Complaint Review: Wachovia Bank - Nationwide

- Wachovia Bank www.wachovia.com Nationwide U.S.A.

- Phone: 800-922

- Web:

- Category: Banks

Wachovia Bank New scam being used - trick accounting to create NSF fees Nationwide

*Consumer Comment: Yes You Cleared It Up PERFECTLY!

*UPDATE Employee: hope this clears up the situation

*UPDATE Employee: hope this clears up the situation

*UPDATE Employee: hope this clears up the situation

*UPDATE Employee: hope this clears up the situation

*Consumer Comment: Read your Bank Service Agreement

*Consumer Comment: What's to correct?

*Consumer Comment: What's to correct?

*Consumer Comment: What's to correct?

*Consumer Comment: Your fault

*Consumer Comment: Yes Trick Accounting

*Consumer Comment: No Trick Accounting

*Consumer Suggestion: How to avoid OD/NSF fees.

*UPDATE Employee: And...

*Consumer Comment: Here's actual items from my online statement

*Consumer Comment: Here's actual items from my online statement

*Consumer Comment: Here's actual items from my online statement

*Consumer Comment: Here's actual items from my online statement

*Consumer Comment: I know the feeling...

*Consumer Suggestion: A Potentially Legitimate CLASS ACTION Lawsuit

*Author of original report: So the fraud has been proven.

*Author of original report: confused

*Consumer Comment: The Employee Has Already Confirmed This Ripoff

*Consumer Comment: No one can explain your imagined 'ripoff' in your mythical land of fraudward.

*Consumer Comment: Thanks to John of New Jersey

*Consumer Comment: You can sit there and play make believe all you want.

*Consumer Comment: You can sit there and play make believe all you want.

*Consumer Comment: You can sit there and play make believe all you want.

*Consumer Comment: The TRUE Scam Here

*Consumer Comment: No deception in not spending money you don't have fraudward.

*Consumer Suggestion: That Was Their Intent

*Author of original report: additional info

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I overdrew my account by 10 dollars and I have no problem accecpting responsibility for that and paying the nsf fee. However, this post is how wachovia is using trick accounting software to create other nsf fees. Very briefly, I had 36 dollars in my account free and clear with no holds. I made a point of sale checkcard purchase for 34 dollars at 7-11 and the money was taken out immeadiately as usual. Then, a 12 dollar online visa payment was processed which caused my account to be overdrawn, and with the first fee of 22 dollars I had a balance of -29 dollars after all transactions had been processed. I am satisfied with that amount. Mysteriously, over 24 hours later my balance had become -65 dollars due to another 35 dollar nsf charge. I called the 800 number and asked the reps the following "if i have a balance of 36 and drafts are presented for 34 and 12, then how can both items bounce? Clearly, one should of been paid and one should of bounced. That is what your online banking system said after all transactions had been processed." Several different reps could not answer that and transferred me to a supervisor. Suspiciously, I have gotten several different stories from the supervisors as to what happened. This is what they claim: First version: When I had 36 dollars the checkcard purchase was put on hold for 34 dollars which left a balance of 2 dollars. Then they processed the 12 dollar charge which bounced and put my account into a negative balance. THEN, they processed the 34 dollar "hold" and because my account was in the red, it also bounced. LOL This is my response. 1) all transactions had been cleared and the online balance showed a negative 29 dollar balance. They went back 24 hours later and claimed the checkcard purchase was a "hold". 7-11 stores has never put a hold on a checkcard purchase, the money comes out instantly. 2) If the 34 dollar purchase was a hold, then those funds should of been set aside to guarantee the money for 7-11. That is the purpose of a hold. That would of left me with a 2 dollar balance and the 34 dollar charge would not of bounced. This is their second version of what happened: There was a hold on the 34 dollar charge which left a 2 dollar balance. When the 12 dollar item was presented, "they dipped into the 34 dollar hold to pay the 12 dollar charge and thus, when the 34 dollar charge was presented it also bounced. My response is 1) if there is a hold on the 34 dollars then you are not supposed to dip into it to pay other claims. 2) If I had a balance of 2 dollars and a 12 dollar item was presented, then there was no need to dip into the 34 dollar hold. Wachovia routinely pays overdrafts of 10 dollars and then charges a nsf fee. And here is the third version of what they say happened: I had a balance of 36 dollars...they processed both debits which added up to 46 dollars and because my account only had 36 dollars, the TOTAL SUM of both charges bounced.

In my opinion, their computer told them i was overdrawn, so they went back 24 hours later and claimed that the 34 dollar purchase was a hold and thus, according to all their versions of what happened, that caused both items to bounce.

Wachovia is a very unethical company. They claim that checkcards are easier to use, yet had I physically withdrew the 34 dollars then only one item would of bounced. Had I physically written a check, then only one item would bounce. They promote checkcards cause they can use trick accounting programs to scam people.

Wachovia uses numerous ways to scam people which are all legal.

1) They give you an "available balance" which is not actually the available balance." Only the posted balance is actually available. If you want to know how much you can spend without overdrafting, you have to actually speack to a rep and ask what your "posted balance" is. The average person does not know to do this and reads that they have an "available balance" of xxx dollars yet it will cause them to incurr very expensive fees.

2) They also removed the security features of requiring a PIN number to use the checkcard. Now, the criminals with your checkcard only have to press "credit" at a store terminal and they can empty your account.

They claim you have zero liability, yet the fine print says that you must notify them within 2 days and your max loss will be 50 dollars. If you do not call them within 2 days, then your max loss is 500 dollars. That's nice to know, that a criminal can get my atm card and spend 500 dollars without having a pin number just by pressing the "credit" button.

3)They promote their checkcard rewards program yet the fine print says that "purchases made by using your PIN number do not earn points" lol what a scam. Most people use their checkcard at POS terminals that require a PIN number.

4) Despite numerous warnings from 9 major banks, wachovia continuted to process illegal fraud transactions for a major telemarketer. The dispute rate of these transactions was over 80% yet industry standards say any dispute rate over 3% is a red flag for fraud and would cause the account to be frozen. Govt. documents show internal emails that wachovia knew of the problem but "they were making so much money" they overlooked them. In fact, wachovia threw a party for the telemarketer saying "they like to take care of their best customers." Wachovia has reached an agreement with federal requlators and agreed to pay 144 million dollars in fines to reimburse all the senior citizens who were scammed. Imagine all the stress and hassles thousands of people put up with cause "wachovia was knowingly scamming people."

