Complaint Review: NCO Financial Systems Inc. - Horsham Pennsylvania

- NCO Financial Systems Inc. 507 Prudential Road Horsham, Pennsylvania U.S.A.

- Phone: 800-383-4761

- Web:

- Category: Collection Agency's

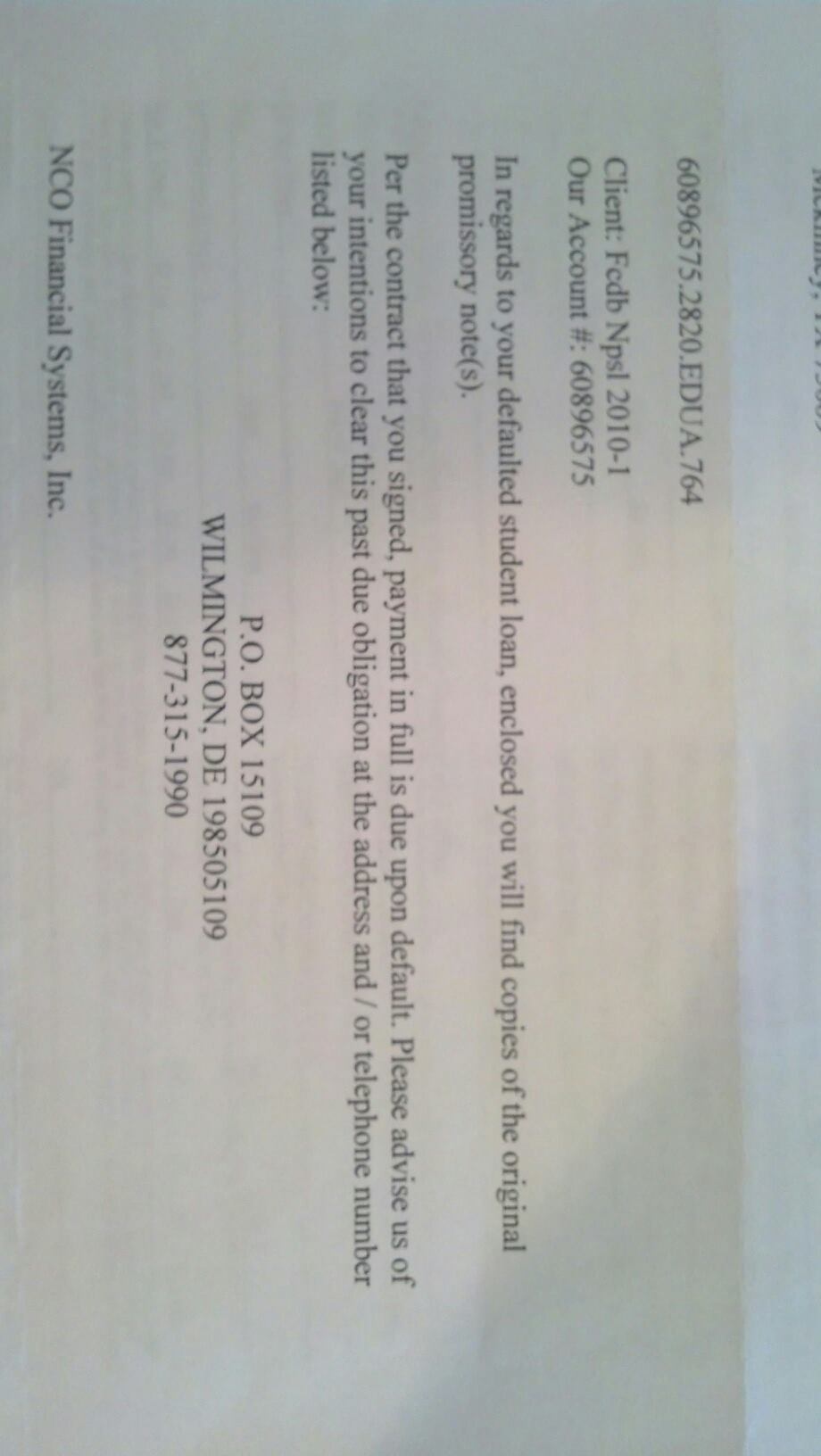

NCO Financial Systems Inc., NCO Portfolio Management, Inc. NCO Financial Systems Inc sent me a collections bill for an account I don't have. Horsham Pennsylvania

