Complaint Review: Open road lending - Internet

- Open road lending Internet United States

- Phone:

- Web: Openroadlending.com

- Category: Car Financing

Open road lending They lied to me several times Internet

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

The entire process was a nightmare.

Lie #1: Intrest rate

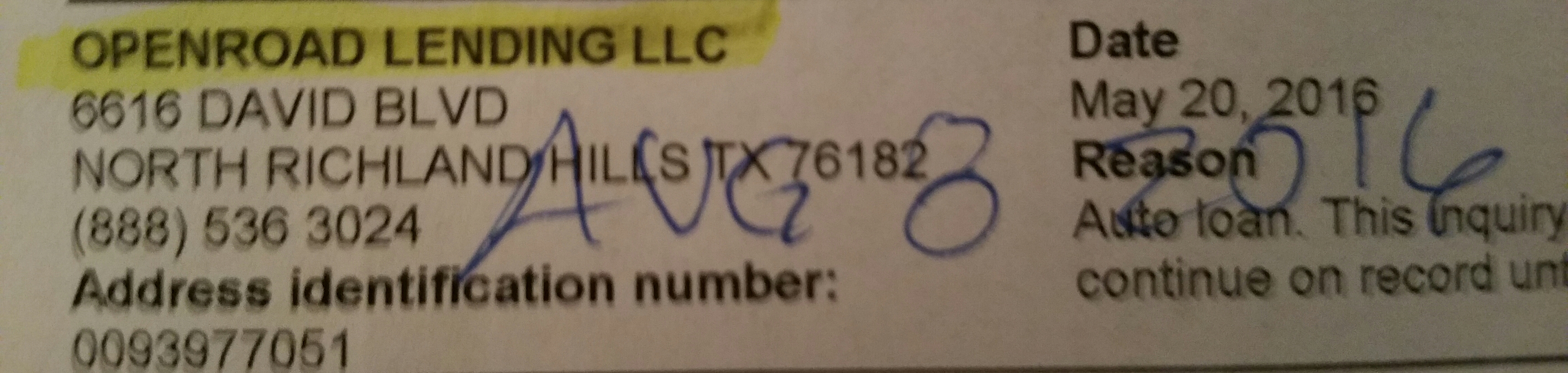

When I initially applied I was told my interest rate would be 7.29% with a 72 month term. I asked the loan care agent if they could do any better than that and she checked and said they could do 6.49%. I asked specifically if lowering the payment term would lower the interest and she said no — this is a lie. I have written documentation from the loan care agent of this that the interest rate was reduced to 6.49%. I said ok and she sent me the loan documents. The documents said 6.7%. I asked about this inaccuracy and was told I wasn’t told that. After referring to the proof she admitted that she misspoke but it is actually 6.7%.

MORAL: READ YOUR LOAN DOCUMENTS CAREFULLY AND BEWARE OF BAIT and SWITCH.

Ok fine.... on to issue #2

LIE #2 - Identification & Gift Card

During our first conversation I was asked to send in various documents, first being my valid drivers license which I submitted to them on 5-18-2018. I was told all documents were approved on 5-21-2018. On 5-31-2018 all of a sudden my VALID Michigan drivers license was no longer acceptable and I was told I had to get a drivers license out of the state of Illinois, where I live part of the year, despite having a valid drivers license from Michigan — mind you I purchased the vehicle in Illinois while having an out of state ID. The loan care agent even went as far to tell me they would raise my interest rate over 12% if I didn’t. My previous rate wasn’t even 12%! So I had to take a day off work. I was told I would receive a $100.00 gift card for the inconvenience. I spent from 8 am to 1:30 pm at the Secretary of State and then provided them with the ID. It would seem as though if this was a requirement It would have been told to me on 5/18/2018 that this was required when they saw my drivers license to begin with — why wait until 5/31/2018. So, when I called to check on my loan status and when gift card was going to be mailed I was told I was never told I would get a 100.00 gift card and I would only be sent a $25.00 which I have of course not received. Another BAIT AND SWITCH tactic.

Finally, after exhausting back and forth, my loan was complete with Kinecta Federal Credit Union at a 58 month term at 6.44%. This leads me to .....

Lie #3 - Due Date

So, I like to pay my car note early and intended on keeping the same cadence as I normally had been. So I logged into the open road lending website and saw my "truth in lending" statement I opened it and it stated my first payment would be due on 7/20/2018. This was a lie. I immediately contacted Kinecta Federal Credit Union to make a payment and they told me it is due on 7/8/2018. Now— obliviously I paid way early but the point is they have the wrong date so based off of that date I would have been 12 days late on my first payment!

All in all I refinanced a 11.5% loan down to a 6.44% and I shaved time off my loan and saved myself thousands of dollars. However, I would recommend for anyone to stay away from this company. Why? You can do you research and go directly through a credit union. This way you won’t have to deal with multiple inquiries and you won’t be paying their middle man mark up on the interest rate. Also, you want to not just research open road lending — you need to research whatever lender they match you with to see what THAT banks reviews are.

Another reason to stay away is all the lies. The loan care agents will say anything to get you off the phone or get you to sign the contract. With anything you must read every word on the contract. Another issue with their contract was that it stipulated that I have an insurance company that does business in the state of California which mine doesn’t. They ended up changing the contract for me but if I wouldn’t have paid attention to that they could have but on forced placed insurance which would have cost me thousands, negating all savings and actually costing me more!

I have a YouTube channel with only over 12,000 subscribers but I will be doing a detailed video on my experience showing proof of how this was handled from beginning to end. If can save a single person from this horrible experience it will be worth it. If you’re going to deal with them, don’t believe anything they say and read over your loan documents with a fine tooth combo— TWICE!

This report was posted on Ripoff Report on 06/18/2018 06:43 PM and is a permanent record located here: https://www.ripoffreport.com/reports/open-road-lending/internet/open-road-lending-they-lied-to-me-several-times-internet-1447951. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.