Complaint Review: State Farm Insurance - Atlanta Georgia

- State Farm Insurance P.O. Box 106169 Atlanta, Georgia United States

- Phone: 480-636-3700

- Web: Www.statefarm.com

- Category: insurance, Insurance Agencies, Insurance Companies, Landlords, Rips off Insurance agents with fake promises

State Farm Insurance State Farm Insurance, State Farm Fire Claims Department, Homeowners Insurance, Liability Insurance, Premises Liability,Personal Injury, Bodily Injury Bad-Faith Insurance Practices Atlanta Georgia

*Author of original report: OPORTUN INC.

*Author of original report: “TOUGH IN A DOWN ECONOMY, TOUGH ON EMOTIONAL HEALTH “

*Author of original report: TOUGH IN A DOWN ECONOMY, TOUGH ON EMOTIONAL HEALTH

*Author of original report: The Dangers of meter tampering and the effects on the human system

*Author of original report: TOXICOLOGY TESTING AND NEUROLOGICAL TESTING

*Author of original report: MALICIOUS HARASSMENT, SEXUAL, PSYCHOLOGICAL ABUSE and BULLYING

*Author of original report: Supporting Documentation

*Author of original report: False Report Of Drivers Record of Duty

*Author of original report: Landlord Harassment and Illegal Eviction Notice

*Author of original report: Department Of Health Care Services (PI) Program Third Party Liability Recovery Division

