Complaint Review: Internal Revenue Service - Bensalem Pennsylvania

- Internal Revenue Service PO Box 57 Bensalem, Pennsylvania U.S.A.

- Phone: 804-304-3107

- Web:

- Category: Internal Revenue Service

Internal Revenue Service The IRS garnished $101.00 from my tiny SS Disability Check Bensalem Pennsylvania

*Consumer Comment: The Fascinating Truth About The 16th Amendment

*Consumer Comment: Geesh, Dora...

*Consumer Suggestion: SS Fund! Psssst!

*Consumer Comment: IRS, cancer and SS

*Consumer Comment: To the OP

*Consumer Comment: Oops.

*Consumer Comment: Are you sure truth attack?

*Consumer Comment: 16th Amendment

*Consumer Comment: IRS screwed me too

*Consumer Comment: Food for thought.

*Consumer Suggestion: That is the point!!

*Consumer Suggestion: To Margaret

*Consumer Comment: EVERY LEGAL TAX PAYER SHOULD WITHHOLD THEIR TAX

*Consumer Comment: Fair Tax Will Not Abolish IRS

*Consumer Comment: Support the Fair Tax and abolish the IRS!

*Consumer Suggestion: the 16th amendment

*Consumer Comment: Well I guess I have to return the favor...

*Consumer Comment: Fred from Kingman: Your response is worse than ignorant...

*Consumer Suggestion: IRS can not take your money because there is no law for income tax on the books

*Consumer Suggestion: Yes they can

*Consumer Suggestion: Advice

*Consumer Suggestion: There is relief for both of you

*Author of original report: Internal Revenue Service response to Striderg fr South Carolina

*Consumer Comment: I'm sorry to hear of your medical condition...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

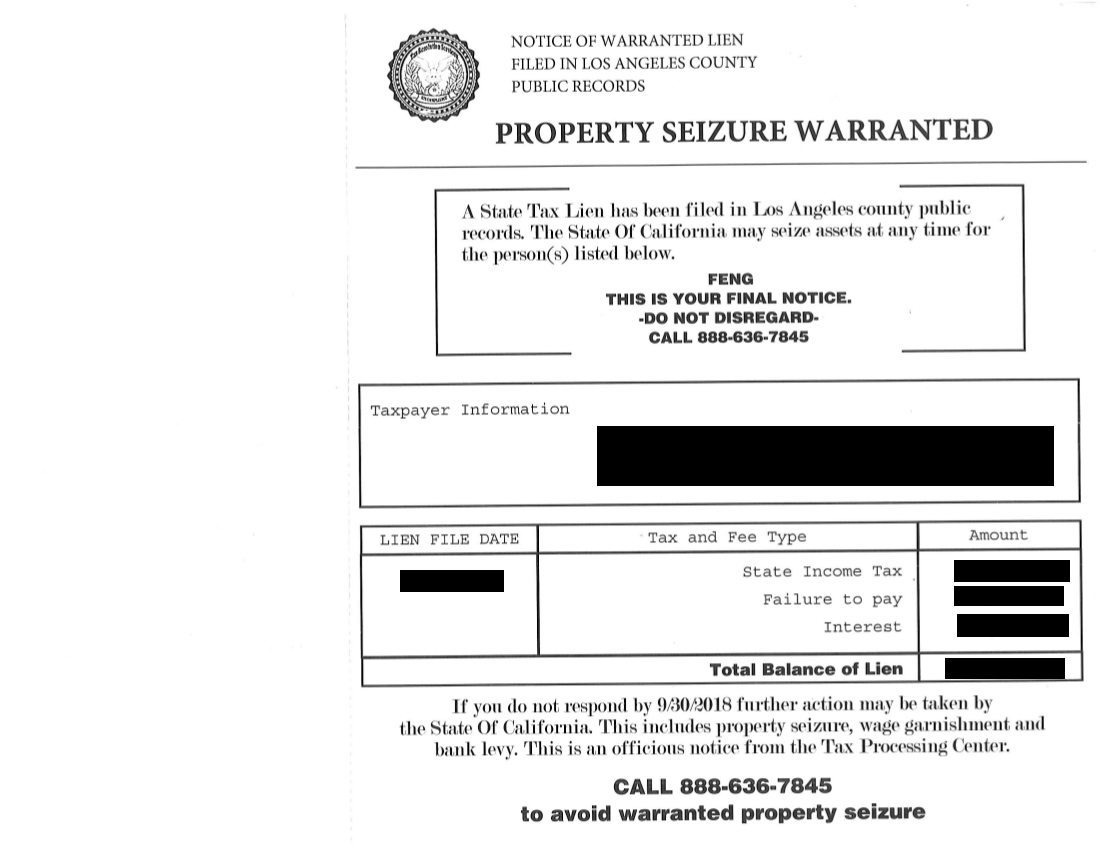

When I was very ill from 4th stage cancer, unable to care for myself, the IRS garnished my Social Security Disability check. What is worst is that according to them, they are collecting for a penalty for not paying my taxes on time in 2003.