*Consumer Comment: JDB

*Consumer Suggestion: ftc complaints

*Consumer Suggestion: Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

*Consumer Suggestion: Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

*Consumer Suggestion: Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

*Consumer Suggestion: Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I received a bill from NCO Financial Systems Inc stating I owed $2811.17 plus interest in the amount of $4788.45, for a total of $7599.72 for a delinquent Chase Acct. However they are willing to settle for 50% of the total amount in three installments. First I don't have an acct with Chase and never have. Concerned that I had been the victim of identity theft, I obtained a copy of my credit report from all three reporting agencies and have no delinquent accounts. What now concerns me is that NCO Financial Systems obtained a copy of my credit report through Trans Union in August of this year. I don't know how they could have received a copy of my credit report without any authorization. If they were legit, clearly at that time they should have seen there were no delinquent accounts and yet they sent a collection letter four months later. My sister works for a leading collections attorney in the state of Arizona and she says they have violated the law. I plan to sit down with the attorney to find out what legal remedies are available to me. This company has a local address on the bill they sent me and when I ran their name on the online yellow pages, they do in fact have a local office here in Tucson. This company has so many arms in so many states its not funny. But we as consumers have to do something to shut them down.

Cheryl W.

Tucson, Arizona

U.S.A.

This report was posted on Ripoff Report on 12/25/2007 12:17 AM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/horsham-pennsylvania-19044/nco-financial-systems-inc-nco-portfolio-management-inc-nco-financial-systems-inc-sent-294287. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Consumer Comment

JDB

AUTHOR: Michael - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Budhibbs.com and (((link redacted))) have good info on how to deal with these and other vultures.

Fight back!

CLICK here to see why Rip-off Report, as a matter of policy, deleted either a phone number, link or e-mail address from this Report.

#5 Consumer Suggestion

ftc complaints

AUTHOR: Keith - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Yep, if you do a search on the FTC's website, you'll find quite a few consumer complaints against NCO, about 40-50+ have been filed thus far. And hopefully you'll take the time to file too, on the ftc.gov website

#4 Consumer Suggestion

Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Cheryl,

At THIS POINT, don't waste your time and money on an attorney. Unless you just have extra money to throw out the window. This is not a legal issue at this point, and although they are real lowlife, they have not broken any laws up to this point.

The fact that they accessed your credit report means that they have at least your full SS#, and most likely DOB and/or current street address. It is not illegal for them to pull your credit. The burden of proof is on you to prove that they did not have "permissible purpose" to pull your credit. This means that you have to prove that they know that the account they are collecting on is bogus or not yours.

Right now just be sure to STAY OFF THE PHONE, and do everything in writing by certified mail, return reciept requested. Be sure to put the certified# on the letter itself and keep a copy for your records. This is very important to do it this way as it proves exactly what you sent. And, NEVER sign the letter or anything you send them as your signature could magically end up on a contract, etc.

By the means above, send a REQUEST FOR DEBT VALIDATION.

In this letter, do not provide any information that is not already on the collection letter. Do not agree to anything or reference any prior account with anyone.

Clearly dispute the validity of the claim and demand to see something with your signature on it that created the alleged debt, as well as a full account history and itemization of ALL charges, including interest, etc.

Also demand to see proof that they are licensed as debt collectors in both your state and theirs. Also demand to see the contract where they purchased the debt as well as proof of payment. You will demand this proof from every owner back to the original creditor. This is called chain of title.

