Complaint Review: TD Bank - Jacksonville Florida

- TD Bank San Juan Jacksonville, Florida USA

- Phone:

- Web:

- Category: Banks

TD Bank Racketeering the legal way Jacksonville Florida

*Consumer Comment: Keeping a ledger/register for a debit card is NOT unrealistic

*Consumer Comment: To Answer Your Question

*Consumer Comment: You Got Me...

*Author of original report: Excuses for incompetence

*Consumer Comment: So true

*Consumer Comment: A better lesson

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

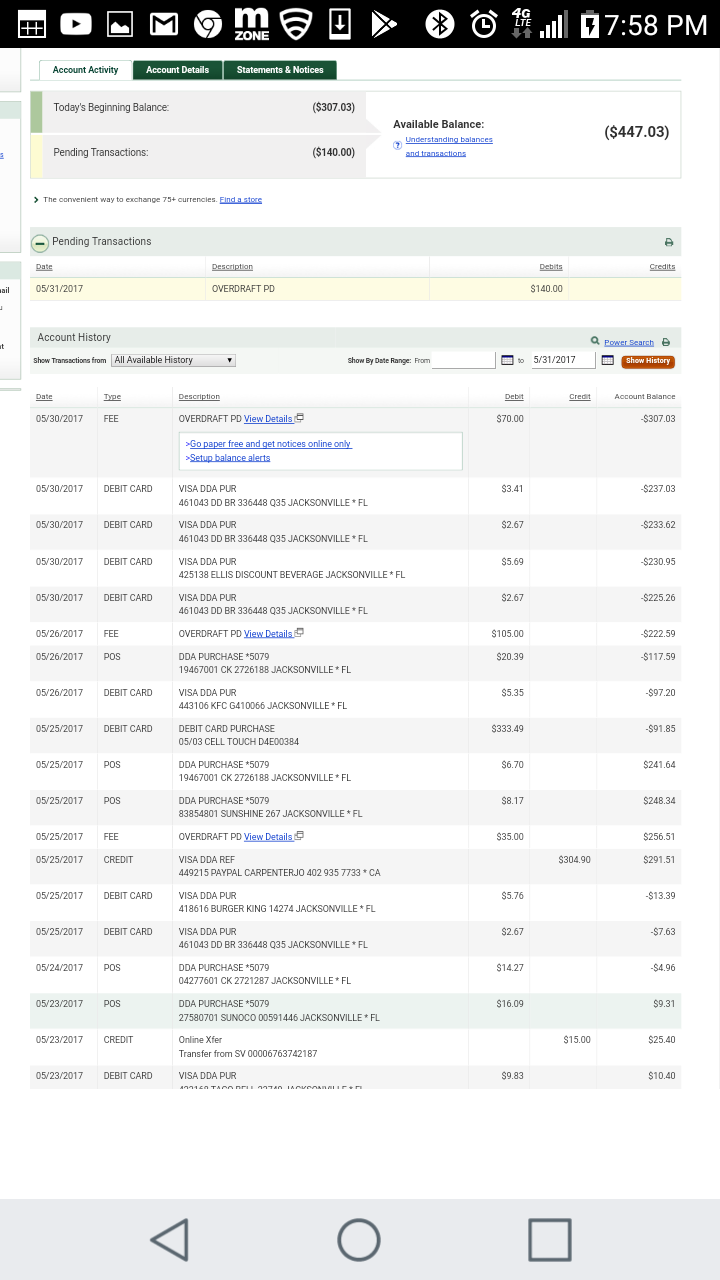

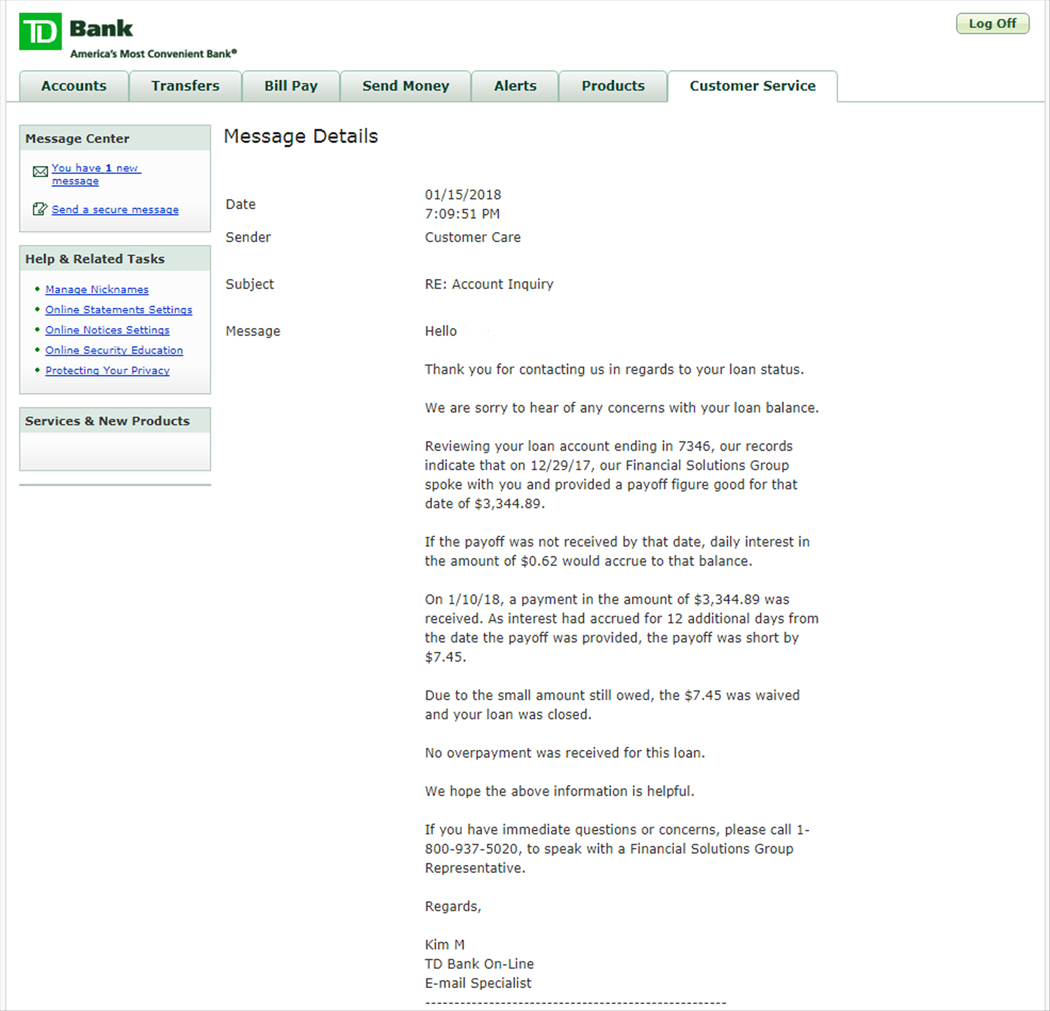

TD unbenounced to me keeps incorrect records of available balances with the intention of charging overdraft fees. My problem started with a refund on the 23rd that didnt post til the 25th made with a debit card. Of course the money is in there because I was informed the money was refunded so i used my card. When oh looky looky its an overdraft fee. Ok thats fine. Its wrong to post a deposit last and charges first but somehow its legal no matter which one occurred first. I bought a cell phone on the 3rd with my debit card and used my pin to purchase and had roughly 3,200 in my account. About the 10th I read all transactions to my daughter to teach her how fast money goes. It was on the page. Eventually my funds dwindled and was down to $25 by the 22nd and then suddenly on the 25th when the refund of $304 was put back into my account suddenly the cell phone charge appeared again. It wasnt a second charge but had already been paid. I go back to look at the 3rd and it was gone and moved to the 25th. Why would they hold it for 3 weeks? I believe someone at the bank is stealing by moving the charge as if it hadnt been paid then paying it again only to herself. Now in my mind Ive already paid it so I have money and used my card. Now somehow I got $307 negative plus a $140 overdrawn fee not including another for $105 and $35. I cant even wrap my head around it. Also I used my card last week on the 23 for the last time even if charges were pending wouldn't they show purchase date as well? Somebody should do something because its wrong how they are doing people!!