*Author of original report: STATE FARM OPEN CLAIM NOVEMBER 2015-OCTOBER 2017

*Author of original report: Claim Documents

*Author of original report: CDI RESOLUTION

*Author of original report: Resolution 11/20/17

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

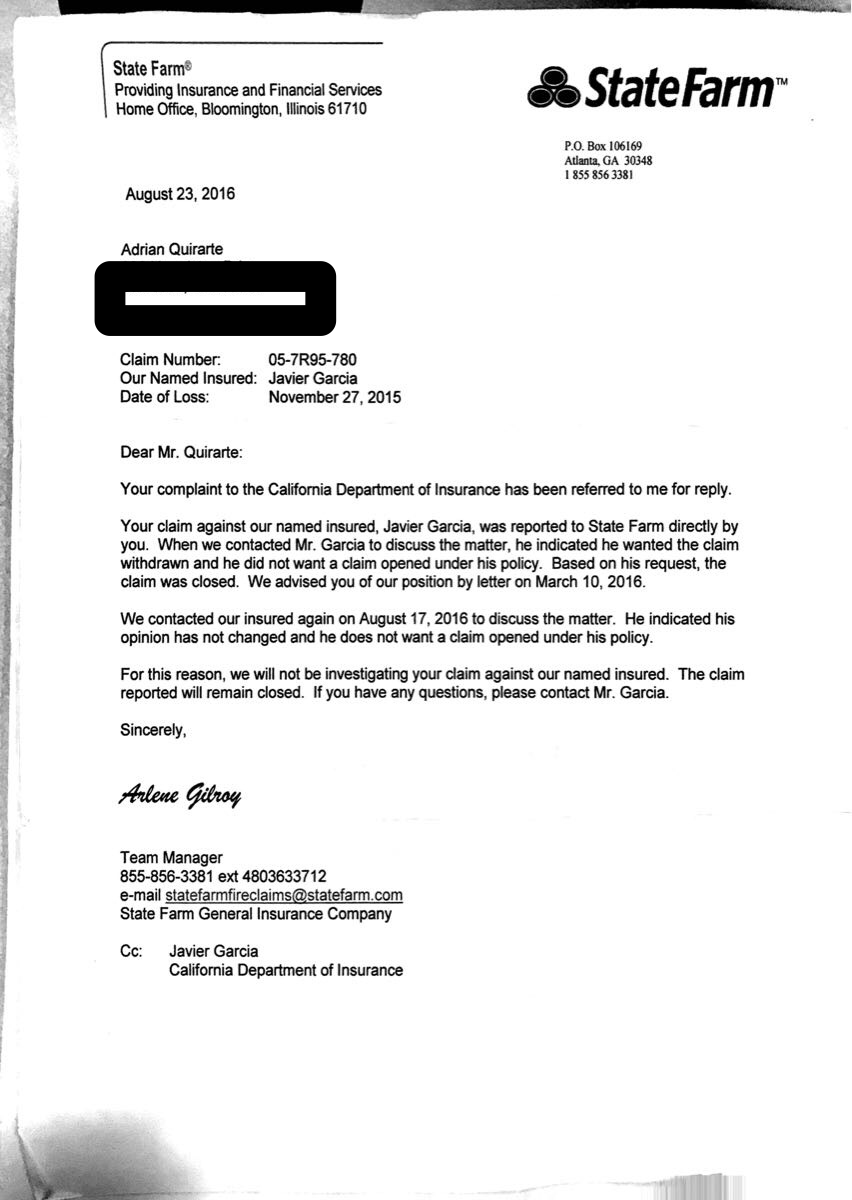

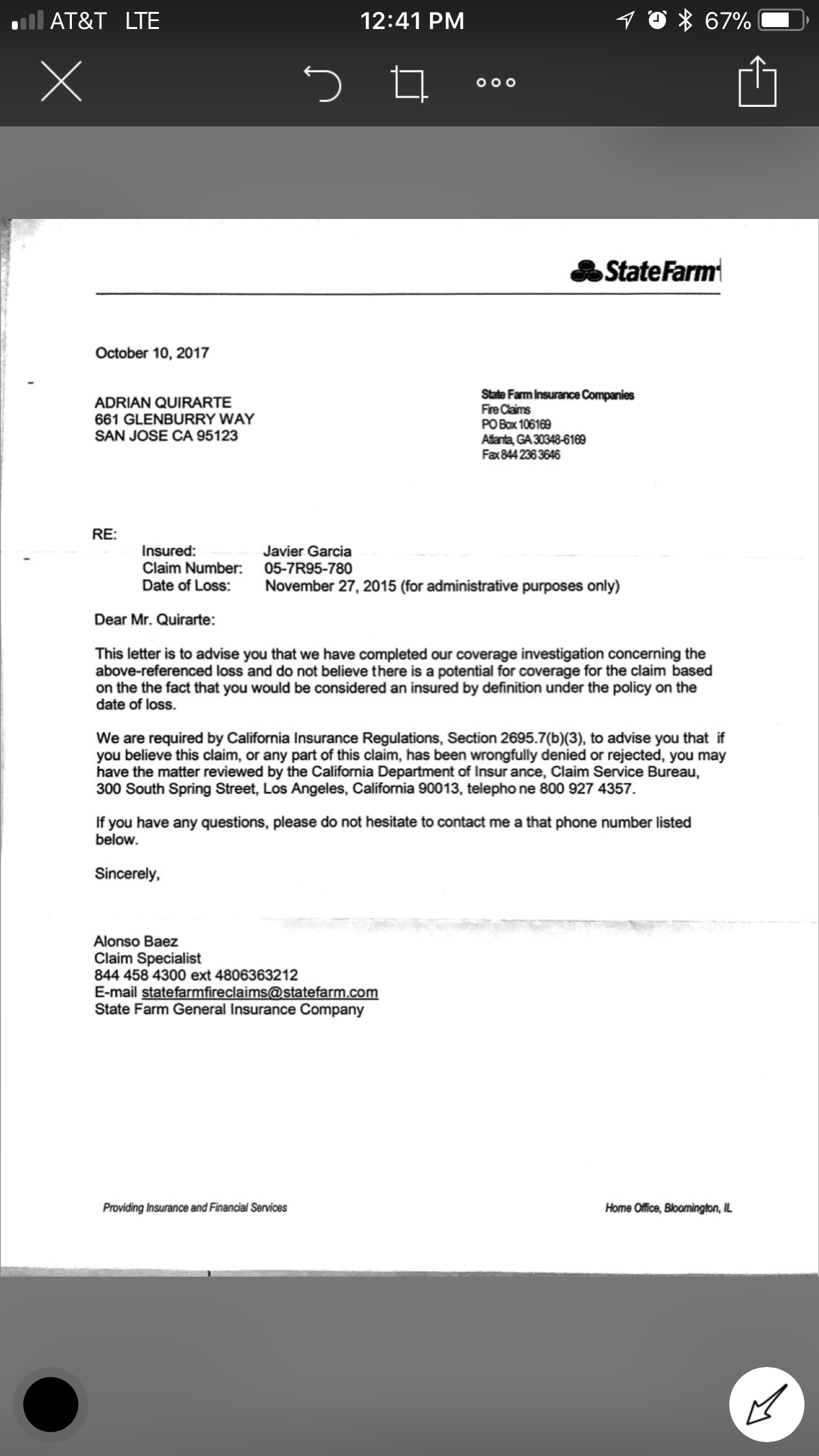

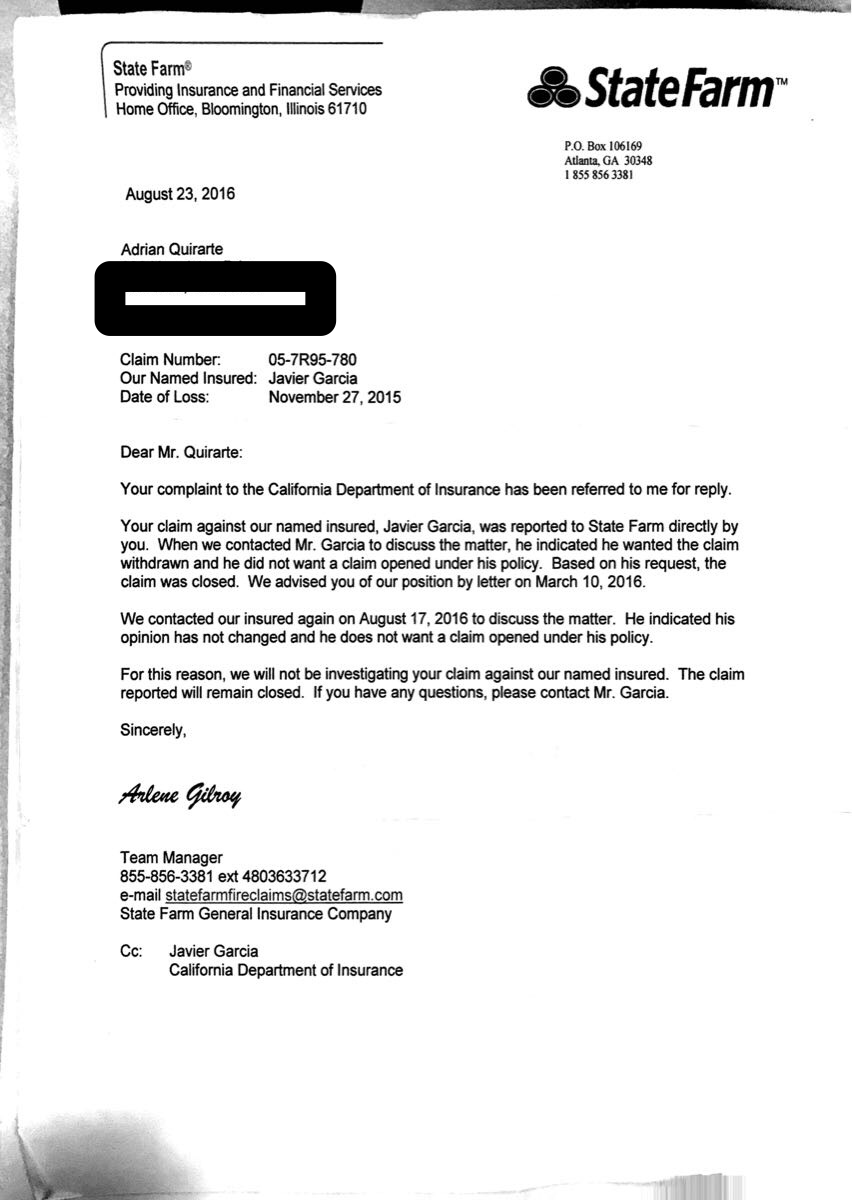

November 13, 2017 California Department of Insurance Claim Service Bureau 300 South Spring Street Los Angeles, CA 90013 I would like to update an existing complaint for further review with The California Department of Insurance addressing State Farm Insurance’s negligence for a personal injury claim on the insured property, 661 Glenburry Way San Jose CA, that was opened on the insureds policy, Javier Garcia, in Nov. 27th 2015. In a notification by letter dated September 18, 2017 State Farm Insurance responded to a complaint I made with The California Department of Insurance regarding bad-faith insurance practices addressing my frustration with the lack of acknowledgement and response from the agency since the date of loss. In the letter they informed me that a second claim had been opened in error with the incorrect date of loss, November 27th 2014 which would have surpassed the 2 year limitation to pursue the claim and to disregard the error. In the letter they also indicated that the reason for their inability to reply properly and conduct a prompt, fair and throrough investigation and effectuate a reasonable evaluation of damages as a result of the insureds liability was due to the insureds instructions to State Farm that he did not want a claim opened or investigated under his policy since the initial filing date and had since changed his position and allowed a claim to be opened and investigated. I was given partial information about Mr. Garcia’s policy which includes Medical Payments Coverage for medical expenses incurred as a result of an accident and that coverage was not available to me as I was a resident of the insured location at the time of the incident and indicated that it can only be applied to a person on the insured location with the permission of the insured or to a person OFF the insured location if the person is an "employee” and if the bodily injury arises out of a condition on the insured location caused by the activities of by their insured. My claim had been partially denied.

I replied to State Farms representative handling my claim, Alonzo Baez, that their insured, Mr. Garcia, was involved in the incident and to please investigate further and advise me in writing whether Mr. Garcia contends that anyone other than himself may be in whole or in part legally responsible for the accident on the premises since they failed to promptly provide a reasonable explanation denying coverage for injuries that had been committed on the insured property, deviating from standard procedures, delaying a settlement in good faith when it was apparent no investigation had taken place. Alonzo Baez, the State Farm Representative, replied to my inquiry although he initially sent the letter to the wrong address, the address of the insured, Javier Garcia, 661 Glenburry Way San Jose CA. He informed me of the mistake by telephone and advised me in advance that the letter in transit indicated that upon further review, State Farm made a mistake and declared their insured and property did not have any liability coverage. He apologized for mistakingly sending the letter to Mr. Garcia’s address. I informed the representative that due to the lack of coverage for their insureds negligence causing bodily injury on the insured location that it was important that he address in his letter following their investigation, once again, if their insured contends that anyone other than Mr. Garcia is in whole or in part legally responsible for the acts committed resulting in bodily injury since State Farm delayed and failed to affirm or deny coverage within a reasonable amount of time.

In response, State Farm replied: "We are willing to consider any additional information you feel may impact our decision. We are required by California Insurance Regulations to advise you that if you believe this claim, or any part of this claim has wrongfully been denied or rejected, you may have the matter reviewed by the California Department of Insurance, Claim Service Bureau, 300 South Spring Street, Los Angeles, California 90013.” I have attached documentation that supports my complaint is fair and further attention to this matter is reasonable and should be held accountable for their violations of unfair, deceptive practices and non-compliance with state law COMPLAINT FILED OCT. 2017 California Department of Insurance Claim Service Bureau 300 South Spring Street Los Angeles, CA 90013 Claimant ,Adrian Quirarte, brings this complaint to the California Department of Insurance for review of bad-faith insurance practices including the failure to take proper actions as mentioned below by State Farm Insurance Company. A claim had been submitted to State Farm Insurance for an incident involving personal injury as a tenant on the policy holders premises, where the landlord was severely negligent for the failure to inspect or repair dangerous and unsafe conditions when the hazards present were directly associated with landlords employment as a trailer driver and reported to The Federal Motor Safety Administration for being in regulatory non-compliance and to State Farm Insurance for property damage and personal injury dated November 27th 2015- March 4th 2016. The damage was presumptively intentional and foreseeable. When I first spoke to a claims representative I was assured that a member of the team would review the claim and that as a third-party/tenant, I had a legal right to pursue a claim due to mere negligence or refusal to remove the dangerous factor; however when the appointed representative contacted me, I informed him I was a third party making a claim on the landlords homeowners policy and from there he made absolutely no effort to return my calls, properly investigate the claim , investigate witnesses involved, failed to investigate the property and failed to acknowledge receiving photographs of injuries or any documents that were pertinent to the claim proving severe injuries and landlords liability.

I informed the Agent that the policy holder was a trailer driver and on route making deliveries about 3 weeks out of the month and that I needed their co-operation because there was very little that would persuade the landlord to accept liability even if it meant breaking the law. State Farm should have told the insured that they must report all matters which may result in a claim. If they fail to do so, they’re in violation of the policy conditions (possibly insurance fraud), and the insurance company could deny the claim should it turn into a legal matter. State Farm should not have given the landlord the option to deny the claim when they should have investigated the property since landlords are legally responsible for the failure to keep tenants safe from dangerous conditions on a property or safe from criminal activity and not create defenses for the allegations. Reviewing policies, it is to my understanding that the insured is required to promptly report all losses.

It is possible that the agent advised the insured that he may be liable for more than the policy limits. I have a statement from a court report that was given to a judge for a family matter in June 15 2016, that the landlord and policy holder, Javier Garcia, mentioned in court that the insurance company told him that my claim was worth 250,000.00 but that he closed the claim because again he denied liability and did not want a settlement out of his policy. I personally was never told by the agents that my claim with worth X amount, barely even being given the claim number at times. Bad-faith was committed when the agent(s) have been giving both the third-party and landlord the wrong information. Protecting the landlord would mean handling an honest claim giving the right information to the insured and protect both the policy holder and the insurance carrier because the tenant can then file a personal injury lawsuit or claim against the landlords insurance company or insured for medical bills, lost earnings, pain, physical suffering, permanent physical disability and disfigurement, property damage and emotional distress. The insureds homeowners coverage carries coverage for liability to tenants or third-party injuries on premises and property damage, but State Farm insisted they are not responsible for a claimant’s allegations due to the policy holders misreporting which was both known by the policy holder and the insurance company that was done in bad-faith..

State Farm shortly misinformed the policy holder, the landlord, who failed to exercise reasonable care and maintain the property safe for tenants, and took the claims advisors advice that there would be no penalty for misrepresentation of facts or denying liability and gave the policy holder the option to close the claim without investigation to avoid having a settlement out of his policy or run the risk of being sued in court funding their own defense and settlement. With all the information present, the agent(s) had separate duties to follow up with an investigation or report the claim information given to the insurance carrier whether or not there was liability. Each Agent that I spoke to on the phone had absolutely no information on the claim and kept transferring me to several agents who eventually had no answer or hung up on me. I would be transferred or placed on hold for nearly an hour on each phone call.

There was several. The Agent(s) inconsistency, lack of knowledge of the claim and failure to report or withholding facts, statements, circumstances or information to the insurance company would mean violating the companies policies, committing bad faith when there is a risk the third party can then sue, the insured and State Farm, who should be protected by its agents and given the correct advice; which they should then not expect to receive any defense or indemnification for their insured in court. I recently decided to re-open the claim because I have several losses, pain and suffering, relocation expenses, damaged property, medical bills and further treatment. I am currently undergoing additional examinations by specialists to provide further information and evidence about the accident. Recently I tried to pursue the claim again, State Farm in bad-faith and possibly illegally, took my social security number this time around and I assumed it was for my profile or claim like I was told, however it was later discussed that it was to access my hospital records. I told them that I did not consent to give them access to my personal information without the advice of an attorney and to remove my social security from their system. They said they did not have the ability to remove my social security from their system, and that if I have an attorney, that they could no longer discuss my claim, that all information including the misuse of my social security without my authority could only be released to my attorney and hung up on me.

When I told my doctor what State Farm did, she informed me that State Farm did not have the authority to access medical records without a signed consent form and that I should get help from an attorney. After informing them that I was going to file a report to the California Department of Insurance, State Farm sent me a letter: "Dear Adrian Quirarte: Please contact us within 20 days if you wish to pursue this claim. We will close your claim if we do not hear from you within the time requested. Please be advised no action for your loss can be initiated against our insured unless the action is filed within 2 years after the date of the incident.” Bad-faith was committed when the claim number for the claim was changed ( I was told each time before that a claim number could not be changed because it would result in a duplicate claim), and the date on the letter reports that the incident happened 11/27/14 not 11/27/15 being past the statue of limitations for an insurance claim, however i have several letters and documents that provide proof that the incidents began in November, 27, 2015. I would like to the California Department of Insurance inform me what they can do for me in this situation. I understand that this is quite a long report, but please understand I have been documenting this since late 2015. If needed I can provide letters, documents, photographs, audio recordings, video recordings, medical summaries as of the result of the landlords behavior. This letter has been written as a response to the letter that was just sent by state farm, indicating they could not discuss any information with me about the claim without an attorney, including the misuse of my social security number and changing the incident date on the last letter received by State-Farm dated August 21st 2017. 2015 Claim: 05-7R95-780 Tony Mayhew 855 856-3381 EXT 4806363271 2014 Claim: -050593-W45 Jeffery Conarton Claim Specialist 844 458-4300 EXT 4806363230 FAX 844 236-3646

This report was posted on Ripoff Report on 11/19/2017 01:17 PM and is a permanent record located here: https://www.ripoffreport.com/reports/state-farm-insurance/atlanta-georgia-30348-6169/state-farm-insurance-state-farm-insurance-state-farm-fire-claims-department-homeowners-1412622. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#14 Author of original report

OPORTUN INC.

