Complaint Review: Suntrust - Nationwide

- Suntrust Nationwide USA

- Phone:

- Web: suntrust.com

- Category: Banks

Suntrust Suntrust Bank Suntrust Banks Closed my account because I SPEND TOO MUCH Atlanta Nationwide

*Consumer Comment: We have a winner...

*Author of original report: Another moron

*Consumer Comment: Classy

*General Comment: What YOU dont know...

*Author of original report: Moron

*Consumer Comment: Their Choice

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I had a personal checking account with Suntrust. The account and relationship were over 15 years old. My busy family consists of a wife and 2 beautiful young kids. I am a high net-worth individual. As a result, I tend to shop online heavily.

On or about November 2016 I was informed that I was performing too many transactions with "Amazon" and "eBay/Paypal." I was stunned by the notice and am still perplexed how my spending patterns are a problem for the bank. It is my right to use my money how I wish. This is America after all. In any event, I was told by Suntrust's regulatory team that if I cut down the transactions I could keep the account.

Despite cutting the transaction activity by 50%, on January 25th 2017 Suntrust ordered me to close my account by February 24th 2017. Again, I complied with their unusual request and still they decided to terminate my account.

In summary, Suntrust Bank has terminated my bank account because I spend too much at "Amazon and eBay/Paypal."

This is outrageous!

This report was posted on Ripoff Report on 02/23/2017 09:35 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust/nationwide/suntrust-suntrust-bank-suntrust-banks-closed-my-account-because-i-spend-too-much-atlanta-1357847. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Consumer Comment

We have a winner...

AUTHOR: Robert - (USA)

SUBMITTED: Friday, February 24, 2017

People that actually have a valid complaint do NOT resort to "name calling"

"High Net Worth" individuals do NOT overdraft unless they are totally irresponsible about their accounts.

Normal usage is NOT 300 transactions a month, the average person uses their debit card about 30 times a month for

