Complaint Review: Openroad Lending - No Richland Hills California

- Openroad Lending 6616 Davis Blvd. No Richland Hills, California USA

- Phone: 888-536-3024

- Web: www.openroadlending.com

- Category: Miscellaneous Companies

Openroad Lending Bait and Switch Lender No Richland Hills Texas

*General Comment: Not a Scam!

*Author of original report: Aggressive, angry, and energetic in their defense of their actions

*Consumer Comment: Still a scam.

*Consumer Comment: Self serving entry by Openroad lending

*Author of original report: Not True - Circumstances improved

*Consumer Comment: Not BBB Accredited

*Consumer Comment: Don't Listen!

*Consumer Comment: Curious about this company myself.

*REBUTTAL Owner of company: Unmerited Claims

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

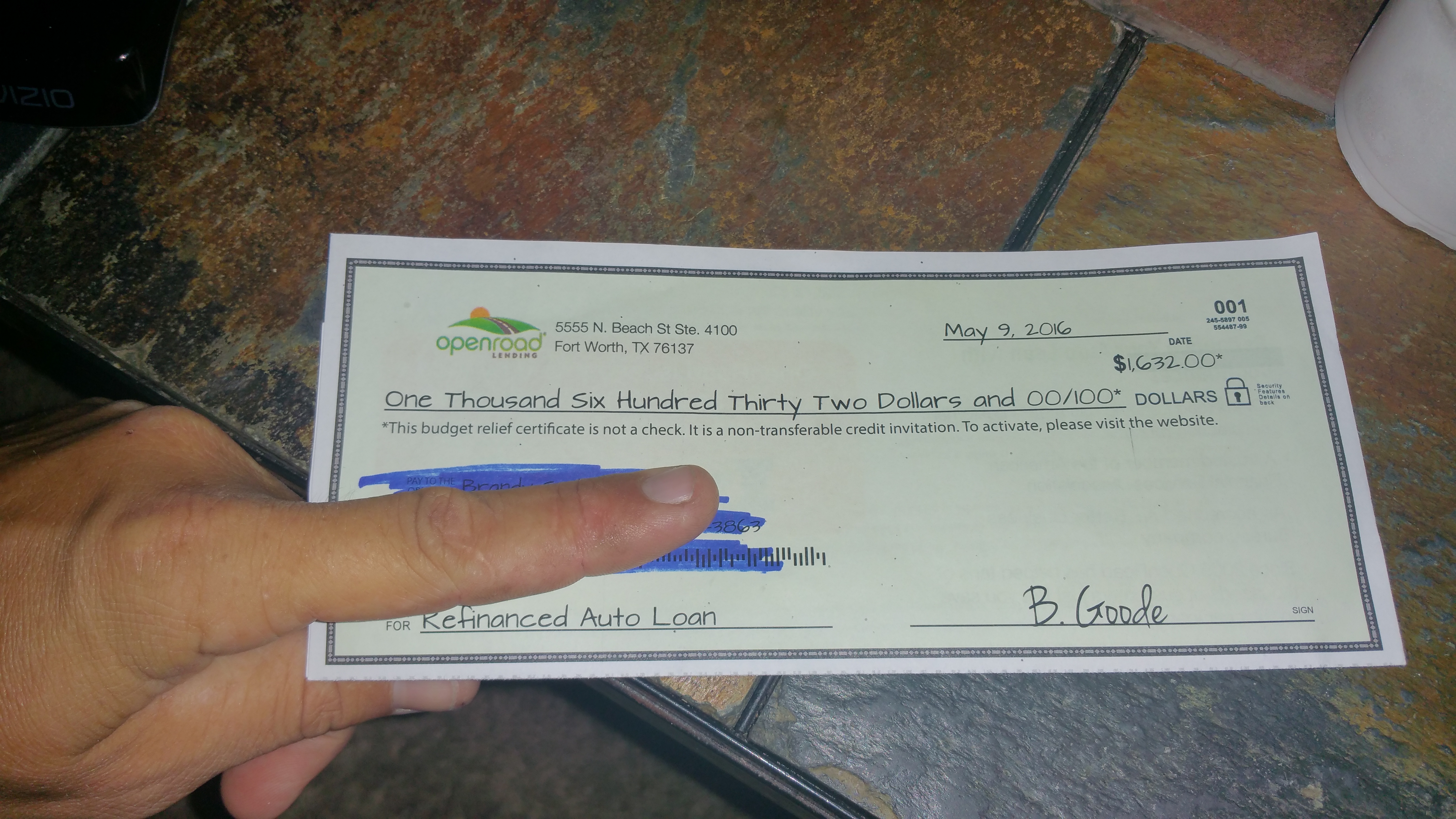

Do not use Openroad Lending! I received a pre-qualified letter from them telling me I'd been approved for a 7.xx loan which would have reduced my current loan rate significantly. But when I applied, they only offered me an 11. something loan. I wouldn't have let them do a credit inquiry if I'd known that they were only offering that rate. I'm due to get that rate anyway on my current loan in August. They did a bait and switch and when I complained and asked them to remove the inquiry from my credit they refused. My credit rating went up significantly in the last month, I have a lot of inquiries on my credit report as I purchased two new cars in the last 18 months, and didn't want any additional inquiries unless I knew I was preapproved. They said that because I'm self-employed that they couldn't offer the rate they stated in the letter. I know I'm self-employed and if I'd seen anything warning me that it was an issue, again, I would not have applied. I think this company is luring people in by offering lower rates and then making up reasons why they no longer offer that rate once you apply. If you talk to these people they talk fast and try to flim flam you. That seems to be how they all work because I spoke to a few other people and they couldn't explain much. If I asked a direct question they would ramble off something that didn't make sence. I think they are crooked and I would avoid using them as a lender. I worked with Jasha Phillips and I think very little of the way she handled the entire issue. Avoid them unless you are desperate!

This report was posted on Ripoff Report on 07/22/2013 11:36 AM and is a permanent record located here: https://www.ripoffreport.com/reports/openroad-lending/no-richland-hills-california-76182/openroad-lending-bait-and-switch-lender-no-richland-hills-texas-1069071. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#9 General Comment

Not a Scam!

AUTHOR: Angela - (United States)

