Complaint Review: TD BANK - Internet

- TD BANK 657 Conchester Hwy Boothwyn, Pennsylvania 19061 Internet United States of America

- Phone: (610) 485-2080

- Web: www.tdbank.com/

- Category: Banks

TD BANK TD BANK FRAUDULENT OVERDRAFT FEE'S!!! FRAUDULENT AND DECEPTIVE BUSINESS PRACTICES!!! Internet

*Author of original report: Thank you for your help!

*Consumer Comment: Two Cents...

*Author of original report: Response back

*Consumer Comment: The Bottom Line

*Author of original report: Response to your rebuttal!

*Consumer Comment: I'm Curious...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

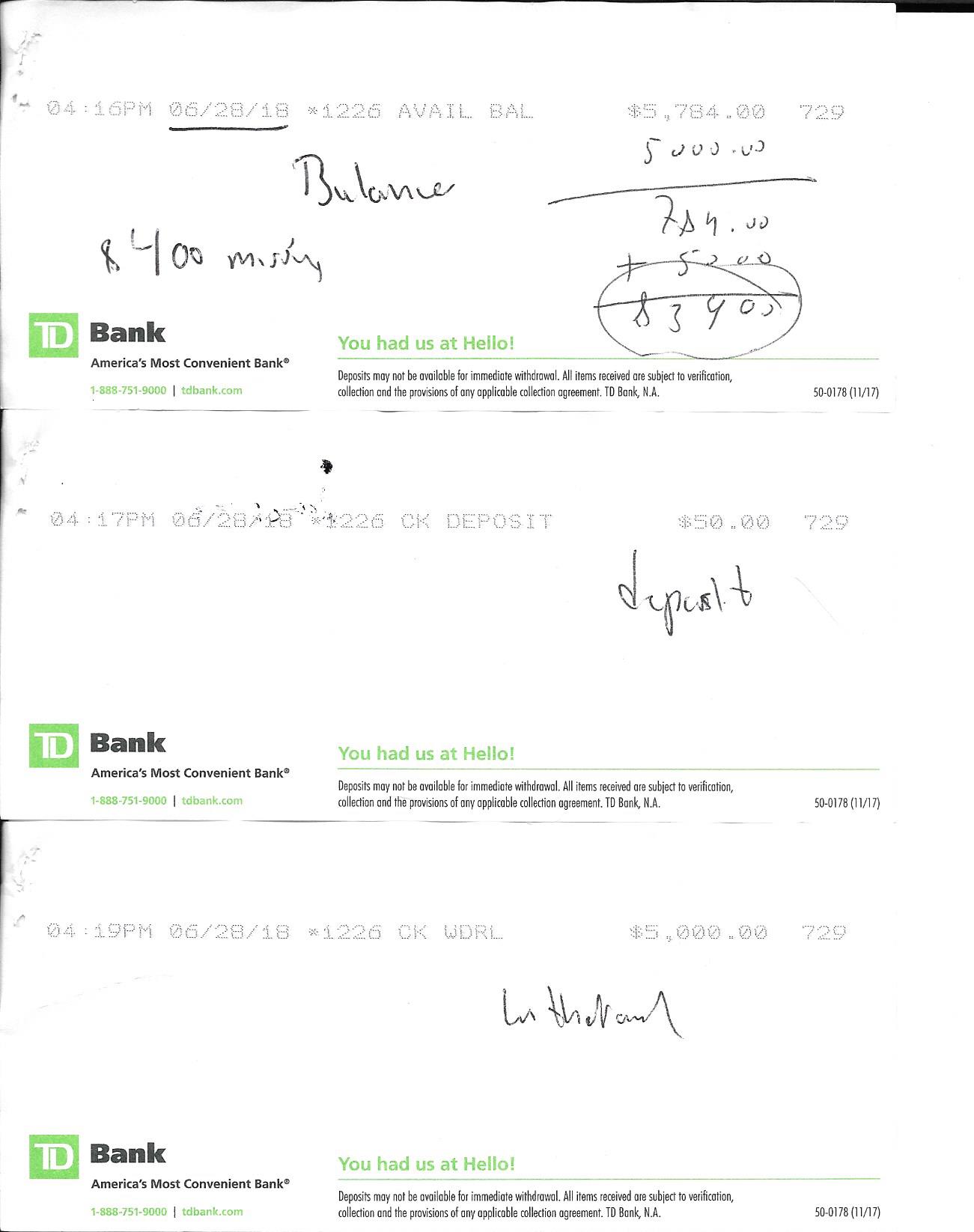

We Disputed the overdraft fee and immediately called the Bank and spoke to the manager and explained that he had plenty of money in the account and didn't overdraw his account and the manager My Uncle and myself went over its itemized statement and checked his personal book my uncle has to keep track of all his funds and nothing matched and the bank couldn't tell us what that fee was really for and the date it bounced and what was supposely bought to make it bounce!

The next day he got another statement claiming he has to pay 175.00 dollars for overdraft fee's that he used his account on Jan. 21st and he didn't use any of his money on that Date we disputed the overdraft fee's and nothing was done as usual!

The following week yet another statement came in the mail for 755.00 dollars he owed and we at this point were fed up with it and didn't even bother to put ourselves though the heartache of trying to fix it!

My Uncle that is 90 years old they tried to take his rent money from him and his market money he is on a fixed income as well!

He currently has an account with a Credit Union and seems like a good place for him at this time!

Just letting everyone know and fore warning you before you consider opening up a bank account with TD Bank!

Don't even try to get an attorney or go to CBS 3 or the attorney general or any organization that is suppose to help you get justice because it won't happen they turned us down on every corner we exhausted all of our resources to fight back!

Something needs to be done about these Criminals they shouldn't be allowed to run a bank and get away with Fraud!

That's The America we live in today no justice for honest hard working people!!!

If everyone sticks together we can stop these people that is the only way!!

This report was posted on Ripoff Report on 03/01/2013 06:01 PM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/internet/td-bank-td-bank-fraudulent-overdraft-fees-fraudulent-and-deceptive-business-practices-1022291. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Author of original report

Thank you for your help!

AUTHOR: Ted - (United States of America)

SUBMITTED: Monday, March 04, 2013

#5 Consumer Comment

Two Cents...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, March 04, 2013