AUTHOR: ADRIAN QUIRARTE - (United States)

SUBMITTED: Wednesday, December 18, 2019

August 8, 2019

U.S. Department of Labor

Acting Secretary of Labor Patrick Pizzella

OFFICE OF THE SECRETARY S-252

200 Constitution Ave. NW

Washington, DC 20210

Mr. Secretary,

I am aware that you have been assigned as the acting Secretary of Labor since July 20, 2019, following the resignation of Alexander Acosta. In the preceding weeks, I have been trying to investigate the best way to go about this matter.

My place of employment located in La Tropicana Shopping Center has been deemed to be a blight on San Jose, a breeding ground for illegal trades moreover the sale of fake immigrant documentation. It has been labeled as "Anti-American" as counterfeit social security numbers and IDs have been allowed to be marketed and sold for years. It has been an "open secret," the trade of fake and counterfeited identities marketed daily outside La Placita Tropicana Shopping Center, that had been operating much longer before I began my employment.

My employer, Oportun Inc., is CDFI Certified. MetaBank and Member FDIC issue Oportuns Ventiva prepaid Visa Card. Oportun Inc. fails to acknowledge that the trade of counterfeit goods of all levels is a threat to National Security. Mr. Secretary, it was not my intention to be permanently associated with National Security affairs when seeking employment with Oportun Inc., commencing by only asking questions on Oportuns in-house policies on unpaid wages to support other employees who had also not been paid.

Making inquiries to Oportuns Executive Management and Oportuns Payroll Department concerning the location of Federal Labor Law and Employee Rights Posters, I was not given a trustworthy explanation. There is no "Kitchen Area" at my place of work inside La Placita Shopping Center.

Oportun employees who worked inside the shopping center were asked to eat in their vehicles, while employees at other Oportun locations were not. Furthermore, there is no exterior signage for Oportun Inc. outside La Placita Shopping Center. I had suggested to Oportuns Executive Management that not having cameras inside provided by the employer or outdoor signage to let others know our exact location in the event of an emergency formulated a "Manufactured Crisis." Oportun, with the help of outside counsel, disputed this.

August 1st, 2018, Oportun Inc. responded to the Department of Industrial Relations as taking "no adverse employment actions" against me for reporting such activities. A qualified executive would be fit to describe an adverse action as an action that would dissuade any rational employee from raising concerns about a possible violation, and because an adverse employment action can be subtle, it may not always be easy to spot.

Oportun Inc., with the help of outside counsel, managed to persuade the California Department of Industrial Relations that I had no reason to believe that an adverse employment action against me had taken place. Oportun Inc. further commented that due to the nature of my complaints, I "was easily identifiable.” Expanding on Oportuns sense of adverse employment actions, The U.S Department of Labor defines retaliation including the various types of adverse employment actions as the following:

- Firing or laying off

- Demoting

- Denying overtime or promotion

- Disciplining

- Denying benefits

- Failing to hire or rehire

- Intimidation or harassment

- Making threats

- Reassignment to a less desirable position or actions affecting prospects for promotion (such as excluding an employee from training meetings)

- Reducing pay or hours

- More subtle actions, such as isolating, ostracizing, mocking, or falsely accusing the employee of poor performance

- Blacklisting (intentionally interfering with an employee’s ability to obtain future employment)

- Constructive discharge (quitting when an employer makes working conditions intolerable due to the employee's protected activity)

Oportuns Executive Management has firmly maintained its position that I had not undergone any adverse employment actions. If I had not been Suspended or Terminated from my employment, Oportun Inc., in "good-faith," had presumed I was actually was treated more favorably than other workers by giving me a raise of .28 cents. This was all done following my leave of absence.

Oportuns lack of response and disregard to my grievances continue to be an element of malice, recklessness, and insensitivity to obstruct any future compensation owed by the employer for a workplace injury. Oportun never took into account how their strategies would affect both my health and employment opportunities in the future.

Oportun has forced me into self-publication and self-defamation having to disclose to third parties, case-managers, housing specialists, doctors, therapists the details leading to unemployment, which remain in Oportuns view "Vague and Bizarre.” From an outsider's perspective, Big Government would deem this reasonably as "silencing a witness." This should not happen to American Workers who are simply innocent bystanders witnessing illegal activities.

Oportun and it's executive management have failed to acknowledge "Anti-Retaliation"provisions that an employer, such as Oportun, can effectively retaliate against an employee by taking specific actions not directly related to his or her employment and cause him or her harm outside the workplace.

My workers' compensation claim for cumulative psychiatric injury as a result of the uncommon working conditions at my place of employment is still pending. Most importantly, it is a common strategy for insurance carriers to delay or deny claims which can then be used as an excuse that loss of housing or other unexpected phenomena was the main contributing factor in causing psychiatric disturbances in their defense to deny payments and overall liability. In 3 months I am potentially facing homelessness.

Mr. Secretary, I ask if you can forward my concerns to the right departments within the U.S Department of Labor, I would be forever grateful, as I may not be able to do so myself with such limited resources and limited time. If you could forward this letter to Mr. Trump, that would also give some relief. As a Young Hispanic Conservative, a strong Trump supporter, a strong supporter of The Administration & Living in Californias 19th Congressional District; one could guess how dangerous it could be going up against egregious employers who cater to the underserved Hispanic community.

My Employer, Oportun Inc., has made contributions to both California Governor Gavin Newsom & The California Secretary of State, Alex Padilla. My foreknowledge of the activities that took place at my place of work leading to a leave of absence following the complications going through the California Workers Compensation System, I do not perceive this to be merely coincidental or "bad luck."

I understand WHD targets low-wage industries because of its geographic area, high rates of egregious violations, the employment of vulnerable workers, and the rapid changes in an industry such as growth or decline. The biggest problem my employer is now facing. ICE raids.

I have already made a complaint to my employer, Oportun Inc., that reckless publications of ICE Raids should not be motivated by an employer's improper desire to manipulate a pending labor dispute, retaliate against employees for exercising their labor rights or otherwise frustrate or obstruct the enforcement of labor laws.

I have also suggested to Oportuns Defense Attorney, Mark Thorndal, that my employer had an obligation to address the forms they had submitted to the OMB ( Office of Management & Budget) accurately. I added, that if there is NO "kitchen area" at my place of employment ( La Placita Tropicana Shopping Center 1690 Story Road Suite C+D), the employers Senior Benefits Manager, should not fill that space with a false location and send it off to a Federal Agency.

My employer, Oportun Inc., continues to be preoccupied with its opinion that my concerns about safety at my place of work being unsafe to have "no merit" to further deny my claim for cumulative injury, which you can see in the records provided.

As the Deputy Secretary of the U.S. Department of Labor, I am most certain that Mr. Trump has made an exceptional nomination to advance the rights and interests of all people including American workers.

SINCERELY,

AUTHOR: ADRIAN QUIRARTE - (United States) FOUR MONTHS after beginning employment with Oportun Inc. is when I had started to write to Executives that I was observing a lack of support by one of Oportuns highly ranked senior employees while in COACHING. I had raised my ANXIETIES having inquiries about Oportun clients' IDENTIFICATION DOCUMENTS (e.g., ISSUE and EXPIRATION DATE, NATIONAL IDENTIFICATION NUMBERS) that were presented to me; DRIVERS LICENCES, STATE ISSUED IDENTIFICATION CARDS, BIRTH CERTIFICATES, SOCIAL SECURITY CARDS, GREEN CARDS, FOREIGN PASSPORTS, CONSULAR IDENTIFICATION CARDS, and other UNSPECIFIED DOCUMENTS that may be ACCEPTED or REJECTED.

WHEN EXAMINING THE VALIDITY OF IDENTIFICATION DOCUMENTS that had been presented to me, such as MISMATCHING or COUNTERFEIT identification documents, I was given VAUGE and UNRELIABLE ANSWERS, although Oportun employees were highly aware that many of these identification documents had been FOREIGN to me before working for Oportun Inc.

ON THE DAYS that I worked alone with a separate Oportun Loan Officer, Cesar Lopez, he would ask me every morning starting our shift, "HOW was your day with Nadachelli?" ( the discussions I had with both employees had been PREDOMINANTLY IN SPANISH, and the CRITICISM I RECEIVED made practice more COMPLICATED.)

AFTER THE QUESTION became a routine every morning, Cesar Lopez then suggested that after reaching my monthly QUOTA then pass all future loans to the other Loan Officer, Nadachelli Davalos; more specifically the applicants with whom I had already gone through the entire loan process, had been approved and waiting to pick up their method of payment, a check issued by a Mainstream Bank or an Oportun Prepaid Debit Card. With this approach, it would BOOST both the highly ranked senior employees and store PRODUCTIVITY, reaching the HIGHEST TIER possible for both senior employees and HIGHER PAYCHECKS.

WHEN BOTH Nadachelli Davalos and I worked together, on almost every occasion, I would hear the senior employee, Nadachelli Davalos, guide consumers through the SCREENING PROCESS; moreover, she would instruct her clients not to provide their PERSONAL BANKING INFORMATION over the TELEPHONE due to ILLEGAL and SUSPICIOUS ACTIVITIES including FRAUD and IDENTITY THEFT since some of Oportuns CALL CENTERS are located in MEXICO.

OVERHEARING THIS INFORMATION established an uneasy feeling as an Oportun employee, given that "IN THE HISPANIC COMMUNITIES, RUMORS TRAVEL FASTER THAN FACTS." I have NEVER worked for an employer, where the exchange of that kind of information for PURPOSEFUL SABOTAGE or FRAUDULENT MANIPULATION of our operations had been so CASUAL.

I MADE EFFORTS to raise my concerns to Oportuns Executives using reasonable judgment. Oportun Loan Officers who engaged with consumers the most, could suffer direct losses from that TYPE OF ACTIVITY, SUFFER SERIOUS HARM OR VIOLENCE by taking the blame for the Corporation's reliability and our FIRST IMPRESSION with clients.

THE FAILURE to follow protocol when interacting with customers for any purpose by other Oportun representatives that were not as skilled under the company's standards; would be expected to result in immediate employment termination, and quite the contrary, those who had involved themselves in QUESTIONABLE ACTIVITIES ADVANCED TO LEADERSHIP positions who have a notable PAY INCREASE.

AUTHOR: ADRIAN QUIRARTE - (United States) I RAISED MY CONCERNS to Oportuns Company Trainer, Banessa Felix, concerning the ACTIVITIES I had WITNESSED at the Oportun Almaden (201 Willow Street San Jose) Store.