In conclusion, wachovia is a bunch of thieves who use numerous deceptive practices to scam consumers.

They don't care if I close my account and I don't care cause I only use it for pocket money...most of my assets are in blue-chips stocks. And my father keeps 30 million dollars in that bank and if he ever leaves me a penny the first thing I am doing is closing every wachovia account.

I am sending a copy of this letter to the House Finanical Services Committie which has the power to outlaw these types of scams.

J

Daytona Beach, Florida

U.S.A.

This report was posted on Ripoff Report on 04/21/2009 08:16 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/nationwide/wachovia-bank-new-scam-being-used-trick-accounting-to-create-nsf-fees-nationwide-445657. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#32 Consumer Comment

Yes You Cleared It Up PERFECTLY!

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Wednesday, June 03, 2009

Quote: 'There are not multiple hold 'buckets' as a poster in this thread stated, but rather the holds stay together in 1 pot.'

Response: Uh, the name would be Edward. It's okay to call me by my first name.

Quote: 'Amounts that are on hold cannot be used to pay transactions when they post to the account.'

Response: So this means the $32.48 on hold for 7-11 cannot be used to pay the automatic bill pay of $12.00. Got it!

Quote: 'A common misconception is that the 32.48 that was on hold for 7-11 is earmarked for them specifically, and it is not'

Response: So this means the $32.48 is NOT guaranteed to be used for 7-11 even though that's WHY IT WAS HELD! Got it!

Conclusion: Two transactions. There's sufficient money to pay for ONE of them. The other transaction will result in a fee. No problem, stated by John in the FIRST SENTENCE of the OP. Also stated by many other customers in their reports. But what happens instead? BOTH transactions are charged a fee.

Why does this happen? The automatic bill pay transaction is charged a fee because $32.48 was ON HOLD for 7-11. But 7-11 is charged a fee because part of the $32.48, which was HELD FOR IT, was used to PAY the automatic bill pay transaction. Huh???? Oh well. I give up and must go now. For some strange reason I feel the urge to go watch Abbott and Costello's Who's On First routine on YouTube.

This obvious TRICK ACCOUNTING is the ripoff here and untested legally. Stay tuned.

#31 UPDATE Employee

hope this clears up the situation

AUTHOR: TryingToHelp - (U.S.A.)

SUBMITTED: Monday, June 01, 2009

I am an employee of Wachovia bank, and I am ashamed to hear that you have not been able to get a response to your inquiries that satisfies you. Hopefully my post will help to make sure everyone knows what triggers these NSF/UAF fees so they can be avoided. Believe me when I tell you this, Wachovia does not want to make our money off of these types of fees. It inevitably leads to a negative customer experience, a negative image to our customers, and generally makes it much harder for us to gain new customers. That being said, the fees exist for a reason. NSF/UAV fees are not applied randomly, they do not post unless they are valid (whether by customer action or a merchant/bank error).

A post by John earlier in this thread is a prime example of the misunderstanding that is behind the majority of these complaints that I hear from customers.

This is what John wrote in part of his update:

"On March 5th, I had both a posted balance and available balance of

36.75.

On March 9th at 11am, I made a check card purchase of 32.48

On March 9th, an auto-debit bill pay of 12.00 was presented for payment.

What is Wachovia's offical statement as to how I went from 36.75 to a

negative 64.73? Specifcally, in what order were the transactions

processed.

Thank you for helping me clear up this confusion."

The e-mail you got from the customer service rep explains most of the reason, but I will expand on it. The key distinction is looking at when i use the words HOLD and POSTED.

1.) You had a balance of 36.75, posted/available balance.

2.) You made a check card purchase of 32.48 bringing your available balance to $4.27 That transaction was placed on hold, but not posted to your account.

3.) your automatic bill pay posted(with no hold) for $12.00 against the 4.27 balance that was available giving you a balance of -$7.73

4.) a $22 UAF fee was assessed giving you a balance of -$29.73

5.) the next day, (or whenever the 32.48 from 7-11 posted) the balance was still -29.73 , which triggered a $35 nsf fee giving you a balance of -64.73

Key points to why this happened:

*Transactions that are on hold come out of your available balance, but do not post to your account until the merchant sends us the final request for payment.

*Banks do not control the dates that transactions get sent to the bank, so it is entirely possible that a transaction you do on today could post to your account before the transaction that you did on Thursday. The delay in the posting time is purely on the side of the merchant/VISA. Banks can, however, re-arrange the transactions that are due to post that day. Wachovia pays charges from largest to smallest each day. What they will not do is what I see posted in these forums all the time is claiming Wachovia backdates transactions, or posts transactions on days other then when we receive them. Those accusations are patently false.

*Amounts that are on hold cannot be used to pay transactions when they post to the account. That is a key distinction that causes most of these errors. A common misconception is that the 32.48 that was on hold for 7-11 is earmarked for them specifically, and it is not. Funds are placed into a hold "bucket" for lack of a better term. There are not multiple hold "buckets" as a poster in this thread stated, but rather the holds stay together in 1 pot.

*NSF/UAV funds are determined when transactions POST to the account. At processing at the end of the day we determine if you get fees assessed by taking your balance, and adding in any cash deposits, or deposits clearing that night, subtract out any holds on the account, then subtract each transaction posting that day. If it turns out that there are 3 transactions that are posting that night against insufficient/unavailable funds, then the fees are assessed per item.

No one likes to pay fees, and I think Wachovia does a pretty good job helping customers avoid paying these fees. Of course there is room for improvement, no company is perfect. I make sure that all my customers who get new accounts or come across these problems know exactly why they happened, and what is available to avoid them in the future.

#30 UPDATE Employee

hope this clears up the situation

AUTHOR: TryingToHelp - (U.S.A.)

