Complaint Review: Credit Karma - California

- Credit Karma California United States

- Phone:

- Web: www.creditkarma.com

- Category: Credit & Debt Services, Credit Reporting Agencies

Credit Karma Credit Karma scores are WAY wrong... Shame on you CK! California

*Author of original report: That's a mouthful

*Consumer Suggestion: Critical Thinking,

*Consumer Comment: Education

*Author of original report: Don't think so

*Consumer Comment: They are not wrong

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Hi,

Until just a little while ago I loved getting my updates from Credit Karma. I was very pleased with the progress they reported I was making, and showed me scores going up up and UP. I started in the low 400's and, acording to CK, I am now comfortably in the mid 600's.

...Or am I?

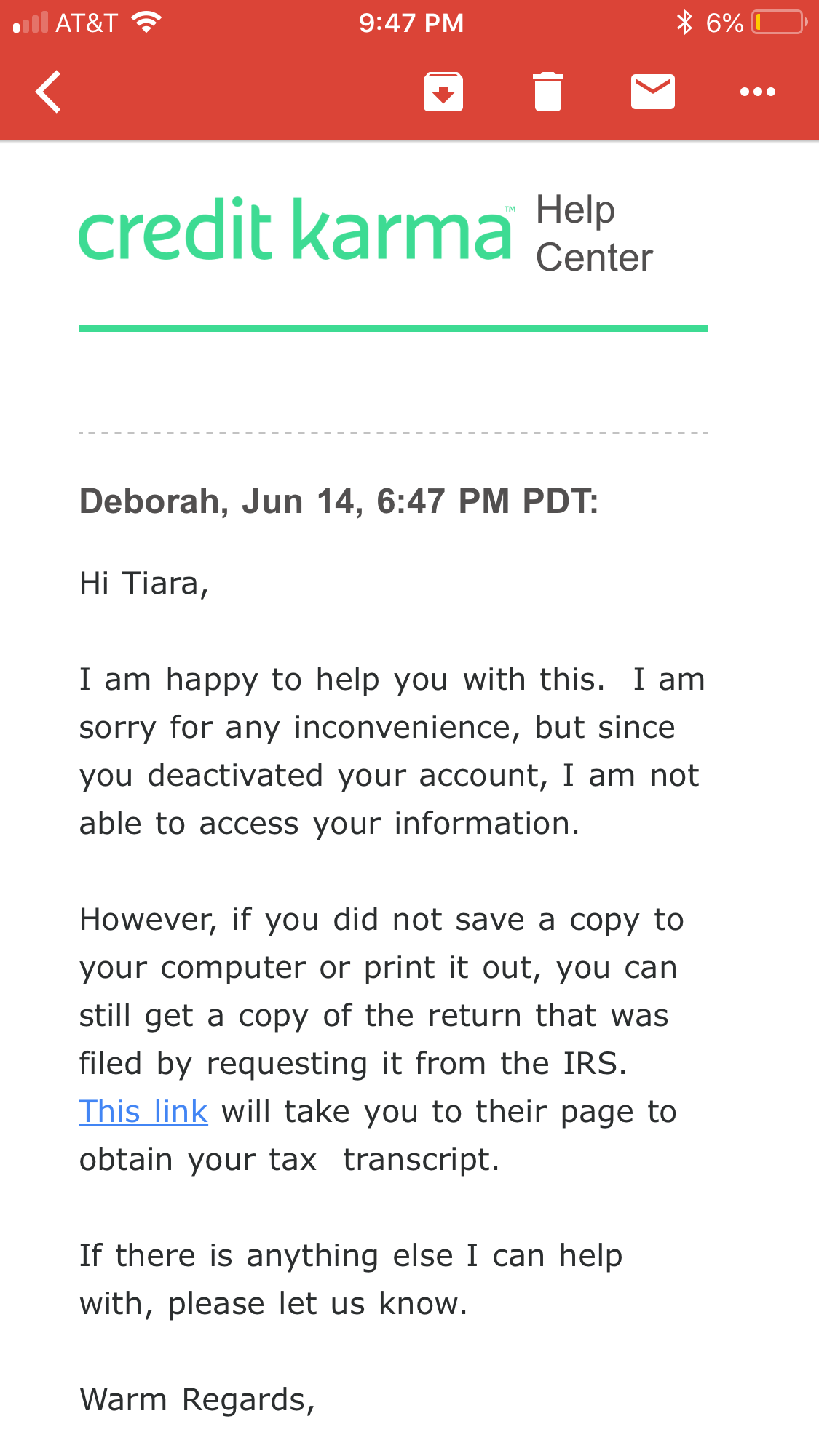

I read a review recently much like the one you're now reading from me. It said that Credit Karma was very innaccurate. I thought, "no, impossible. They update every week, I get little reports and "wll done!" when my score goes up and a "needs work" when it goes down. But, my suspicion remained so today I went directly to all three agencies and requested my actual, official reports.

Guess what?

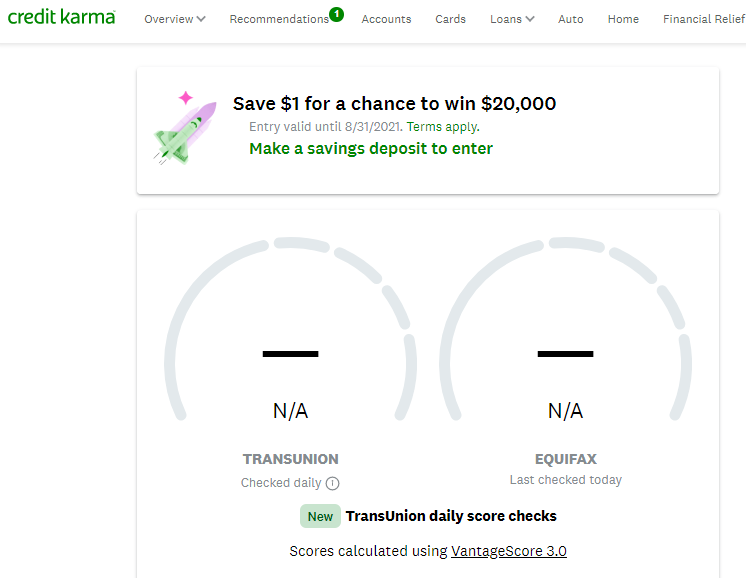

