Complaint Review: TD Bank - Internet Internet

- TD Bank Internet United States of America

- Phone:

- Web: www.tdbank.com

- Category: Banks

TD Bank , previous business Commerce Bank Overdraft fees , Internet

*Consumer Comment: Accountability....

*Consumer Comment: So....

*Consumer Suggestion: Fran, you still are not getting it! Checkbook register is NOT "optional"

*Consumer Comment: Oh..and also...

*Consumer Comment: True..

*Consumer Comment: Robert was attempting to help.

*Author of original report: Robert~Irving~Poor card

*Consumer Comment: You don't get it

*Author of original report: overdraft fees

*Consumer Comment: you could be movin' up

*Consumer Comment: you could be movin' up

*Consumer Comment: Why

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

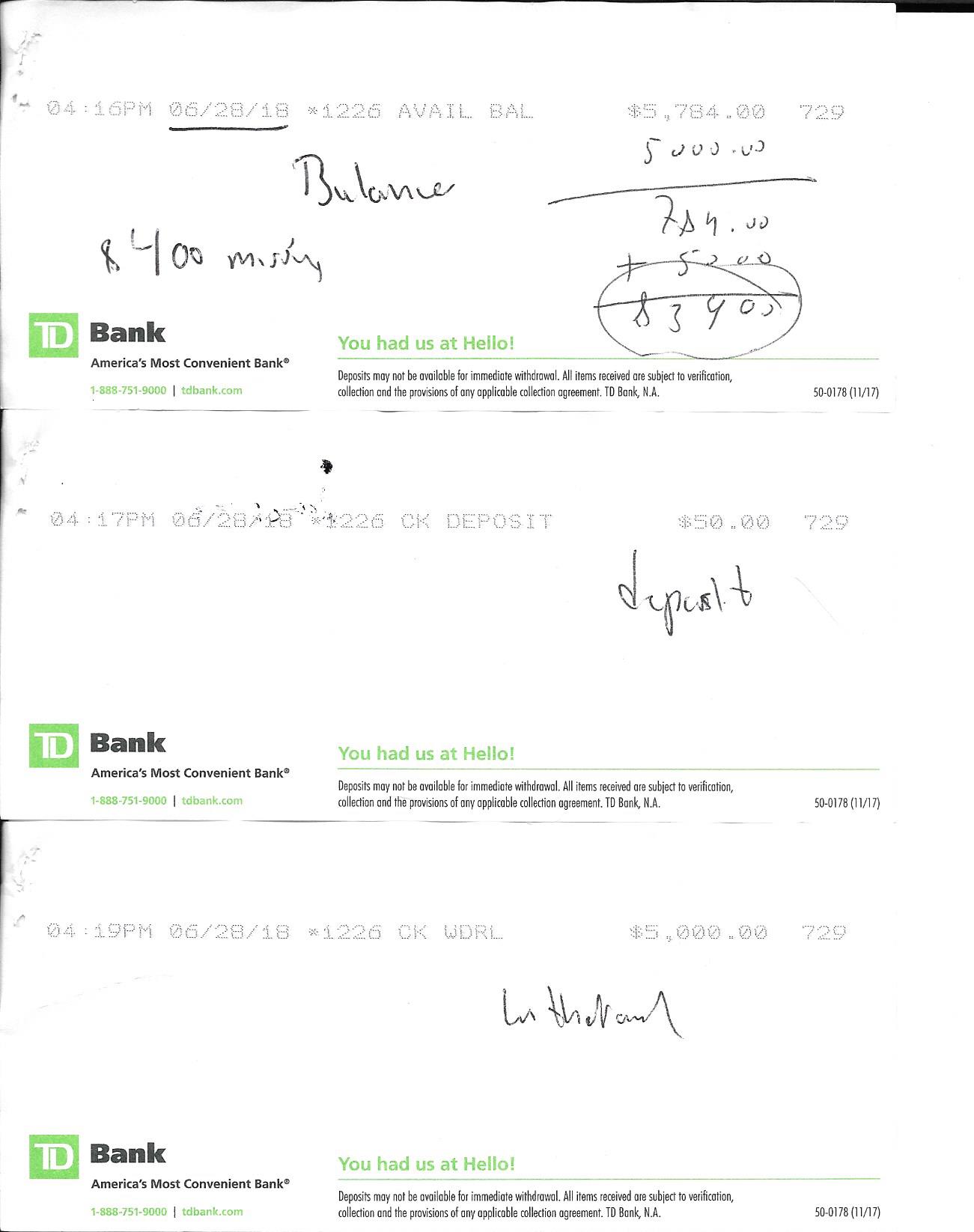

I use my account login daily at the www.tdbank.com website to check my daily balance, so that my account will never be overdrawn. I encountered a problem when they had told me my available balance was not available. Basically, my account has been overdrawn $259.00, for what they say is money not being in the account. According to bank records online it was not. They charged me $35.00 each time they said my account was overdrawn. So about 7 transactions x $35.00 is what they charged. Each debit was below $10.00,and at times below $5.00. I don't feel that their money practices are fair to me, a customer who is also on disability. They would not work with me at all. I have had this happen twice before. They did give me a courtesy refund both times, but did not refund all of the moneys. This is a very bad way in my opinion to make money from customers. I also pay a $15.00 service fee each month. I also live below poverty. They do not care about customers.

This report was posted on Ripoff Report on 10/18/2010 02:12 PM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/internet/td-bank-previous-business-commerce-bank-overdraft-fees-internet-652394. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#12 Consumer Comment

Accountability....

AUTHOR: SamSam26 - (United States of America)

SUBMITTED: Wednesday, October 20, 2010

I'm sorry, I wasn't going to say anything but after reading this:

I put a complaint here to complain about overdraft fees, not opinions of everyone that thinks I should keep a register at home. I am complaining of their unfair fees, and when I am on disability, these fees are too much. I guess you both make enough money so you wouldn't understand? You also don't know anything about my lfe, if you want to judge go look yourselves in a mirror. These types of responses are ignorant.

First off, if you're not keeping a register it's your fault not the banks. When you sign up for a bank account you sign a contract that states in detail all the fees that you could be charged along with the reason for each fee. And by the way a $15.00 monthly fee is extremely high. So I would think that you either can't get an account without the fee, or you aren't telling the whole story.

