Complaint Review: Key Bank - Dunkirk New York

- Key Bank key.com Dunkirk, New York U.S.A.

- Phone: 800-539-2968

- Web:

- Category: Banks

Key Bank they've charged my student checking account for money that my father supposedly owes. Overdraft charges and litigation fees legal? Dunkirk New York

*Author of original report: My Ripoff Update

*Consumer Comment: I am Not a Lawyer

*Consumer Suggestion: Advice for "Blah"........You CANNOT go to jail for any debt!

*Consumer Comment: My Key Bank Experience

*Consumer Suggestion: No, no, and no.

*Author of original report: Who do I challenge?

*Consumer Suggestion: Divorce papers have no effect on a bank.

*Consumer Comment: I think it stinks

*Consumer Comment: Right to offset

*Consumer Comment: Right to offset

*Consumer Comment: Right to offset

*Consumer Comment: Unfortunately it is know as offset.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I opened a Key Student Checking account before turning 18 (I am now 19). To do so I needed to have a legal guardian provide there social sec number and sign some paperwork, which my father did.

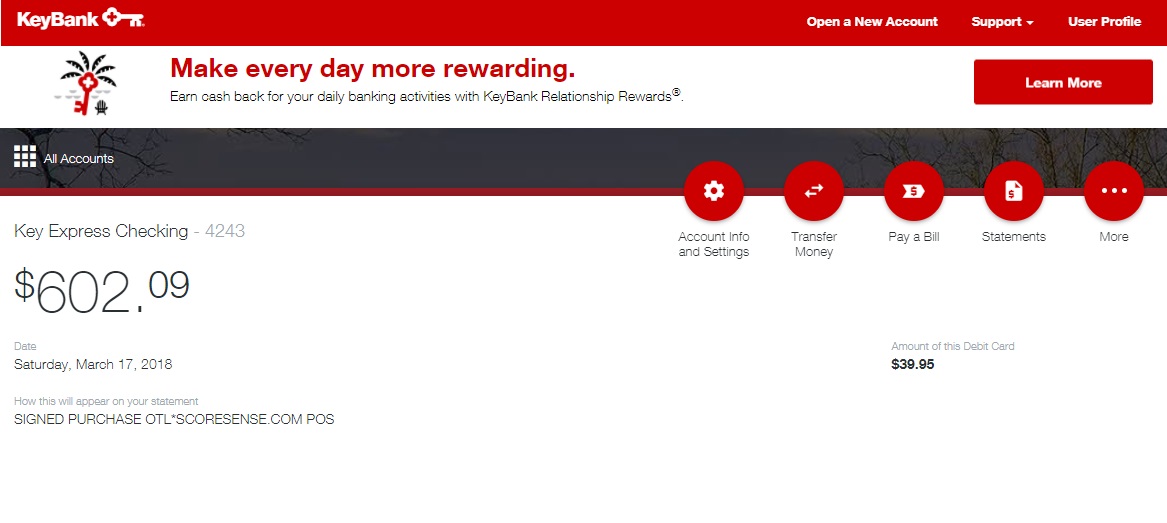

When I went into the Bank a few days ago they told me that my account was frozen because of overdraft charges, and a litigation fee of $90. They told me someone charged my account because my father's soc sec number was attached to it.

They gave me the contact information for the law firm. I called them and they wouldn't provide me with any information. My account is now -$2,057. The bank told me there's nothing I could do besides pay the negative balance on my account, and that I would never be able to get the hold off the account.

How could the bank legally allow someone to charge my account for money my father owes if the money in my account is mine?

I feel like they keep giving me the run around because I'm a young kid. It seems more like fraud to me but the bank doesn't seem to want to help me out.

I don't mind paying for the overdraft charges (althoug there wouldn't be any if my account wouldn't have been charged) but it seems like I'm getting shafted.

looking for help.

Robert

Dunkirk, New York

U.S.A.

This report was posted on Ripoff Report on 05/31/2006 09:12 PM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/dunkirk-new-york-14048/key-bank-theyve-charged-my-student-checking-account-for-money-that-my-father-supposedly-o-194174. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#12 Author of original report

My Ripoff Update

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, July 10, 2006

After making several phone calls to customer service and forcing myself into the ears of those that can pull strings, I was able to get the negative balance reduced. All overdraft fees, except for 2 were waived.