SUBMITTED: Monday, June 01, 2009

I am an employee of Wachovia bank, and I am ashamed to hear that you have not been able to get a response to your inquiries that satisfies you. Hopefully my post will help to make sure everyone knows what triggers these NSF/UAF fees so they can be avoided. Believe me when I tell you this, Wachovia does not want to make our money off of these types of fees. It inevitably leads to a negative customer experience, a negative image to our customers, and generally makes it much harder for us to gain new customers. That being said, the fees exist for a reason. NSF/UAV fees are not applied randomly, they do not post unless they are valid (whether by customer action or a merchant/bank error).

A post by John earlier in this thread is a prime example of the misunderstanding that is behind the majority of these complaints that I hear from customers.

This is what John wrote in part of his update:

"On March 5th, I had both a posted balance and available balance of

36.75.

On March 9th at 11am, I made a check card purchase of 32.48

On March 9th, an auto-debit bill pay of 12.00 was presented for payment.

What is Wachovia's offical statement as to how I went from 36.75 to a

negative 64.73? Specifcally, in what order were the transactions

processed.

Thank you for helping me clear up this confusion."

The e-mail you got from the customer service rep explains most of the reason, but I will expand on it. The key distinction is looking at when i use the words HOLD and POSTED.

1.) You had a balance of 36.75, posted/available balance.

2.) You made a check card purchase of 32.48 bringing your available balance to $4.27 That transaction was placed on hold, but not posted to your account.

3.) your automatic bill pay posted(with no hold) for $12.00 against the 4.27 balance that was available giving you a balance of -$7.73

4.) a $22 UAF fee was assessed giving you a balance of -$29.73

5.) the next day, (or whenever the 32.48 from 7-11 posted) the balance was still -29.73 , which triggered a $35 nsf fee giving you a balance of -64.73

Key points to why this happened:

*Transactions that are on hold come out of your available balance, but do not post to your account until the merchant sends us the final request for payment.

*Banks do not control the dates that transactions get sent to the bank, so it is entirely possible that a transaction you do on today could post to your account before the transaction that you did on Thursday. The delay in the posting time is purely on the side of the merchant/VISA. Banks can, however, re-arrange the transactions that are due to post that day. Wachovia pays charges from largest to smallest each day. What they will not do is what I see posted in these forums all the time is claiming Wachovia backdates transactions, or posts transactions on days other then when we receive them. Those accusations are patently false.

*Amounts that are on hold cannot be used to pay transactions when they post to the account. That is a key distinction that causes most of these errors. A common misconception is that the 32.48 that was on hold for 7-11 is earmarked for them specifically, and it is not. Funds are placed into a hold "bucket" for lack of a better term. There are not multiple hold "buckets" as a poster in this thread stated, but rather the holds stay together in 1 pot.

*NSF/UAV funds are determined when transactions POST to the account. At processing at the end of the day we determine if you get fees assessed by taking your balance, and adding in any cash deposits, or deposits clearing that night, subtract out any holds on the account, then subtract each transaction posting that day. If it turns out that there are 3 transactions that are posting that night against insufficient/unavailable funds, then the fees are assessed per item.

No one likes to pay fees, and I think Wachovia does a pretty good job helping customers avoid paying these fees. Of course there is room for improvement, no company is perfect. I make sure that all my customers who get new accounts or come across these problems know exactly why they happened, and what is available to avoid them in the future.

#29 UPDATE Employee

hope this clears up the situation

AUTHOR: TryingToHelp - (U.S.A.)

SUBMITTED: Monday, June 01, 2009

I am an employee of Wachovia bank, and I am ashamed to hear that you have not been able to get a response to your inquiries that satisfies you. Hopefully my post will help to make sure everyone knows what triggers these NSF/UAF fees so they can be avoided. Believe me when I tell you this, Wachovia does not want to make our money off of these types of fees. It inevitably leads to a negative customer experience, a negative image to our customers, and generally makes it much harder for us to gain new customers. That being said, the fees exist for a reason. NSF/UAV fees are not applied randomly, they do not post unless they are valid (whether by customer action or a merchant/bank error).

A post by John earlier in this thread is a prime example of the misunderstanding that is behind the majority of these complaints that I hear from customers.

This is what John wrote in part of his update:

"On March 5th, I had both a posted balance and available balance of

36.75.

On March 9th at 11am, I made a check card purchase of 32.48

On March 9th, an auto-debit bill pay of 12.00 was presented for payment.

What is Wachovia's offical statement as to how I went from 36.75 to a

negative 64.73? Specifcally, in what order were the transactions

processed.

Thank you for helping me clear up this confusion."

The e-mail you got from the customer service rep explains most of the reason, but I will expand on it. The key distinction is looking at when i use the words HOLD and POSTED.

1.) You had a balance of 36.75, posted/available balance.

2.) You made a check card purchase of 32.48 bringing your available balance to $4.27 That transaction was placed on hold, but not posted to your account.

3.) your automatic bill pay posted(with no hold) for $12.00 against the 4.27 balance that was available giving you a balance of -$7.73

4.) a $22 UAF fee was assessed giving you a balance of -$29.73

5.) the next day, (or whenever the 32.48 from 7-11 posted) the balance was still -29.73 , which triggered a $35 nsf fee giving you a balance of -64.73

Key points to why this happened:

*Transactions that are on hold come out of your available balance, but do not post to your account until the merchant sends us the final request for payment.

*Banks do not control the dates that transactions get sent to the bank, so it is entirely possible that a transaction you do on today could post to your account before the transaction that you did on Thursday. The delay in the posting time is purely on the side of the merchant/VISA. Banks can, however, re-arrange the transactions that are due to post that day. Wachovia pays charges from largest to smallest each day. What they will not do is what I see posted in these forums all the time is claiming Wachovia backdates transactions, or posts transactions on days other then when we receive them. Those accusations are patently false.

*Amounts that are on hold cannot be used to pay transactions when they post to the account. That is a key distinction that causes most of these errors. A common misconception is that the 32.48 that was on hold for 7-11 is earmarked for them specifically, and it is not. Funds are placed into a hold "bucket" for lack of a better term. There are not multiple hold "buckets" as a poster in this thread stated, but rather the holds stay together in 1 pot.

