Complaint Review: NCO Financial Systems, Inc. - Horsham Pennsylvania

- NCO Financial Systems, Inc. 507 Prudential Road Horsham, Pennsylvania U.S.A.

- Phone: 1-866-372-8498

- Web:

- Category: Corrupt Companies

NCO Financial Systems, Inc. This article took place shortly after going through a rather lengthy process of pursuading AOL that they had billed the wrong person. Apparently there are countless others who have received the same bill and has brought great discredit to NCO Financial Systems, Inc. This article was written to detail what steps are necessary to counter such a falsified bill and file a complaint. Horsham Pennsylvania

*Consumer Suggestion: Do send a letter to the collector!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

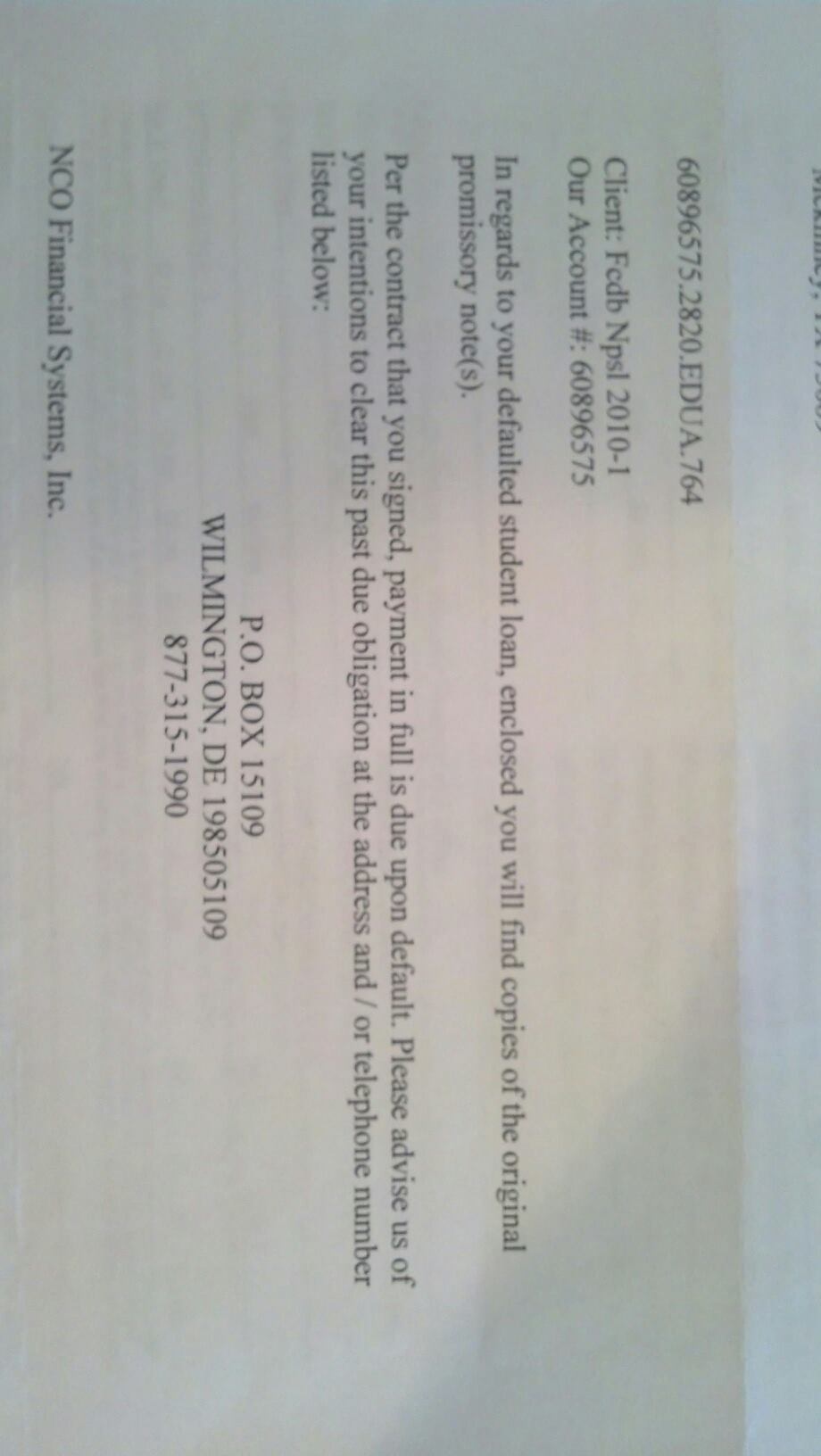

Here was a bill I was sent around January of 2007. After it's listing were some steps I had to take to remedy this apparent falsified bill that everyone seems to be getting these days.

