Complaint Review: TD Bank - Pompano Beach Florida

- TD Bank 3600 N Federal Hwy, Pompano Beach, Florida USA

- Phone: (954) 783-1617

- Web: www.tdbank.com

- Category: Banks

TD Bank Unethical Accounting Practices - Excessive NSF Fees -Steal Customers Money Pompano Beach Florida

*Author of original report: TD Bank Class Action Lawsuit $62 Million

*Author of original report: TD Bank Closed Account

*General Comment: Next report...

*Consumer Comment: Suffer the consequences

*Consumer Comment: The Nail Has Been Hit!

*Author of original report: TD Bank Sucks

*Consumer Comment: Let's Talk About Accounting, Shall We?

*Author of original report: FEDERAL TRADE COMMISSION

*Author of original report: Rip Off Bank

*Author of original report: Really

*General Comment: really

This report was posted on Ripoff Report on 11/01/2013 08:51 AM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/pompano-beach-florida-33064/td-bank-unethical-accounting-practices-excessive-nsf-fees-steal-customers-money-pompa-1096226. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#11 Author of original report

TD Bank Class Action Lawsuit $62 Million

AUTHOR: scott s - ()

SUBMITTED: Wednesday, December 18, 2013

Court Approves $62M TD Bank Overdraft Class Action Settlement

By Mike Holter

A federal court on Monday approved a $62 million class action settlement between TD Bank and customers who say they were improperly charged overdraft fees. Eligible TD customers can expect to see a payment or account credit within the next few weeks.

A federal court on Monday approved a $62 million class action settlement between TD Bank and customers who say they were improperly charged overdraft fees. Eligible TD customers can expect to see a payment or account credit within the next few weeks.

The TD Bank overdraft settlement resolves allegations the bank reordered debit card transactions in order to maximize the number of overdraft fees it assessed to customers. Plaintiffs claimed that instead of declining transactions when an account had insufficient funds to cover the purchase, TD Bank authorized the transactions and then posted them from highest to lowest dollar amount to increase overdraft fees.

TD Bank denies the allegations but has agreed to pay $62 million to settle its portion of the case, which involves more than 30 other banks accused of the same improper overdraft fee policies (In re: Checking Account Overdraft Litigation).

Class Members of the TD Bank overdraft class action settlement include customers who held a deposit account that could be accessed with a debit card at any time between December 1, 2003 and August 15, 2010 and were charged more than one overdraft fee in a single day as a result of TD’s practice of posting transactions from highest to lowest dollar amount.

Class Members will automatically receive a cash payment or account credit – no action is required. The amount of this award will be based, in part, on the number of people in the Settlement Class and the amount of additional overdraft fees each Settlement Class Member paid as a result of TD Bank’s improper posting order.

More information on the TD Bank Overdraft Class Action Lawsuit Settlement can be found atwww.TDBankOverdraftSettlement.com.

The case is In re: Checking Account Overdraft Litigation, case No. 9-MD-02036-JLK, U.S. District Court, Southern District of Florida.

#10 Author of original report

TD Bank Closed Account

AUTHOR: scott surace - ()

SUBMITTED: Wednesday, December 18, 2013

TD bank is the worst bank EVER!!! Even their employees go online to back up their unethical practices in an Unethical way. They did refund my $350 back when I got in touch with the District Manager, so Mr. TD Bank Rep. you are wrong and you can keep writing unethical resonses to customer complaints. Your should loose your job, but you actually belong at TD bank with the other scumbags.

#9 General Comment

Next report...

AUTHOR: Striderq - ()

SUBMITTED: Saturday, November 02, 2013

Since you changed banks but will refuse to change your spending and recording procedure, I eagerly look forward to your next report about Wells Fargo transaction ordering policy.