First of all no one here really knows how much you are directly involved or getting information "2nd hand" from your elderly uncle, as this may be a good part of the problem.

However, as for a few of your other claims perhaps some help for you.

In one sentence you state that when you went over the statements "nothing"(that was your word) matches what your Uncle shows, yet in another sentence a little later say that there is no evidence of anyone else accessing his account "as far as you know". The "as far as I know" lends quite a bit of credibility to the idea that you may be getting this information 2nd hand. So it can't be both, either your Uncle is incorrect in what he says he is spending, you are exaggerating the "nothing", or there is in fact someone else accessing his account. If it turns out to be your uncle...this may be an indication you need to take the legal steps to be able to take over his accounts and manage his finances for him.

Next, you make the claim that they are intentionally holding his rent and medicine check until they would bounce. Well if you step back and think about it, they would have to be a fortune teller to be able to know that if they hold the check a certain amount of time he will bounce. Which of course(I hope) you know that banks are not able to predict the future. But on the flip side of this there is one more thing to think about. If as you seem to infer in the beginning that your uncle keeps a register, it won't matter if they hold the check for 1 day or 1 year..in his register he would know the money has been spent and should not spend it again.

The other thing is to realize that if they in fact are holding checks intentionally or just randomly putting debits on his account, if they were ever caught not only would the feds probably shut them down but anyone involved in this would probably be arrested. Even if it was 10,000 customers they were doing it to at an average of $1000 that is only 10 Million dollars but in terms of a bank it might as well be 10 cents because that is just a drop in the bucket. So no bank is going to take this major risk on a low reward.

Now, as a suggestion I would do the following. If you have not done so already..have him immediately stop using his account. If this means that you must pay for everything out of your pocket for the next couple of weeks then this may be the best option. As doing this may be the only way to not only get him back on track, but once and for all verify that no one else is accessing the account.

The reason I say 10-14 days is because it can take that long for the merchant to submit the check/debit to the bank. By the end of the 14 days, the account should basically stabilize where you know the exact situation he is in. During this time you should also be monitoring his on-line banking, not as a way to balance the account, but to check if debits/checks are still coming in.

