Complaint Review: TD Bank - Northwood New Hampshire

- TD Bank 1st NH Turnpike Northwood, New Hampshire United States of America

- Phone: 1-888-751-9000

- Web:

- Category: Banks

TD Bank TD Banknorth Overdrafts Northwood, New Hampshire

*Consumer Comment: Simple Explanation

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have 2 checking, 1 saving, and 1 IRA accounts with this bank. In addition I am on joint accounts (checking and saving) with each of my children. I've been with Bank of NH/TD Banknorth/TD Bank for years and I've rarely had an issue. All of that changed recently.

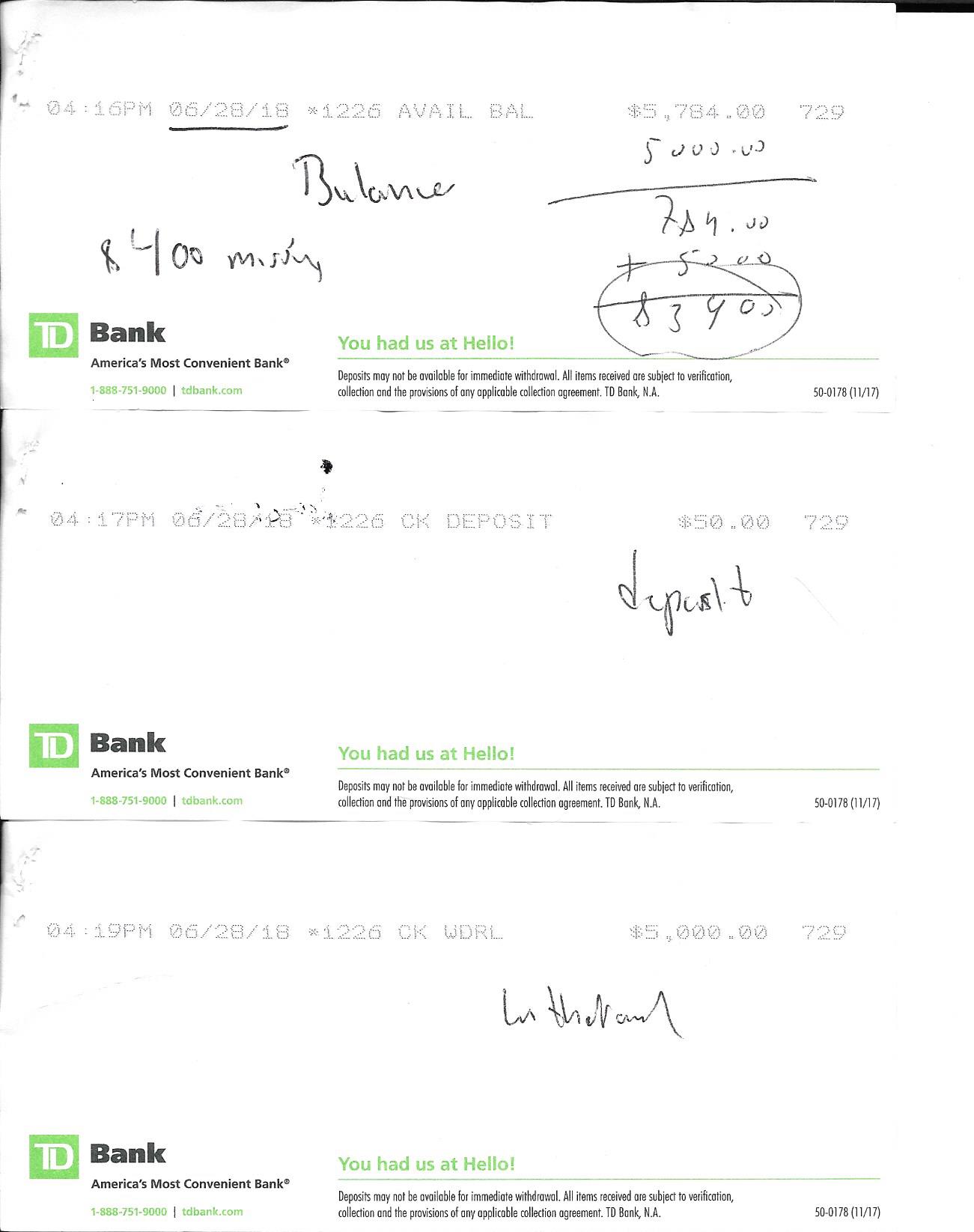

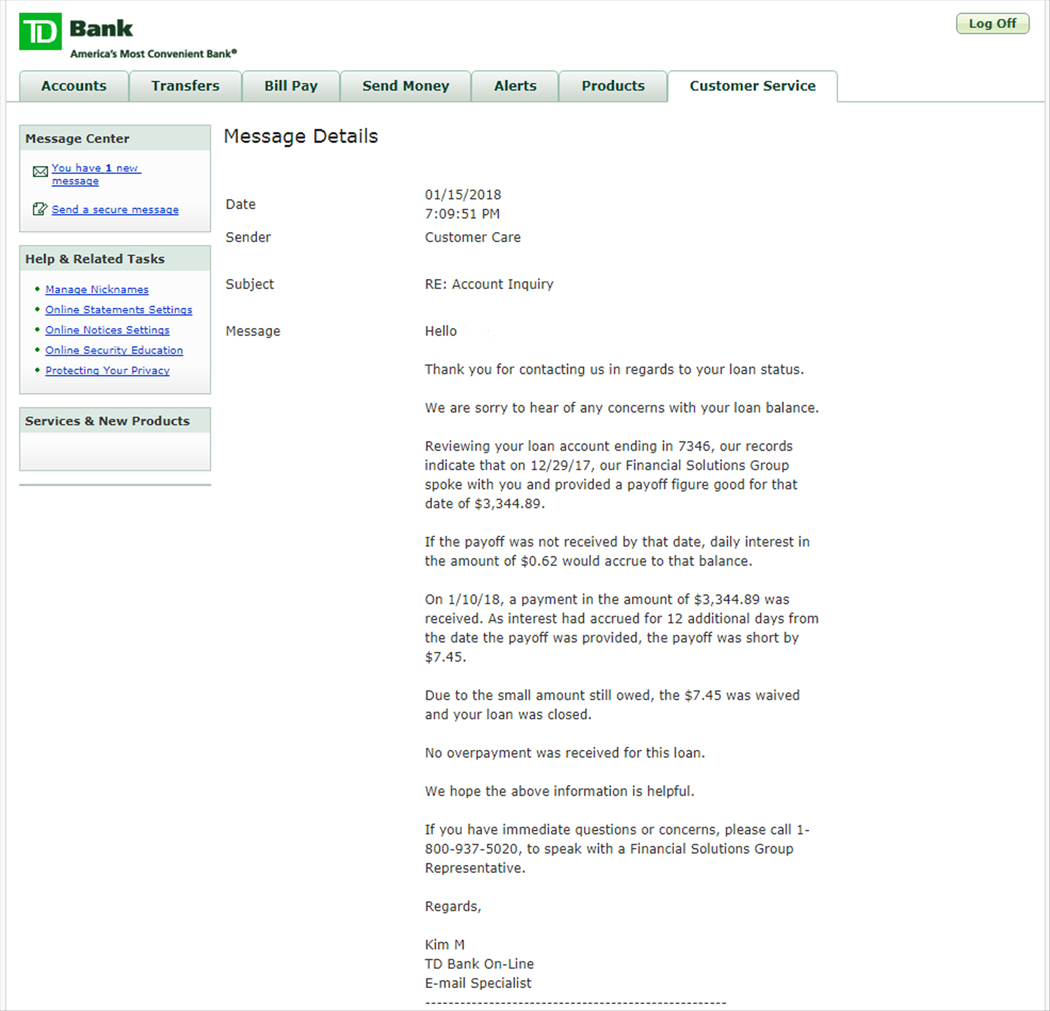

I have had several issues with the accuracy of transfers made using the iPhone app for this bank. At this point it has cost me $315 in overdraft fees. I have spoken to several employees (CS reps, CS managers, and so on) and no one seems to be able to do more than credit $70 of the fees.

Today I hit my limit and demanded that the rep take an in depth look at my account, my spending patterns and my fund transfer patterns. After several minutes and help from a supervisor, the rep admitted that they could view when I logged on, how I navigated through the site and any pass that I had looked at.

The rep did confirm that for the latest transfer in question she could see when I had logged on to the site, when I went into the transfer section, when I checked to confirm that a transfer had gone through. However, something didn't transmit correctly so that is why I was charged the fees. I asked how I was supposed to know that the transfer didn't actually go through when the screen said that it did. Her response is that I should have double checked again later on "just in case."

Seriously?!?! That is crazy. Why would I double check when I have already been given information?

