Complaint Review: BANK OF AMERICA -

- BANK OF AMERICA United States

- Phone:

- Web: BANKOFAMERICA.COM

- Category: Banks

BANK OF AMERICA BANK OF AMERICA CONFISCATED MY MONEY AND THEN CLOSED MY ACCOUNT

*Author of original report: Bank Of America STILL has not given me my money.

*Author of original report: I did call the bank.

*Consumer Comment: Follow up Questions

*Consumer Comment: They Can Still Hold The Check

*Author of original report: 2 DAYS!

*Consumer Comment: Why?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

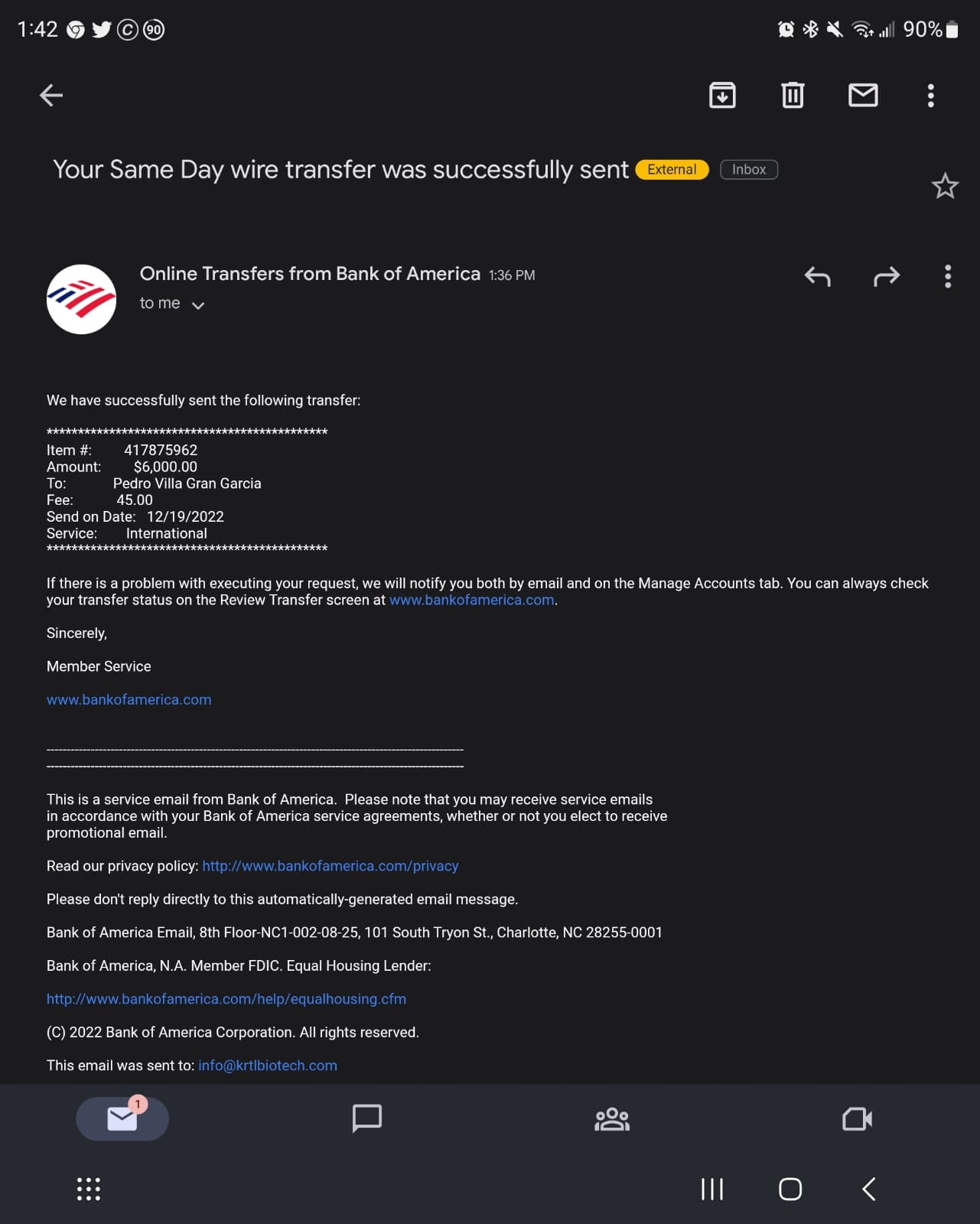

I deposited a check drawn on a local bank. The check was paid by the other parties account the same

night it was deposited. I have copies showing it was paid. A few days after the check was already paid

Bank Of America debited my account for the amount of the check AFTER business hours leaving my

account negative nearly $500.00.

I am assuming they did this sleazy tactic in order to rack up a bunch of over-draft fees by leaving me with

an over-drawn account. I had to drive to the ATM around 10:00 P:M and deposited enough cash to bring

the account current so they could not hit me with a bunch of over-draft fees at $35.00 each!

I went on Facebook and used my 1st amendment right and told them exactly what I thought

of the way they do business. Apparently Bank Of America DOESN'T LIKE CRTICISM!

2 days later, I go to check my account online and find it no longer exists.

I call Bank Of America and speak to several people, no one knows what is going on with my account

which is typical at this bank.

Later, I went to the ATM and tried my debit card to see if it worked, it no longer works.

So in essence because I voiced my DISGUST PUBLICLY with this bank and their unfair

practices they closed my account and have essentially stolen my money!

