Complaint Review: Wellsfargo - Brooklyn Park Minnesota

- Wellsfargo 8460 ZANE AVE N Brooklyn Park, Minnesota United States of America

- Phone: 763-424-8479

- Web: http://www.wellsfargo.com

- Category: Banks

Wellsfargo More Overdraft Fee SCAMS Brooklyn Park, Minnesota

*Consumer Comment: Your right

*Consumer Suggestion: NEVER do "auto drafts".

*Consumer Comment: Not a scam

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

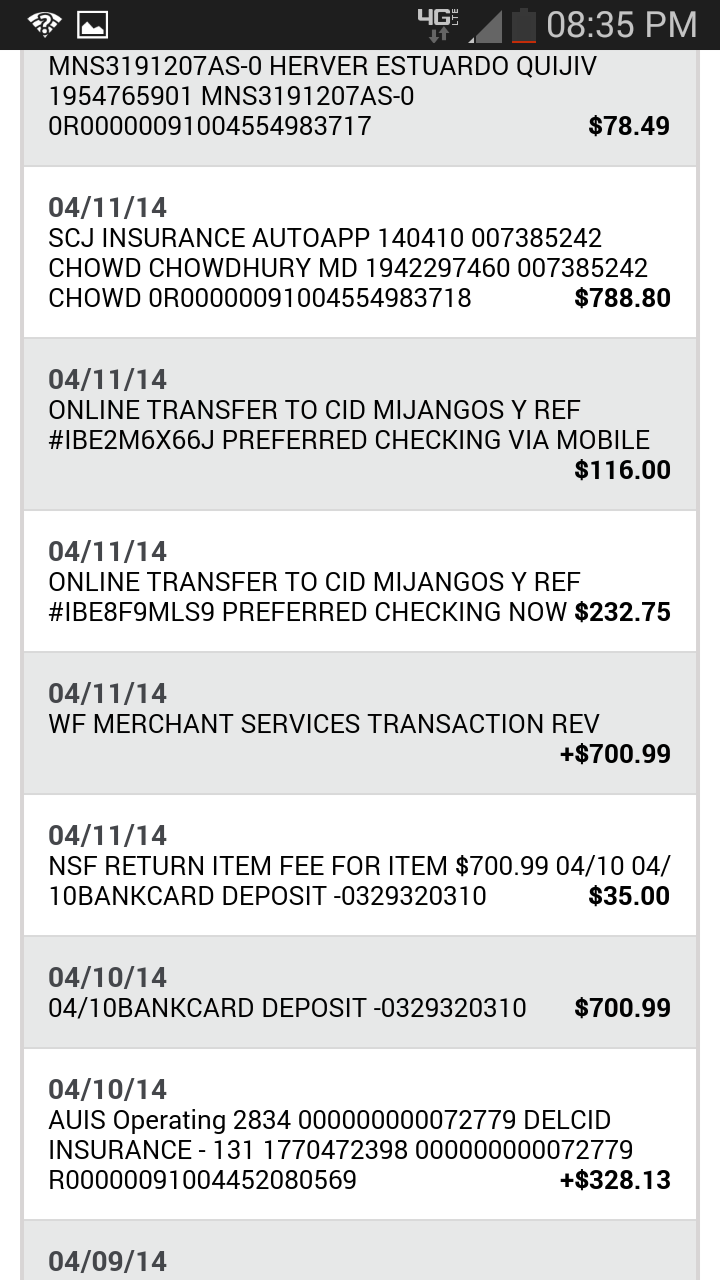

You would think that after the passage of the recent overdraft protection legislation the banks would get it but that doesn't seem to be the case with Wellsfargo. We went in and made sure that we wouldn't be covered by their "overdraft protection service" (aka "we want to continue to be able to charge you overdraft fees"). Unfortunately we recently received another fee for an overdraft caused by a credit card auto payment that was set up on our account. When I called about it we were informed that "existing auto drafts aren't covered" by the legislation (and of course no one at the bank bothered to inform us or check on that when we were assured we wouldn't be getting anymore overdraft fees).

When I complained about that, one of their supervisors (Jeremy) argued with me essentially telling me that "it's in the debit card agreement we mailed out". Yeah that multi page pamphlet filled with tiny legalease print. This is just another way that the banks hope to keep STICKING IT to consumers by dishonestly shading the truth and neglecting to fully disclose things to their advantage.

Here's to Wellsfargo leading the charge in continuing to RIP OFF consumers with their fees!

This report was posted on Ripoff Report on 12/17/2010 04:09 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wellsfargo/brooklyn-park-minnesota-55443/wellsfargo-more-overdraft-fee-scams-brooklyn-park-minnesota-672780. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Your right

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, December 18, 2010

At first some people may think your claim is just stupid, that this is not a RipOff. Some others may even think you have no clue about how to manage an account. But if they really think about it they will see that you are right, and the bank was wrong in charging you an overdraft fee.

Because you "opted-out" and didn't want the bank to pay any items that would put you in overdraft. So the bank should have returned the payment UNPAID. Of course they will still charge you a Returned Item Fee. Then the Credit Card would then charge you a returned item fee. If your payment was now late you would have been charged a late fee as well as additional interest by the credit card company. Then if your credit card was over the limit you would get that wonderful joy of paying an over the limit fee as well.

Sure this would have cost youALOTmore, but at leastthe bankwould not havegotten that nasty overdraft fee. I bet that sounds real logical now doesn't it.

Anyways, when you were given the option to "opt-in" banks sent out information as to what it means to "opt-in". This included in every pamphlet I saw that it only included Point-of-Sale purchases(ATM or Debit Card) and that Checks and ACH transactions the bank still holds the option to pay or return items. This is YOUR money you are dealing with and you should have taken the minor effort it took to make sure what the new regulations meant.

New regulations or not. One of the best ways(if not the best) to manage your account is to keep a written REGISTER. This way you can write every transaction down when you make it. Then never spend more than you have available in your account. Another important point in your situation is to cancel all "Auto-Debits", and pay them on your schedule. Especially if you have a habit of not remembering when they will be coming out.

#2 Consumer Suggestion

NEVER do "auto drafts".

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Saturday, December 18, 2010

Never do "auto drafts", especially if you keep low balances in your accounts.

Just common sense here.

No rip off here. You knew the auto draft was scheduled, and didn't have the money in the account to cover it.

How is that a rip off?

#1 Consumer Comment

Not a scam

AUTHOR: coast - (USA)

SUBMITTED: Friday, December 17, 2010

The new laws do not prevent penalties for overdrafts caused by ACH withdrawals. You failed to understand the changes.

Advertisers above have met our

strict standards for business conduct.