Complaint Review: Comenity Bank - Internet

- Comenity Bank Internet USA

- Phone:

- Web: http://about.comenity.net/

- Category: Banks

Comenity Bank Blood sucking bank Columbus Internet, OH

*Author of original report: Never said it was

*Consumer Comment: I don't see any rip off here

*Author of original report: I did call....

*Consumer Comment: Responsibility

*Author of original report: This is not my bank - it's the PEBBLES CC provider

*Consumer Comment: Who's Account?

*Consumer Comment: I have a suggestion

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

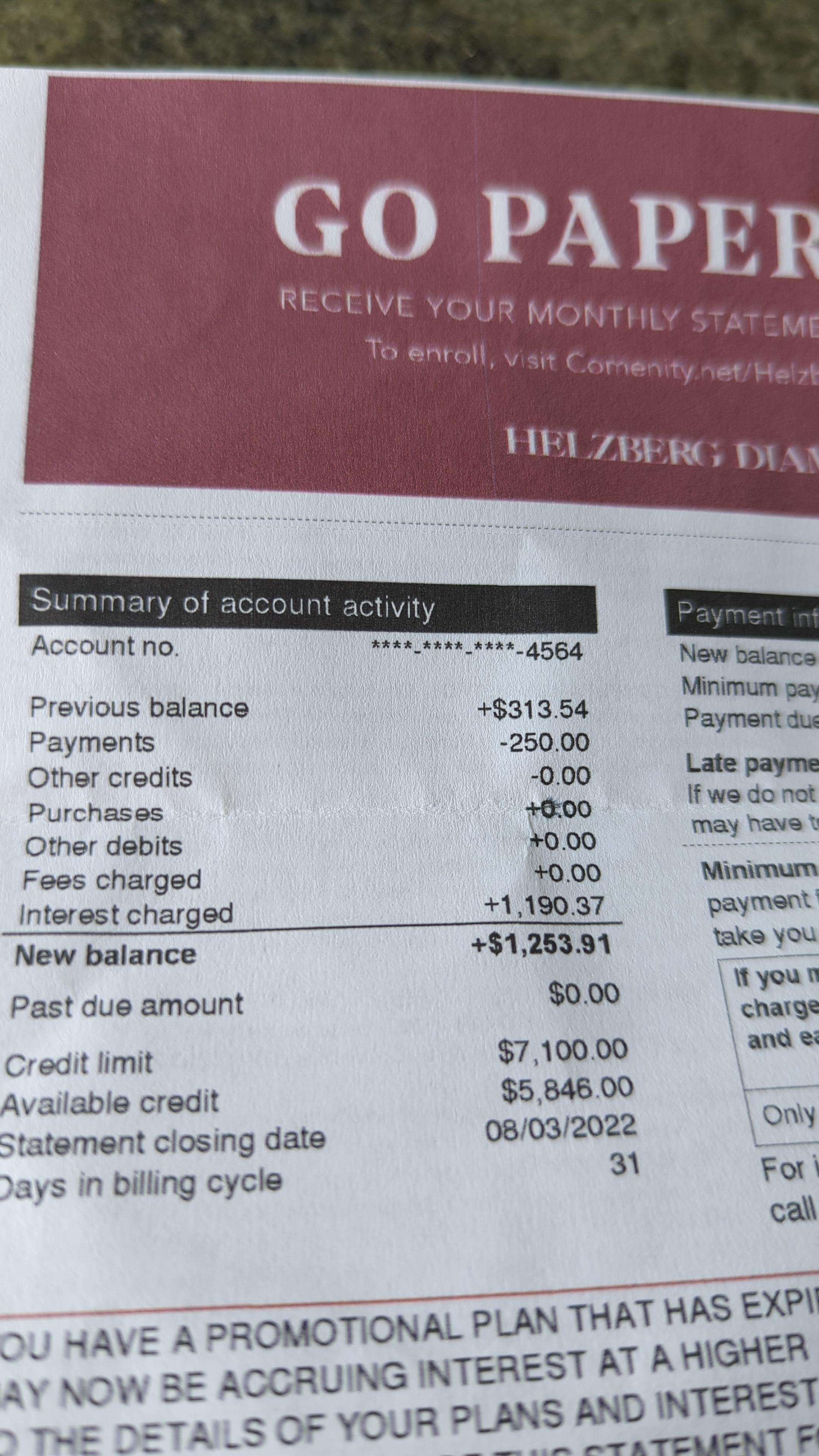

I made a $21.58 purchase at Peebles just before Thanksgiving, 2016. Apparently, though I don't remember requesting it, my account was changed to "paperless". Receiving a paper bill is the prompt I rely on to make payment on credit card bills. As I did not get a paper bill, plus the holiday season, I completely forgot about the purchase.

Today, I received a recorded phone call stating that my account was overdue and that I owed $71.74 to Comenity Bank. Puzzled, I immediately went online to find out what was going on - not remembering the purchase until I pulled up my account. I found that a late fee of $21.58 - 100% of the original charge was placed on my account on January 2, 1017 and a $1.00 "minimum charge" placed on my account on January 6, 2017.

Then on February 2, 2017 a second late fee of $26.58 charged with another $1.00 "minimum charge" put on my account on February 3, 2017. After making sure enough time went by to help themselves to $50.16 in penalties ....they finally got around to calling me about my delinquent account this morning.

In two months, Comenity has assessed over 200% in fees on my original $21.58 purchase! That amounts to 1200% interest per year.

This is no way to treat any customer. I am a prompt payer, paying the bills on the day they arrive and have never before been late on a payment to them.

I paid the Comenity extortion money but they have lost me as a customer forever.

Words cannot express the contempt and disgust I have for this bank.

It is obvious that instead of notifying me in a timely manner as any REPUTABLE bank would, Comenity timed the call to make sure that another month of fees and charges would accrue just prior to contacting me. Despicable policy.