*NSF/UAV funds are determined when transactions POST to the account. At processing at the end of the day we determine if you get fees assessed by taking your balance, and adding in any cash deposits, or deposits clearing that night, subtract out any holds on the account, then subtract each transaction posting that day. If it turns out that there are 3 transactions that are posting that night against insufficient/unavailable funds, then the fees are assessed per item.

No one likes to pay fees, and I think Wachovia does a pretty good job helping customers avoid paying these fees. Of course there is room for improvement, no company is perfect. I make sure that all my customers who get new accounts or come across these problems know exactly why they happened, and what is available to avoid them in the future.

#28 UPDATE Employee

hope this clears up the situation

AUTHOR: TryingToHelp - (U.S.A.)

SUBMITTED: Monday, June 01, 2009

I am an employee of Wachovia bank, and I am ashamed to hear that you have not been able to get a response to your inquiries that satisfies you. Hopefully my post will help to make sure everyone knows what triggers these NSF/UAF fees so they can be avoided. Believe me when I tell you this, Wachovia does not want to make our money off of these types of fees. It inevitably leads to a negative customer experience, a negative image to our customers, and generally makes it much harder for us to gain new customers. That being said, the fees exist for a reason. NSF/UAV fees are not applied randomly, they do not post unless they are valid (whether by customer action or a merchant/bank error).

A post by John earlier in this thread is a prime example of the misunderstanding that is behind the majority of these complaints that I hear from customers.

This is what John wrote in part of his update:

"On March 5th, I had both a posted balance and available balance of

36.75.

On March 9th at 11am, I made a check card purchase of 32.48

On March 9th, an auto-debit bill pay of 12.00 was presented for payment.

What is Wachovia's offical statement as to how I went from 36.75 to a

negative 64.73? Specifcally, in what order were the transactions

processed.

Thank you for helping me clear up this confusion."

The e-mail you got from the customer service rep explains most of the reason, but I will expand on it. The key distinction is looking at when i use the words HOLD and POSTED.

1.) You had a balance of 36.75, posted/available balance.

2.) You made a check card purchase of 32.48 bringing your available balance to $4.27 That transaction was placed on hold, but not posted to your account.

3.) your automatic bill pay posted(with no hold) for $12.00 against the 4.27 balance that was available giving you a balance of -$7.73

4.) a $22 UAF fee was assessed giving you a balance of -$29.73

5.) the next day, (or whenever the 32.48 from 7-11 posted) the balance was still -29.73 , which triggered a $35 nsf fee giving you a balance of -64.73

Key points to why this happened:

*Transactions that are on hold come out of your available balance, but do not post to your account until the merchant sends us the final request for payment.

*Banks do not control the dates that transactions get sent to the bank, so it is entirely possible that a transaction you do on today could post to your account before the transaction that you did on Thursday. The delay in the posting time is purely on the side of the merchant/VISA. Banks can, however, re-arrange the transactions that are due to post that day. Wachovia pays charges from largest to smallest each day. What they will not do is what I see posted in these forums all the time is claiming Wachovia backdates transactions, or posts transactions on days other then when we receive them. Those accusations are patently false.

*Amounts that are on hold cannot be used to pay transactions when they post to the account. That is a key distinction that causes most of these errors. A common misconception is that the 32.48 that was on hold for 7-11 is earmarked for them specifically, and it is not. Funds are placed into a hold "bucket" for lack of a better term. There are not multiple hold "buckets" as a poster in this thread stated, but rather the holds stay together in 1 pot.

*NSF/UAV funds are determined when transactions POST to the account. At processing at the end of the day we determine if you get fees assessed by taking your balance, and adding in any cash deposits, or deposits clearing that night, subtract out any holds on the account, then subtract each transaction posting that day. If it turns out that there are 3 transactions that are posting that night against insufficient/unavailable funds, then the fees are assessed per item.

No one likes to pay fees, and I think Wachovia does a pretty good job helping customers avoid paying these fees. Of course there is room for improvement, no company is perfect. I make sure that all my customers who get new accounts or come across these problems know exactly why they happened, and what is available to avoid them in the future.

#27 Consumer Comment

Read your Bank Service Agreement

AUTHOR: Amber - (U.S.A.)

SUBMITTED: Thursday, May 28, 2009

John,

I am sorry that this happened to you. But honestly, you have absolutly no grounds to stand on for a lawsuit. If you read your bank service agreement it is FULLY DISCLOSED that they have the authority to resequence your transactions. (Most banks process the highest dollar amount first reguardless of when the transactions were made). Your post is too long to try to decifer what all of the numbers come out to be but flat out when you signed up for the account you agreed to the terms and conditions of this account. Any attorney that takes this case for you is a moron. Not only will you have to pay them but also Wachovia's legal fees when you lose in court. As you first stated, you overdrew your account. Banks are not non-profits organizations; they capitalize on people like you who can't manage your account. What this all boils down to is that you screwed up and now you want to file a lawsuit to try to 'prove a scam.' Good luck.

#26 Consumer Comment

What's to correct?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

""And to correct one of the points from the crash course of How to Avoid OD/NSF fees, from Robert of Buffalo. When these banks do realize their error that resulted in fees charged from this TRICK ACCOUNTING, yes they will refund the fees. But it's very likely it will NOT be done quickly and it's 100% guaranteed it will NOT be done gladly.""

IF the OD/NSF fees are not caused by the account holder, but actually caused by an ERROR on the merchant's (payee's) part, every bank I have ever delt with quickly and cheerfully corrected the error-usually with a telephone call. The banks have everything to gain by doing this.

If you're an account holder and the bank doesn't fix it quickly, chances are you will not use the debit card for shopping anymore.

If you're a merchant and the bank doesn't fix it quickly, chances are you will stop ACCEPTING that bank's debit cards as payment.

Remember, almost all bank debit cards are now administered by a credit card company such as VISA or master card. It's not the same as when debit/ATM cards were "young" an actually administered by the banks that issued them. In the "dawn" of the ATM card, banks were motivated by the fact that the number of tellers on the payroll could be reduced and the fact that ATM machines did not require wages, health insurance, unemployment and workman's compensation insurance.

The landscape has changed since 1979.