I HAD EXPLAINED that when both Nadachelli Davalos and I worked together, on nearly every occasion, I would overhear the senior employee, Nadachelli Davalos, guide consumers through the SCREENING PROCESS; moreover, she would INSTRUCT her clients not to provide their PERSONAL BANKING INFORMATION over the TELEPHONE due to ILLEGAL and SUSPICIOUS ACTIVITIES including FRAUD and IDENTITY THEFT since some of Oportuns CALL CENTERS are located in MEXICO.

I HAD OBSERVED this strategy as an everyday habit so that the SENIOR LOAN OFFICER could TRICK Oportun Clients into giving her their PERSONAL BANKING INFORMATION so that she could enroll each one individually in AUTOMATED CLEARING HOUSE (ACH) PAYMENTS, moreover that this Senior Employee was VERY COMPETITIVE, UNWILLING to support new employees in training.

I HAD ALSO SUGGESTED to the company trainer and other employees, that when working for past employers in the telecommunications industry; an extremely COMPETITIVE MARKET that any ILLEGAL or SUSPICIOUS ACTIVITIES by their OUTSOURCING PARTNERS OVERSEAS was unheard of.

THE CALL CENTERS who may be in other places such as the Philippines, and who act on behalf of THE COMPANY, I had never heard stories of an incident that could subject that CORPORATION, to MONETARY LOSS, SIGNIFICANT LEGAL LIABILITY, REGULATORY SCRUTINY, and REPUTATIONAL HARM.

Banessa Felix answered my concerns that "THEY KNEW WHO IT WAS AND THAT THEY WERE LOOKING INTO IT BECAUSE THEY HAD ALSO HEARD IT FROM ANOTHER EMPLOYEE." Although the Misconduct reported adversely effected the BUSINESS REPUTATION, the employee quickly PROMOTED TO A LEADERSHIP POSITION.

WHEN I INQUIRED about the OPORTUNS COMPANY POLICY on UNPAID WAGES for other employees who had also not been paid, Maria Aranda, in the PAYROLL DEPARTMENT, praised me by answering, "I WAS VERY KNOWLEDGEABLE AND WAS IMPRESSED WITH MY WILLINGNESS TO HELP OTHER EMPLOYEES." Maria Arranda further suggested that I apply for the LEADERSHIP POSITION and that I could use both Maria Arranda, from the Payroll Department, and use a CORPORATE EXECUTIVE, Jaziel Velez as REFERRALS.

FOR SOME OBSCURE reason, I never received a response from the payroll department, who had also urged me to INVESTIGATE OPORTUNS LABOR LAWS BINDER AT MY WORK LOCATION, after Maria Arranda had claimed: "THAT ALTHOUGH SHE DOES PAYROLL, SHE IS UNAWARE OF ALL THE STATE LAWS REGARDING PAYROLL BECAUSE SHE HAS MANY JOB DUTIES."

I DISCOVERED from another Oportun employee, Lina Mejorado, that Maria Arranda in Payroll had PRIVATELY told her that "SHE WAS RELUCTANT TO SPEAK TO ME REGARDING THE COMPANIES POLICY ON UNPAID WAGES BECAUSE I COULD GET HER OR THE COMPANY IN TROUBLE."

EXPRESSING DISAPPOINTMENT with my place of work and choosing to TAKING A LEAVE OF ABSENCE, Oportun made a STATEMENT on RECORD that I had been "PAID A BONUS I DID NOT DESERVE", moreover that I was paid the Bonus TO PROVE that I WAS TREATED MORE "FAVORABLY" THAN OTHER EMPLOYEES, by also giving me a RAISE OF .28 CENTS.

HAVING AN EXTENSIVE WORK HISTORY, PAYING EMPLOYEES OUT OF "FAVORITISM" can easily be SEEN BY OTHER EMPLOYEES as a FORM of DISCRIMINATION, HARASSMENT, or any "ILLEGAL BEHAVIORS (INSIDE OR OUTSIDE OF EMPLOYMENT)", besides VIOLATING COMPANY POLICIES or EMPLOYMENT CONTRACTS — all which OPORTUN INC DENIES.

FOLLOWING MY LEAVE of absence from Oportun Inc. on APRIL 4,2018 from CUMULATIVE STRESS, I got an FMLA Form from Oportuns Human Resources Department. The FMLA FORM had specified that the FMLA NOTICE TO EMPLOYEES was located in the "KITCHEN AREA."

THE HUMAN RESOURCES Senior BENEFITS Manager for Oportun Inc., Alberto Trejo, had named the BLANK SPACE with a FALSE LOCATION and sent it ELECTRONICALLY to a FEDERAL AGENCY (OFFICE OF MANAGEMENT AND BUDGET).

THE BUREAU OF FIELD ENFORCEMENT OFFICE was also able to confirm that the LEGAL REQUIREMENTS of the NOTICE I had been asking about (DWC-7) was also to be placed in a CONSPICUOUS PLACE where "ALL EMPLOYEES COULD SEE IT."

THE BFE had advised me to CONTACT my workers' compensation claims examiner, inform her that the ABSENCE of FORM DWC-7, there are ADDITIONAL RIGHTS to employees who have filed a claim for WORKPLACE INJURY.

THE NOTICES FOR EMPLOYEES I have inquired with various agencies UNDER STATE AND FEDERAL LAW are as follows:

- Employee Rights Under the Fair Labor Standards Act

- Equal Employment Opportunity Is The Law

- Employee Rights and Responsibilities Under the Family Medical Leave Act (employers with 50 or more employees only)

- Your Rights Under USERRA (Uniformed Services Employment and Reemployment Rights Act)

- Employee Rights: Employee Polygraph Protection Act

- California employers must also post the following notices specific to California law:

- Official Notice: California Minimum Wage Order

- Payday Notice

- California Law Prohibits Workplace Discrimination and Harassment

- Notice A: Your Rights and Obligations as a Pregnant Employee (employers with five to 49 employees only)

- Notice B: Family Care and Medical Leave and Pregnancy Disability Leave (employers with 50 or more employees only)

- Safety and Health Protection on the Job

- Notice to Employees: Injuries Caused By Work

- Emergency Phone Numbers

- Whistleblowers Are Protected

- Healthy Workplaces Healthy Families Act of 2014: Paid Sick Leave

- Time Off to Vote

- Notice to Employees (unemployment compensation, disability insurance, paid family leave)

STANDARD AREAS for posting include a BREAK ROOM, near the employee entrance, near a copier, vending machines, or near the HR office; moreover, STATE and FEDERAL EMPLOYEE NOTICES in a SAFE, FILE CABINET, LOCKER, SAFE DEPOSIT BOXES, OR any LOCKED CONTAINERS capable of holding items such as:

BOOKKEEPING/ ACCOUNTING RECORDS, EXPENDITURE RECORDS, CHECK REGISTERS, BILLS, RECEIPTS, INVOICES, LEDGERS, NOTES, RECORDS DISCLOSING IDENTITIES and for DEPOSITS, WITHDRAWALS, DEBIT and CREDIT MEMOS, and any other DOCUMENT type DOES NOT meet the first criteria.

Overhearing this information established an uneasy feeling as an Oportun employee, given that "IN THE HISPANIC COMMUNITIES, RUMORS TRAVEL FASTER THAN FACTS." I have NEVER worked for an employer, where the exchange of that kind of information for PURPOSEFUL SABOTAGE or FRAUDULENT MANIPULATION of our operations had been so CASUAL.

AUTHOR: ADRIAN QUIRARTE - (United States) BETWEEN THE MONTHS OF JANUARY TO APRIL 2018, there had been a severe drop in both foot-traffic and store productivity, following the ANNOUNCEMENT that California was TARGETED for workplace raids by the FEDERAL GOVERNMENT. COMMUNICATIONS were DISTRIBUTED informing Small Business Owners" THAT AS OF JANUARY 1st, 2018 NEWS HEADLINES AND THREATS HAD EMPLOYERS WORRIED ABOUT HOW TO MANAGE THE FEDERAL GOVERNMENTS REQUESTS.”

I BEGAN TO RAISE MY ATTENTION to executives and the company trainer as a result of OPORTUNS POOR FRAUD DETECTION, and as a result of declining productivity the company trainer then became the most appropriate person to speak to IN PRIVATE, where I hinted that perhaps I was "NOT FIT FOR THE COMPANY CULTURE."

I SIGNIFICANTLY DECLINED IN PERFORMANCE during this period and gave a number of my OPPORTUNITIES to other LOAN OFFICERS, cautious of potential SECRET SHOPPERS or FEDERAL AGENTS OBSERVING our APPLICATION PROCESS. OBEYING FEDERAL LAW was more critical than COLLUDING in DOCUMENT FRAUD, no matter how LOW (or how HIGH) the RISK.

OPPOSITE TO FRAUDULENTLY COLLUDING with DOCUMENT FRAUD should WORKPLACE RAIDS occur as had been advised by La Placita Shopping Centers in-house PUBLICATIONS and as a result of the SECRECY of the flyer DISTRIBUTED to all SMALL BUSINESSES within La Placita Shopping Center, CONSEQUENTLY I discovered FEDERAL WORKPLACE RAIDS may result in:

CONFISCATION of UNITED STATES or FOREIGN PASSPORTS, VISAS, PAPERS, TICKETS, NOTES, SCHEDULES, RECEIPTS, and OTHER ITEMS RELATED TO INTERNATIONAL OR DOMESTIC TRAVEL...LABOR and EMPLOYMENT RECORDS, including SERVICE AGREEMENTS, I-9s, VOLUNTEER WORKER AGREEMENTS, and STATEMENTS, LISTS OF WORKERS (PAID or UNPAID), JOB ASSIGNMENT SHEETS, DUTY ROSTERS, EMPLOYMENT APPLICATIONS, PERSONNEL FILES, WORKER IDENTIFICATION DOCUMENTS, and ELECTRONIC COMMUNICATIONS related to the same.

EVIDENCE of who USED, OWNED, CONTROLLED a COMPUTER at the time that the ITEMS SOUGHT had been CREATED, EDITED, or DELETED, such as LOGS, REGISTRY ENTRIES, CONFIGURATION FILES, SAVED USERNAMES AND PASSWORDS, DOCUMENTS, BROWSING HISTORY, USER PROFILES, EMAIL, EMAIL CONTACTS, "CHATs," INSTANT MESSAGING, LOGS, PHOTOGRAPHS, and other CORRESPONDENCE... DESKTOP COMPUTERS,NOTEBOOK COMPUTERS, MOBILE PHONES, TABLETS, SERVER COMPUTERS, and NETWORK HARDWARE, SOFTWARE that would authorize others to command THE COMPUTER REMOTELY.

