Complaint Review: TD Bank - North Hampton New Hampshire

- TD Bank North Hampton, New Hampshire United States

- Phone:

- Web:

- Category: Banking

TD Bank This bank sucks ripping everyone off with very unfair over draft fees and Arranging deposits to there advantage also delaying posting as to defraud us Of on time accurate account information This has to stop be for some Really stops them Fraudulent banking practices. F*d everyone over North Hampton New Hampshire

*Consumer Comment: Of course

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

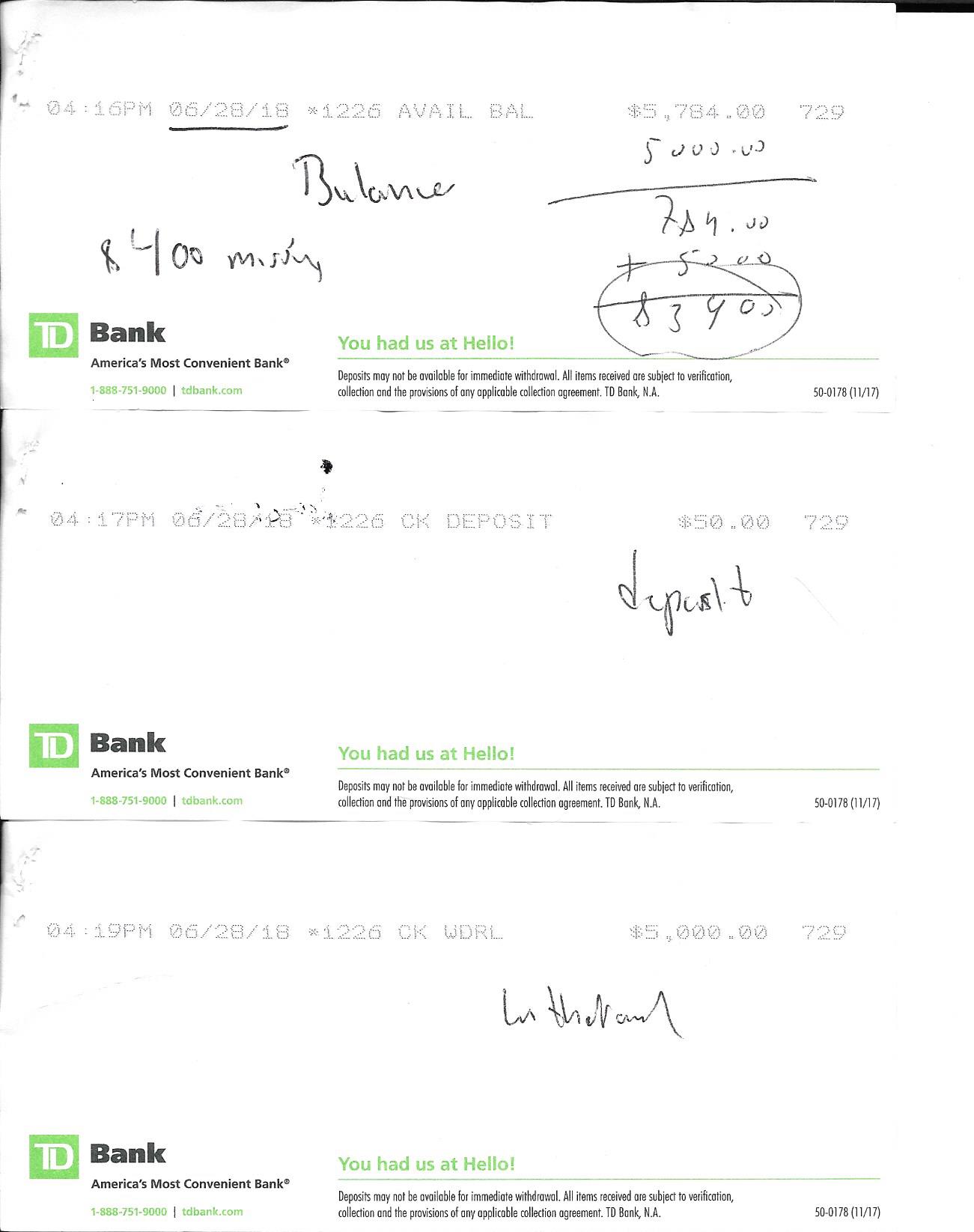

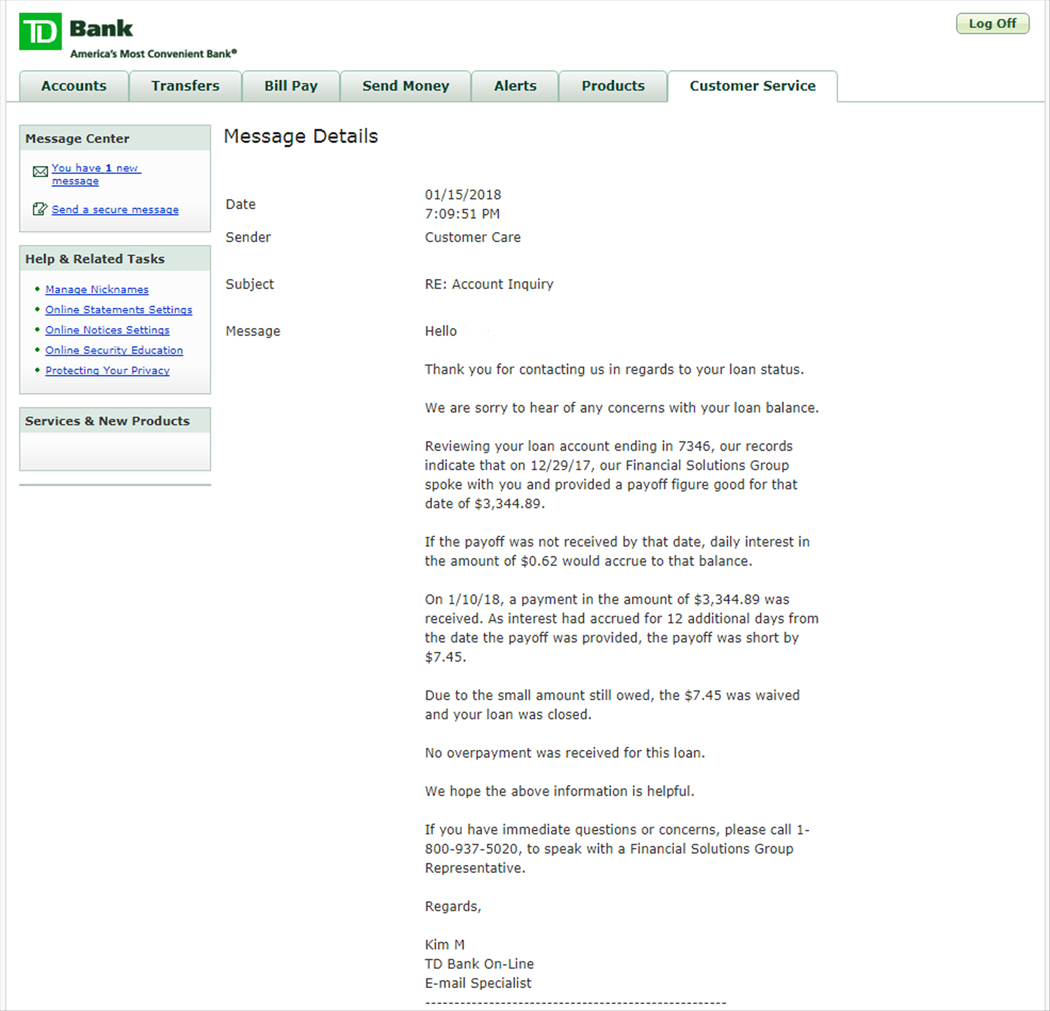

Numerous reports have been filed about this bullshit bank and I'm just one. They won't change . Several class action laws suits are and have been filed yet they continue with fraudulent banking practices . This has to stop I have lost so much Money through there mistakes and deliberate accounting practices. The overdraft fee scam is huge and is hitting everyone. They will deliberately Hold out deposits to forge an overdraft even if it's a cash deposit I have Printed recipes to prove. Yet TD bank won't correct . Yes I'm pissed and it shows in my verbiage. I have received two checks in the past years from These past laws suits. Wow doesn't even scratch the surface to what they owe Myself and many many many other victims. What's up with this? Why and How does F* s* bank get away with it They suck

This report was posted on Ripoff Report on 02/22/2018 05:31 PM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/north-hampton-new-hampshire/td-bank-this-bank-sucks-ripping-everyone-off-with-very-unfair-over-draft-fees-and-arrangin-1430603. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Of course

AUTHOR: Robert - (United States)

SUBMITTED: Saturday, February 24, 2018

Of course you should be upset, in fact you should be very upset at yourself because it is your lack of action and failure to take responsibility over your accounts that has cost you.

If this bank is so bad and has treated you so badly for years, why are you still with them?

