Complaint Review: Bally Total Fitness - Kew Gardens New York

- Bally Total Fitness www.ballys.com Kew Gardens, New York U.S.A.

- Phone:

- Web:

- Category: Health Spas

Bally Total Fitness ripoff Kew Gardens New York

*Consumer Suggestion: Dont let this happen to you!

*Consumer Suggestion: Credit Reports

*Consumer Suggestion: You might be stuck

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

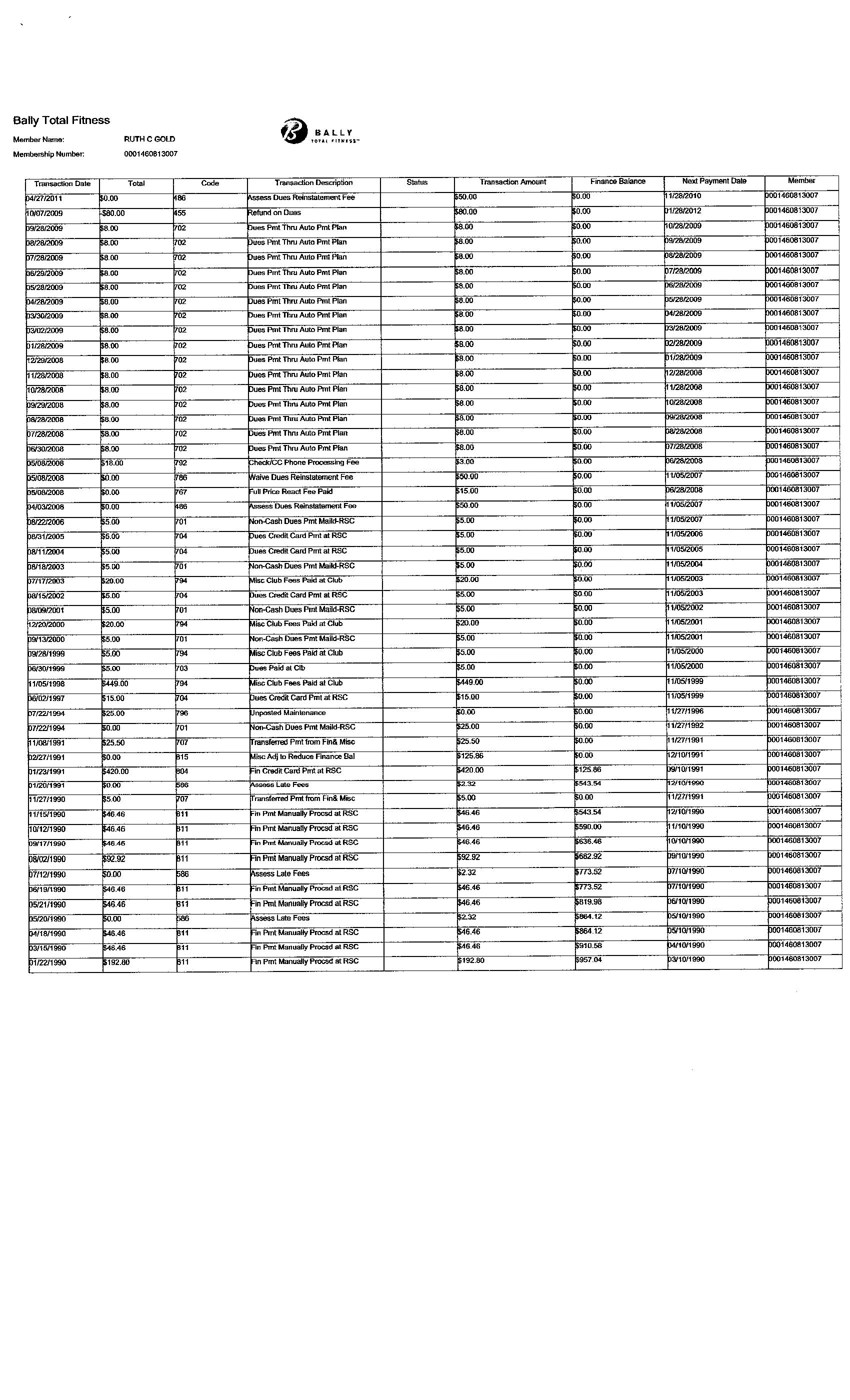

approx about 10 years ago i joined ballys health spa. i paid an enrollment fee to join. i attended the gym only once during my membership. immediately afterward i cancelled my mebership because i was involved in a life threatning motor vehicle accident and no longer could attend the gym. i send numerous letters into the company also i went back to the gym where i signed up. i was told not to worry, i will not be charged the full 2 year membership cost. little did i know i was sent a bill for over 1,900. till this day , over approx 10 years i am receiving blls which has affected my credit tremendously. i have made calls to the company and also i have wrote letters but i am not receiving any feedback. help :0(

Leon

New York, New York

U.S.A.

This report was posted on Ripoff Report on 01/10/2003 12:46 AM and is a permanent record located here: https://www.ripoffreport.com/reports/bally-total-fitness/kew-gardens-new-york/bally-total-fitness-ripoff-kew-gardens-new-york-40874. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Suggestion

Dont let this happen to you!

AUTHOR: Michael - (U.S.A.)