SUBMITTED: Thursday, March 22, 2018

Today is Thursday, Tuesday I received the mailer with the info on my current auto loan and the pre-approval for a lower interest rate and payment. I immediately went to ripoff to see reviews and almost threw the notice away after reading this report. After reading the companies rebuttal I did something I never do, read the terms on the back (with a magnifying glass) and given that I met those conditions, I gave it a shot.

Within 2 hours I got a phone call from Wells Fargo clarifying some questionable notes on my credit. By the end of the day I received a congratualations email saying I was approved at a rate slightly higher than what was on the mailer.

Today, I sent in the final paperwork to close the deal.

In the end... I went from a pymt of 353 at 19% interest with 67 months left on the loan to skipping my next pymt, a new pymt of $319 and 60 months left on the loan. Wells Fargo is the Bank named on the loan paperwork.

Not a scam, you simply have to qualify and given the basic info the credit bureau can provide companies looking to pre-qualify, not everyone will - hence the term PRE-QUALIFY not QUALIFIED!

This customer is happy she didn't give into the negative nellies that didn't get their way and then attacked the company for it!

#8 Author of original report

Aggressive, angry, and energetic in their defense of their actions

AUTHOR: - ()

SUBMITTED: Tuesday, September 01, 2015

Open Road Lending is aggressive in making sure they rebut every negative thing written about them on Open Road. What they don't understand is that regardless of what they say, I had a negative experience in dealing with them. I know that my report was improved and they know they changed the offered deal. In fact, they actually changed the language on the letters they send out based on my complaints.

I did find they were not a member of the BBB and while lots of businesses are not, a business with as many complaints as they have, if reputable, would go to the lengths required by the BBB to satisfactorily address complaints. They do not resolve complaints, just rebutt them.

Maybe Open Road does have good interactions with some customers, but I certainly wasn't one of them. If you choose to do business with this company, make sure you search for complaints on the internet, not just on this site, but elsewhere.

#7 Consumer Comment

Still a scam.

AUTHOR: better than that - (USA)

SUBMITTED: Monday, August 31, 2015

Your company uses fraudulent marketing tactics through direct mail with official sounding titles like " final notice, notice of overpayment. " I believe the Attorney General of Arizona will feel the same after this letter is turned over to their office. If your company is so great, why lie to gain customers?

