Complaint Review: Wachovia Bank - Internet

- Wachovia Bank Internet United States of America

- Phone: 18009224684

- Web: www.wachovia.com

- Category:

Wachovia Bank Was charged overdraft fees when the purchases weren't even cleared yet, Internet

*Consumer Comment: This is the issue

*Consumer Comment: While Stacey makes a valid point...

*Consumer Comment: what did your check register state

*Consumer Comment: Beware the banks tactics....

I checked the balance of my checking account that showed I had 22.00 available when i made 2 charges for 19.00, the charges are still pending but yet i am being charged an overdraft charge when the purchases havent even posted to my account yet. I tried talking to customer service and was told i am being charged for using the banks money and that it was not for free, and you will not be getting any refund back.

This report was posted on Ripoff Report on 02/28/2010 08:59 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/internet/wachovia-bank-was-charged-overdraft-fees-when-the-purchases-werent-even-cleared-yet-int-575813. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

This is the issue

AUTHOR: Dale - (U.S.A.)

SUBMITTED: Monday, March 01, 2010

First, I shoudl point out, Wachovia is now owned by Well's Fargo, so the original suit filed, will need to reflect such...

As for this report, I have been a Wachovia customer for many years and NEVER had an issue. When you use your debit card for 2 purchases of $19 when you only have $22 is self explainitory. It's not the banks fault, this is yours. Budget, use your own statements, we shoudln't have to keep paying for other customers making mistakes themselves, come on now. You have to take responsibility for your own actions and not blame others.

#3 Consumer Comment

While Stacey makes a valid point...

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, March 01, 2010

to keep an accurate register, she seems to believe this is the only way to prevent an overdraft.

Now you did make a mistake in thinking the pending charges would not effect the balance because it hadn't cleared..but these kind of mistakes are where the bank can get you. As I stated in my previous post..that a great back up would have been the if bank simply declined the transactions, and then you would have realized that the word "available" as used by the bank..is also deceptive.

#2 Consumer Comment

what did your check register state

AUTHOR: Stacey - (U.S.A.)

SUBMITTED: Sunday, February 28, 2010

Let me guess - you do not keep one therefore you a liable for these OD charges - Stop relying on atm, phone and online balances because THESE are not correct

Start reconciling your monthly bank statement and keep an accurate check register and walla!! NO more overdraft charges

#1 Consumer Comment

Beware the banks tactics....

AUTHOR: Ronny g - (USA)

SUBMITTED: Sunday, February 28, 2010

I imagine this issue is from use of your debit card..right? Safe assumption because the the amount is small.

I can not say you hold no blame, because in a situation like this it really is our responsibility to know what is in the account. In other words..do not trust the online statement..period.

Now this bank and several other big ones are defendants in class action lawsuits due to certain policies that have been really hurting many customers in the event of an overdraft. As well as contributing to the chance of an overdraft by automatically enrolling every single checking account customer into courtesy overdraft protection..which if you were not enrolled into this automatically and were opted out..the debit card would be denied use at a point of sale or at an ATM hence preventing any overdraft from occurring in the first place. Wachovia will allow you to opt out but sometimes it is a bit of a fight. It is going to be law by July of this year that every bank can no longer automatically enroll you into OD protection.

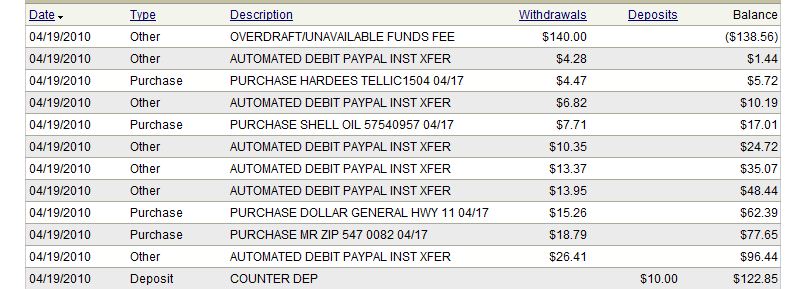

As well, they will compound fees in the event of an overdraft by re-sequencing the times of your transactions, and processing the larger ones before the smaller ones in order to increase fees. This can financially devastate a paycheck to paycheck customer.