The banks WANT you to shop with the debit/ATM cards. Not so much because of OD/NSF fees but because the BANK receives a portion of the credit card company's VENDOR FEE that is taken out of EACH debit/ATM card purchase. If my memory is correct, I believe the current VISA vendor fee is about 4.15%-the bank gets a piece of that on every purchase.

I've been assisting folks with credit issues since 1981. I have NEVER seen a bank refuse or reluctantly correct an issue that was caused by a merchant. I advise folks with low account balances to NOT to use debit cards for shopping because of the extra steps one must take to correct an issue-the account is negative untill it's fixed and the risk for additional OD/NSF fees is high. With a real credit card, things are much easier to fix and your bank account is uneffected.

The overwhelmingly majority of folks who are referred to me with credit/financial issues have problems with managing their bank accounts because they do NOT maintain and reconsile an account register but use an online or telephone balance and use their debit/ATM card for darn near everything-causing 5 or more transactions PER DAY. In severe situations I have successfully interceded and had the old account closed and a new account established (with the same bank) and most bank fees reversed (in many cases ALL bank fees were reversed.) The account holder then follows a detailed budget and uses the debit/ATM SPARINGLY-the idea is to generate as FEW account transactions as possible. This makes reconsiling the account register MUCH EASIER.

#25 Consumer Comment

What's to correct?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

""And to correct one of the points from the crash course of How to Avoid OD/NSF fees, from Robert of Buffalo. When these banks do realize their error that resulted in fees charged from this TRICK ACCOUNTING, yes they will refund the fees. But it's very likely it will NOT be done quickly and it's 100% guaranteed it will NOT be done gladly.""

IF the OD/NSF fees are not caused by the account holder, but actually caused by an ERROR on the merchant's (payee's) part, every bank I have ever delt with quickly and cheerfully corrected the error-usually with a telephone call. The banks have everything to gain by doing this.

If you're an account holder and the bank doesn't fix it quickly, chances are you will not use the debit card for shopping anymore.

If you're a merchant and the bank doesn't fix it quickly, chances are you will stop ACCEPTING that bank's debit cards as payment.

Remember, almost all bank debit cards are now administered by a credit card company such as VISA or master card. It's not the same as when debit/ATM cards were "young" an actually administered by the banks that issued them. In the "dawn" of the ATM card, banks were motivated by the fact that the number of tellers on the payroll could be reduced and the fact that ATM machines did not require wages, health insurance, unemployment and workman's compensation insurance.

The landscape has changed since 1979.

The banks WANT you to shop with the debit/ATM cards. Not so much because of OD/NSF fees but because the BANK receives a portion of the credit card company's VENDOR FEE that is taken out of EACH debit/ATM card purchase. If my memory is correct, I believe the current VISA vendor fee is about 4.15%-the bank gets a piece of that on every purchase.

I've been assisting folks with credit issues since 1981. I have NEVER seen a bank refuse or reluctantly correct an issue that was caused by a merchant. I advise folks with low account balances to NOT to use debit cards for shopping because of the extra steps one must take to correct an issue-the account is negative untill it's fixed and the risk for additional OD/NSF fees is high. With a real credit card, things are much easier to fix and your bank account is uneffected.

The overwhelmingly majority of folks who are referred to me with credit/financial issues have problems with managing their bank accounts because they do NOT maintain and reconsile an account register but use an online or telephone balance and use their debit/ATM card for darn near everything-causing 5 or more transactions PER DAY. In severe situations I have successfully interceded and had the old account closed and a new account established (with the same bank) and most bank fees reversed (in many cases ALL bank fees were reversed.) The account holder then follows a detailed budget and uses the debit/ATM SPARINGLY-the idea is to generate as FEW account transactions as possible. This makes reconsiling the account register MUCH EASIER.

#24 Consumer Comment

What's to correct?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

""And to correct one of the points from the crash course of How to Avoid OD/NSF fees, from Robert of Buffalo. When these banks do realize their error that resulted in fees charged from this TRICK ACCOUNTING, yes they will refund the fees. But it's very likely it will NOT be done quickly and it's 100% guaranteed it will NOT be done gladly.""

IF the OD/NSF fees are not caused by the account holder, but actually caused by an ERROR on the merchant's (payee's) part, every bank I have ever delt with quickly and cheerfully corrected the error-usually with a telephone call. The banks have everything to gain by doing this.

If you're an account holder and the bank doesn't fix it quickly, chances are you will not use the debit card for shopping anymore.

If you're a merchant and the bank doesn't fix it quickly, chances are you will stop ACCEPTING that bank's debit cards as payment.

Remember, almost all bank debit cards are now administered by a credit card company such as VISA or master card. It's not the same as when debit/ATM cards were "young" an actually administered by the banks that issued them. In the "dawn" of the ATM card, banks were motivated by the fact that the number of tellers on the payroll could be reduced and the fact that ATM machines did not require wages, health insurance, unemployment and workman's compensation insurance.

The landscape has changed since 1979.

The banks WANT you to shop with the debit/ATM cards. Not so much because of OD/NSF fees but because the BANK receives a portion of the credit card company's VENDOR FEE that is taken out of EACH debit/ATM card purchase. If my memory is correct, I believe the current VISA vendor fee is about 4.15%-the bank gets a piece of that on every purchase.

I've been assisting folks with credit issues since 1981. I have NEVER seen a bank refuse or reluctantly correct an issue that was caused by a merchant. I advise folks with low account balances to NOT to use debit cards for shopping because of the extra steps one must take to correct an issue-the account is negative untill it's fixed and the risk for additional OD/NSF fees is high. With a real credit card, things are much easier to fix and your bank account is uneffected.

The overwhelmingly majority of folks who are referred to me with credit/financial issues have problems with managing their bank accounts because they do NOT maintain and reconsile an account register but use an online or telephone balance and use their debit/ATM card for darn near everything-causing 5 or more transactions PER DAY. In severe situations I have successfully interceded and had the old account closed and a new account established (with the same bank) and most bank fees reversed (in many cases ALL bank fees were reversed.) The account holder then follows a detailed budget and uses the debit/ATM SPARINGLY-the idea is to generate as FEW account transactions as possible. This makes reconsiling the account register MUCH EASIER.