EXAMINATION of EXTERNAL STORAGE DEVICES containing ELECTRONIC EVIDENCE, and EVIDENCE of the TIMES, the COMPUTER was USED. ROUTERS, MODEMS, and NETWORK EQUIPMENT used to CONNECT COMPUTERS TO THE INTERNET...HOW and WHEN a workstation was ACCESSED OR USED to determine the order of COMPUTER ACCESS, USE, and EVENTS linking to CRIMES UNDER INVESTIGATION and the COMPUTER USER. Oportun has failed to recognize this TYPE of WORKING ENVIRONMENT creates "ABNORMAL WORKING CONDITIONS."

CONCURRENTLY, I began to notice that the CONTACT CENTERS in MEXICO could ERASE NOTES on CUSTOMERS ACCOUNTS; moreover, the NOTES that I had put on CUSTOMERS ACCOUNTS asking those DEPARTMENTS that OPERATE OFF-SHORE to REVIEW the DOCUMENTATION submitted.

THE INTENTIONAL REJECTION of APPLICANTS DOCUMENTATION by the CONTACT CENTERS OFF-SHORE would result in POOR PERFORMANCE REVIEWS and DISCIPLINARY ACTION to LOAN AGENTS who OPERATE DOMESTICALLY.

Should a note be put on record QUESTIONING the first agent who reviewed the documents or asking for a SECOND EVALUATION, the note on the customers' account would be ERASED. As a result of this SUSPICIOUS ACTIVITY, customers in-store needed to call the CONTACT CENTERS for more INFORMATION resulting in a LOSS of OPPORTUNITIES.

AUTHOR: ADRIAN QUIRARTE - (United States) FOUR MONTHS AFTER beginning employment with Oportun Inc. is when I had STARTED to write to Executives that I was observing a lack of support by one of Oportuns highly ranked senior employees while in COACHING.

I HAD RAISED ANXIETIES having inquiries about Oportun clients' IDENTIFICATION and ADDRESS VERIFICATION DOCUMENTS and (e.g., ISSUE and EXPIRATION DATE, NATIONAL IDENTIFICATION NUMBERS) that could be presented to me; DRIVERS LICENCES, STATE ISSUED IDENTIFICATION CARDS, BIRTH CERTIFICATES, SOCIAL SECURITY CARDS, GREEN CARDS, FOREIGN PASSPORTS, CONSULAR IDENTIFICATION CARDS, HOME UTILITY BILLS, CELL PHONE BILL, MEDICAL RECORDS, CAR REGISTRATION, EMPLOYMENT RECORDS, INSURANCE RECORDS, BANK or FINANCIAL INSTITUTION RECORDS, CHANGE OF ADDRESS CONFIRMATION BY THE U.S POSTAL SERVICE, RENTAL or LEASE AGREEMENT(SIGNED by OWNER and TENANT), IRS or CALIFORNIA TAX RETURNs, DOCUMENTS issued by a GOVERNMENT AGENCY(LOCAL, STATE, or FEDERAL), LETTER ATTESTING APPLICANT LIVES AT A CA SHELTER or NOT FOR PROFIT ENTITY. ON OCTOBER 7, 2017, The Regional Manager Rene Gracia RESPONDED ELECTRONICALLY, " CONTINUE TO DO THE BEST I CAN.”

AUTHOR: ADRIAN QUIRARTE - (United States) AUGUST 1ST, 2018, OPORTUN INC. RESPONDED to the Department of Industrial Relations as taking "NO ADVERSE EMPLOYMENT ACTIONS" against me for REPORTING "SUCH ACTIVITIES." A QUALIFIED EXECUTIVE would be FIT TO DESCRIBE an ADVERSE ACTION as an action THAT WOULD DISSUADE ANY RATIONAL EMPLOYEE FROM RAISING CONCERNS about a possible violation. BECAUSE an ADVERSE employment ACTION CAN BE SUBTLE...it may NOT ALWAYS BE "AS EASY" TO SPOT.

A. IT IS NOT ENTIRELY CLEAR what claims COMPLAINANT is ALLEGING against Oportun, but it APPEARS he is ALLEGING claims for FAILURE TO PAY WAGES DUE and RETALIATION FOR REPORTING SUSPICIOUS ACTIVITIES.

B. IF YOU HAVE A CONCERN about Oportuns ACCOUNTING PRACTICES, INTERNAL CONTROLS, or AUDITING MATTERS, you should REPORT YOUR CONCERNS to the same persons.

C. THE PENALTIES are INAPPROPRIATE under the DLSE REGULATIONS, EVEN IF Oportun was INCORRECT REGARDING ITS DETERMINATION that complainant had NOT EARNED incentive compensation."

D. CONFUSION regarding the CALCULATION of the LOAN DISBURSEMENTS led to MISCOMMUNICATION by MANAGEMENT.

E. THE EXCEPTION of the DISTRIBUTION of the GOAL was ORIGINALLY REJECTED BECAUSE it was NOT PROPERLY FILED within the REPORTING SYSTEM.

F. EVENTUALLY, the EXCEPTION was APPROVED, and THE LOAN DISBURSEMENT GOAL WAS ADJUSTED among three employees who worked in the store in December, and the GOALS were ADJUSTED ACCORDINGLY.

G. ONCE, THE DISTRIBUTION EXCEPTION was APPROVED in MARCH 2018, Gracia COMMUNICATED with the team that the INCENTIVE COMPENSATION WOULD BE PAID on MARCH 23, 2018.

H. AT THE TIME GRACIA SENT THIS MESSAGE, he DID NOT KNOW that the complainant HAD NOT MET the INDIVIDUAL or STORE GOAL such that HE WAS NOT ENTITLED to the INCENTIVE COMPENSATION.

I. ONLY AFTER, HE SENT THE COMMUNICATION did HE REALIZE that the COMPLAINANT STILL DOES NOT QUALIFY for ANY INCENTIVE COMPENSATION PAYMENT."

J. NEITHER COMPLAINANT nor HIS STORE MET the MONTHLY loan disbursement GOALS FOR DECEMBER 2017.

K.COMPLAINANTS WAGE WAS INCREASED in 2018 DESPITE receiving a "LESS THAN STELLAR REVIEW" for 2017.

L. THERE IS NO EVIDENCE or any CASUAL LINK between THE PROTECTED ACTIVITY and the NONEXISTENT ADVERSE EMPLOYMENT ACTION.

M. ON THE OTHER HAND, there is AMPLE EVIDENCE to SUGGEST that THE COMPLAINANT has been TREATED MORE FAVORABLY by having been PAID INCENTIVE COMPENSATION that HE DID NOT EARN and for RECEIVING A PAY INCREASE despite PROBLEMS with his work PERFORMANCE.

N. OPORTUN HAD A VALID and BONAFIDE REASON for CONCLUDING that it owed complainant NO INCENTIVE COMPENSATION.

O. COMPLAINANT was, therefore, NOT ELIGIBLE for the INCENTIVE PAYMENT until AFTER it had ADVISED HIM that HE WOULD RECEIVE IT.

P. THIS PAYMENT was VOLUNTARILY made by OPORTUN DUE to the CONFUSION surrounding THE COMMUNICATIONS related to the DISBURSEMENT ALLOCATION.

Q. HE WAS BEING PAID THE INCENTIVE compensation BECAUSE he had BEEN ADVISED that HE WOULD RECEIVE IT.

R. BECAUSE of the DESCRIPTION of the complainant's CONCERNS, "HE WAS EASILY IDENTIFIABLE.”

S. COMPLAINANT SUBMITTED additional CONCERNS on MARCH 24, 2018, namely that HE BELIEVED FRAUDULENT IDENTIFICATION SOLD OUTSIDE his store was USED TO OBTAIN FRAUDULENT LOANS.

T. COMPLAINANT DID NOT ENGAGE IN ANY PROTECTED ACTIVITY because HE DID NOT have a REASONABLE BELIEF of ANY UNLAWFUL CONDUCT.

U. OPORTUN POLICY, specifically MANDATES, that employees REPORT ANY SUSPICIOUS BEHAVIOR.

V. IN SUM, complainants BARELY DECIPHERABLE CLAIMS COMPLETELY LACK MERRIT and SHOULD BE DISMISSED.

W.COMPLAINANT HAS NOT PROVIDED and CANNOT PROVIDE ANY EVIDENCE that OPORTUN took any ADVERSE EMPLOYMENT ACTION AGAINST HIM, let alone any action, BECAUSE OF HIS NATIONAL ORIGIN.

X. COMPLAINANT APPEARS TO EQUATE being HANDED A FLYER by someone "OUTSIDE OF HIS WORKPLACE" who was "UNASSOCIATED" WITH OPORTUN.

Y. HE WAS ALSO CONCERNED ABOUT RECENT ACTIVITY related to IMMIGRATION RAIDS that have BEEN PUBLICIZED in the area AT THE TIME and THE ALLEGED SALE of FRAUDULENT IDENTIFICATION DOCUMENTS that he said he had OBSERVED.

Z. COMPLAINANT DID NOT ENGAGE in any PROTECTED ACTIVITY because HE DID NOT have a REASONABLE BELIEF of ANY UNLAWFUL CONDUCT.

AA. COMPLAINANTS CLAIM FAILS because HE IS UNABLE TO DEMONSTRATE that OPORTUN ENGAGED in any RETALIATORY CONDUCT.

OPORTUN INC., with THE HELP of outside counsel, HOLDS IT OPINION I HAD NO REASON TO BELIEVE that an ADVERSE EMPLOYMENT ACTION AGAINST ME HAD TAKEN PLACE and EXPANDING on OPORTUNS SENSE of ADVERSE EMPLOYMENT ACTIONS, The U.S DEPARTMENT OF LABOR defines RETALIATION, including ADVERSE EMPLOYMENT ACTIONS as the following:

- Firing or laying off

- Demoting

- Denying overtime or promotion

- Disciplining

- Denying benefits

- Failing to hire or rehire

- Intimidation or harassment

- Making threats

- Reassignment to a less desirable position or actions affecting prospects for advancement (such as excluding an employee from training meetings)

- Reducing pay or hours

- More subtle operations, such as isolating, ostracizing, mocking, or falsely accusing the employee of poor performance

- Blacklisting (willfully intervening with an employee's ability to obtain future employment)

- Constructive discharge (quitting when an employer makes working conditions intolerable due to the employee's protected activity)

Furthermore, "It is a CRIME to MAKE OR CAUSE to be made A KNOWINGLY or FRAUDULENT STATEMENT concerning THE ENTITLEMENT TO BENEFITS with the INTENT to DISCOURAGE an INJURED WORKER from CLAIMING BENEFITS or PURSUING a CLAIM."

