our financial problems!.

I do not have to put up with any abuse for her or any other collector nobody has the right to fasely accuse you of anything, what gives nco the right to abuse us mentally & emoitionally. Nco thinks their billions of $ will save them from trouble but with all these complaints their doors will be closing soon & they will be homeless on the streets just like how they have ruined people financially.

Their day is coming. God will shut them down! They better not ever contact me because I will file charges & a restraining order agaisnt nco. And sue them for damages they have caused me & for their harm they have caused me!

It's been 20 months sense nco contacted me. I guess they are afraid let them be afraid they don't have the right to treat people who are in financial diffuclites like crap. I haven't heard a word from nco sense 10/04 I am not playing their games this is what type of world we live in today. NCO will suffer their consequences for the hell & abuse they put us good citizens of the united states threw!.

Charles

Phenix City, Alabama

U.S.A.

This report was posted on Ripoff Report on 06/16/2006 02:33 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial/horsham-pennsylvania/nco-financial-harassment-abused-me-for-no-reason-hateful-to-me-for-no-reason-falsely-acc-196779. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#16 Author of original report

nco

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Wednesday, September 12, 2007

Also, another problem nco had no right to check my credit ruining my credit raiting if we don't have the money to pay we don't why can't these collectors realize this, its not we are refusing to pay the bill I just don't have the money.

It, does not give the right to hound or talk hateful to us or hang up the phone up on us, that is unprofessional behavior then these collectors accuse us of our attuide or being hateful to them which is not true!.

Its, there hateful attuide towards us & we always get the blame also these collection agencies have no right to, check our credit every 90 days this is also ruining peoples credit.

Each, time these collectors check our credit & when people go apply for credit they get denied credit cause of the many inquries from nco & many other collection agencies.

Nco, doesn't care how many people they ruin.

#15 Consumer Suggestion

Charles, please understand the difference here.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 06, 2007

Charles,

I am in no way supporting or defending NCO. They are in my opinion the lowest of the lowlife in bottomfeeders.

Just because someone tells you that your "facts" are wrong, does not mean they are supporting the other party.

You are simply wrong in your post on several issues, and I was trying to educate you.

#14 Author of original report

I never paid nco a dime

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Wednesday, September 05, 2007

I never paid nco a dime after how jennifer powell spoke to me nco has 572 complaints on this site & still climbing why isn't the PA attorney general office doing anything about it, or they are just like all the other agencies who like to prolong our problems with nco to where they never get settle.

Somehow, nco is getting away with there abuse.

#13 Consumer Comment

To Charles

AUTHOR: Virginia - (U.S.A.)

SUBMITTED: Sunday, August 19, 2007

Charles you have fought the same NCO nonsense that I had to fight. The person who called me many times was a "lady" name Jackie Widman. I made so many complaints against her and NCO Financial that I hope she got fired. I finally got them stopped by contacting the Federal Trade Commission and the Insurance Commissioner in my state and filing complaints.

If you have received anything from them in writing,somewhere on the letter you will see an insurance number which represents their license to do business in your state.If you see such a number you can complain to your state Insurance Commissioner.He's probably in Montgomery.

NCO Financial is a predator.They will lie,accuse you of everything in the book,intimidate you to no end if you allow it.You do not have to allow it.

They recently changed their name to: ONE EQUITY PARTNERS.They may try again to contact you under that name.

I used to live across the river from you.

Good Luck!

#12 Author of original report

Jennifer powell had no right to threaten me

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Saturday, August 11, 2007

Jennifer powell had no right to threaten me & leave a nasty voicemail & accusing me of harassing them which never happend she talked nasty to me so I hung the phone up in her ear. she didn't like that & I said something about the extra interest they charged to my previous balance which I had already paid to citibank before they sent it to nco.

I am not the only one nco has done this to nco accuses everyone of harassing them nco is the one harassing us & abusing us & then fasely accusing people of harassing them like jennifer powell did to me.

Well, jennifer powell got fired for it cause nco stated she was no longer working with nco these collectors from nco thinks they can threaten & abuse us & get away with it!.

I hope nco continues to pay fines cause one day they will be shut down forever.

#11 Author of original report

Well I did not pay the extra interest

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Friday, July 27, 2007

Well I did not pay the extra interest I made my complaints & nco backed of its not fair we should have to pay any extra interest I do not care what anyone says on this website, by law nco or any other collection agencie cannot add any extra interest & I didn't pay it. I don't care what anyone else says about it & nco did not get an extra dime from me.

#10 Consumer Suggestion

They can charge you interest.

AUTHOR: Nikki - (U.S.A.)

SUBMITTED: Friday, July 27, 2007

Debt collectors can charge you the maximum allowed interest on debts in your state. Look up your state statutes to find the interest they are allowed to charge.

In Florida, for example, they are allowed to charge you 10% yearly interest on certain accounts, up to 18% for others. That is no joke. In fact, my account with NCO has been charged the 10%. It sound like Jennifer was arguing with you because she knew she was right about the interest and you were wrong. If you insist on calling debt collectors, make sure you have all your facts straight so you can argue the price down knowledgeably.

