Complaint Review: Key Bank - Lacey Washington

- Key Bank Lacey, Washington USA

- Phone:

- Web: www.key.com

- Category: Banks

Key Bank Charged excessive fees Lacey Washington

*Consumer Comment: Incorrect...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

First, let me apologize to anyone I referred to key. The reason I referred people to key is they had excellent customer service. But seems they have become like all banks have and are just greedy.

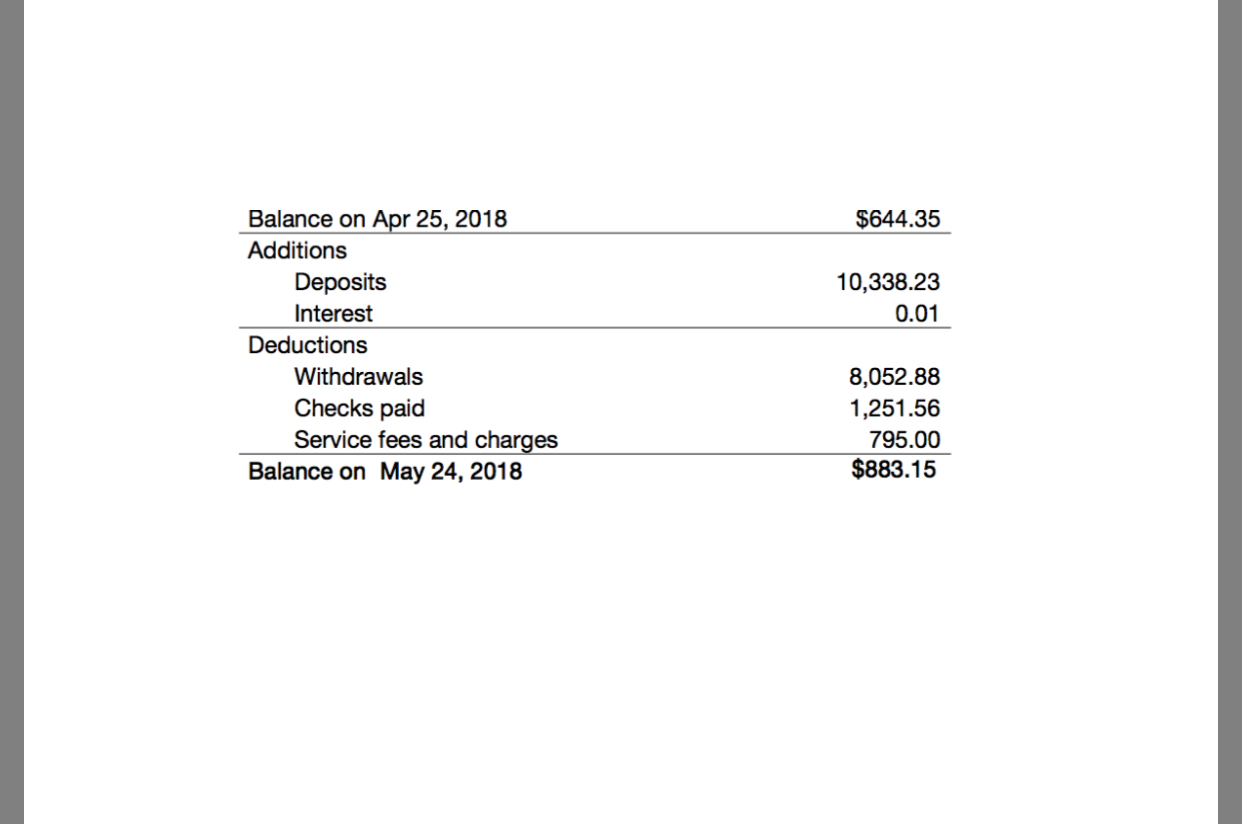

I have had this account for 13 years. I have been a good customer. I never complained when I screwed up and was charged a service fee of $30 some dollars for going $3 over my limit. But, being charged 2 excess transfer fee's on my savings account that is tied to my paypal account is just wrong.

After fighting for 22 years to get my compensation for illness due to serving in the first Gulf War, I got a measly 9k for all of that fighting. Not saying 9k is nothing, but for what I had to do to get that, it is just another slap in the face from Uncle Sam. But I paid off my Bill Me later account which was done with 2 payments. I bought a few things. Then I get 2 fee's of $15 on the SAME day for excess transfers.

Called them and they tell me this is part of having a savings account which is what I was advised to open. I didn't know that and why should it matter, it is my money and I was not doing anything that cost the bank money. They offered me a concession of $15 waived, but not both.

Thank you for the loyalty Key. I will be withdrawing my 5K and taking it to a credit union where I will never have to pay an ATM fee as I have with you, have better banking hours, with actual drive up windows, who appreciate my business.

Nice to know you have become just like every other bank and care more about the money and fee's than customers. 13 years of loyalty lost over $30. Wise move. No wonder banks had to get a bailout. They can't do the math.

This report was posted on Ripoff Report on 08/02/2013 08:13 PM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/lacey-washington/key-bank-charged-excessive-fees-lacey-washington-1072642. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Incorrect...

AUTHOR: Robert - ()

SUBMITTED: Saturday, August 03, 2013

The reason you got charged fees for "excessive" withdraws is because of a Federal Regulation known as "Regulation D". This basically comes down to that any account designated as a "Savings" account is meant to save and not a "transactional" account such as as checking account.

So if you have too many withdraws of various types in a specific period the banks by law must take corrective action. Now, how banks(and credit unions) do this varies but they all will have some sort of "fee" for transactions that get defined as "excessive" withdraws. So when you go to your Credit Union make sure that you ask them about their policy for Regulation D. Or if you plan to have additionnal withdraws consider converting your account from a Savings Acccount to a Checking Account.

Advertisers above have met our

strict standards for business conduct.