This report was posted on Ripoff Report on 02/05/2017 02:58 PM and is a permanent record located here: https://www.ripoffreport.com/reports/comenity-bank/internet/comenity-bank-blood-sucking-bank-columbus-internet-oh-1354207. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Author of original report

Never said it was

AUTHOR: - ()

SUBMITTED: Friday, February 17, 2017

their responsibility to call me. Read the report. What I objected to was their purposefully waiting 60 days, helping themselves to two late charges - each of which was more than the cost of the original purchase. Then and only then did I receive a call notifying me of the oversight. Good timing.....for them!

It appears that a number of ripoff report commenters don't carefully read the reports. How do these "random" commenters find the time to seek out complaints and vigorously defend the actions of big corporations, like Comenity Bank, that routinely skim billions and billions of $$ from consumers in the form of outsized fees and penalties? Paid to do this perhaps?

Apparently these self-righteous paragons of financial virtue have never had a very small transaction slip through the cracks or be forgotten in the midst of thousands of larger transactions ..... it must feel so good to scold those who aren't as perfect as they.

#6 Consumer Comment

I don't see any rip off here

AUTHOR: Sparrow - (USA)

SUBMITTED: Friday, February 17, 2017

You are responsible for keeping up with the money you spend. Also, the fees charged are in the agreement you agreed to when you set up your account. It is not the bank's responsibility to call you when your account goes into overdraft.

#5 Author of original report

I did call....

AUTHOR: - ()

SUBMITTED: Tuesday, February 07, 2017

I called but was not able to speak with them on Sunday though they called me on Sunday. After 5 minutes of "Press 1 for.... Press 2 for..., Press 3 for....etc." was told I was calling at hours when no one was available to speak with me and to call back later. I was able to reach Comenity Bank customer service yesterday.

The Customer Service rep said there were numerous attempts to call me prior to the 2nd set of fees being put on my account. Searching through the last month of my call history, there were no prior unanswered or missed calls from Comenity Bank. Nor were any voice messages left asking me to call them.

I have no way to prove them wrong but when they actually called me on Sunday, I answered the call and took immediate action to pay the charges. The rep did remove the second set of charges which I appreciate.

