Complaint Review: Bank of America - Nationwide

- Bank of America Nationwide USA

- Phone:

- Web: www.bankofamerica.com

- Category: Banks

Bank of America Theft from poor people, they hate us so they punish us Nationwide

*Author of original report: I love this website - it makes a permanent record

*Consumer Comment: So You're A Hypocrite Then...

*Author of original report: wrong again but thanks for playing

*Consumer Comment: I Think We Have A Misunderstanding....

*Author of original report: another low IQ response

*Consumer Comment: Oh yes it's a conspiracy against the poor.

*Author of original report: one more thing

*Author of original report: Never said they set up anything

*General Comment: No

*Author of original report: Ivory Towers

*Consumer Comment: No one likes fees

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

It is easy to tell people keep a minimum balance, unless you are poor. Then every dollar counts.

Bank of America does not care about you.

Their online system fails to show where the account went negative and still they charge a fee

Also, their super smart computers fail to notify you in time to correct the account. Of course they have excuses and it is always your fault.

Get in your deposit by 8pm by they notify you at 12:52AM when you are asleep.

Just like a thief.

I am going to cxxxxxx oxx banking where these fees do not exist. Banks like bankofamerica are a dinosaur who takes from the government and steals from the poor people.

Keep it bankofamerica - I hope the $35 is enough for a cup of coffee.

This report was posted on Ripoff Report on 04/11/2017 05:38 AM and is a permanent record located here: https://www.ripoffreport.com/reports/bank-of-america/nationwide/bank-of-america-theft-from-poor-people-they-hate-us-so-they-punish-us-nationwide-1367035. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#11 Author of original report

I love this website - it makes a permanent record

AUTHOR: - ()

SUBMITTED: Tuesday, April 18, 2017

Wrong again - I love seeing how many come forth thinking they got it figured out then fall on their self-righteous face.

The banks could never get away with this to those who have money and can quickly drop the accounts. The claims on the "processing" functionality is what was said to me by them on the phone - which is hypocrissy because they neglected the deposit which would of made it positive

yes, you right, the account changed - the $50 transaction did not complete until the 2nd day, so now it shows a fee of $35 made the account go negative

you are wrong again on banking - the bank I am converting to has ZERO penalties for NSF, has ZERO monthly fees. I already started the process. Waiting for my bank card in the mail. This financial institution, beginning with the letter "C" will disrupt the traditional banking system and their corruption against the poor - those of us still struggling to get out of the whole the very banks created in 2007-2008.

as far as your claim on using their product - wrong again - that is how the world works unless you want to live in a mountain - it is not a choice, we are all subjected by lack of choice to use these products -

other banks have their doors and drive-thru's open, with staff inside - bank of america has reduced their staff, closed the drive-thru's - and it is a matter of time before they fall

I had a friend who worked in one as a manager - which is the only reason I opened this account - she left, citing the immense pressure managers endure to produce loans or they get replaced - I am sure the fatcats on the board are not getting replaced

#10 Consumer Comment

So You're A Hypocrite Then...

AUTHOR: Jim - (USA)

SUBMITTED: Monday, April 17, 2017

First, the money doesn't have to actually leave your account in order for you to incur the NSF fee. You simply have to agree the money is to be disbursed in order to incur the fee, which by your own admission...you did. Whether the merchant confirms the transaction in an hour or 48...it doesn't matter. The rest of your story/rant is really meaningless. Why??

Because the picture of your online account is not evidence of anything; it's not an official document. Your account agreement also warns you as a customer not to use the online account to determine what your balance is. Your bank statement is ultimately your official document. By the time your bank statement comes out, it will look nothing like your online picture. Your pending transactions will show on your statement on the date in which you agreed to the disbursement and the money will show as leaving your account then, not when the online system says it was agreed to by the merchant. Your account will show the negative balance, and the NSF fee appropriately charged. If you as smart as you think you are, you should know this. But you're not. I suppose that's another problem, besides being out a legit NSF fee...

But the best part for me, by far, in this whole little charade is how you rant about the big corrupt bank taking all of this money from poor little you, and then you continue to use their product (a debit card) for your everyday transactions. You realize that the debit card is the exact reason why banks make as much money as they do off of NSF fees from debit cards, right? You condemn the bank as corrupt, yet have no problem using their product, do you?? If you believe the bank is corrupt, and you continue to use a debit card that makes them corrupt, then you are hardly an innocent person, are you?? You just enable the bank to make their billions. Your new bank will do the same to you.