My actual scores were at least 100 lower than the scores CK was giving me! And the scores I got were directly from TRans Untion and Equifax, the two agencies CK claims to be indirect contact with. SO...either CK is deliberately deceptive (a business using deception to make money? Nah. Could never happen right? lol. At best they are really bad at math.

I recommend you go to experian.com and get your actual credit reports. You get one freebie a year so it's like $1.00 to get your reports. Well worth a buck wouldn't you agree?

Get your actual credit scores. If CK is giving you false data, come on back and REPORT it! Maybe they'll start being ethical. Maybe pigs will fly out of my butt but it's worth spreading the truth.

Love ya RipoffReport.

Truly,

gr8dna

This report was posted on Ripoff Report on 02/09/2018 01:27 AM and is a permanent record located here: https://www.ripoffreport.com/reports/credit-karma/california/credit-karma-credit-karma-scores-are-way-wrong-shame-on-you-ck-california-1428189. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Author of original report

That's a mouthful

AUTHOR: Steven - (United States)

SUBMITTED: Sunday, April 22, 2018

My response to the lengthy response to my original remark about Credit Karma is that Credit Karma's "version" of my credit score was 100 points higher than all three credit agencies. It's not complicated or requiring lengthy, professorial diatribes to try and explain away; it's just just innaccurate.