Since your mentality is that you must know so much more for the banks, it is just easier for you to keep doing what you are doing(nothing) and figure that eventually, at some point, someone may do something. Oh wait that already happened with the "checks" you received. Let me guess they were about $60-$80 each. But what you failed to realize is that not a single one of these "Class Action Lawsuits" has made the fees or the order banks process transactions illegal. The thing that they are about is the disclosures. Yes all of that "fine print" and Terms you agreed to actually do mean something. By the way do you know who is the only group to make any money in these type of lawsuits...the lawyers. Every attorney involved(on both sides) probably walked away with at least a 6 or 7 figure payday. Some of the bigger cases they may have even hit about 8 figures.

Now if you really want to do something that will help you, then here are a few things you can do.

First maintain an ACCURATE Written Register. Every time you use the card, write a check, or have a debit come out of your account..WRITE IT DOWN and keep track of your remaining balance. Then NEVER attempt to spend more than you have available. This alone would probably save you from just about every overdraft fee you have gotten. Online banking while it can be an additional tool, was never meant to replace online banking.

Next is to understand your banks Funds Availability Policy, and cut-off times. As even if you deposit cash if it is after their cut-off time, it may not be processed until the next business day, and if you do this on a Friday night at 8PM that may mean it may not be

available until the following Tuesday.

One other thing to look at is the posting order, that is do they post credits before debits. If they post your debits first you will never be able to "beat" the money back to the bank as any deposit you make once you are Overdrawn the money you put in to replace it will not be counted until after the debits are taken out. This makes it even a bigger factor to NEVER spend more than you have available.

If you are unable to find this information out or still don't understand...go into a branch and ask them. They may even show you how to use a register and may even give you one because whether you believe it or not, they don't want you to overdraft either.

Oh and yes this applies to any bank, so if you actually do something and move to another bank, if you don't change your ways you will run into the same issue again. It may not be tomorrow, but it will happen.

Advertisers above have met our

strict standards for business conduct.