#9 Author of original report

wrong again but thanks for playing

AUTHOR: - ()

SUBMITTED: Friday, April 14, 2017

1) I know what is overdraft protection, the laws surrounding it, when it was changed by obama and so forth.

2) It is you who is misunderstaning. I clearly said all items that were "processing" and one of them included a "credit" - it was a deposit from paypal - which would have put the account at $4 balance if they had counted the credit the way they did the debit. Maybe it was few hours difference between the two, I do not know as the ledger does not show it.

3) The item that allegedly pushed it into -$15 was a $49.99 transaction, which ended up taking 2 days to finish processing. The credit was processed within 1 day.

4) Overdraft works if you have something to overdraft from - if I have something to overdraft from I would still pay a penalty but a smaller one - thanks Sherlock.

Governmental consumer laws protect the average person from unfair practices, so a credit card cannot charge you 200% a year on the credit they extend.

I could understand if they paid it, I did not rectify the situation right away, but I was there at the ATM before banking hours were in sight. Still, a proportional penalty is more suitable and fair. Increasingly we have online banks that adopt this practice. They do not ripoff their customers disproportionally.

Your claim on the use of a debit card only for cash from ATM outlines your own misunderstanding of today's payment methods. Most people use their debit card at retailers for all sorts of goods and services. Unless you are going to an all cash scenario, there is no reason to take out cash - maybe a road trip as emergency form of payment.

These fees target those who have the means to pay, eventually, because those who have a savings account with money are typically not poor. Poor people live week to week and struggle between basic survival costs. We have to leverage our resources to juggle the expenses. Banks count on these events to rake in billions in overdraft fees. Bank of America last year took in $1.6 billion thanks to these fees on transactions that average below $24.

In my situation the money technically was in the account. They CHOSE to NOT count the credit that would have saved the fee. WHY? Because they can. Because they are criminals.

I am going to a credit union and online banking to avoid this issue in the future. Eventually I will dig myself out of this hole, but large banks will never get my business.

Their notifications DO NOT work. They notify you AFTER the event. In fact, well into the next day afternoon, I received notification my account was negative, but it was not.

On the day of the transactions, the bank received debits before 8pm that they claim made my account negative. So to all you experts, since I have my notifications set to my phone and email, tell me - WHY DID THEY WAIT UNTIL almost 1 AM to send me an email? Who even reads their email at that time? I just happened to be up. Why did they wait until more than 16 hours to notify my on my text?

Why? Very simple. Had they notified me immediately, I would have covered the short and no fee would be charged.

A massive bank, first one to bring in check deposit by ATM - so superior to all banks they claim, and in 2017 they cannot set their software to notify us before we get penalized?

Thank you all for your input, but it is worthless as you all have missed the simplicity here and the corruption of the big banks. A Credit Union allows you to cover your short during the processing period without penalty.

Hmmmmm - a small bank can, but a big bank cannot. I wonder why.

#8 Consumer Comment

I Think We Have A Misunderstanding....

AUTHOR: Jim - (USA)

SUBMITTED: Friday, April 14, 2017

There are a couple of very obvious things you have said that are inconsistent with reality. Let's clarify these:

1. Overdraft Protection: This is a free service - it costs the consumer nothing to sign up for it. In fact, on all accounts opened, the consumer must actually tell the bank they DON'T want overdraft protection. This is Federal Law requirement. Otherwise, the consumer has overdraft protection. I would not be fooled into believing overdraft protection saves you - the consumer still gets charged an NSF fee even with there is overdraft protection. Therefore, even the consumer with limited to no means gets overdraft protection.

The other really important thing to remember regarding overdraft protection is that it merely allows the bank to pay your debit whether you have the funds or not. The bank then simply charges you this convenience fee...for the privilege. To not have it only means the bank won't pay the transaction which means your debit card would likely reject with no funds in your account. The bank tells you to make sure you get the overdraft protection because you don't want to be "embarassed" when you have to pay for purchase...and can't when the card rejects.

Now you can also link your checking to a savings account which would allow the savings to be tapped in case the checking account is depleted. However, the fee for doing that is...surprise...the same as an NSF fee.

