Complaint Review: Credit Bureaus - Internet

- Credit Bureaus Internet United States of America

- Phone: 800-461-0524

- Web: www.creditinfocenter.com

- Category: Credit Reporting Agencies

Credit Bureaus Experian, Equifax, TransUnion Negligent Processing of Personal Data, Internet

*Consumer Comment: time 2 face d real world bob from irvine

*Consumer Comment: Advise

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Never name a son after yourself. My son is 28 and I am sad to say has been a deadbeat since he was 18. He has no credit because he hardly pays on any debts. If I had known what I know about the credit bureaus what I know now, my son would have a different name, period.

I am a 57 year old Retired USAF Sergeant who is also a 100% disabled veteran. I spend half of my time at the VA or the local military base due to my health. I have always been fiscally responsible. I had a great credit rating prior to my son turning 18. It would have been even better if several items had not shown up on my reports that were not mine before my son became an issue. My rating should have been perfect!

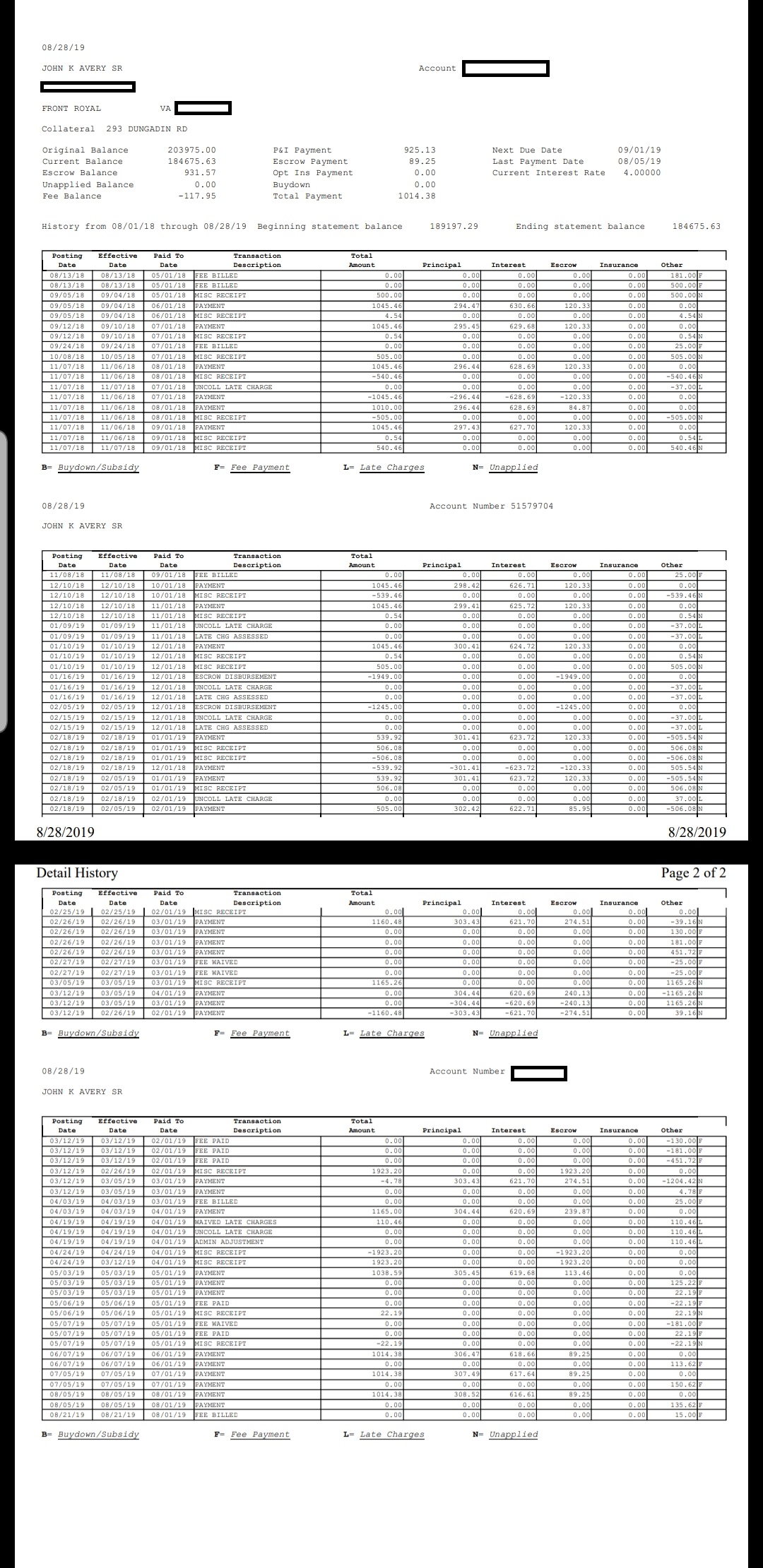

I have been at odds with the three credit bureaus for 10+ years because they do not check simple things like any personal information, let alone the social security number. There has been at least 15 incidents in which they put my son's or someone else's bad credit data on my reports. I am over $300,000.00 in debt due to the negligent processes used by the bureaus.

One of the most glaring issues is having to pay higher interest rates on any and all loans I have taken out in the past 20 years. This has cost me hundreds of thousands of dollars more than I should have had to pay on loans and credit cards. At one time I could set the credit limit on credit cards, but I can hardly get credit now.