#23 Consumer Comment

Your fault

AUTHOR: Susan - (U.S.A.)

SUBMITTED: Tuesday, May 26, 2009

If you bounce your account it is your fault. Dont spend more than you have. EASY

This isn't a bank conspiracy. The places that ask for money first, get paid first, it is that simple.

#22 Consumer Comment

Yes Trick Accounting

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Tuesday, May 26, 2009

Jim, you are certainly smarter than that. I know you're well aware of situations where there is absolutely NO FAULT at all by the customer. They did EVERYTHING they were supposed to do. They kept a check register, balanced to the penny, and they didn't spend more money than they had. But they were still hit with this SAME FEE because of someone else's mistake, like the merchant.

And I'm sure you're well aware that even when the merchant realizes their mistake where they issued a double or duplicate HOLD on the customer's card, and they correct the error by removing the duplicate hold and it never posts. But still the customer is hit with a fee. This ONLY happens because of this TRICK ACCOUNTING. So if it's trick accounting, then it's trick accounting no matter if the customer contributed to the overdraft or not. For those customers who do contribute to the overdraft, 99% of them express admission like J here in this report and his very first sentence of this report. For these customers, the TRICK ACCOUNTING is their complaint for MANUFACTURING additional fees.

And to correct one of the points from the crash course of How to Avoid OD/NSF fees, from Robert of Buffalo. When these banks do realize their error that resulted in fees charged from this TRICK ACCOUNTING, yes they will refund the fees. But it's very likely it will NOT be done quickly and it's 100% guaranteed it will NOT be done gladly.

#21 Consumer Comment

No Trick Accounting

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Sunday, May 24, 2009

I have a real problem with people calling this trick accounting. This OP can't claim trick accounting if he did nothing to prevent this rip off. The truth is, John invited the rip off. He encouraged it by being careless and mismanaging his money. What did this person's check register say in all of this? Unless John performed this trick accounting on himself, there is no trick accounting.

John just learned about the problems associated with debit cards, especially when one doiesn't either use them correctly or use them with sufficient funds in the account. The problem then becomes - is this a problem with this bank or with the debit card usage. Since John's story is repeated with other consumers and other banks, the only conclusion is that this would be an industrywide practice. Now, does that mean that all banks are ripoffs? Potentially, but not likely since most of these banks also disclose the fees and practices in their agreements. Since the agreements have been found to be legal, it is impossible to declare them an illegal act and therefore a rip off. Since we've now eliminated banks as the issue, the only conclusion therefore is the consumer's use of the debit card. Since the 7-11 put a hold on the funds (it can be done even if the money comes out immediately and the hold can exist for at least a week in some cases), it would seem to me that the use of the debit card caused this issue.

Another excellent reason to avoid debit card usage if you want to hold onto more of your money.

#20 Consumer Suggestion

How to avoid OD/NSF fees.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Sunday, May 24, 2009

The reality is that using an account register and reconciling that register with a monthly account statement from the bank will prevent any account holder from causing any NSF/OD fees.

The majority (if not all) of the reports I've read about NSF/OD fees have common behaviors of the account holders:

using atm cards for everyday purchases.

using more than ONE card attached to the account (husband and wife)

using atm cards for online purchases.

using atm cards for 'auto-bill pay' (autodebits)

relying upon telephone or online account balances to determine what money is available for that shopping trip to Walmart.

*NOT using an account register.

*not reconciling an account register with the scheduled monthly account statement generated by the bank.

Ways to avoid these NSF/OD fees:

1. Use an account register and reconcile the account register with a monthly written statement generated by the bank. If the bank is not mailing statements, contact customer service to have monthly statements MAILED to you.

1a. Be aware of ATM fees, such as the 'non-bank ATM fee' that most banks charge when you use an ATM that is not owned by your bank to make a withdrawal and post that fee in your account register immediately.

1b. Also be aware of any monthly 'account service fee' charged by your bank and post that to your register on the appropriate date.

2. Do NOT GIVE bank account information (or ATM card info) to any merchant, service provider, utility, online service to pay for services and goods. Use a REAL credit card for this purpose (either secured cc or unsecured cc.) Do not setup any automatic deposit to an account that is attached to said cc-NO auto payments to CC company-mail a check each month. If the entity demanding payment makes a mistake, you're gonna have a host of problems and risk OD/NSF fees.

3. Do NOT use an ATM card for everyday expenses-USE CASH. Establish a monthly budget and withdrawal a weekly 'allowance' for every day expenses such as 'milk and bread' from the corner store, Burger King, etc. This will reduce the amount of transactions on the bank account which in turn makes RECONCILING the account and detecting ERRORS easier to accomplish. Again, if the entity demanding payment makes a mistake, you're gonna risk NSF/OD fees.

4. Do not shop with the ATM card-use a real credit card. A real credit card offers protections that you don't have with an ATM card. If the merchant/service makes a mistake, you can dispute it with the CC company WITHOUT getting any OD/NSF. Not true if you use an ATM card-if the merchant makes a mistake, your money is gone until you can convince your bank to give it back, as well as OD/NSF fees.

5. ONLY ONE ATM CARD to one account. Do NOT have 2 or more atm cards for one bank account. Having 'his and hers' ATM cards attached to the same account is the same as in the old days when some folks would have 2 checkbooks for writing checks. It was an invitation to disaster then, and it is today.

6. Verify that deposits to the account have actually cleared. Deposits can take anywhere between 1 and 5 BUSINESS days to clear depending on the type and/or source of the deposit.

Follow ALL of these suggestions and you will NEVER pay an OD/NSF fee again unless it is a LEGITIMATE bank error, and then the bank will gladly and quickly rectify the situation and credit any fees generated as well as contact payees and cover any fees the payees assess to you.

This is a tried and true method to avoid these fees. It works EVERY TIME it's tried.

#19 UPDATE Employee

And...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Saturday, May 23, 2009

what was on hold on the 23rd that added up to more than $215.59? That is why you were accessed the fees. You had an item or items that you had used your card to purchase on the 23rd and the total of that item/items was more than $215.59. So the two transactions that psoted on the 23rd that left you with less in your account then you needed to cover your holds were legitimately accessed fees. Bottom line is don't spend money you don't have available in your account and you won't have fees accessed.