You see, the policies of courtesy overdraft protection and re-sequencing were initially designed for large CHECK transactions..whereby a large payment such as a mortgage would be covered instead of returned. Combine this with statement manipulations and unreliability, and it is a recipe for financial disaster for debit card users like yourself who use it instead of cash for everyday small purchases. Now since your total charges were $19.00, what was that important that required the bank to step in and "protect" it? Ask them that next time you are in there.

Now the following does not excuse you for not keeping track of your finances, and no one can guarantee you will get much back if any...but if you feel you were taken advantage of by being enrolled into overdraft protection when you would have preferred the transactions simply be declined if the funds are truly unavailable, which is the way it should be since people do make mistakes or are victims of unauthorized charges...you can submit your complaint to plaintiffs counsel...

Consolidated, Nationwide Class Action Lawsuits Filed in Federal Court Against Bank of America, Wachovia, U.S. Bank, JPMorgan Chase and Citibank

October 20, 2009 11:00 AM Eastern Daylight Time

MIAMI--(EON: Enhanced Online News)--Marking a substantial step forward in litigation over the banking industrys abusive and excessive overdraft fee policies and practices, plaintiffs' counsel announced that bank customers have filed a series of nationwide class action lawsuits against Bank of America, Wachovia, U.S. Bank, JPMorgan Chase and Citibank. The complaints were filed in the United States District Court for the Southern District of Florida in Miami, where all federal lawsuits brought against the banking industry for abusive overdraft fees have been coordinated before the Honorable James Lawrence King.

"The collection of excessive overdraft fees, usually around $35 per transaction, impacts millions of Americans each year and has become a multibillion-dollar profit center for the banks," explained lead plaintiffs counsel Bruce S. Rogow. "In many instances, these overdraft fees cost customers hundreds of dollars in a matter of days, or even hours, when they may be overdrawn by only a few dollars. Charging a $35 overdraft fee when a college student uses her debit card to buy a cup of coffee is unconscionable."

How Bank "Overdraft Protection" Works and Why the Abusive Collection of Overdraft Fees is a National Concern

Today, when customers open checking accounts, banks provide debit cards for the withdrawal of cash from ATM machines and the purchase of goods and services. Many bank customers are not aware that as part of the process of obtaining the debit card, banks automatically enroll their customers in "overdraft protection." The overdraft protection kicks in if the customer spends more than he or she has in the account to cover the purchase, up to a limit of a few hundred dollars.

Banks could simply decline to honor customer ATM or point-of-sale transactions if the account lacks sufficient funds, or could warn customers that if they go through with the transaction an overdraft fee will be assessed. In fact, until a few years ago, most banks simply declined debit transactions that would overdraw an account.

"Banks do not record charges and purchases on ATM or debit cards in the order they actually occur,"

stated plaintiffs counsel Michael W. Sobol of Lieff Cabraser Heimann & Bernstein, LLP. "Instead, banks reorder the charges and purchases so that the largest charge or purchase is the first one paid by the bank. This manipulative practice is intentionally designed, the complaints allege, to maximize overdraft fee revenue."

"If you buy your kids a $15 meal at McDonalds on your debit card and your account was overdrawn, that lunch actually cost you $50," added Mr. Sobol. "The bank wont decline the debit transaction, nor will the bank tell you that you have overdrawn your account and is about to turn your $15 lunch into a $50 expense."

In 2007, banks collected more than $17 billion in overdraft fees. That number nearly doubled in 2008, as more and more consumers struggled to maintain positive checking account balances. In 2009, banks are expected to bring in up to $40 billion in overdraft charges from nearly 50 million customers.

"While all bank customers could have been affected, these overdraft fee policies disproportionately affect young people, the elderly and the poor, who are most likely to maintain low account balances," noted Mr. Rogow. "Moreover, these fees have the tendency to create a domino effect, resulting in even more fees."

Further Information for Bank Customers

Bank customers assessed overdraft fees who wish to learn more about this litigation should visit [www.bank-overdraft.com] where they can submit their complaint to plaintiffs counsel.

Contacts

Lieff Cabraser Heimann & Bernstein, LLP

Michael W. Sobol, 415-956-1000

or

Bruce S. Rogow, 954-767-8909

Advertisers above have met our

strict standards for business conduct.