Complaint Review: Synchrony Bank - Internet

- Synchrony Bank Internet United States

- Phone:

- Web:

- Category: Banking - Credit Cards, credit cards

Synchrony Bank High Yield Savings? Robbing me with High interest Rates; Internet

*Consumer Comment: Hey There, Attorney

*General Comment: LOL what?

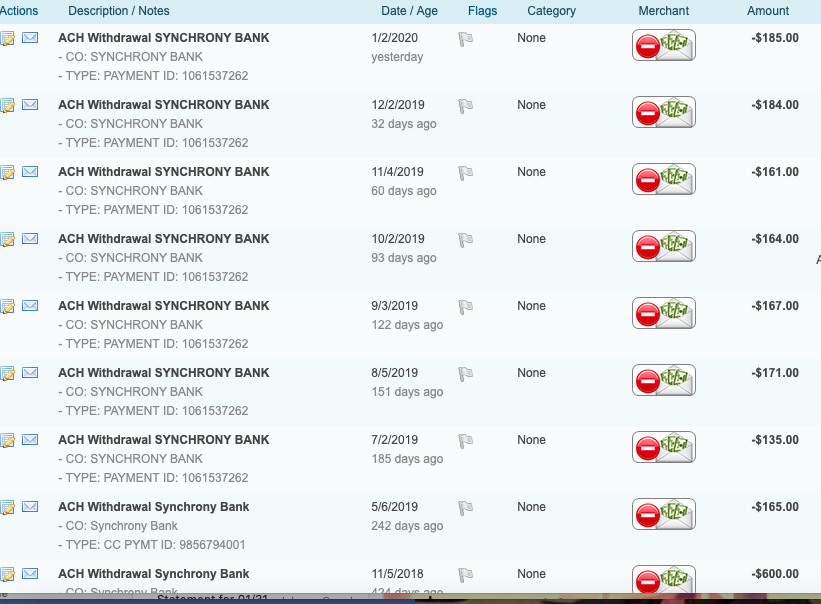

I have an almost perfect credit score of 825 and Synchrony Bank is beyond Loan sharking me with a 23% interest rate? They are illegally charging me with my credit score of 825 and Synchrony Bank is charging me 29.99% interest; and a person I recently spoke to who went Bankrupt is only paying 21.9% interest? (This is criminal) and the Federal Government needs to get involved.

This report was posted on Ripoff Report on 09/14/2024 12:08 PM and is a permanent record located here: https://www.ripoffreport.com/report/synchrony-bank-high-yield/robbing-interest-rates-1534242. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Hey There, Attorney

AUTHOR: Irv - (United States)

SUBMITTED: Sunday, September 15, 2024

Please tell us exactly what laws they are violating by setting whatever APR they have!

#1 General Comment

LOL what?

AUTHOR: Flint - (United States)

SUBMITTED: Sunday, September 15, 2024

They can charge whatever interest rate they want. Certainly 30% is legal (although that's a penalty interest rate for deadbeats who don't pay on time). If you don't like it, refinance with someone who can offer you a lower rate. If your credit score is really 825, that won't be difficult.

Advertisers above have met our

strict standards for business conduct.