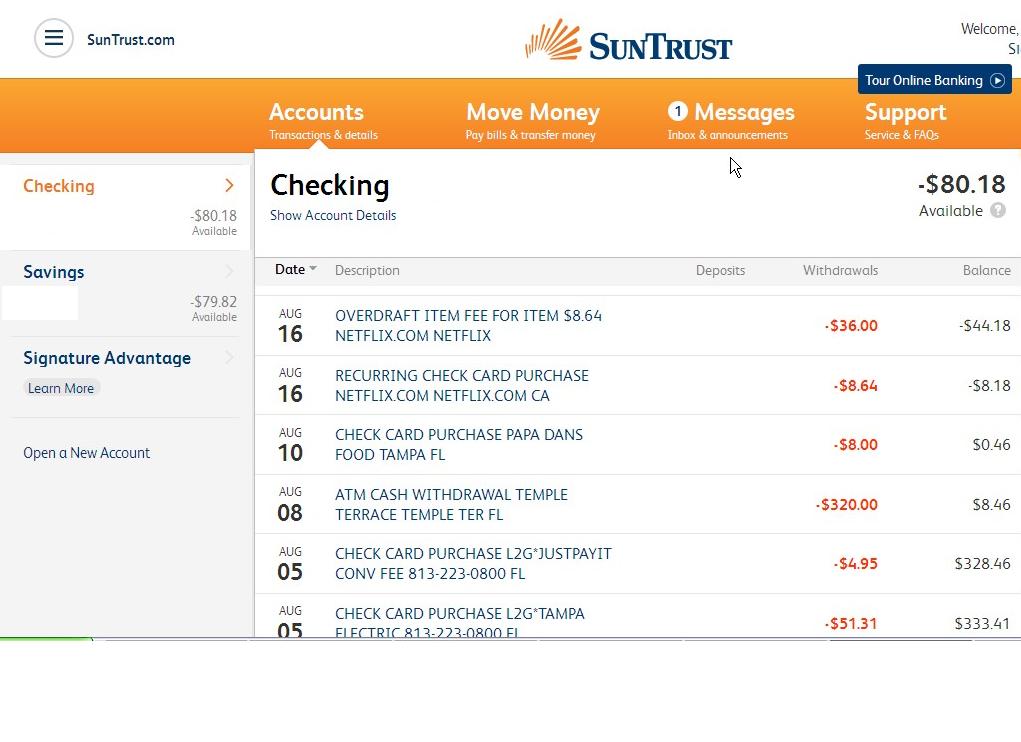

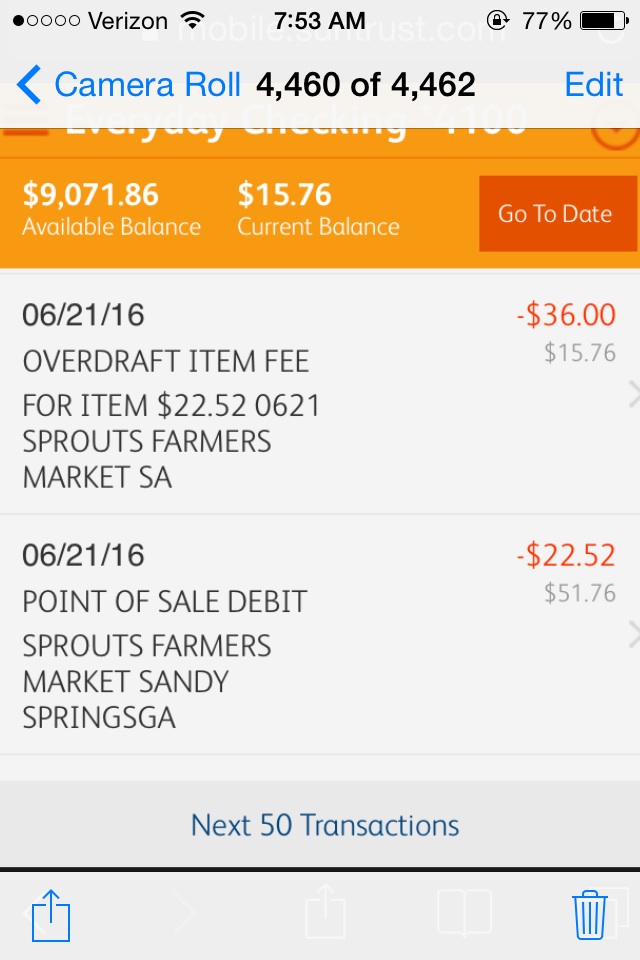

It doesn't matter if you have $1,000,000 in your account if you spend $1,000,010. The overdrafts alone could be more of a reason for your accounts getting closed because that does make you a higher risk. Really more than just an extremely small percentage would ever have to worry about the number of transactions.

I've switched business and personal accounts within a few weeks. You have had 4 months from the first "outrageous" action they took. Remember it was November when they had the nerve to tell you to reduce your transactions. Where you had a choice to start the process to leave or capitulate to their demands. You choose to capitulate. Because if you switched then you would still not have an account in January.

Good luck in your new bank perhaps they will be a bit more to your liking and a bit more favorable in the number of transactions you make.

#5 Author of original report

Another moron

AUTHOR: - ()

SUBMITTED: Thursday, February 23, 2017

Hi other moron,

How many transactions do you do a month? 50? 5000? 5 Million? Less than 300

Have you ever disputed any transactions? NEVER

Has your card ever been compromised? Yes this is a common issue and has nothing to do with this.

Have you had any overdrafts or other negative actions? A few overdrafts

"But here is where else your "ripoff" falls well short. If this is really as "outrageous" as you say and you don't think a company should dictate your spending habits. Then why in November when they told you to cut your usage you did just that? Where was this report back then? Where was this report in January? Why is it only now 2-3 days before they are closing your account that you write it with such "Outrage"."

From reading online I noticed that certain individuals were targeted for similar issues. One of them, unrelated to my issue, happen to use his debit card to purchase a firearm. As he told the story online (and among many others), his account received the same letter mine did and he was told that it was because he purchased a firearm using his debit card. I am happy to provide the source on this. I only deal in facts. In my case the Suntrust representative told me that if I cut down the transactions I would be able to keep my account. I opened another account to move my transactions but primarily because I knew that, like others, my account could be terminated and I had to be ready for this if it happened. When you run a business, you can't just have your account close on you suddenly - how does one make payroll? (I also had a business account with Suntrust and although that one DID NOTHING WRONG they also said they were going to close it). So, the reason for the report is that I did what the bank requested and cut the transaction count by approx 60-70% monthly. Despite that the bank decided to terminate the account. As a matter of fact, I have not found ONE instance reported online where someone receives this "letter" and is able to keep the account. So, it is my belief that anyone who receives this letter will be ultimately terminated. No remedy is possible as they allege.