2. Pending Items: There is no one in any bank that would ever tell you pending, or as you call it, processing, items don't count in calculating the NSF fee. It's not that I think you're lying. I think you misunderstand. They absolutely count and have counted since debit cards were invented. A debit card acts much like an electronic check that cashes immediately and deducts from your account, since the debit represents cash you spent from your bank account, pending or not. The only reason the item shows as pending is for the merchant to confirm the amount spent - sometimes you will have spent more than what you actually did to provide a gratuity (for example).

It's important to note that debit cards essentially eliminated the concept of float for the consumer, which is the idea that you could pay for something and then run to the bank to get the money there before the debit hits your account. I mean unless you can run faster than the speed of light, the consumer will lose that race 100% of the time.

The other real misunderstanding is your attempt to place a cause for increased bank profits on the poor. It is not because they are poor, because the poor can avoid NSF fees fairly simply, and they do that by paying cash for everything. The increased profits for the bank occur on the backs of generally ignorant consumers. If you look at the consumer practices of the educated consumer vs. the ignorant one, generally the ignorant incur these NSF fees because it's only the generally ignorant that use a debit card for everyday purchases. The more educated will utilize a credit card and use the leverage of credit to make their purchases. Now, that practice can potentially lead to credit problems, but that is a different matter. I cannot and will not assume the ignorant consumer is also the poor one, just as I will not assume the educated one is the rich one. None of us should.

The only reason the educated consumer would ever utilize a debit card is to obtain cash from an ATM. Therefore, there is no opportunity for the educated off to incur an NSF fee. Well, that and a check register....

Best of luck to you....

#7 Author of original report

another low IQ response

AUTHOR: - ()

SUBMITTED: Wednesday, April 12, 2017

I guess reading is not your thing as I clearly stated item was not taken but processing

It is ironic how the bank in the past claimed it does not count items processing so it cannot act on them in the case where I had a fraudulent transaction, but they can act on the processing item to apply overdraft costs - and FYI, I checked on the supposed $50 that was processing today after 12AM, it was still processing. So for 2 days it is processing, meaning NOT settled.

Over draft protection is available ONLY to those with means. The poor do not get that protection. The poor disproportionally pays these fees. If it was a scaled rate based on amount I could understand for items CLEARED, not those still processing

So you can move on with your mantra

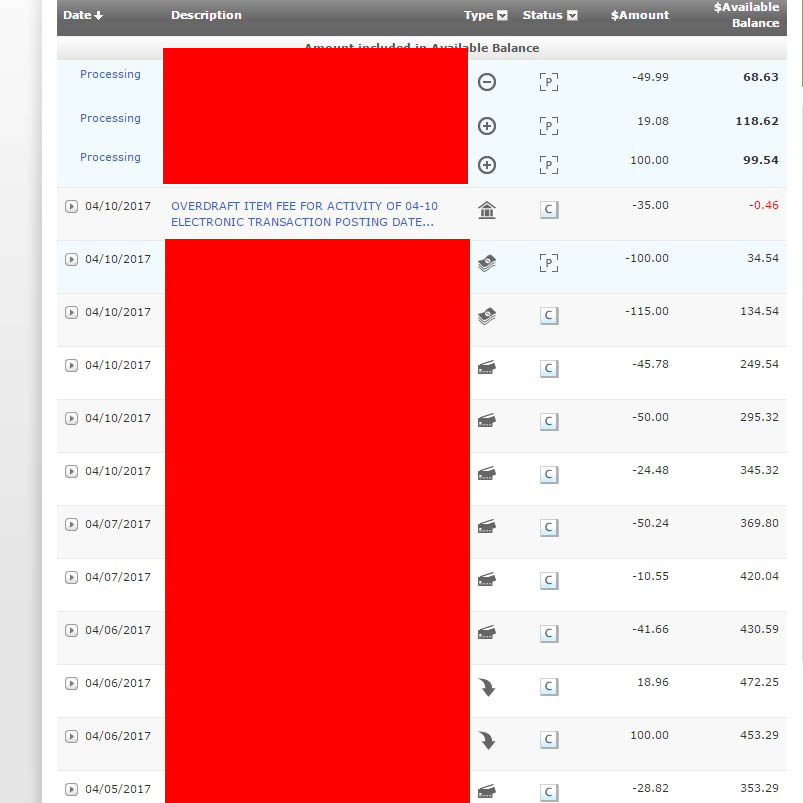

I had a great business with employees and am very competent on these matters. This here is pure theft. Maybe you should learn to read as the image CLEARLY shows nothing negative except the fee itself.