This report was posted on Ripoff Report on 05/31/2017 04:28 PM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/jacksonville-florida/td-bank-racketeering-the-legal-way-jacksonville-florida-1376395. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Consumer Comment

Keeping a ledger/register for a debit card is NOT unrealistic

AUTHOR: FloridaNative - (USA)

SUBMITTED: Saturday, June 17, 2017

It is not the responsibility of your bank to keep track of your spending. The online record of your debits and credits is historical in nature and lags real time. If you use your debit card, then it takes about 10 seconds to write down the debt in your register. It is your responsiblity to do that - and to write down each deposit and each ACH etc. You are too busy to to take 10 seconds out to log when you spend your money? Then don't use your debit card. Use cash.

No, I don't work for this bank or any other bank. I don't have OD's or NSF's either - and I don't pay any fee. I would rather take the 10 seconds to log my transaction in a register than pay $X to the bank for a NSF or OD. It's not hard and its not the bank's responsibility to keep track of your spending/overspending. By the way, I would be pissed if I gave my bank $307 in fees just because I didn't feel like logging the debits and credits in my register. It is just irresponsible - of you. Not the bank.

Grow up. You have to teach your daughter the right way or you are doing a disservice. Don't believe me. Look up the proper way to bank, learn and then teach your daugher.

#5 Consumer Comment

To Answer Your Question

AUTHOR: Jim - (USA)

SUBMITTED: Thursday, June 01, 2017

You asked..."so why does the bank list each purchase and when?" The answer simply put is for you to make certain your records on your ledger (read: your check register) match the transactions the bank shows. In reality, the bank has no responsibility to even provide that. However, the service is provided because of the use of debit cards by the bank's customers. The bank reasons IF its customers use debit cards, the likelihood is that a customer will forget to record a transaction. Accordingly, the bank provides that service to you as its customer to make sure you record all your transactions.

You also expressly stated it's wrong to process debits first and then credits. As long as the bank makes that clear in the account agreement you have with the bank, there is nothing wrong with it. Years ago, banks didn't expressly make that clear, they were sued, and paid a settlement in exchange for making that clear. Now there are institutions that post credits first and debits last, but they are few in nature and will likely have to switch.

It's important to note the debit card is the real source of your problem. It isn't the online system and it isn't how the bank processes transactions. If you have a sufficient balance in your account, the bank can process transactions in any order imaginable, and you won't overdraft. The online system can defer a refund due to you (actually, the bank doesn't do that; the merchant at the establishment where you are owed the refund did that to you and all the shenanigans you describe was not done by the bank - it is usually the merchant as well) and you still wouldn't overdraft. The debit card was designed for your convenience, but the debit card also makes it really simple to overdraft and in doing so, you are paying the bank for the convenience of using a debit card.

I'm not saying the bank doesn't make mistakes - it's just that the systems are generally so automated, there is really no individual involved pulling a lever removing a transaction and then replacing that transaction 1-3 days or weeks later. The real lesson to teach your child is the importance of having good credit and using a credit card for these transactions instead of a debit card, and paying the credit card balance in full each month. In this way, you utilize the leverage of the credit card company to use their money free until such time as the credit card bill has to be paid. Use the debit card at your ATM only to remove cash when needed and that's it... Best of luck to you...

#4 Consumer Comment

You Got Me...

AUTHOR: Robert - (USA)

SUBMITTED: Wednesday, May 31, 2017

I fell right into your trap. The way you wrote your original post I thought you were just like the many other people who had no clue how to manage their account. But with the "over the top" response you gave to common sense shows that you can't believe what you are saying and just posting to see what sort of responses you get all the time laughing your head off.