SUBMITTED: Wednesday, April 09, 2003

I am sorry to hear about your dealings with Bally's and it is unfortunate to hear that another person has been added to the long, long list of people who are now indebted to Bally's finance company or its various assigns (collection agencies). Although what follows will probably do little to help in your case, as you are now aware often times far too few people actually take the time to read the contract that is presented when they are contemplating signing up for a Bally's 'membership'. Of course it probably does not help that Bally's salespeople are know to employ high pressure sales tactics that would make used car salesman look like angels in comparison.

Everyone reading this needs to remember that in simplest terms, although you are purchasing a 'membership' that entitles you to all the applicable privileges of the appropriate Bally's facilities, the contract paperwork that you sign for such privileges is actually a retail finance or installment contract. Furthermore, this contract very carefully disguises the fact that you are actually going to be paying between 19% and 22% interest annually over the course of the next 2-3 years for the privileges of this membership. In consideration of this, it is important to realize that the fitness club aspect of the Bally's corporation is actually quite good but obviously that is not where Bally's generates revenue. Bally's generates revenue as a result of its sales efforts that in turns develops long term revenue from its financial lending arm and that retail installment contract that new members decide to sign. Without getting into a long-winded financial discussion, Ballys takes that contract that you sign and sells it to its own financial subsidiary that in turn pays the corporation the full value of the installment contract that you are now obligated to for the next 2-3 years.

Truth be told, you could have had that same 3-year membership for as little as $599 if you had been willing to pay cash, write a check, or charge it to a credit card. Unfortunately most consumers consider that to much of an outlay of money and instead opt for to accept that membership contract that allows them to pay XX amount of dollars each month and spreads the payments out over 2-3 years. Of course this is the same principle as when we buy a new car since nobody wants to write a check for $15,000 (or more) for a new car. In that case we also elect to pay for the car over a longer term and see the added interest charges as an expense or consequence of the purchase. The difference is that the majority of consumers would never even consider signing the loan papers for an auto loan that carried a 21% interest rate. As I mentioned before, the problem is that most who run into trouble with Ballys universally fail to realize that signing that 'membership' contract at Bally's is also financial agreement and carries the same commitment as if they went to Best Buy and purchased a $1,500 Big Screen Television on Credit. The difference being that a big screen television is tangible as it occupies a space in our house and we get immediate benefits from the purchase, things that are not as apparent with something less tangible like a health club membership.

Now here is where the difference lie, unlike Best Buy, if you are not satisfied with your purchase, getting suitable relief or satisfaction is going to be much more difficult. Sure you might have gone to the club where you bought your membership and spoke to an employee and that employee said that your membership would be canceled. Unfortunately you signed a contract and although the employee may have had good intentions, he/she works for the fitness arm of Bally's and not the financial arm, and for that reason, he/she does not have a signed retail installment finance agreement with Bally's as you do.

Short and sweet but I am sorry, you can not wake up one morning and decide that since the economy is taking its toll on your bank account that your Ballys membership has got to go! In order to cancel your membership you will need to determine if you are eligible to exercise one of Bally's 'escape' clauses that are printed on the backside of the contract.

Once you determine if you meet the criteria set forth in the contract, then for the most part it will require the member to then prepare a formal, written (typed) letter that specifically mentions the cancellation language from the contract which may also require the payment of a dissolution fee of some amount (usually $50). Once that is done, you need to contact Bally's and get the name and address of a representative of Bally's to whom you can send this letter Certified Mail, Return Receipt Requested! In this manner, you will have a legal binding document in the form of the postal return receipt, a copy of your letter, and in a few days a canceled check indicating that you have exercised your right to cancel in accordance with the terms of the contract.

Upon receipt of the return receipt (green card) from the postal service, you need to follow up with a call to Ballys to assure that they have abided by your wishes and cancelled your contract and request written documentation to that effect be forwarded to you. Unless these steps are follow as outlined, you will have no means of proving future claims that you indeed canceled your membership should your account somehow be turned over for collections.

#2 Consumer Suggestion

Credit Reports

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, February 25, 2003

Leon,

Creditors are legally not allowed to report any negative information to credit bureaus after 7 years from the date you made your last payment on your loan/contract.

Go to one of the major credit bureau's websites (Equifax, Experian, or Transunion), and order your credit report.

After you receive your report, you will receive instructions on how to dispute a negative item. Write one of the credit bureaus and let them know that the Bally's account is beyond 7 years old, and not be showing up on your credit report any longer. Here are the websites:

http://www.equifax.com

http://www.experian.com

http://www.transunion.com

FYI, you only need to file your complaint with ONE of the credit bureaus. Because your debt is over 10 years old, the Bally's account should drop off your report fairly quickly. After the credit bureau gives you your updated report, you may want to order credit reports from the other 2 bureaus to make sure that their information is updated also. I hope this information helps.

#1 Consumer Suggestion

You might be stuck

AUTHOR: Terrance - (U.S.A.)

SUBMITTED: Friday, January 10, 2003

Most of these places don't care about anything but getting their money. If you signed up for a certain term, and didn't meet one of the few conditions that would allow a cancellation of your membership, you're stuck. You could be totally paralyzed, and technically, they could hold you to the contract.

Your only option is to try to find a sympathetic sole at the company. Make some calls to the company, and try to find a friendly person. Calmly explain your situation and ask them to help you.

Again, they probably don't HAVE to give you a break, hopefully you can find a person who is sympathetic, and can authorize such a break. Good luck. You're going to need it.

Advertisers above have met our

strict standards for business conduct.