#4 Consumer Suggestion

Critical Thinking,

AUTHOR: Eric - (United States)

SUBMITTED: Sunday, April 22, 2018

It's interesting to read opinions in place of facts here. Try being both reasonable and personally responcible, all of you. First off, you are responcible to read and understand even the finest print contained in anything that you chose to sign your name to. Of course big business knows that the average consumer is focused only on themselves, on convenience over the trouble of actually thinking. Big business then uses this simple notion to their advantage, welcome to the free markplace we have here in these United States.

Being reasonable and responsible means asking yourself a question or two. Hopefully a good, focused and informed question, or two. Secondly, do you know that FICO is an acronym? If so, what do you think F - I - C - O actually stands for, what it really means? Do you have any idea? If not, you're actually in the same company as the vast, overwhelming majority of American Consumers. So here's a quick history lesson for you;

In 1954 two men worked for the Stanford Research Institute in California, one was a mathematician and the other was an engineer. Together they met on their own in a rented studio apartment in San Rafael, CA, where together they designed a system, actually called a Mathematical Algorithm, which assigned a numerical value to specific financial behaviors. They set this numerical value system up in what's called a Scoring Model. That model ranges from between 300-850, this then is the potential range of your General FICO Credit Score.

By assigning these values what the Algorithm does is it uses your past financial behavior as a predictor of your future financial behavior. If you've decoded the acronym what you have is Fair Issac Company, or FICO. So we then have to ask ourselves the next $64K question, which is; What's so Fair about Issac? The honest answer is, absolurtely nothing. Instead you need to go back to 1956 when those two men launched their new Algorithm as a business named, Fair Issac and Company. The official name has changed and morphed over the years but today it is simply stated as, FICO. And the true, clear and honest reality, straight out of the history books, is that these two men who developed that first unique Scoring Algorithm were named Bill Fair and Earl Issac.

The FICO Scoring Algorithm was the first of it's kind but it didn't come into wide spread and common use in lending decisions until the early 1970s. This was in part a result of just what a Credit Card was back then, in the 50's and 60's? In the past they were issued by individual businesses, such as your local Grocery Store Chain, Hardware, Furniture Stores or Diners Club, etc. Then the Banks took over and started to issue the credit cards that you know of today. At the same time Congress created the Fair Credit Reporting Act wich was enacted in 1971. Where the question of credit worthyness was now no longer determined by your local place of business and your personal reputation. Instead it was now being determined by Interstate Banking.

Now, when you decided to get into bed with Credit Karma you needed to ask yourself, what does any/all of this really mean? Well, just read the Terms & Conditions in the CK fine print of what you signed up for and what you'll find is a description of;

3.3 Educational Purposes

All information on our Services is persented for educational purposes only. We do not guarantee that the information we present as part of our Services, including credit report or credit scoring information, is the same information that may be used by a third party to assess your creditworthiness or elegibility for any particular product or service or for employment. (Where CK states "the same information that (may) be used by a third party" read into this what it actually/factually means; Never used by Any Bank, Anywhere, Ever).

What this means, in all reality, is that when you wrote to say , "Credit Karma scores are WAY wrong", you've actually already made crucial errors in your own Critical Thinking. Or, you've simply surrendered any Critical Thinking in order to blame anyone other than yourself in the unreasonable belief that you've been swindled and/or cheated out of your time and money. Of course that argument will never see the light of day in any US Courtroom, for the same reasons that I've now described for you.

So when "Education" states that they are, "not here to give you a Credit Score crash course", they have also made critical errors in any reasonable sense of Critical Thinking. Instead, "Education" is anything but what it proposes itself to be. Chosing instead to simply pick away at your argument rather than doing the intelligent and right thing. Which is to give you new, valuable information for you to work with. While at the same time "They are wrong" is also living in their own "universe". Preferring to simply pontificate by regurgetating the obvious; "4. In general the best scores are for people that carry low balances on their credit cards", blah, blah, blah...

