Complaint Review: Key Bank - Columbus Ohio

- Key Bank http://key.com Columbus, Ohio U.S.A.

- Phone:

- Web:

- Category: Banks

Key Bank Biggest first overdraft policy Columbus Ohio

*Consumer Comment: The posting of items from largest to smallest is not merely a courtesy but it is in fact required by law for all banks

*Consumer Suggestion: I'm surprised about your troubles

*Consumer Suggestion: Gentlemen and ladies please note....

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

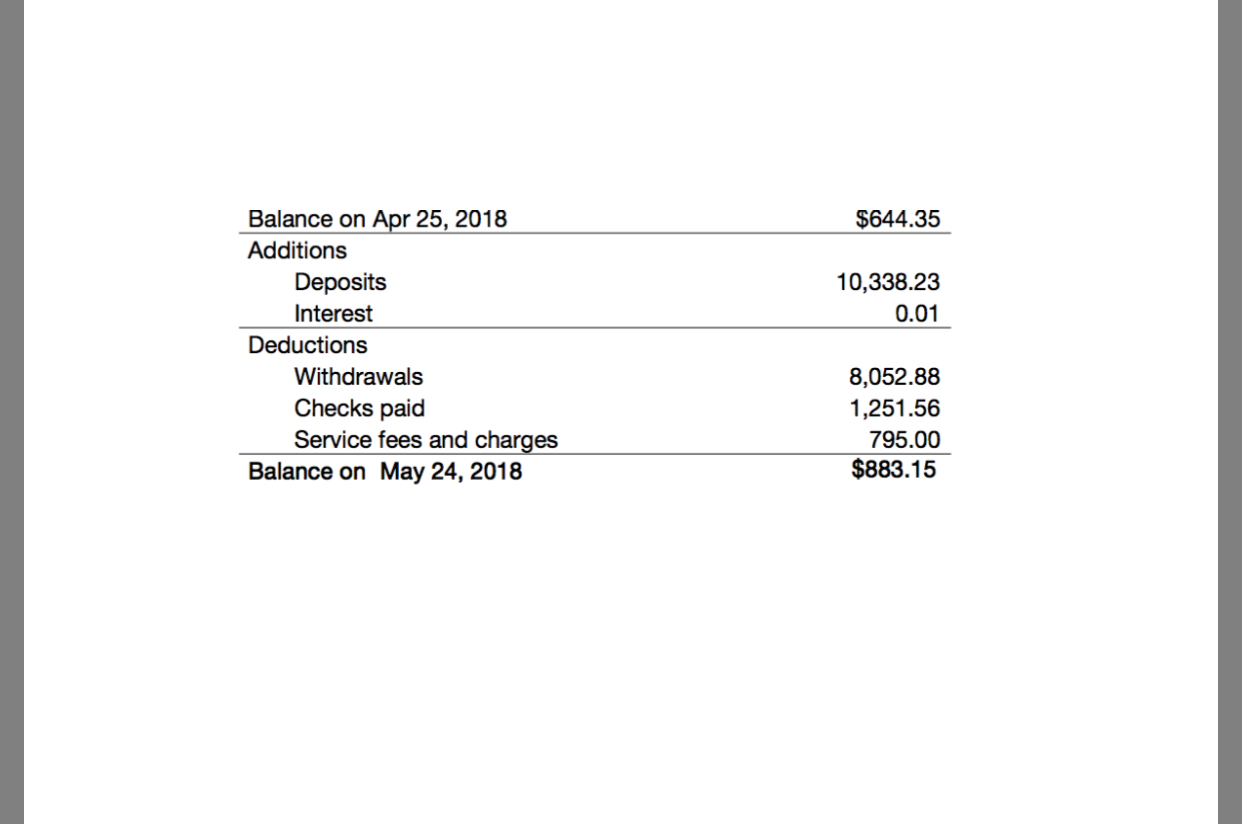

Imagine my shock when I discovered that a company I did business with charged me $862 instead of $162, putting me overdrawn (on a Friday) and Key bank didn't process the deposit that was made the same day (showed it as pending however) till after hours on Monday, This caused about a dozen small transactions (between $5-$30 each) to incur a $28.50 overdraft fee AND an "Excess Overdraft fee" of another $4.50 each, for a total of over $400 in fees. Had they not manipulated the order of the transations using their "biggest first" program I would have incured ONLY a single $28.00 fee.

The company I did the business with cleared up their mistake right away, however they did not feel they were responsible for anything other then one overdraft fee (for their transaction). While the bank and the company exchanged phone calls (with me in the middle) another half dozen automated charges hit the account. Before it was all sorted out there were $680 in overdraft fees. Thankfully I ended up getting the money back from my vendor, but Key Banks actions in this matter are at the least imoral and IMO criminal.

They love to try and excuse their actions by saying "We do this as a service to you so your mortgage payment won't bounce". This fails to pass the intelligence test since they don't bounce any payments because they want you overdrawn so they can rack up these excessive charges.

How any business can look a customer in the face when they charge $32.50 in fees on a $5.95 charge is beyond me.

I am preparing to take legal, political, and media action regarding this practice. It's time that these outrageous fees are eliminated and a regulation requiring them to use "smallest first" and limiting the fees to a percentage of the transaction.

At the least the customer should be allowed to opt out of the program, having them refuse to accept any transactions against overdrawn balances.

Coz

Seattle, Washington

U.S.A.

This report was posted on Ripoff Report on 12/24/2003 06:08 PM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/columbus-ohio/key-bank-biggest-first-overdraft-policy-columbus-ohio-75829. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

The posting of items from largest to smallest is not merely a courtesy but it is in fact required by law for all banks

AUTHOR: Eryn - (U.S.A.)

SUBMITTED: Friday, June 17, 2005

NOT JUST KEY BANK, to post them in that manner. If there is a bank who is not posting credits and debits from largest to smallest out there, they are not adhering to federal guidelines. I am sorry to hear of your situation, however in most cases the bank is willing to cover the fees if they are approached in a polite manner and are informed that the incident was not in fact due to negligence on your part. I do work for a bank, and it is a general practice for one bank to correct another bank's error, and refund fees accordingly.

#2 Consumer Suggestion

I'm surprised about your troubles

AUTHOR: Michael - (U.S.A.)

SUBMITTED: Tuesday, October 26, 2004

I am very surprised that Key Bank gave you a hard time. I'm glad the matter is cleared up. For future reference I have had a similar incident happen to me a few times. I discovered that you can take the vendor to small claims court to recover your fees but it usually is not necessary. Once the bank confirms the overdrafts were due to a mistake by someone else other than you they usually work to reverse any fees you incurred.

#1 Consumer Suggestion

Gentlemen and ladies please note....

AUTHOR: Timothy - (U.S.A.)

SUBMITTED: Sunday, October 24, 2004

Okay...I don't wish to come across naggy but these are the facts, and as I work for a bank, though not keybank, I think most go across the board. When you sign up for your account they give you a schedule of charges, this isn't a toy, it explains that when you go overboard you pay a fee..if you aren't a repeat offender

If you overdraft upon accident the bank PAYS your bounced "check"

I don't work for this bank, but I work FOR a bank, so I know the mindset...these folks want you to prosper so that the bank will...good luck and God bless.

Advertisers above have met our

strict standards for business conduct.