Complaint Review: First Premier Bank - Sioux Falls South Dakota

- First Premier Bank PO Box 5524 Sioux Falls, South Dakota U.S.A.

- Phone: 800-987-5521

- Web:

- Category: Credit & Debt Services

First Premier Bank Taking Advantage of People Trying to Rebuild Their Credit Sioux Falls South Dakota

*Consumer Suggestion: I just went onto their website

*Consumer Comment: First Premier Bank...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

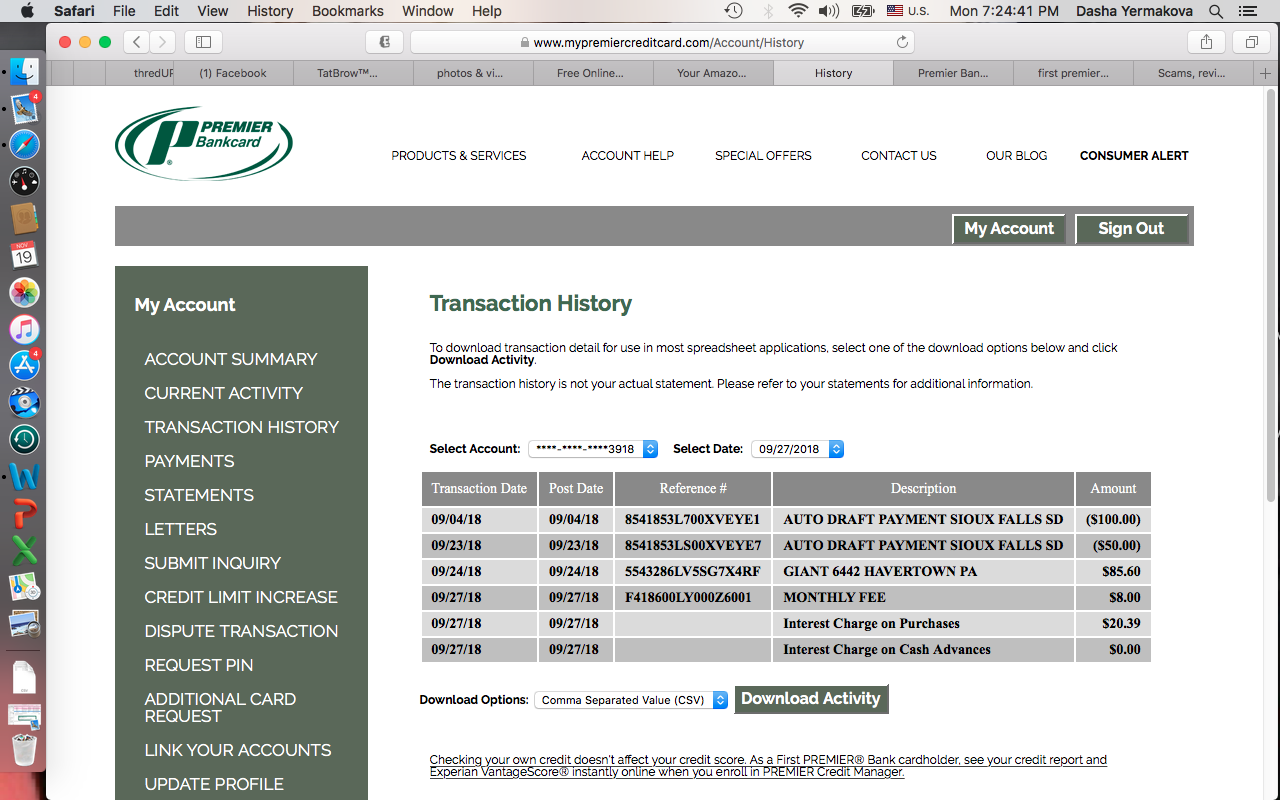

This credit card company preys on those who, for whatever reason, are trying to rebuild their credit. I encountered them after getting my free annual credit report. Experian noted I had no revolving credit and had some credit offers, Premier Credit Card was one of them. I was lulled into a false sense of security thinking somehow they were okay if they were anyways related to Experian. I got the card loaded with charges.

I immediately sent money because I wanted to pay it down and build a great payment history. But, that is when the nightmare began. They have now charged my all types of new fees and as of this date they are charging me $95.00 in over credit limit fees.

I have currently filed a complaint with the Illinois Attorney General's Office, The Better Business Bureau and The Federal Trade Commission. I have also appealed their bill in writing to be mailed tomorrow. My first payment isn't even due until November 17 and I already will have a black mark on my credit. I take responsibility for my error in judgment but will still fight their unfair business tactics.

Dlsowa57

Harristown, Illinois

U.S.A.

This report was posted on Ripoff Report on 11/16/2008 03:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-premier-bank/sioux-falls-south-dakota-57117/first-premier-bank-taking-advantage-of-people-trying-to-rebuild-their-credit-sioux-falls-s-391800. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

I just went onto their website

AUTHOR: Nikki - (U.S.A.)

SUBMITTED: Sunday, November 16, 2008

When I went onto the website and clicked on apply for credit, there was a banner on the left. One stated, "Fees, rates, costs, limitations, available credit, and other terms." It stated the following fees that charged to your account the minute you get the card: $29 set up fee, $95 program fee, $48 annual fee, montly fee $7 (actually at the rate of $84, to be paid monthly).

That means before you even use the card, you have to pay them $179 in fees. If your credit limit is $250, then you can only use $71 right away.

Some people feel it's better not to have a card at all than to pay $179 for $250. Others feel it's worth it to rebuild credit.

The point is, you have to read the terms. You need to see what you are getting into before doing it. No one is going to give a credit card to a credit challenged person without getting lots in return.

Back when I was extremely credit challenged, I got one of these types of credit cards. I did read the terms and conditions and at the time, felt it was worth the $179 to rebuild my credit. In my case, it worked out fine, but I made sure I found out what the catch was when someone was offering me credit.

One other thing. Pay it down right now. Pay it under the limit immediately (add for an overlimit fee), even if you don't make it by the 17th (you said you made a payment anyway, which probably covered minimum payment so you won't have a late fee too). Credit card companies usually do not report to the credit bureaus until the statement drops (the date the next statement is printed). If your payment for November is due on the 17th, the next statement will probably not drop until the 21st or later. If you are not over limit, or 30 days late by the time they report to the credit bureau, you should not have a blemish. The credit bureau reporting is what your account status is at the time they report it, not what it may have been at another time in the month.

#1 Consumer Comment

First Premier Bank...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Sunday, November 16, 2008

While there fees are high, they aren't that bad a deal for people trying to rebuild their credit. Let's face it, people with sub-prime credit aren't going to get great credit card deals.

They minimize their risk by charging fees up front and letting you pay them down. A new card typically comes with about $70 of available credit.

What other fees did they charge you? The over limit fees are consumer generated.

First Premier does inform customers of their fees before the customer accepts them, so I wouldn't quite classify this a s aripoff.

Advertisers above have met our

strict standards for business conduct.