SO item did not clear , money was paid within 6 hours, item remained pending for 2 days.

It is a predatory practice against the poor which accounts for the banks large portion of profits - you can go on with your head in the sand mentality.

#6 Consumer Comment

Oh yes it's a conspiracy against the poor.

AUTHOR: Robert - (USA)

SUBMITTED: Tuesday, April 11, 2017

First get off your "entitlement" attitude where the "man is keeping me down" and "I will survive" mantra. This isn't a case of you being poor, this is a case of you showing proper account management. Banks don't just charge these fees against the poor. These fees are charged to ANYONE who overdrafts their account. Does it "hurt" the "poor" more..yes. But this is even more reason that the "poor" should be extra vigilant with their account to make sure they don't miss anything.

Management...This is the difference between a person who doesn't have overdraft fees a person who does, NOT how much they have.

You should know exactly what is coming in and going out..and WHEN. You can spend down your balance to $0 and not get any overdraft fees. But if you go negative by $0.01 for even just a few seconds you can be hit with overdraft fees.

It doesn't matter what bank you are talking about. Banks are not your parents, they are not your accountant, they are not a charity, and no they are not your friend. They are a business. If you are spending more than you have available you need to either get more income or cut your spending. You "say" you only have the "bear essentials", and since you conveniently blocked out every purchase location we just have to trust you. But I would bet dollars to doughnuts that you probably had several "non essential" purchases that you didn't need to make. Where yes all of that adds up if you could save just $10 a week that gives you $40 in a month.

But then we get to the "odd" part. Just how were you able to make the account right so quickly by depositing $100? Do you have another account somewhere? If so WHY? As let me tell you one of the biggest "D'oh" things I see is people who constantly overdraft accounts and have to "transfer" money from their other accounts. If your financial situation is such that you are struggling managing even one account and having overdrafts...WHY in the world do you have TWO.

This also goes back to the "management". If you were so easily able to move $100 in AFTER, why didn't you keep good enough records knowing a debit was going to come through and do it BEFORE? You can never beat money back to the bank, and you have to realize that Auto-Debits could be sent up to 3 days in advance especially if a weekend is involved.

If your excuse still is..."Well I just forgot", then get yourself a journal, a written register, a stack of post it notes...SOMETHING to remind you. It is YOUR money and YOUR responsibility.

One final item. IF this is truly your first Overdraft, have you called the bank? Many times(but not guaranteed) they will waive the first few OD fees as a "courtesy", where hopefully you will take it as a lesson learned. But if you call them remember the courtesy works both ways. You spend 20 minutes on a rant yelling at the CSR you aren't going to get anything.

#5 Author of original report

one more thing

AUTHOR: - ()

SUBMITTED: Tuesday, April 11, 2017

The $50 item caused the balance to go $15 negative, YET at the SAME time I was receiving a credit for $19 from Paypal - AT THE VERY SAME TIME

SO wise guy - they chose to COUNT the debit STILL PROCESSING but not the credit STILL PROCESSING

You can have 5 transactions going same time, and they will take the largest one first to cause a negative so they can charge you $35 for each overdraft, instead of taking the smaller ones first to reduce impact on fees.

It is an attack on poor people because rich people do not pay these fees. I will not always be in this financial situation, I will get back up again. But I will NEVER give Bank of America actual business as they are nothing but crooks.

PURE THEFT

#4 Author of original report

Never said they set up anything

AUTHOR: - ()

SUBMITTED: Tuesday, April 11, 2017

The original post is about excessive overdraft fees for the poor. $35 is way to much for an overdraft. They charge this even if you are over 1 penny, or $1k. You can ramble on all you wish - but it is the poor, like me - who get impacted the most with unfair fees.

I have low balance notifications set. I monitor my account routinely, maybe 7-15x per month. Even on this day I logged in and nothing else was pending. The account had money. The keyword is POOR. As in low revenue. IMPACTED severely by a recession - not everyone has the opportunity to bounce back on your timeline.