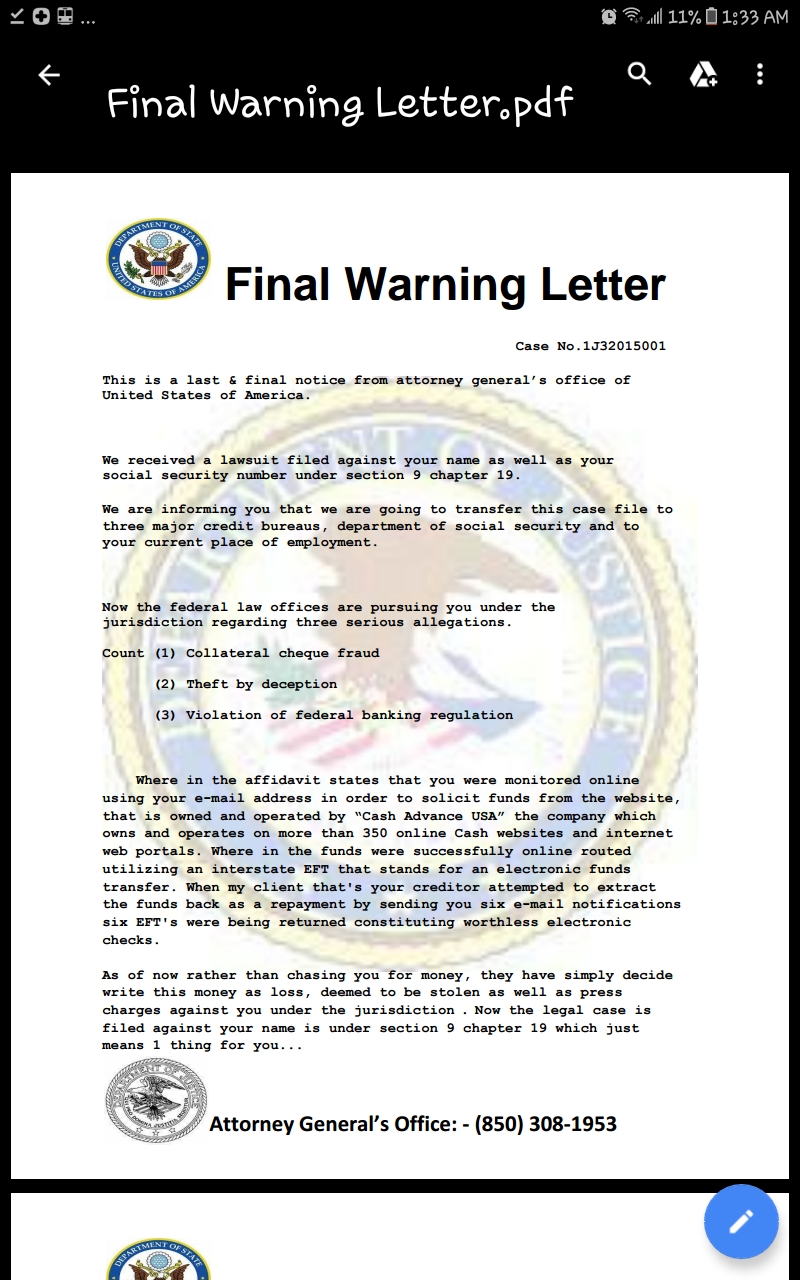

The bureaus put something on my report simply because it matches my name, my rating goes down, and I have to fight with the bureaus for months, if not years to get it corrected. Even when an item is removed my rating never goes up to where it should have been. All because they do not even check the SSN, address, full name, phone, etc.

Hence the bureaus are not protecting me from anything and have damaged my credit for life due to their gross negligence. Nothing should appear on a credit report before at least checking the SSN and personal information. If something is in question it should be flagged and investigated before ruining someone's credit rating.

Lastly, the credit rating is used for everything, including getting jobs and anything else that involves money. And as an independent computer consultant, I also did not get several jobs where this information was checked, like working for the local Sheriff's office. With the power the bureaus wield they should take extra precautions to protect a client's data, not less...

The issue is still ongoing and I cannot see a light at the end of the tunnel. Only darkness and doom...

Bureau Info Follows:

Experian

P.O. Box 2002

Allen, TX 75013

(888) 397-3742

www.experian.com

Equifax Credit Information Services, Inc.

P.O. Box 740256

Atlanta, GA 30374

(800) 685-1111

www.equifax.com

TransUnion, LLC

P.O. Box 2000

Chester, PA 19022

(800) 888-4213

www.transunion.com

This report was posted on Ripoff Report on 03/06/2013 07:44 AM and is a permanent record located here: https://www.ripoffreport.com/reports/credit-bureaus/internet/credit-bureaus-experian-equifax-transunion-negligent-processing-of-personal-data-inter-1024289. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

time 2 face d real world bob from irvine

AUTHOR: The Outlaw Josey Wales - (United States of America)

SUBMITTED: Wednesday, March 06, 2013

ur rebutts r senseless and stupid. u don't know it all. seek help and u might b cured

#1 Consumer Comment

