Complaint Review: OCWEN - Orlando Florida

- OCWEN Orlando, Florida USA

- Phone:

- Web: www.ocwen.com

- Category: Mortgage Companies

OCWEN dba HSBC predatory lender, loan modification, lack of communication, forced bankruptcy/foreclosure Orlando Florida

*Consumer Comment: Not Quite...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My loan was sold to Ocwen by the mortgage company with whom I signed papers.

After being laid off from my job in 2009 I fell behind on mortage payments and tried contacting Ocwen about a loan modification. During the course of 13 months, I called them well over 300 times. MAYBE 4 times, someone in India/Pakistan answered or returned my call and could provide no information other than telling me I need to submit paperwork. I submitted requested paperwork, not once, not twice, but three times. Every time they received it and I tried to follow up with them, by the time I could reach them, they said all of the financial data was outdated. THROUGH NO FAULT OF MINE.

There were times I'd be on hold and the recording would say my wait time was over 1200 minutes! When If finally got through, all my calls were diverted to one extension in India. I could not press any other options or talk to anyone else if I wanted to.

During the 13 month process of trying to have my loan modified, I was harassed by lawyers, dragged to court three times. They would not suspend the action despite the loan mod in process. I had to hire a lawyer to fight it and learned that OCWEN could not produce an original note to do the foreclosure!

I was denied loan mods twice. Had to spent $1000 for a company to "broker" a deal with Ocwen to get a loan modification. The entire thing was resolved in a 15 minutes phone call... after 13 months of attempts on my part.

Worst customer service ever.

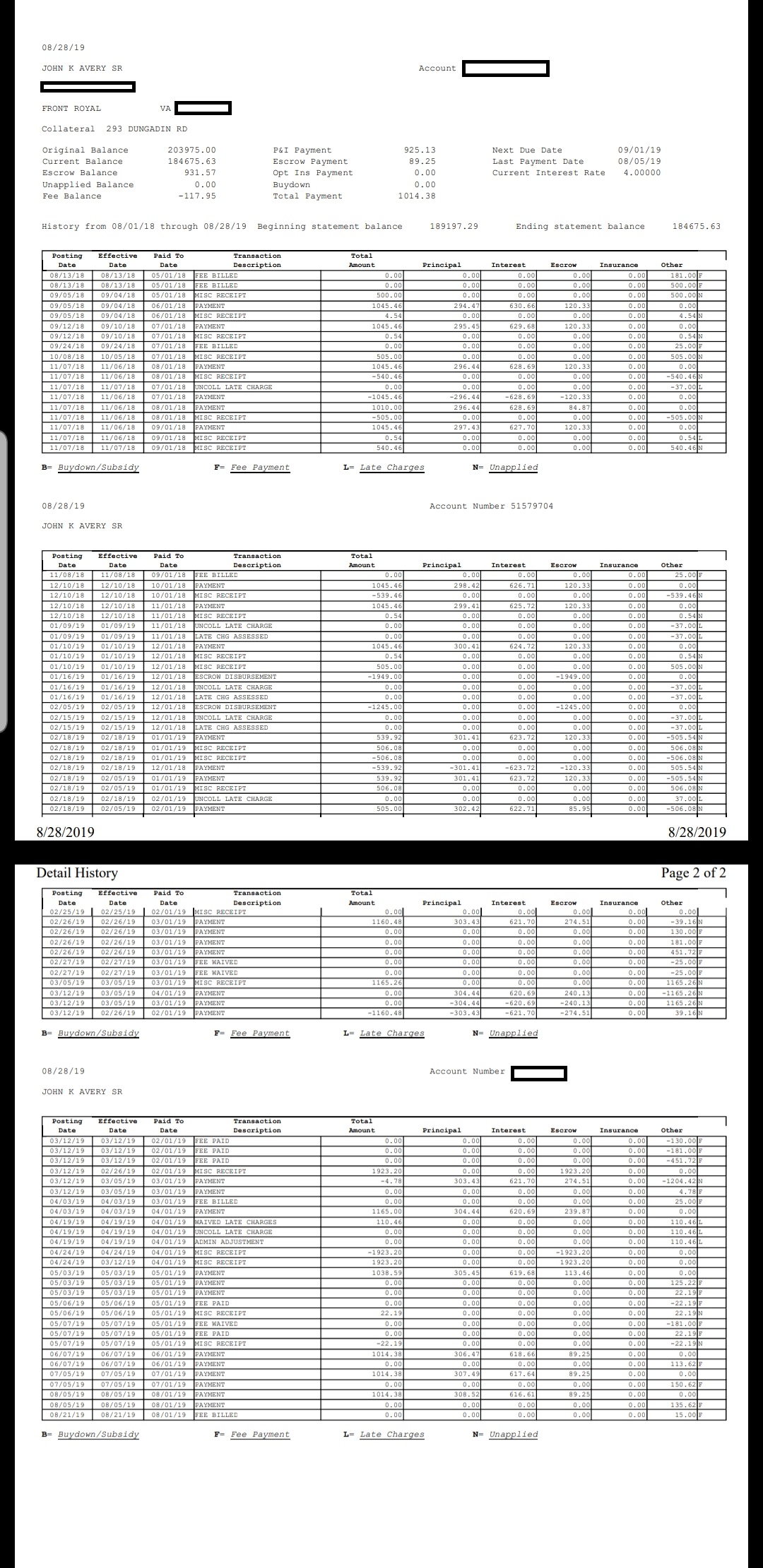

Once the deal was struck, they neglected to tell me they were adding $35k onto my $55k principal to my new loan balance would be $90k!!!

Long story short, I was forced into bankruptcy because of all this. I receive notices in the mail saying they are purchasing an overpriced homeowners insurance policy on my behalf. Technically I still own the house because they have not foreclosed on it.

It's been a horrible experience trying to work with them. I hope all those liars and their lawyers burn in hell.

This report was posted on Ripoff Report on 12/19/2013 01:45 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ocwen/orlando-florida/ocwen-dba-hsbc-predatory-lender-loan-modification-lack-of-communication-forced-bankrup-1108369. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Not Quite...

AUTHOR: Robert - ()

SUBMITTED: Thursday, December 19, 2013

They are not a Preditory Lender. They were not the company you got the original loan from and they have NOTHING to do with your ORIGINAL mortgage. So if any company was Preditory it was that company. However, one thing to remember. They are only "preditory" if you allow them. That is did you go right along with them if(when) they falseified your paperwork? Did you go right along with them when they told you what your payments would be?

Next, while it is not a good thing to loose your job, where in your Mortgage documents does it say a company MUST provide a Loan Modification?

I won't even go into the 300-400 phone calls..as that is at best a slight exageration. Well that is unless you were on the phone with them twice a day every other day for the entire 13 months.

Then let's get to these people you hired. First the lawyer who found out they don't even had the original documents..so what did he do. That should have stopped any action right then and there. Oh and as this company you paid $1000 to settle the issue in 15 minutes. Yea..I bet if you offered them to add 35K to your loan balance you could have settled it in 15 minutes as well.

As for the Homeowners insurance. Yes you "own" the house but they hold the deed. So they are going to protect their interest by making sure it is insured. So if you cancelled the insurance or don't have the minimum they require the loan documents you signed(with the original lender) allows them to put in what is known as "Forced Placed Insurance" which is always going to be a premium price.

Advertisers above have met our

strict standards for business conduct.