I closed my bank account and vowed to find a local bank or credit union to bank at. I feel that there should be better safe guards to protect us. I mean we do give the banks our money to hold onto, right? I'm glad, It wasn't worse and that I was able to get the situation resolved quickly before more damage was done.

Thank you all for advise and knowledge.

#11 Consumer Comment

I am Not a Lawyer

AUTHOR: Elisa - (U.S.A.)

SUBMITTED: Monday, July 10, 2006

I am not a lawyer, I never had to deal with these issues. I'm glad to hear that I can't be sent to jail for being in debt. However they said that I would do time for breach of contract. I am sorry if I'm wrong or ignorant when it come to knowing every little bit of the law but they shouldn't be threatening me with false information.

#10 Consumer Suggestion

Advice for "Blah"........You CANNOT go to jail for any debt!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, July 07, 2006

Blah,

You wrote:

"Frightened I said "okay transfer the money." Thinking I would worry about it laterand this was better than jail."

Jail? When was the last time you saw someone go to jail for not paying a debt?

FYI...News Flash! There is no debtors prison.

#9 Consumer Comment

My Key Bank Experience

AUTHOR: Blah - (U.S.A.)

SUBMITTED: Thursday, July 06, 2006

This is what they do!

I owed 2k to key bank. Long story short, a family member was sick so I borrowed 2k. Shortly afterwards I was laid off and was unable to pay back the loan.

Key bank first used threats saying if i did not pay back the money they would take my car, sue me and throw me in jail. After about 5 minutes of them tring to scare me they said "You have a credit card account in out records with a 4k availible ballance. If you transfer your funds all will be forgiven." I had no idea what this account was or where it came from, I asked and Key Bank said it was just an old account I most likely forgot about. Frightened I said "okay transfer the money." Thinking I would worry about it laterand this was better than jail. Key bank had the account number, routing number, and a bunch of info they probably shoulden't have had. It turns out this mysterious account was an old joint account with my father when he was helping me out with college. I was not even the primary on the account my father was primary. Fortunatly his bank stopped the transfer,contacted my father, and I asked my name to be removed from this old account. It's funny that Key Bank failed to tell me that this account was not actualy my account. It's also odd that they would just happen to have all the account information and access to it. Is that even legal?

#8 Consumer Suggestion

No, no, and no.

AUTHOR: Stile - (U.S.A.)

SUBMITTED: Sunday, June 04, 2006

"Mike...do I call the debt collector and challenge the methods he went about collecting this money from my account, or do I challenge the bank for allowing him to do so?"

The Debt collector is a Key Bank employee. Third party debt collectors cannot simply offset your account, they must obtain a judgement first. Since your father had an old account, and he was listed on your account, right of offset applies. The person you should challenge is your father.

"Also, does anyone know if their is a state or federal law that prevents them from taking more than the positive amount in the account?"

I don't think so.

#7 Author of original report

Who do I challenge?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

Mike...do I call the debt collector and challenge the methods he went about collecting this money from my account, or do I challenge the bank for allowing him to do so?

Also, does anyone know if their is a state or federal law that prevents them from taking more than the positive amount in the account?

I don't mind paying the fees imposed by the bank, but the other -$2000 is what I'm worried about.

thanks for the help!

#6 Consumer Suggestion

Divorce papers have no effect on a bank.

AUTHOR: Mike - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

Both people have signed agreements with the bank. A divorce court does not have the power to nullify those agreements without the bank's permission. Usually this means the account must be closed, and paid off if it is a loan account. At the time of divorce, it is essential to close all joint accounts and refinance or otherwise pay off all joint debts.

A lot of divorcees get in trouble over this. The need to pay off joint loans can leave one or both having to file bankruptcy. Unfortuantely it is a messy process, but handling it at the time of divorce is the only way to be sure not to have financial trouble from something your ex may do in the future.