These are JUNK DEBT BUYERS who pay pennies or less on the dollar for old, usually past SOL debts which are legally uncollectable. I have see seen debts for which 1/10th of a penny on the dollar has been paid!

Also keep in mind that "collection fees" are ILLEGAL to pass on to the debtor/consumer. Agencies can charge each other all day long, but CANNOT add it on to the collection amount.

Legally, the collection amount can only be whatever was in your contract with the original creditor up until date of charge off, then after charge off the interest is greatly reduced and regulated by federal law. At last I checked it was 6-8%. This is why federal law mandates that a debt be charged off after 180 days from first major delinquency if a payment has not been made, etc.

Immediately file an FTC complaint at FTC.gov for the bogus collections effort, and go to budhibbs.com for massive info on debt collectors and bottomfeeders.

Knowledge is power, and all of this information is readily available. I would only get a lawyer if they actually filed a lawsuit on you.

#3 Consumer Suggestion

Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Cheryl,

At THIS POINT, don't waste your time and money on an attorney. Unless you just have extra money to throw out the window. This is not a legal issue at this point, and although they are real lowlife, they have not broken any laws up to this point.

The fact that they accessed your credit report means that they have at least your full SS#, and most likely DOB and/or current street address. It is not illegal for them to pull your credit. The burden of proof is on you to prove that they did not have "permissible purpose" to pull your credit. This means that you have to prove that they know that the account they are collecting on is bogus or not yours.

Right now just be sure to STAY OFF THE PHONE, and do everything in writing by certified mail, return reciept requested. Be sure to put the certified# on the letter itself and keep a copy for your records. This is very important to do it this way as it proves exactly what you sent. And, NEVER sign the letter or anything you send them as your signature could magically end up on a contract, etc.

By the means above, send a REQUEST FOR DEBT VALIDATION.

In this letter, do not provide any information that is not already on the collection letter. Do not agree to anything or reference any prior account with anyone.

Clearly dispute the validity of the claim and demand to see something with your signature on it that created the alleged debt, as well as a full account history and itemization of ALL charges, including interest, etc.

Also demand to see proof that they are licensed as debt collectors in both your state and theirs. Also demand to see the contract where they purchased the debt as well as proof of payment. You will demand this proof from every owner back to the original creditor. This is called chain of title.

These are JUNK DEBT BUYERS who pay pennies or less on the dollar for old, usually past SOL debts which are legally uncollectable. I have see seen debts for which 1/10th of a penny on the dollar has been paid!

Also keep in mind that "collection fees" are ILLEGAL to pass on to the debtor/consumer. Agencies can charge each other all day long, but CANNOT add it on to the collection amount.

Legally, the collection amount can only be whatever was in your contract with the original creditor up until date of charge off, then after charge off the interest is greatly reduced and regulated by federal law. At last I checked it was 6-8%. This is why federal law mandates that a debt be charged off after 180 days from first major delinquency if a payment has not been made, etc.

Immediately file an FTC complaint at FTC.gov for the bogus collections effort, and go to budhibbs.com for massive info on debt collectors and bottomfeeders.

Knowledge is power, and all of this information is readily available. I would only get a lawyer if they actually filed a lawsuit on you.

#2 Consumer Suggestion

Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Cheryl,

At THIS POINT, don't waste your time and money on an attorney. Unless you just have extra money to throw out the window. This is not a legal issue at this point, and although they are real lowlife, they have not broken any laws up to this point.

The fact that they accessed your credit report means that they have at least your full SS#, and most likely DOB and/or current street address. It is not illegal for them to pull your credit. The burden of proof is on you to prove that they did not have "permissible purpose" to pull your credit. This means that you have to prove that they know that the account they are collecting on is bogus or not yours.

Right now just be sure to STAY OFF THE PHONE, and do everything in writing by certified mail, return reciept requested. Be sure to put the certified# on the letter itself and keep a copy for your records. This is very important to do it this way as it proves exactly what you sent. And, NEVER sign the letter or anything you send them as your signature could magically end up on a contract, etc.

