Complaint Review: NCO Financial Systems Inc. - Horsham Pennsylvania

- NCO Financial Systems Inc. 507 Prudential Road Horsham, Pennsylvania United States of America

- Phone:

- Web:

- Category: Collection Agency's

NCO Financial Systems Inc. NCO NCO Collection NCO Financial Systems Illegal Collection Practices Horsham, Pennsylvania

*General Comment: Tim's advise is sound, but you cannot just forget about it

*Consumer Comment: It's not that complicated

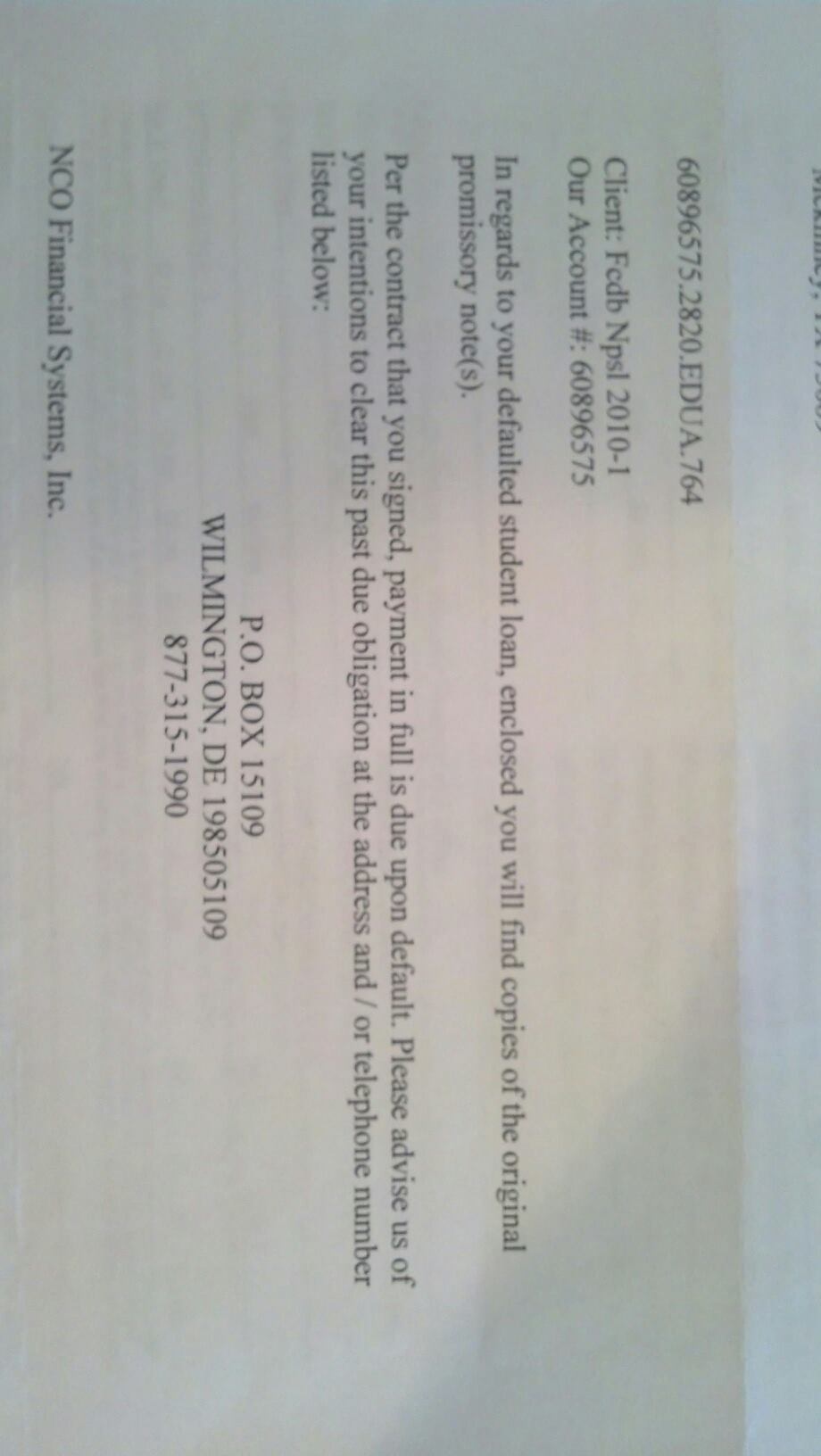

*Consumer Comment: Make them validate the debt

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Out of the blue, got a letter from NCO demanding payment of over $5,000 to Bank One. First, never had an account with Bank One. Second, contacted NCO and spoke with "Rosalyn" who could not validate any information as to what type of account this was, when opened (kept flip flopping on dates back into the 1990's), etc.