NCO FINANCIAL SYSTEMS INC

507 Prudential Road, Horsham, PA 19044

1-866-372-8498

OFFICE HOURS

8AM-9PM MON THRU THURSDAY

8AM-5PM FRIDAY

8AM-12PM SATURDAY

Oct 9, 2006

CREDITOR: AMERICA ONLINE, INC

ACCOUNT #: 123456789

REGARDING: PAST DUE BALANCE

PRINCIPAL: $ 99.60

INTEREST: $ 0.00

INTEREST RATE:

COLLECTION CHARGES: $ 0.00

COSTS: $ 0.00

OTHER CHARGES: $ 0.00

TOTAL BALANCE: $ 99.60

The named creditor has placed this account with our office for collection.

It is important that you forward payment in full.

If you choose not to respond to this notification, we will assign your account

to a collector with instructions to collect the balance.

To assure proper credit release please put our internal account number ABCDEF

on your check or money order and enclose the lower portion of this letter with

your payment. If you need to speak to a representative contact us at 1-866-372-8498.

Returned checks may be subject to the maximum fees allowed by your state.

You may also make payment by visiting us online at www.ncofinancial.com. Your

unique registration code is ABCDEFGH-IJKLMNO.

Unless you notify this office within 30 days after receiving this notice that

you dispute the validity of the debt or any portion thereof, this office will

assume this debt is valid. If you notify this office in writing within 30 days

from receiving this notice, this office will obtain verification of the debt or

obtain a copy of a judgement and mail you a copy of such judgement or verification.

If you request this office in writing within 30 days after receiving this notice,

this office will provide you with the name and address of the original creditor,

if different from the current creditor.

This is an attempt to collect a debt. Any information obtained will be used for

that purpose. This is a communication from a debt collector.

PLEASE RETURN THIS PORTION WITH YOUR PAYMENT (MAKE SURE ADDRESS SHOWS THROUGH WINDOW)

-------------------------------------------------------------------------------------

LOCAL ADR:1234 N ABCD STREET CITY, ST 12345

LOCAL OFFICE HOURS: 8:00AM-5:00PM MONDAY-FRIDAY

8:00AM-12:00 NOON SATURDAY

_ Check here if your address or phone number has

changed and provide the new information below.

NAME ........................................

STREET ADDRESS ..............................

CITY ............... STATE ...... ZIP .......

HOME PHONE ........ BUSINESS PHONE ..........

Account #: ABCDEF

Total Balance: $ 99.60

YOUR NAME

Payment Amount: _ _, _ _ _._ _

Make Payment To:

NCO FINANCIAL SYSTEMS

PO BOX 15740

WILMINGTON, DE 19850-5740

If you have recently receive a notice like this in the mail, chances are you're yet another unfortunate victim to what appears to be some sort of fradulent activiting going around, even common amongst supposedly "incorporated" online financial entities. Most originating creditors listed on these notices will be AMERICA ONLINE, INC. Not to worry, if you have never had an account with America Online or are confident that you should not have received this debt collection notice, here's what you need to do to bring things back under control:

1. DON'T PANIC - Many unsuspecting citizens have been the recipient of this ordeal. It's nothing new. Just stay calm.

2. STOP - Don't contact NCO Financial Systems, Inc. After all, they were the ones that sent you the bill and they are the ones you are going to file a complaint against (and if you have enough money, time and resources, press charges against). Secondly, don't bother visiting the site that was listed in the notice, www.ncofinancial.com. You will be subject to spyware and/or malware which could infect your computer and possibly validate or confirm the debt to NCO Financial Systems, Inc. which you obviously do not owe. Lastly, don't bother calling the number listed on the notice from an anonymous phone booth. You'll only waste your time calling an invalid number that will ring for a long time and then hang up.