Mind you, I have an ongoing problem with NCO too, so I am not defending them in any way.

#9 Author of original report

Jennifer powel no longer with nco

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Friday, July 27, 2007

Jennifer powel, is no longer with nco after I filed my complaints agaisnt nco to the BBB & the pa attorney general office & the alabama attorney general office, jennifer powell must have had many complaints agaisnt

her for abuse cause when I filed my complaints agaisnt jennifer powel

was not a collector for nco.

I, also complaind about the extra interest

to my account which I refused to pay which is what I also stated in my complaint along how with there collector jennifer powell spoke to me.

Nco, stated they could not talk with jennifer powel because she is no longer working for them & of course nco denied there collector abused

me in anyway, nco lawyers never said nothing about me harassing them which jennifer powel left a threatening message on my voicemail accusing me of harassing them this was a complete lie.

I, am not worried I did not harass nco or call them several times which jennifer powel accused me of. Nco, probally fired nco after receiving many consumer complaints agaisnt her besides my complaint for abuse of consumers.

Its, not our fault jennifer powel got fired from nco she should have not been so threatening & abusive towards us & accusing & brining false accusations of people harassing nco.

#8 Consumer Suggestion

Of NCO & All debt collectors...

AUTHOR: James - (U.S.A.)

SUBMITTED: Thursday, July 26, 2007

Companies like NCO are indefensible and in my view any defense put forward comes from company employees. The debt collection agencies know this website exists. So, when you see highly defensive remarks in favor of debt collectors assume it's from someone under their employ. Contact the FTC at www.ftc.gov and learn, learn, learn your rights as a consumer. You do not deserve to be harassed or threatened as many debt collectors like to do.

While collectors may feel free to add on charges to a debt you may have owed another company, don't worry about it. Companies that sell off (or charge-off) uncollectable debts you had with them are the only companies you had a responsibility to pay. When a company sells off your old account they receive money from the debt collector often less than a quarter of the full amount you owed. That collector then tries to get their money back plus the original debt (if not more) by hounding you.

There's only one problem in this little arrangement... you never agreed to be bound to pay your debt to any third party. Go ahead and read that fine print that comes with any credit card (though I know everyone has right?) or store card etc. There'll be something to the effect that you agree to pay the ORIGINAL creditor what you owe. You will find no clause that states... if you fail to pay the original creditor you are obligated by law to pay whomever the creditor sells off your account to and the creditor will not notify you the account has been sold. No, sorry debt collectors there is no clause in any credit card issuers contract to guarantee you profit upon purchasing their charge-offs.

This is the reason that an unfortunate many debt collectors pursue debts as they do. They are rude, they threaten and attempt to browbeat people into paying for one simple reason... it works on more than a few individuals. If they had any real legal legs to stand on they'd simply drag you into court and file a lawsuit. Oh but then that would cost them money too and they don't want that so if they can browbeat you by phone into paying they score. Back to that previous paragraph though... your obligation to pay your legitimate debt is real but only to the ORIGINAL creditor. That company you signed a contract with... that is who you owe. When a consumer fails to pay and the original creditor charges it off they are accepting a payment from a debt collector and so release all rights to that contract.

I've had credit cards where the card issuer changed its terms and you know what? they had to notify me of it in writing. If I chose not to accept that change I'd contact them and my account would be closed. Now you mean to tell me that if a card issuer is going to sell off my delinquent account (and original creditors NEVER tell consumers they will do this) I'm supposed to pay whomever comes to call? Eh... something sound out of sorts about that type of shady deal? It should but again by law the original creditor can sell off your old account and a debt collector can buy it and come hound you. All of that... sadly is legal however consumers have rights when it comes to how debt collectors can treat them, do be sure to visit www.ftc.gov and read up. See if you can find any info. that says you MUST pay a debt collector on the FTC website and come back here and cite where it was.

People need to not allow themselves to be bullied. There needs to be more consumer info. sites like this one to let people know about things like sending debt collectors Cease & Desist letters via Certified Mail with Return Receipt. Yes the debt collectors will threaten to sue you and in fact some collectors are attorneys making the odds of your getting sued that much better. I've had my go round with debt collectors for years... years! With debts into the 5-digit thousands and those of a few hundred dollars... not one of them has ever gone to court to sue me but they threatened they would. Hmmm so how did I escape them? I must be on the run with multiple identities or something. No, sorry I haven't gone anywhere, haven't had multiple phone number changes or identity altering and not one bankruptcy. I've whipped out more than a few Cease & Desist letters though and those have had amazing effect. I advise anyone dealing with debt collectors to do so unafraid... you can fight back and you should.

#7 Author of original report

Why are u defending these thugs

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Tuesday, July 10, 2007

Why, are u defending these thugs no nco cannot legally charge interest to the account I don't care if u defend nco steve, what people say about u is true all u do is give people crap like how u are treating me.

U, think u know everything & then u come on this website to people's reports & give them crap, I don't care if u think I am a 5 year old. I, refused to pay the extra internest nco added to the balance I don't care

what u say or believe, I don't care about there lawyers or how much money they have which they think cause they have good lawyers & money don't give them the right to abuse us!.