Once he is balanced back, you may even want to monitor his accounts and even on a weekly(or daily) basis verify what he is spending. As this way it would probably be a lot easier for him to remember what he spent that day instead of having to remember a month later. This way you can catch any discrepancies as they occur, and as I mentioned decide if you need to take more legal action to be able to manage your uncles finances. Yes, I am leaning more toward "user error" with your Uncle, but quite frankly I have been through issues such as this before so I know from experience that there is a point and time when people are at an age they can no longer manage their finances.

Good Luck..

#4 Author of original report

Response back

AUTHOR: Ted - (United States of America)

SUBMITTED: Monday, March 04, 2013

I checked all the debit deposits and no one else has his account! Its not identity theft as far as i know! Looks like the bank is being fraudulent on there end!!!

I have other resources in action as well as the federal bank!

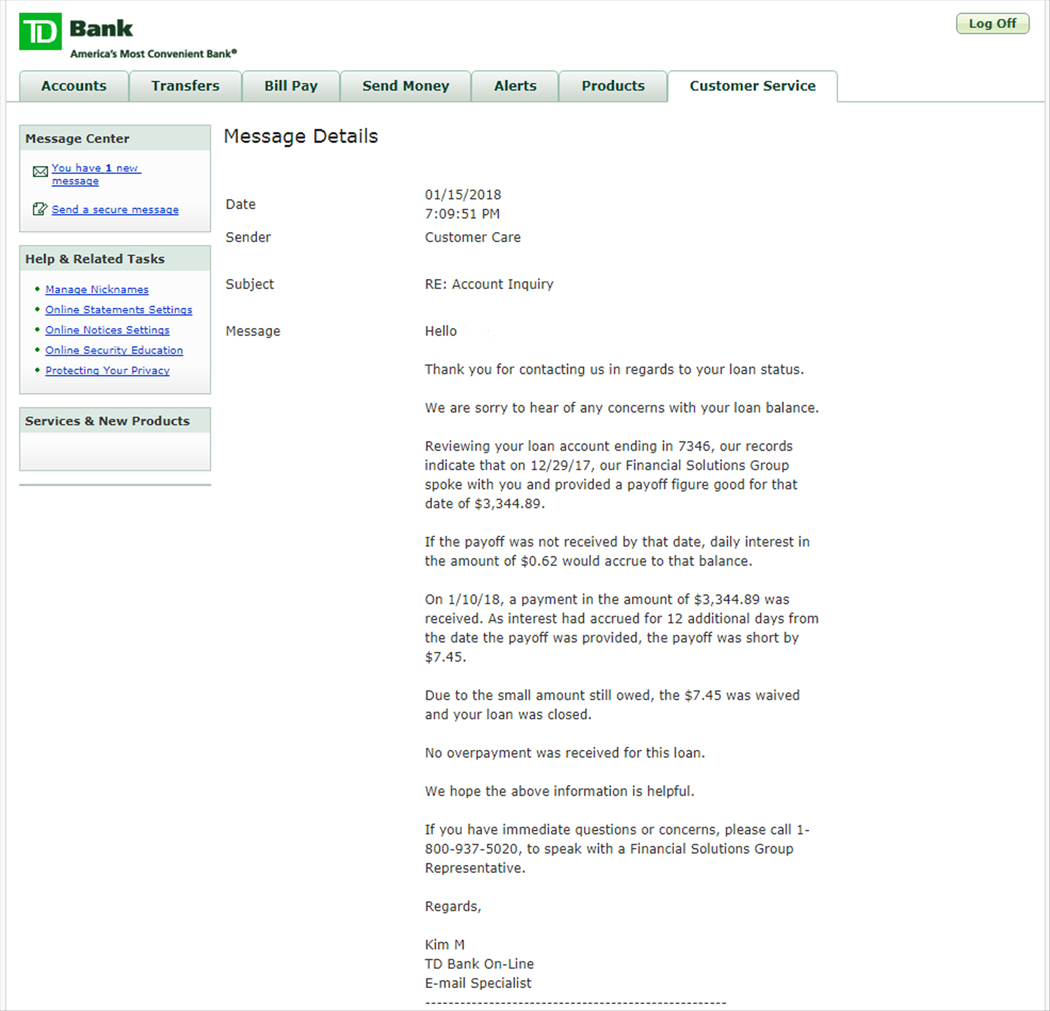

This is what makes me think they are being fraudulent on there part, They purposely held a check that is for his rent or food or his medicines and wait for it to bounce and than re-order the check and causes it to bounce again and the result its my Uncles fault you have a outrageous overdraft fee and it just grows from that point on every other day statements come in the mail with a bigger figure and than just yesterday now he only owes 187.00 dollars!

