Complaint Review: Synchrony Bank - Orlando FL

- Synchrony Bank P.O. Box 960061 Orlando, FL United States

- Phone: 1-877-471-5643

- Web: https://www.synchrony.com/

- Category: credit card

Synchrony Bank charging late fees that I do not owe Orlando FL

*Consumer Comment: Terms and conditions

*Consumer Comment: Three Questions

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

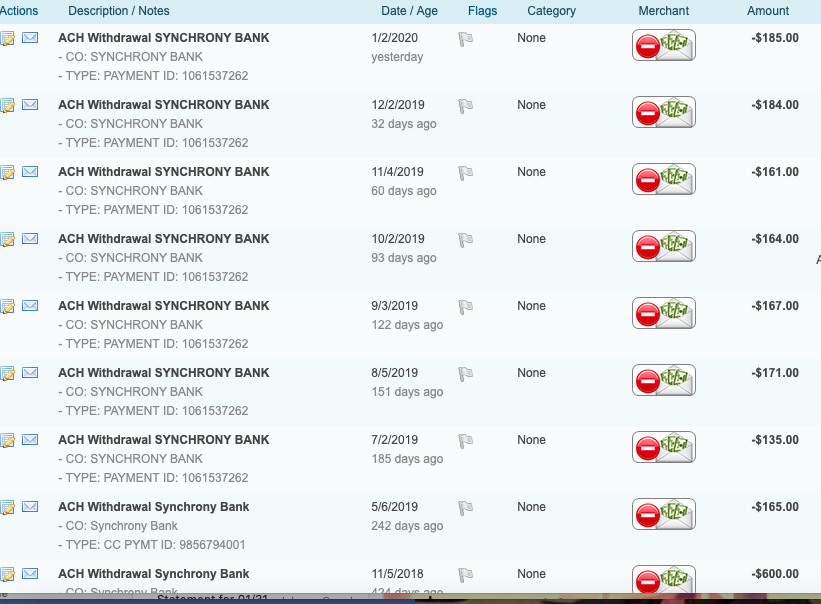

I purchased furniture from Ashley Furniture in Aug 2018. The total I should pay when the card is paid off is $2,600. ONE year after I was issued the card I discoverd I had been being charged $39 a month in late charges every month since I purchased the furniture. Obviously the sales person at Ashley wrote down the wrong payment date we had discussed. Synchrony did not once notify me by phone or email during the first year. In Sept 2019 I starting recieving large amount of mail from the bank stating I was late on my payments. They called me day and night until I requested they stop the phone calls.

I offered to pay off the card. If I pay what they are requiring I will have paid $3,900. This is an overcharge of $1,300. I have asked them to drop late charges and show my account in good standing on my credit report.

Every CSR I have talked to has been rude and refused to do anything but overcharge me and ruin my credit report.

This report was posted on Ripoff Report on 04/15/2020 09:08 AM and is a permanent record located here: https://www.ripoffreport.com/report/synchrony-bank/orlando-fl-charging-late-fees-1494053. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Terms and conditions

AUTHOR: Stacey - (United States)

SUBMITTED: Wednesday, April 15, 2020

From their website

No Interest if paid in full within 6, 12 OR 18 Months††

Can be combined with online discount offers.

On qualifying purchases with your Ashley Advantage credit card. Interest will be charged to your account from the purchase date if the promotional purchase is not paid in full within 6, 12 OR 18 months††. Minimum monthly payments required. No minimum purchase required.

††Offer applies only to single-receipt qualifying purchases. No interest will be charged on the promo purchase if you pay the promo purchase amount in full within 6, 12 OR 18 Months. If you do not, interest will be charged on the promo purchase from the purchase date. Depending on purchase amount, promotion length and payment allocation, the required minimum monthly payments may or may not pay off purchase by end of promotional period. Regular account terms apply to non-promotional purchases and, after promotion ends, to promotional balance. For new accounts: Purchase APR is 29.99%; Minimum Interest Charge is $2. Existing cardholders should see their credit card agreement for their applicable terms. Subject to credit approval. We reserve the right to discontinue or alter the terms of this offer any time.

Once approved for the Ashley Advantage™ Credit Card, you’ll be able to select a payment option that suits you.

Did you read this conditions when you applied?? Just wondering. And NO I do not work for them

#1 Consumer Comment

Three Questions

AUTHOR: coast - (United States)

SUBMITTED: Wednesday, April 15, 2020

Did you pay by the due date shown on your monthly statements? Why did you disregard the late payment penalty noted on each statement for the previous month?

$39 a month for 12 months equals $468 so why do you claim they are charging you an additional $1300?

Advertisers above have met our

strict standards for business conduct.