Nco, had to pay the largest fine for violating consumer rights & if nco keeps violating our rights they will have to pay more fines, & sooner or later they will be shut down forever!.

#6 Consumer Suggestion

Charles, they CAN legally charge interest.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Wednesday, July 04, 2007

Charles,

First of all, it is NOT illegal for NCO to add interest. If they can prove they legally own the "debt", they can charge interest at the federally mandated post charge off rate until the debt hits SOL and is no longer collectable.

Second, the FTC does NOT represent individuals. It only gathers data, and then goes after a collection agency after so many complaints are filed, and they do it on behalf of the state.

Third, NCO is the largest collection agency in the world. They have revenues in the BILLIONS of dollars. They also have many good lawyers on retainer.

Fourth, I hope when you sent that letter to the PA AG's office you had someone else write it for you. otherwise, they just laughed and put it in the shredder thinking it was a hoax by some 5 year old.

Get a life.

#5 Author of original report

How is nco still in business

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Wednesday, July 04, 2007

How is nco still in business nco has almost 600 complaints agaisnt them on this website & they are still running & the federal trade commission office will not do anything to help us. just like the pa attorney general office. When will these creditors learn nco is the ones costing them there money not us. People do have hardtimes & it is not our fault for not having money for us to pay these bills.

#4 Author of original report

NCO

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Friday, June 15, 2007

Yes I do have grounds to sue nco first for the harassment & charging extra interest buy law they cannot add any interest or make u pay more money, the second thing leaving threatening messages on my voice mail & accusing me of harassing them. I made payment aggrangements but I never paid them a cent I filed complaints with the alabama state attorney general off, also with the PA attorney general office & the pa better business bureau.

After I made these 3 complaints I never head from nco sense their collector jennifer powell left the threatening message on my voicemail accusing me of harassing them. but sense nco is not bothering me anymore there is no need to sue them. If people would do these 3 things complaint to the pa attorney general office the pa better business bureau & there state attorney general office, nco will back of & will never bother u again. If you don't have the money to pay the bill u don't so there is no reason why nco should keep harassing u. Also one last thing everyone needs to pay there legit depts. but if u don't have the money to pay them u dont.

#3 Consumer Suggestion

Charles...That's not the way it works..

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, September 08, 2006

Charles,

There are many things you do not understand here.

First of all NCO was not collecting FOR CitiBank. CitiBank charged off and sold that account. NCO was collecting for THEMSELVES as the new owner of the "account".

The BBB is a totally useless and corrupt organization that has no legal authority to do anything. They are a FOR PROFIT business who charges membership fees to be listed with positive rating. If you do not pay, or join, you do not get a positive rating.

The AG has no jurisdiction over debt collectors and cannot do anything for you on an individual basis. They can do an investigation and file a lawsuit on behalf of the residents of the state, etc..but they cannot do anything for you individually. If NCO chose not to respond, they could have done nothing. The FTC has jurisdiction over debt collectors.

Rule #1 is that you NEVER speak to any debt collector on the phone. Demand everything in writing.

As soon as you made that payment to NCO, you re-affirmed the debt. Now they can LEGALLY sue you for it and win. Expect to be served soon. They will sue you now.

You have no grounds to sue them, as you did not document anything in writing by certified mail. Did you ever send them a CEASE COMMUNICATIONS request by certified mail/RRR.? Do you have a copy of it along with proof of delivery?

Did you record any of the conversations? Did you keep an accurate call log?

WHEN you do get served, STAY OFF THE PHONE and hire a lawyer ASAP.

#2 Author of original report

update from pa attorney general office pa resolved

AUTHOR: Charles - (U.S.A.)

SUBMITTED: Thursday, September 07, 2006

I, am updating this report this has been resolved lawyers for nco advised the pa attorney general office that they had closed my account for citibank 11/04, they could not interview jennifer powell due to she is no longer employed with nco she must have had other complaints for abuse & harassment!. Finally, sense 10/04 this has been resolved! I cannot pay citibank due to my financial diffuclites but if nco had done their part not charged extra interest which they are no suppose to this would have been settle months ago!, but due to nco actions citibank did not get paid their money & know I am unable to pay citibank!, but due to ncos harassment & abuse citibank lost their money!.

This, is finally resolved! thanks to rip-off report I got nco off my back! & help from the pa attorney general & alabama attorney general, nco is out of my life! if they had been nicer towards me this would had been settle then not 20 months later! & threw all my complaining!.

#1 Consumer Suggestion

Start Filing Complaints

AUTHOR: Vickie - (U.S.A.)

SUBMITTED: Tuesday, July 25, 2006

I dont know what the statute of limitations for filing complaints is with the FTC, but if you are within those limits, if any, please file a complaint against them. This is very important. Strength in numbers. Everyone, including me, needs to quit complaining and take ACTION against these people. Also, file complaints with the PA AG's office, and also the same in your state

Advertisers above have met our

strict standards for business conduct.