I explained to them that I was seriously ill and could not deal with penalties from years before. I also told them that the SS check was all I had. I lost everything due to disability. They did not care, they garnished what they wanted and at the time I could not defend myself. They are low lives that will take advantage of a dying person. I thought I had paid into Social Security so I would have a little income in case of disability, what a joke. I paid into Social Security so the IRS could dig in. Vultures.

Dora

San Antonio, Texas

U.S.A.

This report was posted on Ripoff Report on 01/02/2008 07:13 PM and is a permanent record located here: https://www.ripoffreport.com/reports/internal-revenue-service/bensalem-pennsylvania-19020/internal-revenue-service-the-irs-garnished-10100-from-my-tiny-ss-disability-check-bensal-296486. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#24 Consumer Comment

The Fascinating Truth About The 16th Amendment

AUTHOR: losthorizons - (USA)

SUBMITTED: Monday, January 09, 2017

#23 Consumer Comment

Geesh, Dora...

AUTHOR: John - (U.S.A.)

SUBMITTED: Monday, December 22, 2008

You whine that while you are suffering from Cancer in 2008, you are being garnished for taxes you didn't pay in 2003? Here's a tip- next time, pay your bills when they are do. How DARE you complain that the IRS wants you to fulfill your obligations ("while I'm laying on my back, tubes in my arms, etc. etc.?") five years later? Were you on your back suffering from cancer in 2003, 2004, 2005, 2006 or 2007? If not, what was your excuse then?

"I don't mention my disability to garner sympathy..." Oh like hell you didn't. I am constantly amused at how many people who file complaints here just "happen" to mention that they are handicapped, or are "Good Christians," or have reputations for honesty, blah blah blah which is all supposed to translate "so I should not be held responsible for fulfilling my responsibilities." Why did you wait five years to pay your taxes?

Finally- I hope all you idiots who believe that the income tax is Unconstitutional DO stop paying taxes. I'd be glad to pay a little extra to see your freeloading butts tossed into jail. Don't worry, the court will let you bring your Bibles with you.

#22 Consumer Suggestion

SS Fund! Psssst!

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, September 01, 2008

Pssssssst! There is NO social security fund! ALL SS benifit are paid out of the GENERAL FUND.

#21 Consumer Comment

IRS, cancer and SS

AUTHOR: Chris - (U.S.A.)

SUBMITTED: Sunday, August 31, 2008

The IRS as has been stated can collect on tax returns either not filed or filed late. They can garnish your wages and levy your accounts until the amount owed is paid.

Sorry to hear about your illness, as I have also been taking care of my mother who had stage three/four breast cancer. She had help through the local cancer society, for either financial or other help as needed. Depending on your age the Office of the Aging or the like could also have helped you in regards to the IRS. Still can. Also call the IRS directly to see if a payment agreement can be reached at far less than the garnishment amount.

About the comment SS wont be there for your generation and your paying into it. This has nothing to do with the current Government. President Johnson tapped into SS to fund the Vietnam War. So dont get on your high horse, because my mother and the baby boom generation paid into it far longer than you and I have, are looking at a shortfall. Half of that generation most likely wont collect at all because it wont be there. Had Johnson not touched that fund we wouldnt be in this situation now. The fund would have paid the current retiring generations with more than enough leftover to fund ours. And our paying into it would fund our children.

#20 Consumer Comment

To the OP

AUTHOR: Dani - (U.S.A.)

SUBMITTED: Friday, August 08, 2008

"I thought I had paid into Social Security so I would have a little income in case of disability, what a joke."

You're right, it is a joke, but think about this for a sec. You paid into social security, then elected a president and his parties that used your pay in for other crap like people too lazy to take care of themselves. Who do you think pays your SSI now? That's right, young people like me who will never see a dime of what we are forced to pay into it to support your old a*s. I say we cut our losses an stop treating you all together. You should have saved in your younger years for your retirement like us young ones are being forced to do. Obviously, wisdom does not come with age.