#8 Consumer Comment

Suffer the consequences

AUTHOR: coast - ()

SUBMITTED: Friday, November 01, 2013

"I am very unhappy with the accounting techniques used for insufficient funds"

All banks use the same accounting process. They subtract the total amount of debits and withdrawals from the current balance. If sufficient funds are not available, the account is considered to be in overdraft mode. It's simple math.

"There was money to cover every purchase that I made."

If that statement is true, then why did you write, "your bank does not apply transactions in the order they are made"? If the funds were available, then why would you care what order the transactions are applied? I don't care what order my transactions are applied because the funds are available BEFORE I write checks or authorize debits against my account.

"You are a looser, go get your ged and try to go to college to get education, moron"

You called a previous commenter a looser and a moron. The word is loser, moron.

No, I don't work for any bank. If you were to read other comments on this site you would discover that the previous two posters also don't work for TD Bank.

Banks provide check registers for free. If you are too stupid or lazy to do the math, you can purchase a calculator for less than $10. If you continue your current banking habits you will continue to suffer the consequences for your sloppy bookkeeping.

#7 Consumer Comment

The Nail Has Been Hit!

AUTHOR: Jim - ()

SUBMITTED: Friday, November 01, 2013

I see, the typical response from someone who has no intelligent rebuttal because the nail has been hit squarely on the head, so its the "you must work for them" immature crap. So, problem solved. YOU gave YOURSELF o/d fees because YOU don't keep written records and a running balance! Happens every time!!!

#6 Author of original report

TD Bank Sucks

AUTHOR: scott s - ()

SUBMITTED: Friday, November 01, 2013

Apparently you have nothing better to do, you seem highly uneducated so you are very qualified to work for TD bank. You are a looser, go get your ged and try to go to college to get education, moron

#5 Consumer Comment

Let's Talk About Accounting, Shall We?

AUTHOR: Jim - ()

SUBMITTED: Friday, November 01, 2013

What does YOUR ACCOUNTING say for the days YOU were overdrawn? How about now? What does YOUR check register give as the running balance in YOUR account this very second? No doubt, YOU have given YOURSELF these overdraft fees because YOU used YOUR card when YOU had no clue as to what the balance in YOUR account was, before YOU used it! YOU don't keep written records nor do you maintain a running balance! There's NO rocket science here. When you use the card, you subtract the balance at once and you have the most acurrate balance know to man. No, I don't work for them.

#4 Author of original report

FEDERAL TRADE COMMISSION

AUTHOR: scott s - ()

SUBMITTED: Friday, November 01, 2013

WE WILL LET THE FEDERAL TRADE COMMISSION INVESTIGATE YOUR UNETHICAL ACCOUNTING PRACTICES

#3 Author of original report

Rip Off Bank

AUTHOR: scott s - ()

SUBMITTED: Friday, November 01, 2013

I just changed banks from Wells Fargo, they have ethical banking practices, UNLIKE TD BANK. TD BANK IS A RIP OFF. DO NOT USE THEM.

THE EMPLOYEES ARE ALO SCUM

#2 Author of original report

Really

AUTHOR: scott s - ()