To the OP, you may be able to challenge the judgement that a debt collector has apparently obtained against your father. Though if it is a fully legit judgement, they could the money from your joint account, debt collectors often do things that they are not legally allowed to do. The judgement may not be legit for example because they didn't properly serve your father with a summons to court. Also they probably aren't allowed to take more than the positive amount in the account. When you end up with a large negative balance, that is making the bank give you an expensive loan that you didn't ask for.

#5 Consumer Comment

I think it stinks

AUTHOR: Tracy - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

I know it may be in the terms and conditions of the banks, but I think the policy stinks.

When my ex-husband and I got together about 10 years ago, he added my name to his already existing checking account, making it a joint account in the eyes of the bank. When we separated, I opened my own checking account in the same bank, just a different branch. I chose to bank with the same bank because it was where my mother-in-law at the time worked. In my separation agreement, it talks about the "joint" checking account and how I relinquish all rights and responsibilities towards the account.

In the spring of last year, he was overdrawn for some time and the main branch of the bank took money out of my account and deposited it in his, overdrawing my account. I spoke with the branch manager of the branch where my ex banked and he returned all the money and fees to me. I gave him copies of my separation agreement and everything. He told me that the bank could not just take my name off the account, but that my ex (or I) would have to actually close the account. My ex refused because he felt because of his history, the bank would not open a new one for him. I begged the bank to do something. They told me there was nothing they could do.

Twice more it happened and each time the branch refunded my money. If I didn't have a child with this man, I would have closed the account myself, but it would have started World War 3 and I just couldn't have my son caught in the backlash that I guarantee would have occurred. My ex is just like that.

Finally last August his account was overdrawn for over 30 days. The Recovery department in Buffalo, NY froze my checking account, conveniently the day after my direct deposit was posted. They bounced all my automatic withdrawls, took money out of my account to pay off his overdrawn balance. They hot carded all my atm cards and all this was done with not one iota of notice to me. I went to take money out to pay for my babysitter and found everything was gone. The whole thing cost me my entire paycheck between the bounced check fees to the bank, the actual bounced checks and automatic withdrawls, and I am still suffering from it. I spent quite a lot of time dealing with my local branch who knew the entire situation. They put me in touch with the recovery department in Buffalo. They didn't care. The guy there told me too bad. You should have closed the account. I had divorce papers and everything by that time because we were legally divorced when this happened. I was never nasty or disrespectful on the phone with Buffalo. I admit to crying on the phone because I wasn't going to be able to pay my rent or my other bills because they returned all my electronic payments, including my car insurance and my cell phone, all of which would have been more than covered by the money they withdrew. They didn't care. All they saw was my direct deposit and they took it.

After they froze my account, they continued to bounce checks that had already written and electronic payments that had already been set up. Laughably, the bank has sent me to collections for $150.00. I told them forget it. You won't see a d**n dime from me. Those are bogus bounced check charges that the bank's own actions caused. I won't pay them. I don't care. They reported me to Chexsystems even though I did absolutely nothing wrong except not push the issue of closing his checking account. My account was not overdrawn. I hadn't had an overdraft fee in more than 6 months. Then this happens and I'm the bad guy. My ex still owes them money.

So while this may be a legal "offset" I don't think it is ethically right. I thought I was doing the right thing, but apparently I wasn't.

Good luck to you with your situation. I can definitely sympathize with you.

Take care.

#4 Consumer Comment

Right to offset

AUTHOR: Michelle - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

I agree 100% with Robert. I would defiantly get your fathers name removed as soon as this is resolved, as to prevent any other debits from being paid by you.

#3 Consumer Comment

Right to offset

AUTHOR: Michelle - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

I agree 100% with Robert. I would defiantly get your fathers name removed as soon as this is resolved, as to prevent any other debits from being paid by you.

#2 Consumer Comment

Right to offset

AUTHOR: Michelle - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

I agree 100% with Robert. I would defiantly get your fathers name removed as soon as this is resolved, as to prevent any other debits from being paid by you.

#1 Consumer Comment

Unfortunately it is know as offset.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, June 01, 2006

There should be a section in your account terms and conditions that explains it. In a nutshell, the bank can debit from ANY account listed for an account holder that owes them money (joint account or not).

You may have to get the money from your father to bring your account current and then remove him from your account now that you are over 18.

Good luck.

Advertisers above have met our

strict standards for business conduct.