#19 Consumer Comment

Oops.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, August 08, 2008

My mistake-the domain has been around for over 4 years, but the NS and IP address keep getting changed. Was recently acquired at the end of June.

The website currently doesn't have any "legal tax info" on it, rather it's simply a form to contact the domain owner.

#18 Consumer Comment

Are you sure truth attack?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, August 08, 2008

the truthattack.com website is registered to an outfit in RUSSIA!!!!

Further, this domain was created at the end of June, 2008.

Yeah, right, OK...

#17 Consumer Comment

16th Amendment

AUTHOR: Truth Trooper - (U.S.A.)

SUBMITTED: Thursday, August 07, 2008

The person that posted the 16th amendment quote as an

end-all is dead wrong. There are many Supreme Court rulings

clarifying precisely what the 16th amendment is all about.

Read this for SC decisions, rulings, and clarifications of just what

the 16th amendment "did" and "did not" do.

www.truthattack.com is a website belonging to an prominent

attorny from Louisana with 30 plus years experience, construction

of statutes, etc....He also defeated the IRS regarding two charges

against him personally of "failure to file", and the IRS dropped "tax evasion" charges just prior to trial. Tom Cryer won 12-0

#16 Consumer Comment

IRS screwed me too

AUTHOR: Irene - (U.S.A.)

SUBMITTED: Sunday, May 25, 2008

The IRS has been taking 15% of my social security check every month since December to pay the back taxes I owe. I had no problem with that as that was the only way I could afford to pay the taxes I owed after I became disabled and lost my job. Well this month I receive two letters one stating my economic stimulus check will be garnished again I have no problem with that the sooner I pay the taxes the less interest I pay. The second letter I received was the one I get every month stating that 15% of my social security check which is exactly $149 was garnished to be sent to the IRS. Again no problem with that letter I get that every month. Now here is the big problem. I was balancing my checking account and low and behold the IRS took $3000 everything that was in my checking account. This includes money that my daughter put in there for sales of her merchandise on ebay. No notice was sent to me regarding this bank levy and since they had been garnishing my social security check since December with no complaints from me I did not know they could do that. According to information I have read they are supposed to send you notice and as I mentioned I only received the two letters. This has left me in a difficult financial situation also $450 of that was my daughters that she was saving for her choir trip. She sold two items on ebay and since she is a minor I had to sell it under my account. Can the IRS still levy bank accounts since they are garnishing my Social security. No wonder people hate the IRS.

#15 Consumer Comment

Food for thought.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Wednesday, March 26, 2008

No tax dollars = No jails.

Think about it.

#14 Consumer Suggestion

That is the point!!

AUTHOR: Sandra - (U.S.A.)

SUBMITTED: Tuesday, March 25, 2008

As far as going to jail, I don't think so. This country is coming to a crisis that organizations such as the IRS will be thrown out. I just paid for a lovely trip for Senator John McCaine and the rest of his group to the Middle East. I paid for free beer for the Congress. Going to jail is one of the stands we need to pay to get these bums out. We have been a nation of frightened victims that work half the year so that our leaders can have the good life.

#13 Consumer Suggestion

To Margaret

AUTHOR: Bankworker - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

that sort of response will have you thrown in jail at some point

#12 Consumer Comment

EVERY LEGAL TAX PAYER SHOULD WITHHOLD THEIR TAX

AUTHOR: Margaret - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

If everyone in the USA withheld their TAX Payments that stupid IRS would be out of business!!

I RIP THEM OFF ANY TIME I CAN AND PAT MYSELF ON THE BACK EVERYTIME I DO!!!

They should be ABOLISHED!!

#11 Consumer Comment

Fair Tax Will Not Abolish IRS

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

Let's all get over the idea that somehow the IRS will be abolished through any major reformation of the tax code - it will not. The existence of the IRS is not justified through the existence of crazy tax codes that favor certain people or businesses. It exists through the establishment of income taxes. The bottom line is that people still have to collect the tax and people still have to audit and process the returns, as indicated by the experience of the OP. Even instituting something as corrupt as a Fair Tax (because it won't be fair) or as unpopular as a Flat Tax (because it will not be Flat) will not eliminate the existance of the IRS because collection of the tax and processing the returns are the most important aspects of the income tax process.