Also, they paid my items for that day from largest to smallest so rather than having just 1 overdraft fee I was hit with SIX on this last occurrence!!!! (I had 3 the first time around.)

At this point I am not happy with the bank. They won't look into the possibility that their mobile banking application has a flaw.

I'm frustrated and I'm going to pull my money out and go elsewhere. If I owe a fee then I will pay the fee. I might not be happy about it, but fair is fair. However, I refuse to support this bank with fees obtained underhandedly.

This report was posted on Ripoff Report on 08/22/2012 12:04 PM and is a permanent record located here: https://www.ripoffreport.com/reports/td-bank/northwood-new-hampshire-03261/td-bank-td-banknorth-overdrafts-northwood-new-hampshire-930967. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Simple Explanation

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, August 26, 2012

You were charged overdraft fees because you used the account without knowing what the real balance was. You did not know that real balance because you don't have any written records such as a register. You can close the account and blame them and go elsewhere but you will take the problem with you until and unless you start using a check register...write down EVERY check or card usage and transfer then do the math right then and there with the exception of deposits or transfers. You add them in when you have proof they have been credited to your account. When you do it this way you will have the most accurate balance known to man. What you see on line is NOT accurate due to holds, batching and other legitimate reasons. When or if there is a discrepancy, you will have all the evidence you need to prove your case. The other alternative is to do what the losers do...blame the bank, go elsewhere, not keep any records because they are too lazy and blame the new bank when the overdrafts start again.

Advertisers above have met our

strict standards for business conduct.