These banks know they can smash us with fees, a major source of their revenue.

As shown in the screenshot - the only thing negative was the overdraft fee. So, not even on the balance sheet does it show the account negative. I checked the account at 12:52AM when the email came in. Everything was still processing. By 6:50AM I put in $100. Yet the fee was still added, and as proven the item was STILL processing.

They have the technology to warn us faster but they do not implement it. Having notifications is not the same as having beneficial notifications.

I know how to balance an account very well. I am not on welfare. I do not have any addictions, I do not go out, I do not even have cable. I have the bear essentials. My car is paid for. Some items must be auto debits - and in fact, one of the items I bought was FOOD because it was cheaper only by $30. I was not expecting the auto draft, but I have ALL my notifications active. It slipped by me - I rectified it immediately - but the bank caught me and exercised their right to punish me with an insane fee for a $50 transaction that technically was not withdrawn.

They use these fees because they can - and don't you come here talking responsibility when these crooks caused the crash in 2008 - got their bailouts, massive bonuses and we are lectured on balancing an account - where is my bailout from the business that I lost?

Banks screw the poor guy because they can. If this happened to an account that routinely had a lot of money, I guarantee the bank would refund the fee. But the little guy gets smashed every time.

So you can CAPITALIZE all you wish - it means nothing - these companies punish others for the very same things they have done - it's called hypocrisy.

Bank of America did not care with their robo signing - they did not care when they GAMBLED our money - they did not care they were part of the cause for the market crash - they will not care if they cause another

One word

DERIVATIVES

#3 General Comment

No

AUTHOR: Tyg - (USA)

SUBMITTED: Tuesday, April 11, 2017

You are WRONG!!!! The bank DID NOT set up your auto drafts, YOU DID!! So YOU need to NOT spend that money. This entire situation is because YOU cant keep your money straight. YOU can TRY and play the victim all you like but the reality is that YOU have failed to control YOUR spending. The bank charges a fee when YOU dont have enough money to cover your purchases. All YOU have to do is NOT spend the money for the auto drafts. Simple enough. To place the blame on the bank because YOU over spend is not only silly but truly shows YOUR maturity level. GET OVER IT!!! The bank did NOTHING WRONG!!!!! YOU OVER SPENT and that is all. From time to time even I have to pay over draft fees, but I KNOW Im going to get charged that fee IF I dont have enough in the account. The bank, ANY bank, is a business. As a business their job is to MAKE MONEY!!!! NOT pander to YOUR inability to control YOUR spending. NOT allow YOU to use THEIR or ANOTHER CUSTOMERS money to pay YOUR purchases. WHERE do you think the money is comming from that ALLOWS you to overdraft?? Thats right, from YOU!!! When YOU overdraft, YOU pay the fee.

#2 Author of original report

Ivory Towers

AUTHOR: - ()

SUBMITTED: Tuesday, April 11, 2017

When you have the means to hold a better cushion you can account for things missed. We have thing called auto debits, maybe you heard of it - they do not come out exactly on the day they claim. Sometimes early sometimes late. When you are POOR, it is a juggling act between paying bills and basic survival - so thank you for your 2 cents -

charging $35 for a $50 transaction that was not even posted is theft pure and simple -

#1 Consumer Comment

No one likes fees

AUTHOR: FloridaNative - (USA)

SUBMITTED: Tuesday, April 11, 2017

I agree with your conclusion, but not the way that you got to it. No bank cares about their customers. They are profitable businesses that charge fees for all kinds of banking activity. The banks are there to provide a service to their customers AND to charge a fee when the customer requires certain services or violates bank guidelines such as spending more than they have in the account.

It is totally up to you to control the balance in your bank account so it is positive rather than negative. You do this by keeping track of your deposits and your expenditures - including any auto payments or other debits to your account. I do this with a simple register - it takes seconds to record the transaction and keep a running balance. I don't pay fees because when my account is low, I don't spend any more money.

You say because you are poor you are being charged a fee. That is false. You are being charged a fee because you spent more than the available balance in your bank account. That's it. There is no conspiracy to take fees just from poor people. Banks fee anyone that spends more than what is in their account. Learn to keep track of your spending (that is free) and you won't have those fees.

Advertisers above have met our

strict standards for business conduct.