To the OP, the only event that will delay the IRS from performing its duty is a nuclear attack on this country, and then it will be stopped for a period of 30 days. Your illness is of little consequence to them and is not an excuse for not paying taxes (do not mistake my statement of fact for a lack of compassion - I do have compassion for what you're going through. The IRS, as you now know, does not have any such compassion). I would contact a tax attorney or an enrolled agent (I would probably look at the former only if you think this may be a case for a court to hear because your attorney's consultation would be privileged, while an enrolled agent's communication would not be) and see if they can wade through the bureaucracy of the IRS.

#10 Consumer Comment

Support the Fair Tax and abolish the IRS!

AUTHOR: John - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

This is as good an argument I could ever come up with to support the Fair Tax.

#9 Consumer Suggestion

the 16th amendment

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Sunday, January 13, 2008

THIS is exactly what the 16 amendment to the US Constitution says

Amendment XVI

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration

I find that MOST people who spout constitutional quotes have not even read the thing. Also the IRS is going after several of those "tax reduction" or tax evading companies and forcing them to turn over their whole client lsit, so if you ahve fallen for one of those the IRS WILL find you.

#8 Consumer Comment

Well I guess I have to return the favor...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Sunday, January 13, 2008

So little two year old, first off you need to learn your letters. The last letter is "q" as in quiet not "g" as in golf. Secondly, since you don't know me you're pretty bold to say that my statement was a lie. You know I was sorry to hear about your condition, but your attitude has changed my mind to where I really don't care about your condition now. And if your condition had nothing to do with the report why did you include it? Where you just looking for sympathy? Thirdly, maybe you should have taken the time to think while you wrote your OP and your response to me. The IRS can garnish SS payments for unpaid taxes. SS payment are excempt from garnishment from most things, but not IRS. And, gee, you paid your taxes late? Gee, how did that happen? Did you forget the date? Seems it's always the same, unless it falls on the weekend.

You should be glad they didn't freeze your bank account and take all of the money until the debt was paid. They can do that.

My suggestion would be once they stop taken the money to use that amount to invest in some anger management classes for yourself, because your response indicates that you need it badly. Oh but I forgot, all two year olds have problems with temper tantrums.

And you probably won't believe this but good luck in both medical and financial situations.

#7 Consumer Comment

Fred from Kingman: Your response is worse than ignorant...

AUTHOR: Mr. - (U.S.A.)

SUBMITTED: Sunday, January 13, 2008

It's dangerous! The same tired "truths" of the income tax are rehashed ad infinitum this time every year. It's like the same old creaking zombie rising to roam restlessly around the internet. You talk about the Sixteenth Amendment to the Constitution...personal income tax has been in existence since 1913 and will never go away. You will counter this and say something in the vein that the "State of Ohio never ratified this" or "approved that," and therefore there are no legitimate federal tax laws.

You mention lawsuits; when was the last time you have heard of a tax evader getting away with it? Ask Al Capone, or Leona Helmsley, or even that couple in New Hampshire recently. Your spewing your wish fulfillment fanatsies and filling people with false hope is irresponsible.

#6 Consumer Suggestion

IRS can not take your money because there is no law for income tax on the books

AUTHOR: Fred - (U.S.A.)

SUBMITTED: Sunday, January 13, 2008

The IRS has no authority to take taxex on personal income. If you were to file a law suit you would win as the 3 years have proven in over 24 cases. The 16 amendment states that the government can only tax profit. Wages are not profit because you are trading you work for money. Find a lawyer and you will win just like others.

#5 Consumer Suggestion

Yes they can

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Saturday, January 12, 2008

Yes, social security disability benefits can be garnished. However, garnishment can only be carried out in a few specific scenarios. According to the social security administration, SSI benefits cannot be garnished, while social security disability benefits may only be garnished to enforce child and alimony obligations, pay federal tax and debts owed to the IRS, and pay debts owed to federal agencies.

So, if you owe taxes or IRS penalties, you can have your social security disability benefits garnished. If you have alimony or child support obligations, you can be garnished. If you have a delinquent student loan, your SSD benefits can be garnished.

Creditors, however, are not entitled to garnishment provisions for social security disability benefits, so SSD recipients are protected from credit card companies, finance companies, auto lenders, and other lenders.