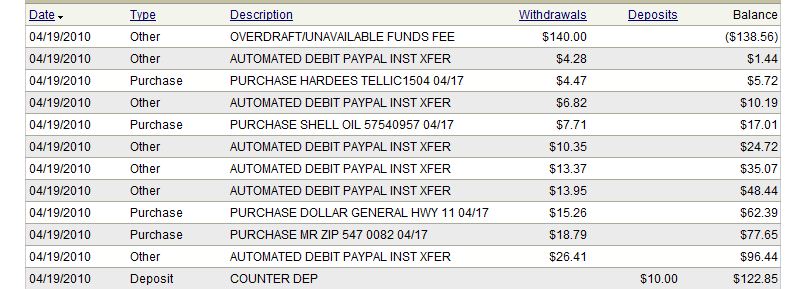

#18 Consumer Comment

Here's actual items from my online statement

AUTHOR: Whatsinaname - (U.S.A.)

SUBMITTED: Wednesday, May 20, 2009

For those of you who doubt that this is happening, here are some entries from my transaction log, which I printed out while online.

I will type them in as they appear on the statement, and you judge for yourself....

DATE Type Description With's Dep's Bal

04/24/2009 Deposit Automated Credit ***corp. $1,064.91 $1,185.51

04/23/2009 Other Unavailable Funds Fee 2x@$35 $70 $138.60

04/23/2009 Purchase Purchase Pilot 0000 04/21 $6.99 $208.60

04/23/2009 Purchase Purchase Zaxby's 27501 04/21 $10.50 $215.59

04/22/2009 Purchase Purchase Mercedes Shop 04/21 $118.57 $226.09

There are more entries, but those are the ones closest to the 2 NSF charges I was hit with even though my account NEVER went into the negative.

I had to scream and threaten legal action to get them to remove them.....

I think this is proof enough. So all of you "skeptics" who are just Wachovia employees can put this in your pipe and smoke it.

#17 Consumer Comment

Here's actual items from my online statement

AUTHOR: Whatsinaname - (U.S.A.)

SUBMITTED: Wednesday, May 20, 2009

For those of you who doubt that this is happening, here are some entries from my transaction log, which I printed out while online.

I will type them in as they appear on the statement, and you judge for yourself....

DATE Type Description With's Dep's Bal

04/24/2009 Deposit Automated Credit ***corp. $1,064.91 $1,185.51

04/23/2009 Other Unavailable Funds Fee 2x@$35 $70 $138.60

04/23/2009 Purchase Purchase Pilot 0000 04/21 $6.99 $208.60

04/23/2009 Purchase Purchase Zaxby's 27501 04/21 $10.50 $215.59

04/22/2009 Purchase Purchase Mercedes Shop 04/21 $118.57 $226.09

There are more entries, but those are the ones closest to the 2 NSF charges I was hit with even though my account NEVER went into the negative.

I had to scream and threaten legal action to get them to remove them.....

I think this is proof enough. So all of you "skeptics" who are just Wachovia employees can put this in your pipe and smoke it.

#16 Consumer Comment

Here's actual items from my online statement

AUTHOR: Whatsinaname - (U.S.A.)

SUBMITTED: Wednesday, May 20, 2009

For those of you who doubt that this is happening, here are some entries from my transaction log, which I printed out while online.

I will type them in as they appear on the statement, and you judge for yourself....

DATE Type Description With's Dep's Bal

04/24/2009 Deposit Automated Credit ***corp. $1,064.91 $1,185.51

04/23/2009 Other Unavailable Funds Fee 2x@$35 $70 $138.60

04/23/2009 Purchase Purchase Pilot 0000 04/21 $6.99 $208.60

04/23/2009 Purchase Purchase Zaxby's 27501 04/21 $10.50 $215.59

04/22/2009 Purchase Purchase Mercedes Shop 04/21 $118.57 $226.09

There are more entries, but those are the ones closest to the 2 NSF charges I was hit with even though my account NEVER went into the negative.

I had to scream and threaten legal action to get them to remove them.....

I think this is proof enough. So all of you "skeptics" who are just Wachovia employees can put this in your pipe and smoke it.

#15 Consumer Comment

Here's actual items from my online statement

AUTHOR: Whatsinaname - (U.S.A.)

SUBMITTED: Wednesday, May 20, 2009

For those of you who doubt that this is happening, here are some entries from my transaction log, which I printed out while online.

I will type them in as they appear on the statement, and you judge for yourself....

DATE Type Description With's Dep's Bal

04/24/2009 Deposit Automated Credit ***corp. $1,064.91 $1,185.51

04/23/2009 Other Unavailable Funds Fee 2x@$35 $70 $138.60

04/23/2009 Purchase Purchase Pilot 0000 04/21 $6.99 $208.60

04/23/2009 Purchase Purchase Zaxby's 27501 04/21 $10.50 $215.59

04/22/2009 Purchase Purchase Mercedes Shop 04/21 $118.57 $226.09

There are more entries, but those are the ones closest to the 2 NSF charges I was hit with even though my account NEVER went into the negative.

I had to scream and threaten legal action to get them to remove them.....

I think this is proof enough. So all of you "skeptics" who are just Wachovia employees can put this in your pipe and smoke it.

#14 Consumer Comment

I know the feeling...

AUTHOR: Williec66 - (U.S.A.)

SUBMITTED: Tuesday, May 12, 2009

Same thing happened to me only I was signed up for Overdraft Protection on top of this. I spent $89 over on my main bank account through two purchases with $100 overdraft protection. I was told when I signed up for Overdraft Protection that my any purchases that needed to draw from another account would be lumped together and one $10 fee would be assessed for using the service. Great. Saves me time having to go to the bank to withdraw money. I'll take that hit.

What happens? Same thing as above. Posted balance was not available balance even though the funds were available to cover the costs, so a hold from a previous charge caused overdraft protection to kick in while my main account is showing a positive balance. $10 fee is assessed to cover one of the charges (these were supposed to be lumped together, remember). Next post goes through. $10 charge and $35 overdraft. Even though the math all added up to me being covered based on what I had been told by the bank manager. I did the responsible thing and got overdraft protection and got even further screwed for it. I wanted to limit liability to $10 but instead get $55 ripped off through lies and shady accounting. Fraudulent in my opinion.

