Complaint Review: Regions Bank - Orlando Florida

- Regions Bank 12100 Lake Underhill Rd Orlando, Florida United States of America

- Phone:

- Web: www.regions.com

- Category: Banks

Regions Bank Regions Stealing Money Orlando, Florida

*Consumer Comment: If you really want to be smart

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

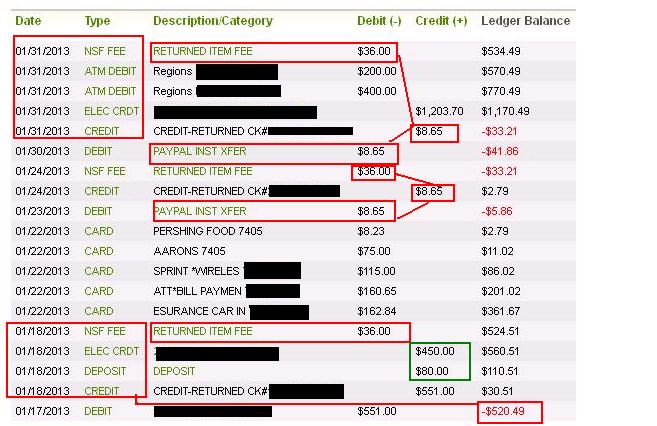

Seems like for the past three years right after Christmas I start giving my money to Regions Bank. So I decided to get smart and add the Overdraft Protection on my checking account, remind you that it was advised by the Bank manager in order to not incur recurring charges. Less than a year later, Christmas Season again... I look at my account and I had a payment returned, overdraft charged, and it hit my account a second time and returned plus another charge to my account. I went to Regions Bank to ask the same individual about the overdraft protection and she stated, "It's not really Over-Draft Protection and it is only helpful if all your accounts are in good standing and how healthy your account is..." Of course I was upset, but being professional was about to leave me because I do not like it when people steal my money and I don't have control over it... So, I said okay and took it as a loss, even though the same had happened some months previously and they covered it... Seems odd though that this happened not in my favor around Christmas, AGAIN! So I set up all kinds of alerts, android app, online app, and internet online banking just so I can monitor my account closer... But that did not work either because the same Bank manager told me, "what I see on my screen is actually 24 hours behind what the bank is able to view... So, if you (as I have learned), see an indication in PENDING activity consider it TOO LATE to do any thing... Case and Point, a check hit my account, I was short the funds because another payment hit my account I totally forgot, So I ran to the Bank and added the funds, by the close of business my account was showing $9.58 in the POSITIVE... next morning I recheck and I was -$156.58 in the hole. REALLY!!! I called online banking then the bank and I was told the same again... what I see as a customer is actually 24 hours behind what the bank sees... so the check was returned.. Overdraft protection ~ not really!!! This week NetFlix hit my account and took my account in the NEGATIVE by $5.86, I got charged an overdraft twice for a total of $72.00 one of which happened on my payday and still charged the fee and cleared the check.... This Bank is so sorry! Do Not Do Business with them... If you do not catch them with their errors, they say it is too late and will not do anything to correct it.... Some body help me, I so much more to say about this bank...

This report was posted on Ripoff Report on 02/01/2013 08:22 AM and is a permanent record located here: https://www.ripoffreport.com/reports/regions-bank/orlando-florida-32825/regions-bank-regions-stealing-money-orlando-florida-1007221. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

If you really want to be smart

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, February 01, 2013

YOU need to manage YOUR accounts better and don't attempt to spend more than YOU have available.

Do you notice the key word in that statement just made? Well if you haven't let me give you a hint..YOU.

It really is simple. The first thing is to get an register to write down ALL of your transactions as you make them. If you don't have a register you can find them on line to download for free, or even if you go into the bank they will be more than willing to give you one..all you have to do is ask. Even just a simple piece of paper would do if all else fails.

On-Line/Phone/ATM statements were never meant to be the way to manage your accounts because they only know what they have received. By your one example you had written a check. The bank won't know you have written the check until they receive it, which could be anywhere from 1 to 7 days later. So if you go using your Debit Card or write other checks because you "thought" you had the cash, when the check is deposited...unless you keep track of your transactions you may not have enough money to cover it. If you write EVERY transaction you make it is 100% impossible to forget what you have spent.

As for Overdraft Protection. There are several types. The basic is where your debit card is used and does not have enough protection. If you have the standard protection, if you attempt to use your debit card they will allow the debit to go through..and charge you an OD fee(usually around $30-$35 each it). For Checks/ACH transactions they still have the option to accept or return the check unpaid.

The next level of protection is when your account is tied to another "backup" source. This could be something like a Savings Account, Credit Card, or some other line of credit. In this case anytime you don't have enough money in your account the bank will transfer(for a much smaller fee usually $5-$10 for everything that comes in on a single day) enough money from this alternate source to cover the deficit. They will continue to do this until your backup funds are depleted or reached their limit.

If you have made a purchase or write a check you must treat that money as spent. Regardless of how long you think it would be before it is actually withdrawn. If you try to play this "game" of floating funds..you are going to eventually loose.

You also need to be aware of the Funds Availability Policy for deposits. This is where you can make use of On-Line banking as it will show you when your deposits are actually available(not just pending). As depending on the source of the deposit the funds may not be available right away..in some cases it could be 1-2 weeks(although that is a very small percentage of cases).

So while you will probably ignore everything said here and come up with 1000 excuses why you should not have to keep a register. If you really want a solution then in the end using a register and not spending more than you have available is what is really going to make you smart and avoid these fees. Oh and this goes for ANY bank.

Anyways there is your Checking 101 lesson..now back to your regularly scheduled programming of being oblivious to your responsibilities.

Advertisers above have met our

strict standards for business conduct.