I still think they are a lousy institution and it is a shame that so many stores have allowed them to take over billing of their store credit cards. Google "Comenity Bank Lawsuit" or "Comenity Bank Late Fees" or "Comenity Bank Complaints"....there are thousands of complaints.

In addition, over the last few years, Comenity Bank has had to pay millions of dollars in settlements for violations against consumers that were proven in class action lawsuits against them.

(((REDACTED)))

https://www.law360.com/articles/700389/comenity-bank-hit-with-64m-fdic-credit-card-add-on-penalty

https://www.law360.com/articles/583738/comenity-bank-pays-8-4m-to-class-of-4-million-in-tcpa-suit

https://www.lawyersandsettlements.com/lawsuit/comenity-bank-tcpa-violations.html

http://www.creditcards.com/credit-card-news/comenity-bank-fdic-fine-refund-1282.php

The list goes on and on. Seems strange that people pop up here almost immediately to defend every complaint against Comenity.

#4 Consumer Comment

Responsibility

AUTHOR: Robert - (USA)

SUBMITTED: Monday, February 06, 2017

Sorry, but you made the charge and you are responsible for making sure it is paid. The "it was only one purchase" or the "I got too busy" isn't an excuse. If you are set up for paperless statements, you received an e-mail stating you had a statement ready. Now, this could have gone to your junk or you could have deleted it thinking it was junk. But the fact is that you did get it because they are required by FEDREAL law to send it. No, they are not going to risk running into issues with this for just a few late fees on people who they hope don't remember they made any purchases.

If you want a "backup" to help you remember, perhaps you should put the receipts in a place that will help you remember, such as your Register for your bank account or perhaps where you put all of your statements for the other bills you know you need to get paid.

Now, with that said. If you have as good of a history as you say have you tried to call them? Sometimes companies will waive part(or all) of the late fees if there is a legitimate reason in the name of "Customer Service". Not all will, and not all would with you describing the situation you wrote.

However, you won't know unless you ask. When you ask don't go off on a tirade how they are horrible how they are one step below Satan. Explain your situation and see if they will do anything about it. Now if they do...great. But if they don't it is still NOT a rip off and hopefully a good lesson for you.

#3 Author of original report

This is not my bank - it's the PEBBLES CC provider

AUTHOR: - ()

SUBMITTED: Monday, February 06, 2017

It may not have been clear from my original post but Comenity is NOT MY BANK. Nor do I do my banking online with them. Comenity is a Bank that many retailers are using to handle their store credit card accounts. The list is almost endless -