AUTHOR: ADRIAN QUIRARTE - (United States) USING OPORTUN INC AS A MODEL EMPLOYER, PROVING SERIOUS AND WILLFUL MISCONDUCT IS A "NO-BRAINER" WHEN THE EMPLOYER DIRECTLY BENEFITED (e.g., PROFITED FINANCIALLY) FROM THE ALLEGED "QUASI-CRIMINAL" ACTIVITIES.

AGGRAVATING FACTORS: DIRECT or INDIRECT SOLICITATION by EMPLOYER and INSURANCE COMPANY to DISMISS MY CLAIM in HOPES that EVIDENCE WOULD DISSIPATE or REACH THE STATUTE OF LIMITATIONS, EMPLOYER MISLEAD INVESTIGATIVE AGENCIES to DISMISS my COMPLAINTS for "HUMANITARIAN PURPOSES" (PROFIT) REGARDLESS OF THE LONG TERM IMPACT of A PERSON or PERSONS WELLBEING, INVOLVEMENT by EXECUTIVE MANAGEMENT, PERVASIVE MISCONDUCT, SIGNIFICANT PROFIT from MISCONDUCT, REPEAT OFFENDERS. TO PROVE those as mentioned above, OPORTUN STATES THE FOLLOWING:

A. "NEGATIVE PUBLICITY or PUBLIC PERCEPTION of our INDUSTRY or our COMPANY COULD ADVERSELY AFFECT OUR REPUTATION, BUSINESS, and RESULTS of OPERATIONS."

B."SECURITY BREACHES of CUSTOMERS CONFIDENTIAL INFORMATION THAT WE STORE MAY HARM OUR REPUTATION, ADVERSELY AFFECT our RESULTS OF OPERATIONS, and EXPOSE US TO LIABILITY."

C."IF WE or our competitors RECEIVE NEGATIVE PUBLICITY MAKING LOANS TO UNDOCUMENTED IMMIGRANTS, IT MAY DRAW ADDITIONAL ATTENTION from regulatory bodies or consumer advocacy groups, ALL WHICH MAY HARM OUR BRAND AND BUSINESS."

D."OPORTUN POLICY, specifically MANDATES, that employees REPORT ANY SUSPICIOUS BEHAVIOR."

E."COMPLAINANT DID NOT ENGAGE in any PROTECTED ACTIVITY because HE DID NOT have a REASONABLE BELIEF of ANY UNLAWFUL CONDUCT."

F."COMPLAINANT has NOT PROVIDED and CANNOT PROVIDE ANY EVIDENCE that OPORTUN took any ADVERSE EMPLOYMENT ACTION AGAINST HIM, let alone any action, BECAUSE OF HIS NATIONAL ORIGIN."( PROTECTED STATUS)

G."COMPLAINANTS CLAIM FAILS because HE IS UNABLE TO DEMONSTRATE that OPORTUN ENGAGED in any RETALIATORY CONDUCT."

EXPANDING ON OPORTUN INC SENSE OF PROTECTED ACTIVITIES: SEEKING INFORMATION or LEGAL ADVICE on your WORKPLACE RIGHTS, NOTIFYING ANYONE about a POSSIBLE VIOLATION of LEGAL RIGHTS in YOUR WORKPLACE, COMPLAINING that YOU or SOMEONE ELSE IS OWED UNPAID WAGES, COMPLAINING about HARASSMENT or DISCRIMINATORY TREATMENT ON THE JOB, COMPLAINING ABOUT UNSAFE WORKING CONDITIONS, TALKING WITH YOUR COWORKERS ABOUT YOUR WAGES or WORKPLACE CONCERNS, FILING A WORKERS COMPENSATION CLAIM, FILING or PARTICIPATING IN A COMPLAINT with a GOVERNMENTAL AGENCY, FILING a LAWSUIT AGAINST YOUR EMPLOYER, or SUPPORTING coworkers, WHO HAVE FILED a LAWSUIT, WHISTLEBLOWING (ALERTING GOVERNMENTAL AGENCIES about your EMPLOYERS UNLAWFUL PRACTICES)...

RETALIATION, including ADVERSE EMPLOYMENT ACTIONS, INCLUDE: FIRING or LAYING OFF, DEMOTING, DENYING OVERTIME OR PROMOTION, DISCIPLINING, DENYING BENEFITS, FAILING to HIRE or REHIRE, INTIMIDATION or HARASSMENT, MAKING THREATS, REASSIGNMENT to a LESS DESIRABLE POSITION, ACTIONS AFFECTING PROSPECTS FOR ADVANCEMENT, REDUCING PAY OR HOURS, ISOLATING, OSTRACIZING, MOCKING or FALSELY ACCUSING OF POOR PERFORMANCE, BLACKLISTING, and CONSTRUCTIVE DISCHARGE.

AUTHOR: ADRIAN QUIRARTE - (United States) AS AN OUTCOME of the increasing documents that reflect poorly on Oportun Inc's lack of experience with EMPLOYMENT LAWS, I have been further incentivized to INVESTIGATE THE TERMS ON "AGREEMENTS OF NON-DISCLOSURE."

THE LANGUAGE IN THE CONTRACT when departing from an employer, SHOULD BE QUITE LONG and THE DIRECTOR should strive to COVER: "ANY AND ALL" LIABILITIES, COMPLAINTS, PROMISES, and CAUSES OF ACTION IN LAW AGAINST THE COMPANY and its OFFICERS, DIRECTORS, SHAREHOLDERS, EMPLOYEES, SUBSIDIARIES, PARENT COMPANIES, AFFILIATES, SUCCESSORS...CLAIMS RELATED TO DISCRIMINATION, DISCRIMINATION BASED ON DISABILITY, VIOLATIONS OF CIVIL RIGHTS LAWS, VIOLATIONS OF THE FAMILY MEDICAL LEAVE ACT, WRONGFUL TERMINATION, all which Oportun failed to provide. (e.g: SOCIAL MEDIA)

I HAD BEEN SENT A NOTICE OF TERMINATION to THE INCORRECT MAILING ADDRESS JANUARY 23,2019. Following receiving the NOTICE OF TERMINATION 30 DAYS LATER, THE ONLY ANSWERS I RECEIVED FROM OPORTUNS HR was that THE CHECK FINAL CHECK noted IN THE NOTICE OF TERMINATION had BEEN DONE IN ERROR, moreover, OPORTUNS DECISIONS to TERMINATE MY EMPLOYMENT had NOTHING TO DO WITH MY WORKERS COMPENSATION CLAIM (LC 132a).

A PRIOR LAWSUIT AGAINST OPORTUN alleged that OPORTUNS DIRECTORS BREACHED THEIR FIDUCIARY OBLIGATIONS by ORGANIZING SEVERAL ROUNDS OF FINANCING — IN WHICH OPORTUNS SHAREHOLDERS WERE WIPED OUT.

HAVING PRIOR MISTRUSTS with OPORTUNS EXECUTIVES ACCOUNTING PRACTICES, INTERNAL CONTROLS, and AUDITING TROUBLES when considering SUSPICIOUS ACTIVITIES such as DUPLICATING RECEIPTS, ALTERING, BACKDATING FUTURE DATING DATES or FORMS and CASES WHERE THERE ARE SIGNS OF COLLUSION by OPORTUN EMPLOYEES and its ADMINISTRATORS; the FINAL PAYCHECK NOTED BY OPORTUNS HR DEPARTMENT DONE IN ERROR triggered me to consider SUSPICIOUS ACTIVITIES such as TIMEKEEPING, AUTHORIZING OVERTIME, CHECK PREPARATION, DISTRIBUTION, CHECK SIGNING, BANK RECONCILIATIONS. FURTHERMORE WHEN THE OPORTUN PAYROLL EMPLOYEE HAD NOTIFIED ANOTHER OPORTUN EMPLOYEE and me:

1." I WAS VERY KNOWLEDGEABLE AND WAS IMPRESSED WITH MY WILLINGNESS TO HELP OTHER EMPLOYEES.”

2." THAT ALTHOUGH SHE DOES PAYROLL; SHE IS UNAWARE OF ALL THE STATE LAWS REGARDING PAYROLL BECAUSE SHE HAS MANY JOB DUTIES.”

3. " SHE WAS RELUCTANT TO SPEAK TO ME REGARDING THE COMPANIES POLICY ON UNPAID WAGES BECAUSE I COULD GET HER OR THE COMPANY IN TROUBLE."

4. THE DUPLICATE CLAIM FOR "LA PLACITA KIOSK" (1690 STORY ROAD SUITE C+D SAN JOSE CA) FILED "IN ERROR" BY THE CLAIMS EXAMINER, INVITING ME TO ENROLL in DIRECT ACH PAYMENTS for an INSURED/EMPLOYER THAT DOES NOT EXIST.

5. IN THE ABSENCE OF THE CLAIMS ADMINISTRATOR ( ON "PERSONAL TIME OFF" SIMULTANEOUSLY OPENING TWO DUPLICATE CLAIMS IN MY NAME?) and HER DEFENSE ATTORNEY; SEVERAL INCONSISTENCIES WITH THE DEFENDANT PARTY ENCOURAGED ME TO LOOK FURTHER INTO WHAT ARE COMMONLY KNOWN AS " GHOST PAYROLL EMPLOYEES and MONEY MULE SCHEMES."

AUTHOR: ADRIAN QUIRARTE - (United States) The public statements made in Oportuns interest concerns the Directors' and Officers' Insurance Liability Coverage and is directly associated with my claim of Serious and Willful Misconduct by my employer under LC 4553.

1."No public market for our common stock currently exists, and an active public trading market may not develop or be sustained following this offering." "The lack of an active market may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the market price of your shares of common stock."

2."The price of our common stock may be volatile, and you could lose all or part of your investment."-"The trading price of our common stock following this offering may fluctuate substantially and will depend on a number of factors, including those described in this "Risk Factors" section, many of which are beyond our control and may not be related to our operating performance. These fluctuations could cause you to lose all or part of your investment in our common stock because you might be unable to sell your shares at or above the price you paid in this offering.

We also expect that being a public company will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage, incur substantially higher costs to obtain coverage or only obtain coverage with a significant deductible."

3. "Changes in immigration patterns, policy or enforcement could affect some of our customers, including those who may be undocumented immigrants, and consequently impact the performance of our loans, our business and results of operations."- "Some of our customers are immigrants and some may not be U.S. citizens or permanent resident aliens. We follow appropriate customer identification procedures as mandated by law, including accepting government issued picture identification that may be issued by non-U.S. governments, as permitted by the USA PATRIOT Act, but we do not verify the immigration status of our customers, which we believe is consistent with industry best practices and is not required by law. While our credit models look to approve customers who have stability of residency and employment, it is possible that a significant change in immigration patterns, policy or enforcement could cause some customers to emigrate from the United States, either voluntarily or involuntarily, or slow the flow of new immigrants to the United States.