Well Done...Bravo...10 points for originality.

But on the ever so slim chance you are serious, I truly feel sorry for you and more specifically your daughter as she gets a lot of her "life lessons" from you and when it comes to bank accounts you are not a good example. As there is not a single Banker(yes those evil banks), Financial Planner, Credit Counselor or anyone who works at helping people manage their money that would agree with your attitude. But go ahead and believe what you want.

#3 Author of original report

Excuses for incompetence

AUTHOR: - ()

SUBMITTED: Wednesday, May 31, 2017

You would have me believe that its a consumers problem if they dont keep a ledger. So tell me why does the bank have to state each purchase and when. Account for all monies total and available, whats been deposited and whats been charged. Im all for responsibility and accountability so Im definetly responsible for the overdraft that occured due to my refund not posting yet even though its slimy. However, when I know I paid something on the 3rd and confirmed it on my account and suddenly it disappears and reappears on the 25th as the same charge 3 weeks later something is going on and it has messed up the rest of my account. Im gonna be easy because apparently your affiliated with a bank or else you wouldn't sound so defensive. Im just going to say that keeping a ledger for a debit card is UNREALISTIC and is indeed the BANKS responsibility for keeping a correct ledger. And indeed should be able to be used as one. Incompetence isnt acceptable by banks and shouldnt be tolerated!

#2 Consumer Comment

So true

AUTHOR: Stacey - (USA)

SUBMITTED: Wednesday, May 31, 2017

The one and ONLY way to keep an accurate measure of your finances is to use a check register and balance your monthly statement. I am paying that price right now and I do not blame the bank!!! This one is on you!! And a helpful hint: Zero out your check register every payday and round up your purchases in the register. Can help with saving a little money and quit spending money you do not HAVE~

#1 Consumer Comment

A better lesson

AUTHOR: Robert - (USA)

SUBMITTED: Wednesday, May 31, 2017

There is a better lesson you could teach your daughter. How to PROPERLY manage YOUR account.

Yes, I know that would require you to actually learn that first, but perhaps you can make it a nice Parent/Child activity.

So let me help you out a bit here. Online banking was NEVER meant to be a sole method of account management. It is to be used in conjunction with your WRITTEN REGISTER. Every time you write down a transaction you make a note of it subtracting it from your available balance. When you do this it doesn't matter if the merchant doesn't submit it for 1 day or 1 month as you know it has been spent.

As for your credits, these you can not count until they are posted, and yes just like debits could take a few days to post, so can credits. So once the credit has POSTED you can then add it into your available balance.

If you do this and DO NOT spend more than you show you have available you will not overdraft.

Now, as for the item you purchased on the 3rd. When you made a purchase on the 3rd the merchant just requeted a hold. Depending on the exact situation they may not actually post the final debit for a day or several weeks later. In this case they finally posted the debit on the 25th. But if you had a check register and followed the proper account management it would NOT have mattered when it posted.

I will say that there are banks that post credits before debits, but just like this bank ALL of their terms are disclosed up front and it is up to you to know your banks Posting Order and Funds Availability policy. But which ever bank you go with you are bound by their terms and not what you "think".

Spare me the "Oh you work for the bank". As I do not now or have I ever worked for any bank, I just know how to manage my accounts.

One final item. It is really amazing how fast money goes, especially when just in the transactions you showed about 20 of the 40 transactions were for debits under $10 each. Believe it or not this is part of your problem.

As all of those "small" debits add up and I bet most if not all were more non-essential. Well unless KFC or Taco Bell are a need. So I would suggest(but don't expect you to listen) to take out a set amount at each paycheck in CASH. Use that cash for any and all of these small purchases, when you are out of money you get no more treats. I can just about guarantee you this in the end will make you realize how much you are spending and may be a good lesson for your daughter as well. It has another effect in that if you happen to overdraft you won't get this overdraft "cascade" with all of these small purchases.

Advertisers above have met our

strict standards for business conduct.