- Abercrombie & Fitch

- AdWords Business

- Alon

- American

- American Home

- American Kennel Club

- American Signature Furniture

- Anne Geddes

- Annie Sez

- Ann Taylor

- Appleseed’s

- Arhaus Archarge

- Ashley Stewart

- Avenue

- Barney’s New York

- Bealls Florida

- Bed Bath & Beyond

- Bedford Fair

- Big Lots

- BJ’s

- Blair

- Blue Nile

- Bon-Ton

- Boscovs

- Brownstone Studio

- BrylaneHome

- Buckle

- Burkes Outlet

- Camping World/Good Sam

- Carson’s

- Carter Lumber

- Catherines

- Chadwicks of Boston

- Children’s Place

- Christopher & Banks

- Coldwater Creek

- Colombian Emeralds

- Crate & Barrel

- Crescent Jewelers Inc

- David’s Bridal

- Design Within Reach

- Domestications

- Draper’s & Damon’s

- dressbarn

- DSW

- Dunlaps

- Earthwise Windows

- Eddie Bauer

- El Dorado Furniture

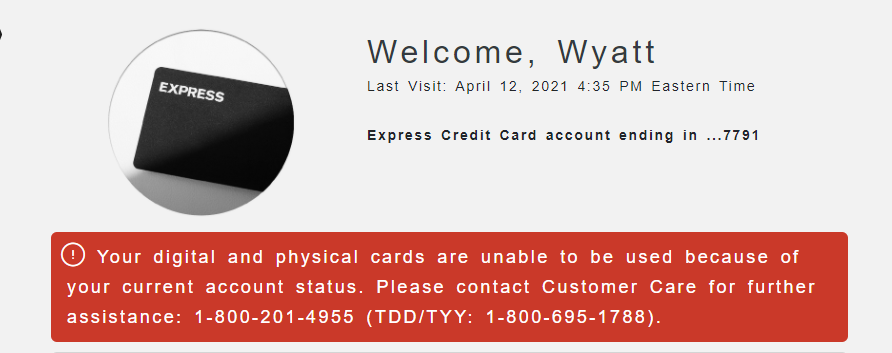

- Express Next

- Fashion Bug

- Forever21

- Fuel Rewards

- Friedman’s Jewelers

- fullBeauty

- GameStop

- Gander Mtn

- Garden Ridge

- Gardner-White

- GEM ACCOUNT

- Giant Eagle

- Gordmans

- Goody’s

- Haband

- Hannoush

- Herberger’s

- Home & Garden Showplace

- Hot Topic

- HSN

- iComfort

- Iddeal

- J.Crew

- Jessica London

- J.Jill

- Kane Furniture

- KingSize

- Kohler Generators

- Lane Bryant

- LaRedoute

- Lenovo

- Levin Furniture

- Linen Source

- Little Switzerland Jewels

- LOFT

- Mandee

- Marathon

- Marianne

- Marisota From JD Williams

- Maurices

- Meijer

- M.E.S.A

- Metro Style

- Modell’s

- Motorola

- MyPoints

- My World

- Newport News

- NY&C (New York & Company)

- Old Pueblo Traders

- Orbitz

- Orchard Supply Hardware

- Overton’s

- PacSun

- Palais Royal

- Peebles

- Petite Sophisticate

- Piercing Pagoda

- Pier 1 Imports

- Pottery Barn

- Priscilla of Boston

- Reeds Jewelers

- Roaman’s

- RoomPlace

- Restoration Hardware

- Samuels Diamonds

- Saturday Night Live

- Sharper Image

- Shop At Home

- Smile Generation Financial

- Spiegel

- Sportman’s Guide

- Stage Stores

- The Company Store

The Limited- Tile Shop

- Tog Shop

- Torrid

- Total Rewards

- Trek

- True Value

- UBG

- Under Gear

- Value City Furniture

- Venue

- Venus

- Victoria’s Secret

- Vintage Kind Audio

- Wayfair

- West Elm

- Williams-Sonoma

- Winter Silks

- Woman Within

- Ulta

- Younkers

- Zales

- Z Gallerie

The $21.58 was a credit card charge on a Peebles credit card at the Peebles store. I have been a customer of Peebles for many years and have never had a late payment. I make purchases there maybe 2 or 3 times a year. It is not a regular thing. This particular rare purchase slipped my mind....and with no paper statement to remind me....I failed to make payment.

Even though the first late fee was out-sized for the offense, I don't mind paying it as I was at fault. It was the sleasy timing of the phone call....timed precisely shortly after the second set of fees was slapped on my account. And what right do they have for the "Minimum Charge" fee of $1.00 per month???? Aren't $21.58 and $26.58 far above the "minimum charge" of $1.00 per month???

If they were reputable, the phone call would have been made before the 2nd set of fees.

#2 Consumer Comment

Who's Account?

AUTHOR: Jim - (USA)

SUBMITTED: Monday, February 06, 2017

It is YOUR account involving YOUR money! Common sense dictates YOU should be managing YOUR account by YOU keeping track of YOUR account usage! This is YOUR responsibility, not theirs.

#1 Consumer Comment

I have a suggestion

AUTHOR: Stacey - (USA)

SUBMITTED: Sunday, February 05, 2017

STOP relying on online banking and keep a check register of ALL your deposits and payments!! YOU overdrafted your account therefore there is no rip off. And NO I do not work for them.

Advertisers above have met our

strict standards for business conduct.