Immigration reform is a legislative priority of the current administration, which could lead to changes in laws that make it more difficult or less desirable for immigrants to work in the United States, resulting in increased delinquencies and losses on our loans or a decrease in future originations due to more difficult for potential customers to earn income.

In addition, if we or our competitors receive negative publicity around making loans to undocumented immigrants, it may draw additional attention from regulatory bodies or consumer advocacy groups, all of which may harm our brand and business.

There is no assurance that a significant change in U.S. immigration patterns, policy, laws, or enforcement will not occur. We cannot predict the likelihood, nature, or extent of government regulation that may arise from future legislation or administrative action. Any such change could adversely affect our business, financial condition, results of operations, and cash flow.”

SOME OF THE ATTACHMENTS ARE RELATED TO A LIMITED LIABILITY COMPANY THAT INVOLVES: SUSPECTED CORPORATE FRAUD AND IDENTITY THEFT, EMPLOYING UNDOCUMENTED WORKERS, LABOR VIOLATIONS, OFF-SHORE ACCOUNTS, TAX EVASION, FALSE BOARD OF DIRECTORS, GHOST EMPLOYEES, GHOST PAYROLL, BANAMEX (CITIBANAMEX), BBVA MEXICO BANK, HSBC BANK MEXICO, LA PARRILLA EL DIAMANTE COCINA MEXICANA XALAPA VERACRUZ MEXICO http://laparrilladiamante.com.mx .

I WAS NOT EMPLOYED OR RECEIVED WAGES FROM THE BUSINESS BALDERAS JALAPEÑOS MEXICAN KITCHEN AND GRILL INC. STONESTOWN GALLERIA SAN FRANCISCO CA and FOUND OUT MUCH LATER THAT MY NAME HAD BEEN FRAUDULENTLY USED TO OPEN AN LLC AS PART OF THE BOARD OF DIRECTORS. THE BUSINESS CLOSED AND THE PERPETRATORS RELOCATED.

I presume that the Defendants in action ( Oportun Inc.) will continue to want to take my deposition and interrogate me about my personal history and prior relationships; however, I would like the Defendants to take into account that I do not know where any of the individuals involved are residing other than in The Mexican States. I ask that moving forward, the defendants please acknowledge receiving my correspondence.

#13 Author of original report

“TOUGH IN A DOWN ECONOMY, TOUGH ON EMOTIONAL HEALTH “

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Saturday, February 17, 2018

In addition, constant hostility and harassment from management regarding our productivity, as employees we were pressured to do things that were "dishonest” or "inappropriate” to meet unreasonable workloads or demands. As a result of these demands, as employees we were trained to pressure or deceive customers on each encounter into giving us referrals ( at the time it would be phone numbers of family and friends), while misleading the victim that "We only want to call your contacts to "offer them information on how to build credit.” without properly informing the customer that they give us their personal contacts to send them telemarketing solicitations by mail and phone to apply for a loan, which result in several complaints daily asking us that we please stop soliciting and harassing them. In many of these cases, the victims of Oportuns telemarketing come in to complain that they keep receiving calls from the call centers although they have told them time and time again, to stop calling because they are on a "DO NOT CALL LIST. As employees who have no direct access to the call centers in Mexico when complaints are made, however we were trained to to tell the person making the complainant that perhaps one of our applicants, may have put them down as a reference when applying for a loan and that "the applicant gave us permission to send them telemarketing solicitations by phone or mail.” Another predatory tactic to lure individuals to give us their personal contacts to send them telemarketing solicitations is by having an seasonal incentive where we inform the victims that each contact they provide us is a chance to enter to win 300.00, where the winner will be announced at the end of the week. Again, the victims of Oportuns telemarketing on” DO NOT CALL LISTS”, get rather upset because someone other than themselves have gave Oportun permission to call them or to send them solicitations, in order for the person who provided their contact information to enter to win a prize. In some extreme cases, the victims of constant harassment and unwanted solicitations come in to one of the many locations and say "I don’t care if I’m approved, I don’t need the loan. I’m just applying because I was called constantly and wanted it to stop.” One of the most dishonest practices that I have learned from another employee ( Kelin Sierra who also got promoted to store lead) working for Oportun is to encourage customers to apply for a loan, ( It will only take 5 Minutes to get pre-approved!) without informing the customer than once we run their credit, their credit score is lowered and thus the incentive to apply for a loan is to take the loan to bring their credit score back up. In many cases, although Oportun promotes its product as a "credit-building loan” many of the clients don’t realize or take the time to monitor their credit to ensure that their credit score went up. One particular case presented itself when an Asian client came in to apply for a loan, to both his and my own surprise, his application had been denied due to personal identifying information being linked to another account. When I had asked the applicant if he had ever applied for a loan with Oportun, he was certain that he had never applied for a loan. After searching for the applicant by several methods, it was determined that he had never applied and that some of his personal identifying information was linked to another account. Due to the embarrassment that presented itself as an employee working for Oportun who mainly serves the "Underserved Hispanic Community” as best described by the CEO, Raul Vasquez, I had no ulterior option but to ask another employee ( Kelin Sierra) "How do I explain to the applicant that his personal identifying identification is linked to another account, without upsetting him further?” In many cases it’s not until much later (sometimes after multiple loans) clients come in to ask why their credit score had not changed, upon applying for a credit line elsewhere and not being approved. Typically there is no answer or resolution we can provide to the customer at that very moment.

#12 Author of original report

The Dangers of meter tampering and the effects on the human system

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Saturday, February 03, 2018

Evidence of "meter tampering” and questionable cables that were placed by my mothers husband( ex-electrician )under my room to cause severe injuries to me and dog+destruction of a property. Very "poorly” hidden wires, disconnected, split cables & clamps that indicate tampering. Damaged Cables or physical tampering can excite electrons + radiation exposure and play a role with various human systems – particularly the nervous system – leading to symptoms of mental confusion, headaches, sleep

#11 Author of original report

TOXICOLOGY TESTING AND NEUROLOGICAL TESTING

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Tuesday, January 30, 2018

During and after the exposure in my residence took place it was evident by the physical signs of toxicity such as some burning of the skin, feeling ill, loss of concentration, fatigue, poor cognitive function, a dust, metallic, or acidic taste in the mouth, I quickly began to look for options for medical treatment and request blood and hair sample tests to identify the toxins in the body and neurological damage. At the time, I had no knowledge that if the agents were rotated frequently, it would defeat a sample collection.

When I searched for treatment options, toxicology, neurology tests, I unfortunately came to find Medical insurance typically doesn’t pay for toxicologists outside of ordinary drug testing as it is very costly so very few solicit to the general public with the inability to pay.

During an emergency and the need for me and my dog to leave the residence immediately with heavy symptoms of intoxication, I decided to ask the landlord, Javier Garcia, if he could make a claim on his insurance policy for personal injury which occured in my living space so that his homeowners insurance would cover the cost of medical expenses, where I expressed my emergency by sending photographs of my injuries and never got a response, and then accused me of sending him " the naked" photographs according to my mother. As I have reported before, this was obviously a poor defense against accepting liability, where it is not an option for the homeowner wether or not it should be reported to police or insurance to prevent discovery of the incidents that occured in the home.

I had expressed how it was nessecary to daily functioning.

I had expressed the health complications in the future if the incidents were not reported.

I had expressed I had already tried finding a solution on my own, where I explained my medical insurance would not pay for toxicology and neurology tests where then I became aware that the knowledge of discovery would be prevented if I was ignored.

I have medical summaries from Foothill Clinic San Jose that indicated I had rashes and burns that had gotten worse since my last visit 2 months prior. I had been diagnosed for radiation poisoning, evaluated for dermatitis due to chemicals and poor concentration and cognitive functions and was reffered to Standford University for Toxicology, Neurology and Dermatology tests, which I never was able to get admitted due to my lack of the ability to pay and my medical insurance denied coverage just like i had explained.

There was no reasonable alternative option for what I was asking for.

Javier Garica later went on to file a domestic violence petition 3/6/16 claiming me as his "step-son" to report that I had been harassing him by text, that I had assaulted him, telling my mother that I had sent naked photographs by text message, which he failed to include in his victim impact statements and also writing in his declaration that I had stolen money from him, to evict me unlawfully taking the law into his own hands.

A few months later during the hearing he created a defense to falsifying facts on his petition declaration that he had never written that I had stolen money from him to the judge, and failed to report the claims or accusations of nude photographs that he had mentioned to family about, and in court claimed that the reason why he wanted me to be prevented from returning home was "due to being disrespectful by listening to music, on the computer, or talking on the phone. He is very disrespectful."

Javier Garcias, Victim Impact statements can be found in the photographs attatched to this report.

#10 Author of original report

MALICIOUS HARASSMENT, SEXUAL, PSYCHOLOGICAL ABUSE and BULLYING

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Sunday, January 28, 2018

Recently on 12/18/17 I made the decision to ask my mom a second time about an incident that occurred on my last days living in the home that involved harassment , humiliation, sexual and psychological abuse and bullying. My mother told me she DID remember the incident when her husband, Javier Garcia, had told my mother that I was sending him naked pictures of myself and then she continued that she had asked him to see them when the false accusations were made and he " suspiciously” had replied that he had already deleted them. I told my mother, if he had deleted the "evidence of my sexual harassment”, I had still had my old phone with the text messages that were sent that day, and without a problem i could show them to her, when i had only sent photographs for my injuries ( in clothing) that had occurred in the home and i had also asked him to please contact State Farm home insurance and report my injuries as the policy holder and yet after receiving the photographs which he claimed were sexual harassment, he never answered my calls or replied with a text showing the slightest bit of concern, when it was his obligation as the landlord to the Home and the "STEPFATHER”, that all residents and tenants should be kept safe from harm and remove the dangerous factor. Therefore it was clearly evident that he created a poor defense of liability for injuries and neglected the fact that I needed medical attention immediately yet falsified that he had been " sexually harassed, allegedly claiming receiving naked pictures and committed the crime of defamation and humiliation, malicious harassment and the crime of perjury, where he told the courts, " I sent multiple texts to him that didn’t make any sense to him.” Withholding his previous allegations that I had sent naked pictures to the judge and also neglecting to report that under oath he continued to fail to report in his declaration and victim impact statements important information such as that I had actually had been gravely injured, that he had maliciously denied all my attempts to speak to him, avoiding all calls and texts with photographic evidence of injuries that needed to be immediately treated due to chemical toxic exposure directly linked to his line of work as a truck driver for "Alexxandras Transport” and then continued with his petition claiming me as his "STEPSON”on his domestic violence petition seeking a protective order to qualify for a U-VISA and get PERMANENT US RESIDENCY according to the qualification guidelines that indicates the "VICTIM OF A CRIME” qualifies for permanent US residency if the immigrant or RESIDENT ALIEN suffers from a crime such as psychological and physical abuse by a "child” that is a either a U.S CITIZEN or PERMANENT RESIDENT.