In addition, they charged me a monthly service fee of $25.00 just a couple days prior to them closing my account.

I never told them to close this account.

They have done this to me NUMEROUS times in the past when I deposit a check. AFTER they have already

been paid by the other parties bank they then confiscate the money from my account leaving me over-drawn

and depriving me the use of my own money.

When I call I am told, I can have my money in about 10 days or so.

I am going to file a complaint with the Federal Reserve, The States Attorney's Office, and consult my attorney

about a class action lawsuit against this bank.

This report was posted on Ripoff Report on 11/29/2017 10:57 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bank-of-america/bank-of-america-bank-of-america-confiscated-my-money-and-then-closed-my-account-1414241. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Author of original report

Bank Of America STILL has not given me my money.

AUTHOR: Shawn - (United States)

SUBMITTED: Sunday, December 10, 2017

It is now December 10th, Bank of America still has MY MONEY from a deposited check that Wells Fargo PAID on NOVEMBER 24TH. That is now 16 days for a LOCAL CHECK that they were ALREADY paid for. 16 DAYS they have DEPRIVED me the use of MY MONEY

16 DAYS they have DEPRIVED me the use of MY MONEY, MY FOOD MONEY, MY MEDICINE MONEY...This is CRIMINAL in my opinion!

#5 Author of original report

I did call the bank.

AUTHOR: Shawn - (United States)

SUBMITTED: Monday, December 04, 2017

They gave me some excuse that the check was being held as a risk hold. It's now been over 10 days since the check CLEARED the other parties bank account and they still refuse to give me my money

It has now been over 10 days since the check CLEARED and was PAID by the other parties bank account and they still refuse to give me my money.

#4 Consumer Comment

Follow up Questions

AUTHOR: Robert - (United States)

SUBMITTED: Friday, December 01, 2017

Did you contact BoA by phone or in person at any time before you "blasted" them on Social Media asking WHY they took the funds back?

What did the other party that gave you this check say when you told them that the bank took back the funds?

#3 Consumer Comment

They Can Still Hold The Check

AUTHOR: Jim - (United States)

SUBMITTED: Thursday, November 30, 2017

The Funds Availability policy allows the bank to place funds on hold more than two days regardless of whether the check clears - be it a local check or not. Exceptions are clearly stated to the policy, including the person who wrote the check to have a history of overdrafting, or you overdrafting, the dollar amount of the check, or for other reasons. The fact that you knew the check cleared that night by the other bank and secured copies of the information from the other bank implies your general lack of faith regarding the person who wrote you the check. Before you say your lack of faith is with your bank, let's remember exceptions to the Funds Availability policy since the bank can still hold the check. If you believe BofA is the issue, then let's remember Chase, or Wells, or US Bank, or Union, or any other bank all have to abide by those same policies and can institute similar holds for the same reasons.

There is also no correlation between your criticism of the bank, and their action to close your account. Banks don't care about postings on social media. When you opened the account, you signed an agreement allowing the bank to close your account if you violate the T&C's of the account. Several overdrafts would generally constitute a terms breach of that agreement. Criticizing the bank would not constitute a breach of your agreement; if the bank were to close your account for that reason, then you'd be able to sue them. Banks may be hard to deal with, but they're not stupid.

Finally, there is no theft here. You know where your money is. So does the bank. The bank stated that after 10 days - the bank will release the remaining funds to you. Clearly, that's not theft. Your attorney can explain this in more detail to you and why a class action lawsuit is a waste of time. Ask anyone who was a part of the last class action lawsuit against this bank - the people who waited 9 years and some were out thousands of dollars....got $67 each.

Before you accuse me of it, no I don't work for this bank nor do I speak for it. Best of luck to you.

#2 Author of original report

2 DAYS!

AUTHOR: Shawn - (United States)

SUBMITTED: Thursday, November 30, 2017

I did check the fund's availability act on the Federal Reserve website and it states the

funds for a local check are to be released in 2 days. I'm surprised you don't know that since you

felt compelled to respond on the bank's behalf. Let me say this SLOWLY for you, they took the money from

my account AFTER the check was already paid by the other parties bank. Did you miss reading that in your rush to jump to the

rush to jump to the banks defense? I do NOT have a history of dealing in bad checks either for your information. And yes they can

close my account, what they can't do is KEEP MY MONEY, this may be news to you but that is called THEFT. Thanks for your

concern for Bank Of America and the way they do business. Since you probably work for them why don't you get them to

give me back my d**n money!

#1 Consumer Comment

Why?

AUTHOR: Robert - (United States)

SUBMITTED: Thursday, November 30, 2017

I would actually be concerned about why you seem to have a history of depositing bad checks. You don't mention the source of these checks, but having even one check returned would be cause for concern.

Even though I am sure it makes you feel better, no bank is going to just randomly pick on someone taking back checks, there is a reason. You should look up the Federal Expedited Funds Availability Act. It specifices the amount of time a check can hold the funds of a check deposit. So it is possible that they were required to make the funds avaialble to you before it actually "cleared" the other bank. It is also possible that the accout holder at the other bank reported it as a fradulent check and therfore had it returned.

Now, just like you used your "Rights" to complain, they used their rights to decide they no longer wanted you to be a customer so they closed your account. There is no law or regulation that states a bank has to give you warning they are going to close your account or that they even must keep your account open.

But one has to ask if you have had so many problems with them in the past, why would you want to continue to stay with them? So I bet there is a lot more to this story than you are saying.

Advertisers above have met our

strict standards for business conduct.