There figures are bouncing all over the place now instead of getting higher n higher its now lower and then it goes up again i just know it will I'm waiting for that to happen!

Something is seriously wrong and I'm working to resolve this issue!

#3 Consumer Comment

The Bottom Line

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, March 03, 2013

Alot of this doesn't make sense! Overdraft fees are generated when there isn't enough money in the account to cover a check or ATM card usage. You say the bank's records do not jive with his records. Does this mean the bank has evidence showing there have been debits which he knows he hasn't made? If so, then somebody got into his account, they need to investigate it accordingly. The bank would know who received those funds...they just don't disappear into thin air. If somebody like the branch manager says "they don't know" what happened to the money then go to the Federal Reserve, which regulates banks and have them look into it. Better yet, tell them you'll call the Federal Reserve. It is unclear here exactly what you are saying. You say "they" took his rent and food money. Who? Are you saying the bank dipped into his money to pay overdraft fees or are you saying "somebody" received debits from his account which he did not authorize. If you are under the impression somebody has gotten into his account and the bank will not investigate it or even acknowledge that possibility, then you have every right to be upset with them. They are required to investigate fraud because they are acting as a trustee of his money. However, this would be a new one on me! I have never heard of a bank's refusal to investigate a case of fraud when presented with the facts by a depositor. The banks don't want the FEderal Reserve or any state banking authorities snooping around, trust me! On the other hand, you say he has kept good records. That's great...everyone should! Is it possible he could have forgotten some check or ATM card usage and failed to write it down and append to his running balance? Is it possible somebody else may have access to his account that you don't know about?

There are only a few things which would cause this set of circumstances. Somebody got into his account. If he makes manual deposits at the teller or ATM machine, he forgot to do it but made a record of it as if he did. THe bank failed to properly credit his account for a deposit(s). There is a record keeping problem in which he made a mistake and thought he had more money than he did. If the bank provides you with a list of checks or debits and none of them seem weird then I'd look at evidence of deposits.

#2 Author of original report

Response to your rebuttal!

AUTHOR: Ted - (United States of America)

SUBMITTED: Sunday, March 03, 2013

It is my uncles account if you read it carefully!!! Read the first sentence or two and it says its my uncles account!!!

Your right its not rocket science if you read my report thoroughly you would know that and the details you are looking for are the only ones i put in my report his rent and market the others i didn't list!!!

When everybody turns you down to help you fight for justice what else is there you walk away and start a new account some where else no one was willing to help me so if your such a genius than enlighten me on what we should do cause u name it we tried it and the answer we got go talk to the manager something is wrong than! We know something is wrong and tried to talk to the manager and nothing is being done about it! We are currently looking for help else where but keep getting turned down!

so with your rocket science brain of yours please help us on what we should do!!!

nothing i hate more than someone that thinks they know what they are talking about and didn't comprehend anything they read and ask the same question again and again!

So hope that answered your questions and i'm not looking for satisfaction from you or a response back!

#1 Consumer Comment

I'm Curious...

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, March 03, 2013

You say you are facing around $1000 in what you believe are over draft fees caused by account activity which is NOT that of your Uncle (I believe)...right? When you talked to the bank, WHAT SPECIFIC DEBITS did they say overdrew the account? This isn't rocket science here. They have the information about account activity. WHAT DID THEY SAY? They can tell you when the debit happened and who received the money. With you allegedly willing to walk away from what you say is around $1000 of improper overdraft fees leads me to believe there's probably alot more to this story. Either you didn't ask the right questions, didn't talk to somebody above the "teller" level or this is a fradulent report. NOBODY walks away from $1000!

Advertisers above have met our

strict standards for business conduct.