By the means above, send a REQUEST FOR DEBT VALIDATION.

In this letter, do not provide any information that is not already on the collection letter. Do not agree to anything or reference any prior account with anyone.

Clearly dispute the validity of the claim and demand to see something with your signature on it that created the alleged debt, as well as a full account history and itemization of ALL charges, including interest, etc.

Also demand to see proof that they are licensed as debt collectors in both your state and theirs. Also demand to see the contract where they purchased the debt as well as proof of payment. You will demand this proof from every owner back to the original creditor. This is called chain of title.

These are JUNK DEBT BUYERS who pay pennies or less on the dollar for old, usually past SOL debts which are legally uncollectable. I have see seen debts for which 1/10th of a penny on the dollar has been paid!

Also keep in mind that "collection fees" are ILLEGAL to pass on to the debtor/consumer. Agencies can charge each other all day long, but CANNOT add it on to the collection amount.

Legally, the collection amount can only be whatever was in your contract with the original creditor up until date of charge off, then after charge off the interest is greatly reduced and regulated by federal law. At last I checked it was 6-8%. This is why federal law mandates that a debt be charged off after 180 days from first major delinquency if a payment has not been made, etc.

Immediately file an FTC complaint at FTC.gov for the bogus collections effort, and go to budhibbs.com for massive info on debt collectors and bottomfeeders.

Knowledge is power, and all of this information is readily available. I would only get a lawyer if they actually filed a lawsuit on you.

#1 Consumer Suggestion

Cheryl, here's how you deal with JUNK DEBT BUYERS like NCO.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, December 25, 2007

Cheryl,

At THIS POINT, don't waste your time and money on an attorney. Unless you just have extra money to throw out the window. This is not a legal issue at this point, and although they are real lowlife, they have not broken any laws up to this point.

The fact that they accessed your credit report means that they have at least your full SS#, and most likely DOB and/or current street address. It is not illegal for them to pull your credit. The burden of proof is on you to prove that they did not have "permissible purpose" to pull your credit. This means that you have to prove that they know that the account they are collecting on is bogus or not yours.

Right now just be sure to STAY OFF THE PHONE, and do everything in writing by certified mail, return reciept requested. Be sure to put the certified# on the letter itself and keep a copy for your records. This is very important to do it this way as it proves exactly what you sent. And, NEVER sign the letter or anything you send them as your signature could magically end up on a contract, etc.

By the means above, send a REQUEST FOR DEBT VALIDATION.

In this letter, do not provide any information that is not already on the collection letter. Do not agree to anything or reference any prior account with anyone.

Clearly dispute the validity of the claim and demand to see something with your signature on it that created the alleged debt, as well as a full account history and itemization of ALL charges, including interest, etc.

Also demand to see proof that they are licensed as debt collectors in both your state and theirs. Also demand to see the contract where they purchased the debt as well as proof of payment. You will demand this proof from every owner back to the original creditor. This is called chain of title.

These are JUNK DEBT BUYERS who pay pennies or less on the dollar for old, usually past SOL debts which are legally uncollectable. I have see seen debts for which 1/10th of a penny on the dollar has been paid!

Also keep in mind that "collection fees" are ILLEGAL to pass on to the debtor/consumer. Agencies can charge each other all day long, but CANNOT add it on to the collection amount.

Legally, the collection amount can only be whatever was in your contract with the original creditor up until date of charge off, then after charge off the interest is greatly reduced and regulated by federal law. At last I checked it was 6-8%. This is why federal law mandates that a debt be charged off after 180 days from first major delinquency if a payment has not been made, etc.

Immediately file an FTC complaint at FTC.gov for the bogus collections effort, and go to budhibbs.com for massive info on debt collectors and bottomfeeders.

Knowledge is power, and all of this information is readily available. I would only get a lawyer if they actually filed a lawsuit on you.

Advertisers above have met our

strict standards for business conduct.