To say that my name didn't just come up in their system out of nowhere is a moot point. It's obvious why it came up and that's not being contested. The issue here is why it's even a problem.

To the poster who mentioned using a "Prepaid card" online and suggests the bank is losing money on "fees" - I'm not going to do that. I don't know anyone who does that. Nobody should have to do that. Indeed, I will not face this problem with other banks. I know because I took my statements to my new bank and they told me they see no issues whatsoever. Every banker I have met and told my story to, including SunTrust's own employees DO NOT BELIEVE MY STORY. The issue here is a failure of a policy at SunTrust bank.

Bad business is what it is because for 15 years I was a loyal customer. I had multiple car loans with them. Never a late payment. At one point my balance reached 7 figures and that account earned no interest. They have definitely made good money from me.

100% Fact.

#4 Consumer Comment

Classy

AUTHOR: Robert - (USA)

SUBMITTED: Thursday, February 23, 2017

So you don't like what someone said and resort to name calling ? As I said...you are one Classy person.

You are arbitrarily are calling this "bad business" without any details. You come off as a person who is familiar with business, so you should know that Risk isn't just a board game. Businesses including banks are always assessing risk. The bank isn't closing your account because they drew your name out of the hat. Something in your pattern has triggered their system to indicate your usage makes you an increased risk.

How many transactions do you do a month? 50? 5000? 5 Million?

Have you ever disputed any transactions?

Has your card ever been compromised?

Have you had any overdrafts or other negative actions?

But the reality is that only the bank knows exactly what the factors are, however there is an excellent chance that you have at least an indication of the exact reason and more than you are telling us here, even if you don't agree with it. So if anything it could be "bad business" for them to keep you on and having an increased risk on their behalf.

But here is where else your "ripoff" falls well short. If this is really as "outrageous" as you say and you don't think a company should dictate your spending habits. Then why in November when they told you to cut your usage you did just that? Where was this report back then? Where was this report in January? Why is it only now 2-3 days before they are closing your account that you write it with such "Outrage".

Were you hoping that they would let you keep your account open if you promised to cut your usage even more? Again..why as the entire premise of your report is that they shouldn't tell you how to spend your money even though you totally let them do it, and would have still be doing it if they weren't closing your account.

You say you wrote this highlight the issue. Well again if your usage is something that 99.5% of the people will never hit then 99.5% of the people aren't really going to worry.

Sorry something just doesn't add up here.

#3 Author of original report

Moron

AUTHOR: - ()

SUBMITTED: Thursday, February 23, 2017

Hi Jim,

I never said what they did is illegal. If that was the case I would deal with this matter in the court system.

I am fully aware they have the right to refuse service to anyone for any reason.

The purpose of the report is to highlight and bring attention to this problem. They need to understand that this is bad business.

#2 General Comment

What YOU dont know...

AUTHOR: Tyg - (USA)

SUBMITTED: Thursday, February 23, 2017

See the issue is while YES its YOUR MONEY the bank has to pay roughly $0.44-$0.55 PER TRANSACTION!!!! Be it a online purchase or a debit purchase at the store. While YOU may be a "High-Networth" person the reality is that YOU are costing THEM more money then they can make off YOU being a banking customer. YOU can solve this by having a PREPAID card for all YOUR online transactions. Or use a credit card NOT a debit card. It IS what it IS!! The cost of online purchases has gone up!!! So while im 100% sure YOU look at this as a raging headache, YOU must understand that NO ONE is going to PAY for YOU to shop. The difference really boils down to the fact that items tend to be purchased as a one or two item purchase vesus say shopping at a store where the same amount of money can be spent but its used on a BULK order.

#1 Consumer Comment

Their Choice

AUTHOR: Jim - (USA)

SUBMITTED: Thursday, February 23, 2017

It's their bank and they can close whatever account they want whenever they want and for whatever reason they want. It's all covered in the terms and conditions of your account holder agreement which quite obviously, you didn't read!

Advertisers above have met our

strict standards for business conduct.