In regards to these being charged all these fees, it's called responsibility, a trait that can be maintained by anyone regardless if they are on disability or not. You can come back at me and say that I must make a lot of money and I don't find myself in this situation. Only thing is dear sir, I have been there. I too relied on the internet and was charged overdraft fees for overdrafting my account. I took responsibility and learned my lesson and now keep a register. I have not had an overdraft fee in over three years.

In regards to the banks knowing exactly what is going to post and when ACH funds are coming into your account....YOU ARE AN IDIOT!!

I do not work for a bank. However I would think that each bank has quite a few customers and unless they have some type of super power, they could not review all accounts 100% of the time. That's why it is YOUR job to keep track of your spending.

This is not a rip off. You are the ignorant one.

#11 Consumer Comment

So....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, October 20, 2010

So exactly who are you going to report me to for posting on a PUBLIC web site, suggestions on how to avoid those fees?

#10 Consumer Suggestion

Fran, you still are not getting it! Checkbook register is NOT "optional"

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Wednesday, October 20, 2010

Fran,

YOU caused your own problems here, so PLEASE stop being so defensive when people are giving you good advice.

PROPERLY maintaining a CHECKBOOK REGISTER is not optional if you don't want to pay fees! As previously stated "online banking" was NEVER intended to replace the checkbook register.

Not keeping an accurate checkbook register is just plain stupidity, ESPECIALLY if you are "in poverty" as you claim!

USE SOME COMMON SENSE HERE!!

No rip off here. You caused your own problems.

#9 Consumer Comment

Oh..and also...

AUTHOR: Ronny g - (USA)

SUBMITTED: Tuesday, October 19, 2010

The bank does not care that you are on disability..or below poverty. How would they even know..or why would they care? So many people are struggling these days.

As a matter of fact if anything...this makes you a PRIME target for overdraft fees, which has been a major profit center for the banks the last few years. They LOVE customers like you and won't change a thing if it was their choice.

Why are you opted into ANY overdraft protection on your debit card? Recent regulation changes forbid ANY bank to automatically enroll you, or force you to enroll into the service. If you go to the bank ASAP and tell them you wish to opt out of overdraft protection with the debit card, they will have to allow it.

Then if you ever try to use the debit card for a small 5 or 10 dollar transaction and the account is overdrawn, the transaction will be declined possibly causing to a bit of embarrassment..but you will avoid the fees. If you opt out and keep better track or your spending, you will surely avoid these fees in the future. If you expect the bank to care about you or watch the account for you..you will be even further below poverty then you are now in little time.