SUBMITTED: Friday, November 01, 2013

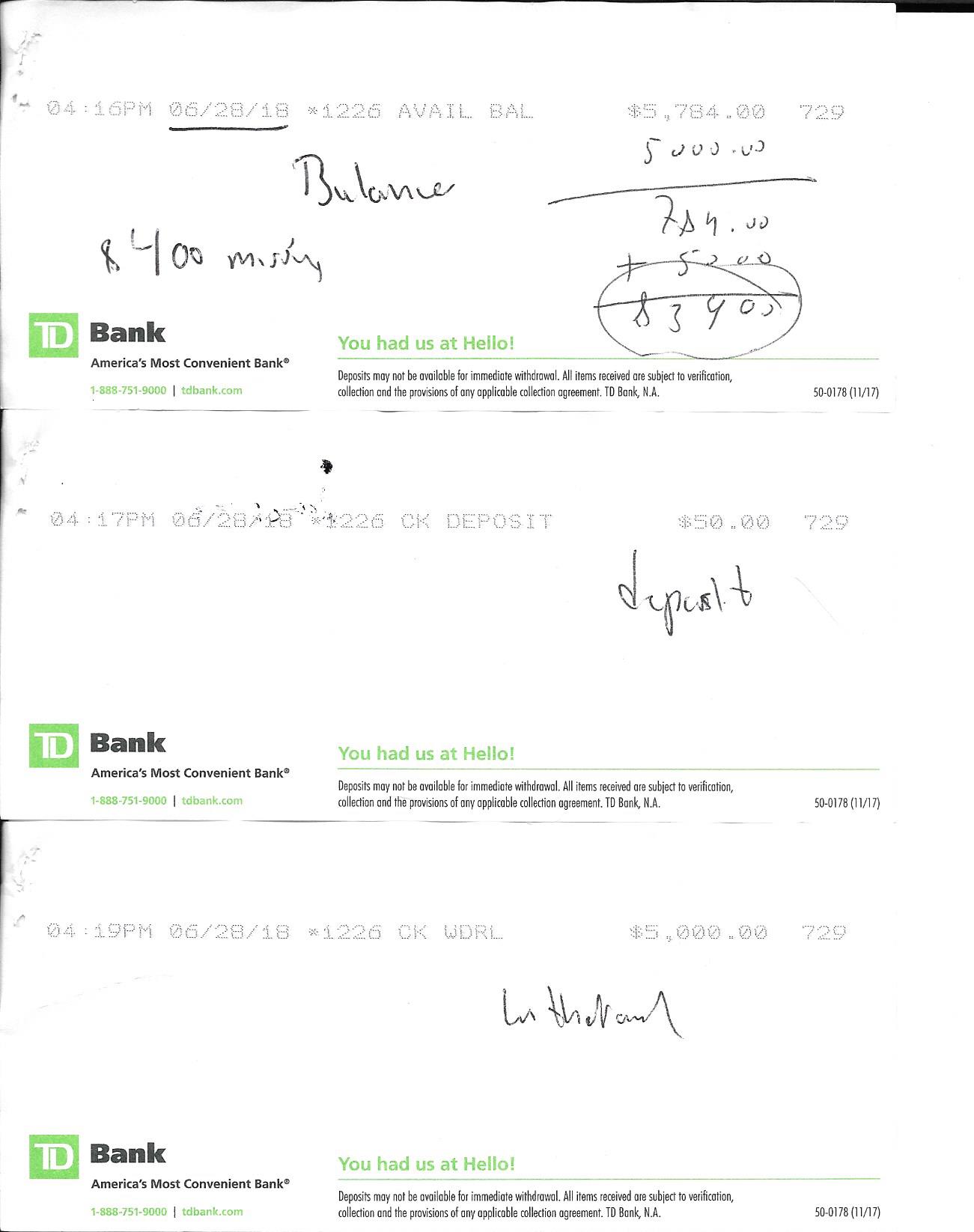

Who are you? If you work for the bank, it just shows what scum bags you are. There was money to cover every purchase that I made. There was one NSF that the ATM allowed me to take out, then the bank went back and rejected 10 purchases and charged the fee.

Your are a f***ing scum bag, just like the company you work for.

#1 General Comment

really

AUTHOR: Tyg - ()

SUBMITTED: Friday, November 01, 2013

First you can not dispute to what you agreed to. Second, there MAY be money in your account but not enough to cover your charges. Third, this is all your fault for not keeping a accurate register and spending more then you had to spend. Dont blame the bank for what is your fault. Thats what a child does. Grow up and accept responsability for the fact that you spent money you did not have.

Read the TOS of your bank if you dont believe you agreed to this. Its also in the body of text in the overdraft protection. If you did not read it and understand it, then thats all on you. Take responsability for both your actions and spending.

Advertisers above have met our

strict standards for business conduct.