#6 Consumer Comment

Self serving entry by Openroad lending

AUTHOR: Mkat - ()

SUBMITTED: Monday, April 28, 2014

I read the rebuttal from Openroad Lending regarding the guys credit had changed since the offer letter went out. Hogwash, I received one of these letters as well and came out here yesterday researching the company. Understanding that everyone is capable of having a bad experience I decided to move through and follow up with Openroad. The key here is I am two years since completing a bankruptcy. I purchased a vehicle just over a year ago. My bankruptcy was due to a government lien, which we won't go in to, and all my other bills were up to date. Since coming out of the bankruptcy I have kept all accounts current, mainly my house note and the car I just spoke of. I have not attempted, other than the car, to purchase anything off credit and I carry no credit card debt. I have an above average income, not that I make a lot but it is above average.

In short, I know my credit has dings and have been monitoring it carefully. I have not attempted to purchase anything by credit as I do not wish to pay the inflated interest rate. I purchased the car because I needed one. Not only did Openroad raise the interest rate from the original letter they raised it within 100th of a point of my current interest rate. The actual monthly payment they offered me was higher than my current payment. Can we say J@ck@sses? I can.

Openroad can do business how they want but be forewarned they are a scam. If they bother to send me more fliers I will collect them then find the nearest location and dump them on their front doorstep.

#5 Author of original report

Not True - Circumstances improved

AUTHOR: Linl - ()

SUBMITTED: Tuesday, March 11, 2014

When I spoke to the people at Open Road I found my credit report score was actually higher than the date they issued the offer. They used the excuse of self-employment as the reason to offer a higher rate and I've been self-employed for 15 years. I would ignore offers from this company. They aren't worth the hassle of working with them at the least and seem shifty to me. That is my experience and there is no rebuttal needed because they cannot change my experience of them.

#4 Consumer Comment

Not BBB Accredited

AUTHOR: co1336 - ()

SUBMITTED: Tuesday, March 11, 2014

Please refer to the Better Business Bureau web site that states that OpendRoad Lendings is not a BBB accredited business. Thank you.

#3 Consumer Comment

Don't Listen!

AUTHOR: Thomas C - ()

SUBMITTED: Monday, December 16, 2013

I have seen this same compliant on numberous sites and as a HAPPY OPENROAD LENDING CUSTOMER, I wanted to share the "other" side of the story. I too received a pre-approved mailer from this conpany and the process from start to finish with done top nothce! The customer service was great, I was kept informed through the entire process and was able to end up saving nearly $2,300 over the life or my loan! I think these guys are great and will continue to sing their praises to family and friends.

#2 Consumer Comment

Curious about this company myself.

AUTHOR: anon_in_auburn - ()

SUBMITTED: Friday, November 01, 2013

I too have rcvd an "offer" in the mail, with claims of lowering my interest rate if I refinance my vehicle. I am however, a little skeptical. What's to stop Open Road Lending from using the same excuse with every letter they send out? "Sorry, but you no longer meet the requirements of the initial offer" ... here's a new offer, with a slightly higher rate. Seems to me, that if you provide an offer, with an expiration date, said offer should HAVE to be honored. With the exception of a change in income or job loss.

Personally, in my case, the offer needs to be lower for me to consider switching from my current lender. Who, I might add, have been great and I'm happy with them. Savings of 2.45% from my current loan, just isn't worth the hassle IF this company is in any way a little wishy washy. The potential headaches are not worth it, IMO. 4-5%, maybe I would interested.

As with any company and offer you may rcv, always check them out first. This company does appear to be accredited with the BBB. And I haven't found many online complaints. But it only takes one complaint like this to make potential customers second guess. I for one, will take this as it is and stay with my current lender. :-)

#1 REBUTTAL Owner of company

Unmerited Claims

AUTHOR: OpenRoad Lending - ()

SUBMITTED: Monday, July 22, 2013

We were not able to offer this consumer the rate indicated on thier original offer because her credit rating deteriorated since the original offer was made. Our offer clearly stated that if anything changed in her credit profile, we could withdraw the offer.

We did not choose to do that, but could no longer offer her ther terms originally quoted because she no longer qualifed for that rate. We instead offered her terms that would reduce her current 16% rate to 11% and lower her payment considerably from where it is today. If her credit report had not changed, we would have indeed offered her the original terms quoted like we do everyday for the hundreds of consumers who contact us each day.

To date, we have funded over $250 million in car loans helping thousands of satisfied consumers save on on their car payments with an "A" Better Business Bureau rating. While we have made every effort to satisfy this consumer, unfortunately, you can't always make everyone happy.

Advertisers above have met our

strict standards for business conduct.