#8 Consumer Comment

True..

AUTHOR: Ronny g - (USA)

SUBMITTED: Tuesday, October 19, 2010

but it often goes a step further. The bank OFTEN knows EXACTLY what checks and ACH payments are pending..they simply CHOOSE to delay posting it in hopes that suckers depend on the online statement for their balance..and subsequently overdraft..which is PURE profit for them at usury rates.

Best bet as stated...keep track yourself..to the PENNY. And checks you write or and electronic bill pays you submit....go to your online account..look at the "available" balance...take a register and SUBTRACT whatever check you wrote or electronic bill pay you submitted from that "available" balance..and you will have a much better idea in REALITY, where you accuratly stand regarding the actual "available" balance. Is this a game?? Yes..yes it is..but easy to win if you are SMARTER then the bank and their scheming systems.

#7 Consumer Comment

Robert was attempting to help.

AUTHOR: Flynrider - (USA)

SUBMITTED: Tuesday, October 19, 2010

"I'd appreciate it if you'd get off my back. I did try to avoid the charges. Checking online, and in my own head how much money I had."

Neither checking online nor keeping track in your head is going to help you avoid these fees. What the other posters are trying to tell you is that you will keep incurring these fees unless you start keeping a register. If you do, chances are very good that you will never pay another overdraft fee again.

Online banking is not a substitute for keeping a register because the banks computer has no idea what checks or ACH tranfers you have pending. Only you have that information.

#6 Author of original report

Robert~Irving~Poor card

AUTHOR: Fran41 - (United States of America)

SUBMITTED: Tuesday, October 19, 2010

I'd appreciate it if you'd get off my back. I did try to avoid the charges. Checking online, and in my own head how much money I had. I do not have to explain my situation to you. You can't even log on to my account to see what I am saying. They use unfair practices.Get a life, and pick on someone else. People such as yourself w/no compassion, and whom obviously lives their life perfectly will soon have their day. If you keep responding to my post in negative ways, I'll have you reported.

#5 Consumer Comment

You don't get it

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, October 19, 2010

I am complaining of their unfair fees, and when I am on disability, these fees are too much.

- If you are on disability and the fees are too much then take responsibility to AVOID the "unfair" fees. Those fees are not required, and actually very easy to avoid..if you choose to.

If you are going to pull the "poor me" card in that we don't know your life and that somehow your situation is special and you deserve special treatment. Well then I hope you learn to enjoy paying those fees. Believe it or not YOU are in control as to if you get hit with them or not.

#4 Author of original report

overdraft fees

AUTHOR: Fran41 - (United States of America)

SUBMITTED: Tuesday, October 19, 2010

I put a complaint here to complain about overdraft fees, not opinions of everyone that thinks I should keep a register at home. I am complaining of their unfair fees, and when I am on disability, these fees are too much. I guess you both make enough money so you wouldn't understand? You also don't know anything about my lfe, if you want to judge go look yourselves in a mirror. These types of responses are ignorant.

#3 Consumer Comment

you could be movin' up

AUTHOR: coast - (USA)

SUBMITTED: Monday, October 18, 2010

Maintain a check register and you may be able to move up to poverty.

#2 Consumer Comment

you could be movin' up

AUTHOR: coast - (USA)

SUBMITTED: Monday, October 18, 2010

Maintain a check register and you may be able to move up to poverty.

#1 Consumer Comment

Why

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, October 18, 2010

Why do you need to log into your account daily to check your balance? Yes that is a good way to VERIFY your transactions, but on-line banking was never meant to take the place of a written register. What you need to do is every time you have a transaction, you write that in a register and deduct it from your available balance. As long as you don't go negative, it is impossible to get any overdraft fees.

The big question is did you "opt-in" to overdraft protection? If you did the very first thing you need to do is "opt-out". This way if you do not have enough "available" and attempt to make a Debit or ATM transaction, it will be declined. Now, this DOES NOT apply to checks or ACH transactions. So you can not use that as an excuse to not keep a written register.

As for the the $15 a month, unfortunatly the same regulations that allowed people to "opt-out" is at least indirectly responsible for your monthly fee. The best thing you can do is start to shop around for a better deal. There are banks that offer free checking under various conditions, others will have lower fees than $15 a month. But be aware that free checking is probably going to get harder to find as time goes on.

Advertisers above have met our

strict standards for business conduct.