And REMEMBER up to 50% of your SSD is subject to income tax. If theya re taking 101.00 each month then you owed a lot more. That was 5 years ago. They don't jsut out of the blue take your money, you ahd 5 years to take care of it. Ia m sure you were not bed ridden taht whole time.

AND by the way, that 42USC 407(a) that you referred has nothing to do with the IRS. It is about child support

#4 Consumer Suggestion

Advice

AUTHOR: Lisa - (U.S.A.)

SUBMITTED: Saturday, January 12, 2008

As the previous person said you should call collections 1-800-829-7650 and they will release the levy, work out a payment plan or put your account in currently not collectible. It is UNTRUE that they can't levy your SSDI check, if you meet certain income guidelines they can't but you first have to show your expenses and they put your account in not collectible status for 12 months at a time.

Call them they will work with you which is something that should of been done before a levy happened. They send out numerous notices before a levy happens and most of them are registered.

#3 Consumer Suggestion

There is relief for both of you

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

If paying the tax is a hardship, there is relief available but you have to ask for it.

Contact the IRS and ask that they place your tax account in "Currently Not Collectable" (or CNC) status. To do this they will ask for Financial information. To see what they will be asking for, go to the IRS web site and download Form 433-A (Collection Information Statement for Individuals) or Form 433-F the short version of that form. There are certain limitations on what the IRS will allow as living expenses and these limitations vary from county to county. These standards are available on the IRS web site (search for "Collection Standards"). If you sole income is SSD or SSI, then you very likely meet those standards.

Once you are classified as CNC the IRS will cease all levies, attachments and collection actions. they may request a new 433A each year, but if you are on SSD or SSI your situation probably will not improve much over time. Meanwhile, the 10 year Statute of Limitations on Collections clock keeps ticking.

If you can afford to hire a professional to help, I suggest looking for an Enrolled Agent. You can do a search on the web for EA's, but be sure to verify that they are proficient in "IRS Problem Resolution".

#2 Author of original report

Internal Revenue Service response to Striderg fr South Carolina

AUTHOR: Dora - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Striderg from South Carolina, you start your sentence with a lie, you know you could care less about my health. Further, I did not mention my health in this post for sympathy, but to explain my situation at the time that IRS contacted me. If you would have taken the time to think while you were reading you would have understood the point I was trying to make. Thus, I will try to explain as if I am talking to a two year old.

Imagine, you being in the hospital having some organs removed because they are cancerous. Imagine you having tubes in your arms, nose, and back and being on heavy medication to help the pain you are enduring. Now imagine that your doctor told you that you have about a year to live because the cancer has spead to your bones. Do you follow me so far.

Now imagine, that as you lay there, your world totally shattered, you see a great big shadow approaching. You can't make out who it is, perhaps because of the medication, maybe because of the depression that comes from being given a death sentence, who knows. Anyway this big shadow calls itself the IRS (Internal Revenue Service) and they say sorry it took us so long but we just discovered that you PAID your taxes late so you owe us money unless you can prove other wise and you only have 30 days to do it.

Well, let me educated you Striderg from South Carolina, at that point you do not care about penalty taxes. Honestly, you will not be concerned about how the IRS will recover money if you die.

Now, as for my compliant here in rip-off. The IRS garnished $101.00 MONTHLY from my Social Security Disability check. Further, I did not admit that I owed penalty taxes, and I still don't think I do. If you read you will notice I told them that I was very ill and could not deal with it at the time, and I begged them to consider my situation. But, like you, they felt that my situation did not warrant an excuse.

Update, according to 42 USC 407(a) if SSD is your only source of income, the IRS cannot touch your Social Security Check. So, when the time comes and you or a loved are in my situation, I hope you remember me.

To all readers, that at one time had a business and a serious illness forced you to shut your doors; I hope the IRS does not come knocking on your door. Sorry, it is never a bad time for them to come a calling, and if you should pass away they will probably sell any left over organs to recover anything they feel you owe.

Sincerely,

Dora

#1 Consumer Comment

I'm sorry to hear of your medical condition...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Thursday, January 03, 2008

But how do you think this gives you the right to avoid legal debts. Apparently the 2003 payment was late, you didn't say it was on time. IRS would have sent notification to you of the debt. You probably don't get a refund that could have been confiscated for the debt. So, yes the IRS had to garnish your money to pay your debt. Sad thing is that if they only garnished $101 for 2003 debt, the amount owed was not very much and should have been paid then.

Advertisers above have met our

strict standards for business conduct.