"They are wrong" continues in this dis-service by doing bad/incomplete homework; "For example FICO has (no less than about?) 28 different models used for different factors." The truth and reality is that FICO maintains and supports a total of 52 different scoring algorithms, depending on which financial industry that it's focused on. As a consumer what you really need to know and understand is that a FICO Credit Card Scoring Algorithm model actaully ranges from 250-900. This is why above it's stated as your, "General" Credit Score being between 300-850.

In conclusion it's important to recognise a spade for what it really is, a spade. FICO is a business and they're in business to make a profit. But so are all three of the Credit Reporting Agencies (CRA's). You see, the CRA's are each subscribers to FICO and are each independently licensed by FICO to use and resell their data.

But, back in 2006 the CRA's had grown weary of paying FICO it's service fees and decided that not only do they want to control your financial future, through the information they re-sell on the consumer to/from their own Subscribers/Furnishers of information, here the Consumer cannot be confused with the Multi-Billions of dollars they earn every year through their Paying Subscrigers/Furnishers, but they also decided to attempt to impose themselves into the Credit Scoring marketplace. Which is why they collectively launched their Vantage Scoring Model back in '06 through their Lobbying Group, the Consumer Data Industry Association (CDIA). You see, it's pretty hard to stay in business when you want to advertise "Get Your Free Credit Score" when they'd have to pay for a Valuable Credit Score that only and ever comes from FICO. So instead they chose to deceive, in a legally conceived/construed and intentionally manipulated way, and then to "missinform" the American Consumer in their all too well known ignorance to these simple, basic truths.

So if you're still angry don't be, just get yourself a better education. Understand what it is that you're really working with and then decide how to best work with it, or not? That's what's called Critical Thinking here folks. In this case you shouldn't be wasting your valuable tme being angry at Credit Karma. Instead you should be Scared to Death to know that the CRA's are currently attempting to completely dominate your entire financial future. And now, through reading this, you can begin to understand that the CRA's are ready, willing and able to knowingly missguide/missinform you, and the rest of the American Public/Consumers, by using what amounts to a game of legally construed slight of hand, for a profit, and at your expense...

*"Education", you truely are laughable in your own ignorance and self contrived arrogance.

*"They are wrong", you now know who you are too.

#3 Consumer Comment

Education

AUTHOR: Robert - (United States)

SUBMITTED: Saturday, February 10, 2018

I'm not here to give you a Credit Score crash course. But I will point out just a few of your inaccuracies...

The reason I stated it is laughable is because the same "marketing" you are spouting is same information they are using to try and sell you THEIR services.

You probably don't even realize this but at a basic level we are saying the same thing. The CK score is different than other scores you have gotten. I am telling you WHY it is different and that different is NOT wrong. You may not agree with it, but it is not wrong. As it is correct based on the model that CK uses.

Now, what model does CK use? They use the VantageScore 3.0, do you know who came up with the VantageScore? I'll give you a hint it is a joint venture by 3 companies and their names start with Equ****, Tran******, and Exp*****. Don't believe me? Then go ahead and search "who created the VantageScore", and prepare for your jaw to drop.

You say going directly to the Credit Reporting Agencies site will get you your FICO score. Really? So you can get your FICO with all 3? You may want to double-check your facts on that as well. Exp*** uses it, but try to get it from TU or Equi*** and let us know how that goes.

But even with the one company that does give you a FICO score, in your original post you figured it was $1. Again..go read the details of that "$1" offer and let us know how you feel about that the second month after you get that additional charge because you didn't cancel. Again don't believe me, just search this site using those company names and see what you think then.

Now, I am not here to recommend or suggest any other sites so take this for what it is. But generally if I want to get a FICO score I go straight to the source, the company that created the FICO score. You can search for a site called "my FICO" and you will find quite a bit of very useful information from the company that created it. Including the difference between a Credit Score and Credit REPORT and the Credit Reporting Agencies role.

