Complaint Review: Ocwen - Palm Beach Florida

- Ocwen 16661 Worthington Rd Ste 100 Palm Beach, Florida USA

- Phone: 800-746-2936

- Web: www.ocwen.com

- Category: Mortgage Companies

Ocwen - freedom mortgage Stopped autopayment with no consent or contact! Palm Beach Florida

*Consumer Comment: Wrong

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

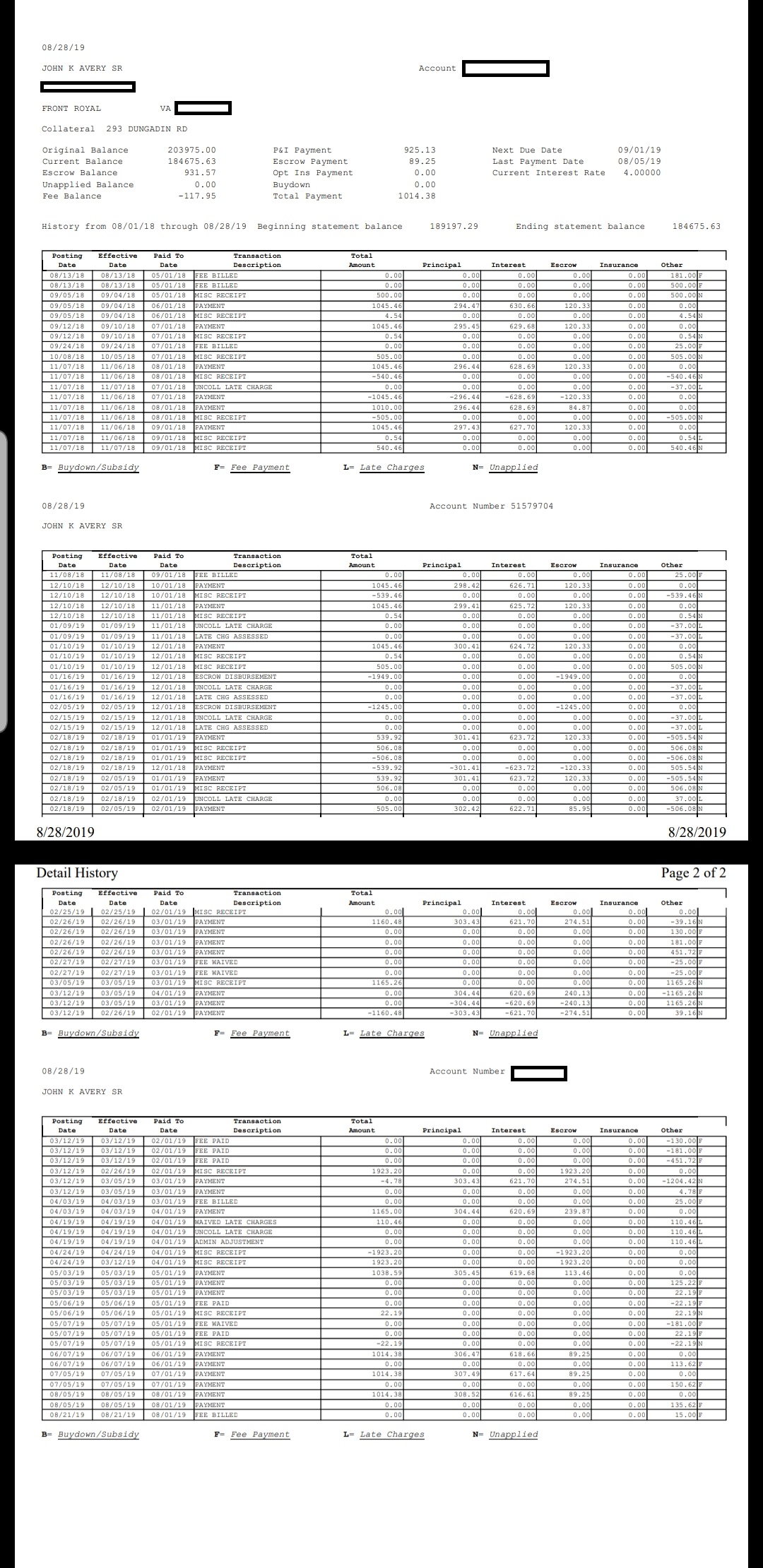

I have had a loan with Ocwen for a number of years and suddenly without contacting me or getting consent, they stopped the auto-payments on my loan. If it had not been for a paper that was left on the door of the property offering a face to face consult, I would not have even realized that I was late 2 payments. As soon as I found out, I made the payments and requested the research department to look at the problem and of course they denied my claim.

There are many things I do not get here, 1. when you have a person on auto pay, why on Earth would you cancel it? 2. Is it even legal to cancel something that affects someone so greatly without any contact method that insures the person actually received something? According to Ocwen they sent a letter in January, however I never received any such letter.

I am a business owner and in my business if we are making a serious change like that, we either get a consent signature in person, electronic signature, speak on the phone in a recorded call or at the very least send a certified letter, so that someone actually has to sign for it. I do not normally pay any attention to my bank statements unless my accountant needs it or I am applying for a home loan or the like and they request it. I keep money in that account, and my paycheck is directly deposited on the same day twice a month that Ocwen pulls the auto-pay for the mortgage on that house.

Long story short, I could have lost my house, but more importantly now, my credit is affected because I show late payments after 9 years of never having a late payment (because of auto-pay). I would have expected that to be a fool-proof system. The other thing I would have expected is Ocwen to do something about it based on the information above, however they refuse to amend my credit report.

This report was posted on Ripoff Report on 06/02/2017 09:56 AM and is a permanent record located here: https://www.ripoffreport.com/reports/ocwen/palm-beach-florida-33409/ocwen-freedom-mortgage-stopped-autopayment-with-no-consent-or-contact-palm-beach-flori-1376756. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Wrong

AUTHOR: Robert - (USA)

SUBMITTED: Friday, June 02, 2017

First off I will give you that in the beginning them removing the Auto-Pay puts some responsibility on them...However in this case the end result is that YOU are actually the one to blame for the situation you now find yourself in.

That money for your mortgage comes from somewhere, for the sake of this post let's say it is from Bank A. Now, every month Bank A sends you a statement either in the mail or by e-mail. It is YOUR responsibility to reconcile your statement with your written register. I am sure that if you asked your accountant they would tell you basically the same thing.

But since you obviously don't keep a written register, for just about everyone a mortgage payment is the single biggest payment a person will make on a monthly basis. This makes it pretty obvious to realize something is up if you all of the sudden have several hundred(or a few thousand) more than you think you should have.

Had this gone one month...yes it is some sort of error that they should have at least some responsibility in. Had you found it after that first missed payment and they charged you any sort of fees I would be with you that you should not be responsible for it.

However at 2 missed payments this falls squarely and fully on YOU. Because the "Well I just don't pay attention to my bank account" is not a valid excuse or way to shift blame. You had the opportunity to take care of this before you got to 2 late payments.

Let me give you one other example. Say you had someone withdraw $25/month for 10 months and you never "noticed" it because of your failure to monitor your accoutns. Do you think you are entitled to all of that money back? Nope...FEDERAL law limits disputes to 60 days. After 60 days you are at the mercy of the bank or business to see if they want to give you the money back. Oh and before you say it..no it doesn't apply to Auto-payments.

would have expected that to be a fool-proof system

- It is until you get a borrower that is a fool.

Advertisers above have met our

strict standards for business conduct.