Advise

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, March 06, 2013

I really don't know how much of your report is exaggeration, but if you are being 100% truthful you are making things a lot more difficult than they need to be.

First of all, the Credit Bureaus and anyone who puts information on your credit report MUST follow the Fair Credit Reporting Act(FCRA). Some of the regulations they must follow is that if you report inaccurate info they must remove it if it can't be verified. If any creditor or the Credit Bueaus violate any part of the FCRA, you have the right to sue them. If you prevail you could be entitled to not only your actual damages but also $1000 in statutory damages per violation. So for example if you have one creditor reporting to 3 Bureaus, if you got your "ducks in a row" you may be able to come out with $6000 ($1000 from each Credit Bureaus, and $3000 from the creditor because they reported it 3 times).

Now, if any of these listings are Collection Agencies, they must follow an additional set of regulations known as the Fair Debt Collection Practices Act(FDCPA). As with the FDCRA if they violate any provision of the FDCPA you can sue them, but unlike the FCRA you can only get the $1000 in Statutory damages per company. So even if they did 100 violations, you would be limited to $1000 + your actual damages.

Now, to be able to prove these violations you need to do certain things, which basically includes you notifying them of the error and giving them the opportunity to correct it. This is why it would be to your advantage to look up both of these regulations. Then when ever you deal with any of these companies ONLY send things in writing by a method that can prove you sent it(Certified Mail with Return Receipt works great)

If you are going to say that you have tried this before, then you either don't have the situation you are saying, or it is time to get a lawyer(or a better one).

Good Luck

Advertisers above have met our

strict standards for business conduct.