I will also say that unless you are actively looking for a loan or additional credit, checking your score is really just a waste of money. You may want to get one for a "baseline", but then after that just do things that you know will help your credit. Such as paying your bills on-time reducing the balances owed, removing any collection accounts and you can be just about guaranteed that regardless of what model is used your score is increasing, but baring a dramatic change anything more than a few points a month is out of the ordinary. Use that money you are saving from not buying more scores into paying off your debt.

A few other "hints". When you do get your credit score, if it points out what your biggest negative factors are, pay attention to them and work on them first.

By the way I don't use CK and I do get my FICO score from other sources...Including a few of my accounts that offer it as a free service.

#2 Author of original report

Don't think so

AUTHOR: Steven - (United States)

SUBMITTED: Friday, February 09, 2018

My comparison is not to "another company." My comparison was to the actual FICO scores on record with each credit reporting agency. So Credit Karma is exactly wrong, off by more than 100 points.

No lender looks at Credit Karma to get your credit score. Lenders look at one or more of the three reporting agencies. So that's great that Credit Karma has their own algorhythm but unfortunately, it spits out numbers that are vastly different from what is actually on record. You're saying it's correct if you live in the Credit Karma universe. I do not. I live in a universe where lenders use scores from actual cedit reporting agencies.

Go ahead and call my report laughable. At the end of the day, if you use Credit Karma, you're the one using incorrect data so have fun with that.

In your defense, Credit Karma has some web pages that offer a fairly convincing justification as to what exactly the scores they give me differ so greatly from what the credit reporting agencies have on file, including your argument about algorhythms, but if you really dig in and do your homework, lenders are only concerned with one algorhytm, which is your FICO8 Scores. And again, Credit Karma scores do not match up.

If CK was only a few points off that would be one thing, but over 100 points off? That seems like dirty pool to me.

To anyone reading this; go directly to Experian, TransUnion or Equifax, these are the credit reporting agencies lenders use to get your actual FICO8 score, a standard that has been in use for decades by lenders. It's a buck to get your reports DIRECTLY from all three agencies. Then look at your Credit Karma score. The only conclusion I can make is that it's ....Bad Karma!

#1 Consumer Comment

They are not wrong

AUTHOR: Robert - (United States)

SUBMITTED: Friday, February 09, 2018

Your lack of understanding of Credit Scores is laughable..understandable..but laughable.

The scores you receive from CK are correct, based on CK's credit scoring algorithm that they use. The problem is that you are trying to compare the score you received from them with another company who uses a different scoring model. Where by some miracle you think they should be the same. Well..they aren't.

CK uses Vantage 3.0, Experian uses NES, and the most popular scoring model is FICO. All of which look at different factors and score them in different ways. You could get different scores from the same exact credit report depending on which model is used. Not only that but they can use different ranges. For example Vantage 3.0 and FICO use the 300-850 range for scores, but NES uses a 360-840 range. If you found a company that uses the original Vantage score that goes from 501 to 990.

If you go beyond that even within the companies there are different models. For example FICO has no less than about about 28 different models used for different factors, but there are really only 3-4 that are for "public" use.

The keys you need to take away from this.

1. Any credit score is only as good as your credit report. If your report is incorrect no score is valid.

2. Don't bounce between scores. Stick with one company and look at the trend. If you are trending up(or down) with one you will probably trend up(or down) with the others. Your goal is to look at the long term..not quick snapshots.

3. If you want to know what your true(well as true as you can get) score is, stick with FICO. Find a company that will report your FICO score.

4. In general the best scores are for people that carry low balances on their credit cards, don't have a lot of credit inquiries, have a solid payment history(no late payments and no collection accounts), and a variety of credit(credit cards, installment loans..etc).

By the way don't sign up for that $1 score. As if you read the fine print you will realize you are actually signing up for a monthly service(billed at $15 20/month).

Advertisers above have met our

strict standards for business conduct.