#9 Author of original report

Supporting Documentation

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Monday, December 11, 2017

The photos of injuries indicate that bodily injury took place by the wreckless and negligent actions of the insured. When I spoke to Alonzo Baez, I told him in writing that their insured, Javier García, was directly responsible for the injuries in connection with his line of employment as a truck driver for his buisness, Alexxandras Transport, due to the fact I had over heard a conversation by the insured instructing deliveries to be made to our residence the evening of Nov. 27th 2015 and took a photo of a trailer parked outside our home in the evening hours. I asked Mr. Baez, the State Farm Representative handling my claim, to investigate if their insured contends that anyone other than himself was responsible for the bodily injuries and to reply in writing on more than one account and never recieved a response from the agent handling my claim, when I had also provided documentation that their insured identified me as a tenant on my last attempt Nov. 27 2017. The last response I recieved from State Farm was that upon investigation, their insured had no minimal coverage availiable for bodily injury to a tenant, resident or guest at the insured location.

#8 Author of original report

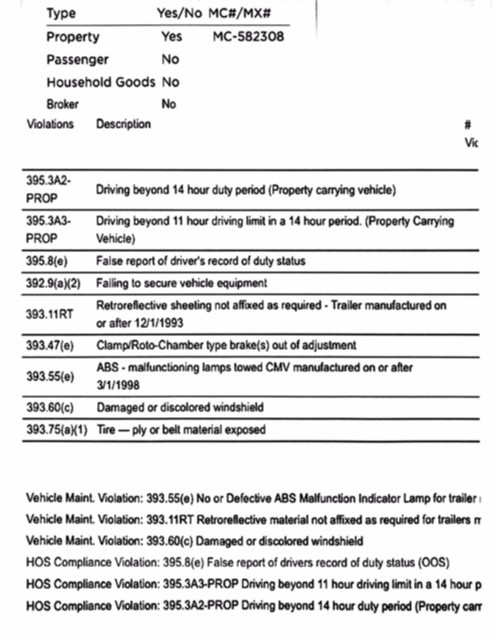

False Report Of Drivers Record of Duty

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Sunday, December 03, 2017

Photo: Alexxandras Transport Public Driving Record indicating false reports of drivers record of duty status, where enforcement action from the FMCSA (Federal Motor Carrier Saftey Administration) can be taken against the truck driver even though that record may or may not have been signed in the drivers logbook.

Making false reports shall make the driver and/or the carrier liable to prosecution. This document is being used to support that the insured has a history of falsifying facts, thus engaging in several illegal practices that require a true or valid statement, report or testimony.

For example this would include several false calls to police to encourage police misconduct that are on record, presenting fake legal documents such as eviction notices, false victim impact statements in hopes of obtaining nationality or permanent residency all while involving himself in wreckless behavior and ignoring the laws of duty of care and the obligation to make a report on tenants injuries to both police and to State Farm Insurance and not conceal the disabilitating injuries for weeks with the obligation, to remove a dangerous condition or factor at the insured location and the responability to continue keep all residents and tenants safe not place them in further danger.

#7 Author of original report

Landlord Harassment and Illegal Eviction Notice

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Thursday, November 23, 2017

A FALSE EVICTION NOTICE ALLOWING 60 DAYS TO TERMINATE TENANCY SERVED BY THE LANDLORD, JAVIER GARCIA, ILLEGALLY. THE LANDLORD FAILED TO PROVIDE AN EXPLANATION FOR THE TERMINATION, FAILED TO SIGN AND DATE THE DOCUMENT, FAILED TO PROPERLY FILL OUT PROOF OF SERVICE INFORMATION AS REQUIRED, HE DID HOWEVER CHOSE TO SIGN THE EVICTION NOTICE UNDER PENALTY OF PERJURY BY HIMSELF, JAVIER GARCIA, UNDER THE LAWS OF THE STATE OF CALIFORNIA THAT THE FOREGOING IS TRUE AND CORRECT. THIS IS AN EXAMPLE OF "SEWER SERVICE" WHERE THE LANDLORD NEGLECTED TO FILE THE EVICTION PAPERS BY LAW, THUS ENGAGING IN THE HIGHLY ILLEGAL PRACTICE OF "SEWER SERVICE."

#6 Author of original report

Department Of Health Care Services (PI) Program Third Party Liability Recovery Division

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Thursday, November 23, 2017

Personal Injury (PI) Program The Department of Health Care Services’ (DHCS) Personal Injury Program seeks reimbursement for services that Medi-Cal paid on behalf of its members who are involved in personal injury actions, such as auto accidents, slip and falls, and premises liability. When a Medi-Cal member receives a settlement, judgment or award from a liable third party as compensation for injuries they incurred, the Personal Injury Program is required by federal and State law to recover funds for any related services paid by Medi-Cal. Section14124.73(c): (1) The date of the Medi-Cal member’s injury, (2) the Medi-Cal member’s Medi-Cal identification number, (3) the contact information of the liable third party or insurer, (4) the contact information of the claims administrator including their claim number, and (5) the contact information of any defense counsel representing the liable third party or insurer.

#5 Author of original report

STATE FARM OPEN CLAIM NOVEMBER 2015-OCTOBER 2017

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Wednesday, November 22, 2017

Letters indicate State Farm initially opened my claim in November 2015 and failed to investigate their insured, Javier Garcia, until October 2017.

#4 Author of original report

TOUGH IN A DOWN ECONOMY, TOUGH ON EMOTIONAL HEALTH

AUTHOR: Adrian Quirarte - (United States)

SUBMITTED: Monday, November 20, 2017

In addition, constant hostility and harassment from management regarding our productivity, as employees we were pressured to do things that were "dishonest” or "inappropriate” to meet unreasonable workloads or demands. As a result of these demands, as employees we were trained to pressure or deceive customers on each encounter into giving us referrals ( at the time it would be phone numbers of family and friends), while misleading the victim that "We only want to call your contacts to "offer them information on how to build credit.”

without properly informing the customer that they give us their personal contacts to send them telemarketing solicitations by mail and phone to apply for a loan, which result in several complaints daily asking us that we please stop soliciting and harassing them. In many of these cases, the victims of Oportuns telemarketing come in to complain that they keep receiving calls from the call centers although they have told them time and time again, to stop calling because they are on a "DO NOT CALL LIST.

As employees who have no direct access to the call centers in Mexico when complaints are made, however we were instructed to tell the person making the complaint that perhaps one of our applicants, may have put them down as a reference when applying for a loan and that "the applicant gave us permission to send them telemarketing solicitations by phone or mail.”

Another predatory tactic to lure individuals to give us their personal contacts is by having an seasonal incentive or raffle, where we inform the victims that each contact provided is a chance to enter to win 300.00, where the winner will be announced at the end of the week. Again, the victims of telemarketing and DO NOT CALL LISTS, get rather upset because someone other than themselves have gave Oportun permission to call them, in order for that person to enter to win a prize.

In some extreme cases, the victims of constant harassment and unwanted solicitations come in to one of the many locations and say "I don’t care if I’m approved, I don’t need the loan. I’m just applying because I was called constantly and wanted it to stop.” One of the most dishonest practices that I have learned from another employee ( Kelin Sierra who also got promoted to store lead) working for Oportun is to encourage customers to apply for a loan, ( It will only take 5 Minutes to get pre-approved!) without informing the customer than once we run their credit, their credit score is lowered and thus the incentive to apply for a loan is to take the loan to bring their credit score back up.

In many cases, although Oportun promotes its product as a "credit-building loan” many of the clients don’t realize or take the time to monitor their credit to ensure that their credit score went up. One particular case presented itself when an Asian client came in to apply for a loan, to both his and my own surprise, his application had been denied due to personal identifying information being linked to another account.

When I had asked the applicant if he had ever applied for a loan with Oportun, he was certain that he had never applied for a loan. After searching for the applicant by several methods, it was determined that he had never applied and that some of his personal identifying information was linked to another account. Due to the embarrassment that presented itself as an employee working for Oportun who mainly serves the "Underserved Hispanic Community” as best described by the CEO, Raul Vasquez, I had no ulterior option but to ask another employee ( Kelin Sierra) "How do I explain to the applicant that his personal identifying identification is linked to another account, without upsetting him further?”

In many cases it’s not until much later (sometimes after multiple loans) clients come in to ask why their credit score had not changed, upon applying for a credit line elsewhere and not being approved. Typically there is no answer or resolution we can provide to the customer at that very moment.

#3 Author of original report

Claim Documents

AUTHOR: Adrian - (United States)

SUBMITTED: Monday, November 20, 2017

Claim Documents File Claim Date Nov.27th 2017

#2 Author of original report

CDI RESOLUTION

AUTHOR: Adrian - (United States)

SUBMITTED: Monday, November 20, 2017

CSB-7083965 Mediation or corrective action against State Farm Insurance for the failure to provide a prompt, fair and reasonable investigation since the initial filing date of loss, the poor and substantially delayed evaluation of damages and equitable settlements of claims including deceptive practices or non-disclosure of policy limits or coverages availiable where liability of their insured is reasonably clear and it was evident that the agency committed several acts of negligence,bad-faith, and violating industry standards and state law. As written in State Farm’s Last Letter, the agency is willing to consider any additional information that may impact their decison where they are required by law to inform me that I may have further review by CDI if the claim or part of the claim has wrongfully been denied. I am requesting that CDI review my complaint and documentation.

#1 Author of original report

Resolution 11/20/17

AUTHOR: Adrian - (United States)

SUBMITTED: Monday, November 20, 2017

Mediation or corrective action against State Farm Insurance for the failure to provide a prompt, fair and reasonable investigation since the initial filing date of loss, the poor and substantially delayed evaluation of damages and equitable settlements of claims including deceptive practices or non-disclosure of policy limits or coverages availiable where liability of their insured is reasonably clear and it was evident that the agency committed several acts of negligence,bad-faith, and violating industry standards and state law. As written in State Farm’s Last Letter, the agency is willing to consider any additional information that may impact their decison where they are required by law to inform me that I may have further review by CDI if the claim or part of the claim has wrongfully been denied. I am requesting that CDI review my complaint and documentation.

Advertisers above have met our

strict standards for business conduct.