3. CONTACT FTC (877) 382-4357 - Contact the Federal Trade Commission (FTC) and file a complaint. This is very important. As of the writing of this article, you are only asked for your name and basic contact information. Once you have completed your complaint with FTC, you will be highly advised to send a copy of the debt collection notice you received in the mail back to NCO Financial Systems, Inc. with a note attached to it explicitly stating that you do not owe the principal on the notice. It would be good for you to provide a simple reason as to why you don't owe that amount (e.g. you've never had account with AOL before). Be sure to write down the case number you're given over the phone.

4. CONTACT AOL (800) 307-7969 - Shortly after filing a complaint with the FTC, you'll want to notify AOL's Fraud Department of the notice you received in the mail. All critiscms of AOL's poor service set aside, their representatives are courteous and easy to work with. Simply explain your situation and tell them that you received a billing notice from NCO Financial in regards to the principal amount shown that you do not owe. Also state the reason why you do not owe it. They will ask for the account number shown on the notice. This will be located in the ACCOUNT # line. Chances are, 9 times out of 10, the account will register as being valid and that someone did in fact register this account under your name. Sounds like identity theft, doesn't it? Well it happens. Once AOL acknowledges your complaint, they will request a mailing address to send an affidavit form to. Simply fill out this form and send it back.

5. CONTACT YOUR LOCAL PD - If you would like information on the account itself that was set up under your name (for further investigation purposes), you will have to contact your local police department, let them know what's going on and have them call AOL's Fraud Department (the same number) to retrieve the account's information. The police will then act as a middle man and relay that information back to you. Be sure to write down any case numbers you are given by AOL or your local police department.

6. CONTACT BBB - The Better Business Bureau can be of great help in resolving the matter. Follow the links on their site to file a complaint against NCO Financial Systems, Inc. Any contact information that pulls up under NCO Financial Systems, Inc. simply discard. You'll only get in touch with Capital One and get yelled at. Once you've finished going through BBB's website, be sure to write down the tracking number on the final page.

Once you've done that, the weight is now off your shoulders and on that of the Better Business Bureau and the Federal Trade Commission. These are your two biggest intecessors you need to alert when confronted with a problem like this. You will want to make sure you fill out and return the affidavit form that AOL sends you in a timely fashion. Over the phone, they will immediately stop any bills sent to NCO Financial and suspend the offending account's billing cycle that's incurring these charges. By filling out and returning their affidavit form, this ensures that the total principal amount shown on the notice that you presumably owe will be cleared completely so that you won't have to worry about it while the FTC, BBB and your local police department are investigating the matter.

Southwest coders

Chino Valley, Arizona

U.S.A.

This report was posted on Ripoff Report on 10/17/2007 10:47 AM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/horsham-pennsylvania-19044/nco-financial-systems-inc-this-article-took-place-shortly-after-going-through-a-rather-l-279287. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Suggestion

Do send a letter to the collector!

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, October 18, 2007

I disagree with the recommendation to NOT contact the debt collector.

I encourage folks to send a certified, return receipt requested letter to the debt collector to DISPUTE and demand VALIDATION of the alleged debt per the Fair Debt Collection Practices Act. The FDCPA clearly states that the consumer must dispute and demand validation from the collector in WRITTING.

Please Read the Fair Debt Collection Practices Act at http://ftc.gov/os/statutes/fdcpa/fdcpact.htm

Here's the section of the FDCPA about dispute and validation of alleged debts:

809. Validation of debts [15 USC 1692g]

(a) Within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written notice containing --

(1) the amount of the debt;

(2) the name of the creditor to whom the debt is owed;

(3) a statement that unless the consumer, within thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector;

(4) a statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector; and

(5) a statement that, upon the consumer's written request within the thirty-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor.

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

(c) The failure of a consumer to dispute the validity of a debt under this section may not be construed by any court as an admission of liability by the consumer.

Hope this helps.

Advertisers above have met our

strict standards for business conduct.