She said account was old and when I inquired re: Statute of Limitations, she gave me false information stating when something keeps going to collections, "it starts the clock all over again" which is totally untrue and varies from State to State with my State being Florida, which only allows 4 years for a collection of a debt.

Now, again, we don't owe Bank One or anybody that kind of money, never have, and BAM > we get this collection letter. I wrote a letter of dispute re: Bank One, and also stated even if we did owe them money, they were way past the Statute of Limitations for collections. I also advised them that if they don't stop this collection, and/or it is placed on our credit reports, legal action will pursue.

There appears to be so many complaints just on this site re: NCO that I'm surprised an Attorney hasn't begun a class action suit against them!

This report was posted on Ripoff Report on 09/30/2009 11:56 AM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/horsham-pennsylvania-19044/nco-financial-systems-inc-nco-nco-collection-nco-financial-systems-illegal-collection-p-502134. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 General Comment

Tim's advise is sound, but you cannot just forget about it

AUTHOR: IamGood - (USA)

SUBMITTED: Tuesday, October 06, 2009

Louis:

Sending out a Cease and Desist letter will stop the collections calls, and letters, however if they attempt to sue you, be sure to show up in court, and dispute the suit, as it violates the statute of limations.

If you fail to show up because you think the judge will see the age of the debt, and throw it out of court, you are mistaken. NCO will win by default.

This will require you hiring a lawyer, and spending money to defend yourself, but it is a necessary evil.

Why do you think so many doctors settle lawsuits rather than go to court. It is cheaper to pay out, than it is to hire a lawyer, and go to court.

But even then your problems wont end, because NCO will sell you debt to another agency, and you will have to go through the process all over again.

I should have looked at the state you are from, from some states allow creditors to take your house, and garnish your wages, so be very dilligent.

Some times these agencies will send service to old addresses, so yo will not know you were served, and then they win by default. next thing you know your paycheck is 70% lighter.

B E C A R E F U L

B E D I L L I G E N T

#2 Consumer Comment

It's not that complicated

AUTHOR: Tim - (U.S.A.)

SUBMITTED: Sunday, October 04, 2009

There is nothing wrong with the above advice, but I don't think you need to make it that complicated.

First, bear in mind that it is not illegal to attempt to collect on a debt that is time barred (past the statute of limitations). It IS, however, illegal to sue on such a debt. And it IS illegal to report such a debt to a credit reporting agency.

So, basically, the only means they have to collect this debt, within the bounds of the law, is to continually call you and send you letters.

This can be remedied via a simple cease and desist letter. Just google "cease and desist letter" and I'm sure you'll find some good templates.

With the C&D, you pretty much cancel out every avenue they have to harrass you, and you can forget about the matter altogether, without going through all the work involved with validation and dispute requests.

Best of luck!

#1 Consumer Comment

Make them validate the debt

AUTHOR: tailer - (USA)

SUBMITTED: Saturday, October 03, 2009

NCO is scum and they will do anything to get paid.

First off look up the Fair Debt Collections Practices Act and read up on your rights. Then send a certified letter with a return receipt and have them validate the debt. They have 30 days in which to do so. Ask them for proof that they now own the debt and legally authorized to collect it, ask for a complete payment history documentation from the original creditor, and copy of original loan contract that you signed with creditor. They cannot attempt to collect during this time. Keep all copies and green return card.

If they cannot validate the debt then send any and all documentation and letters you have written to the credit bureaus that you dispute the debt and that they could not validate it. The credit bureaus have to investigate.

You have to remember that NCO has one purpose and that is to collect money and they do not care who pays. If this account is from the 90's they may not be able to validate the debt Do all communcation in writing and if you talk to them on the phone record, but be sure to know what the recording laws are in your state.

I have an attorney working on a claim for violations and they agreed to a settlement. It is not much, but at least it is something. So if need be, there are attorneys willing to take these low lifes on.

Advertisers above have met our

strict standards for business conduct.