The cherry on top? They had the audacity to offer me 16% back "as a courtesy" when I called demanding the money back for having been lied to.

Please, if this goes to court, CONTACT ME. Wachovia deserves to be held accountable for this.

#13 Consumer Suggestion

A Potentially Legitimate CLASS ACTION Lawsuit

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Friday, April 24, 2009

The title of the report says it best. Trick Accounting. And it's that 'tricky accounting' or 'fuzzy math' that always causes everyone to take forever to see exactly how this RIPOFF works. It took me forever to see it, and apparently John of New Jersey still doesn't WANT to see it, which is why has to label it 'make believe'. Because now that John of New Jersey sees what's happening, he just can't believe his eyes. So, to him, it has to be 'make believe'. Having contemplated this extensively, I'm beginning to question whether it will REMAIN legal. I'll use the quote from the Wachovia employee in John's email:

-----

'Please note, when you make a purchase using your Check Card, the funds

from the purchase are placed on hold in accordance with Visa policy for

a period of three business days or until the merchant collects the

funds, whichever comes first.'

-----

That's the reason holds are made, to GUARANTEE the money is AVAILABLE when the transaction is sent in by the Merchant for payment. Using that logic, I go back to my example. And to answer your question, John of Dayton, the ending balance in my example is indeed a negative $25. I simply used the Accounting format to represent it, where negative amounts are denoted in parenthesis ($25). Back to the example:

If I swipe my card at Walmart at 10am, and Home Depot at 11am, the funds for those two purchases are held in that TIME STAMPED ORDER, with a positive Available Balance left. Then I swipe my card at Best Buy at 12pm and this overdraws my Available balance. This ONE FEE I understand and ACCEPT, no problem. BUT! When the Walmart and Home Depot transactions post, they will each be charged a fee ALSO.

Referring back to the Visa Policy, the Walmart and Home Depot funds were HELD FIRST and they will remain on hold for up to three days or until the merchant collects the funds. So when these two transactions are presented for payment the VERY NEXT DAY, those funds are STILL ON HOLD and therefore should be AVAILABLE to post these transactions. Once they post, the hold is then released. But Wachovia's logic is the funds are UNAVAILABLE because of the Best Buy hold. That's impossible because the Best Buy funds were held LAST, only after the funds for the first two transactions were already SAFELY HELD FIRST and SET ASIDE.

This 'tricky accounting' method is a RIPOFF, no doubt. But to be honest, I'm beginning to have suspicions this might in fact be deemed to be ILLEGAL in the near future. I'm no lawyer, but if I were, I would be ALL OVER this and maybe they are. The recent Bank of America cased that was just settled this year, was filed way back in 2004. So these things do take time.

#12 Author of original report

confused

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, April 23, 2009

Edward, I am confused by the following:

Walmart $100, Posted Balance=$500, Hold Bucket #1=$100, Available Balance=$400

Home Depot $300, Posted Balance=$500, Hold Bucket #1=$100, Hold Bucket #2=$300, Available Balance=$100

Best Buy $125, Posted Balance=$500, Hold Bucket #1=$100, Hold Bucket #2=$300, Hold Bucket #3=$125, Available Balance=($25).

Doesn't 100+300+125 = 525 thereby leaving a balance of negative 25?

#11 Author of original report

So the fraud has been proven.

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, April 23, 2009

john new jersey, why don't you post some type of facts or constructive rebuttal rather than resort to name calling etc? You can't cause you know it is a scam. Are you one of those paid lobbyist from the american bankers association?

Yes, no bank can make you spend money you don't have. However, they can use trick accounting to declare your account overdrafted when it isn't.

Here is my new communications with wachovia scam corporation via email:

Original Message:

I am planning on filing a lawsuit against Wachovia bank in small claims

court. I am also filing a complaint with the OCC and Rep. Barney Frank

of the House Financial Services Committie.

I overdrew my account and I accecpt full responsibility for that and

have no problem paying legitimate fees. I am not seeking a refund of

fees. I feel your bank has begun using some very unethical methods of

processing debits, and I am just trying to get your offical version of

what happened because I have recieved 3 different versions from your 800

number and still am very confused. I also need your offical response for

future legal action and complaints.

On March 5th, I had both a posted balance and available balance of

36.75.

On March 9th at 11am, I made a check card purchase of 32.48

On March 9th, an auto-debit bill pay of 12.00 was presented for payment.

What is Wachovia's offical statement as to how I went from 36.75 to a

negative 64.73? Specifcally, in what order were the transactions

processed.

Thank you for helping me clear up this confusion.

----------

Dear JOHN D xxxxx JR,

Thank you for contacting Wachovia. My name is Amanda S and I will be

addressing your concerns today.

I have received your e-mail regarding the unavailable funds fee assessed

to your account on 03/09/2009. I understand your concern and would like

to take this opportunity to explain this fee to you.

After reveiwing your account, I find this fee was assessed due to the

following item which posted to the account on 03/09/2009:

$12.00 AUTOMATED DEBIT CREDIT CARD WEB PYMT

The available balance in the account prior to the above transaction was

$36.75. However, the following Check Card purchase was on hold the same

day brining the available balance to $4.27 at the time the above

transaction posted to the account:

$32.48 7-ELEVEN 0

The unavailable funds fee is applied when an item is paid when funds are

not available due to holds (outstanding authorizations) on the account.

An unavailable funds fee of $22.00 was charged to the account for each

item paid.

Please note, when you make a purchase using your Check Card, the funds

from the purchase are placed on hold in accordance with Visa policy for

a period of three business days or until the merchant collects the

funds, whichever comes first.

My records reflect a partial refund of $14.00 was given to the account

on 03/12/2009 as a courtesy.

To send correspondence to Mr. Stumpf, CEO, please use the following

address:

Wachovia Corporation

301 South College Street

Charlotte, NC 28288

I appreciate the opportunity to address your concerns.

Sincerely,

Amanda S

Online Services Team

1-800-WACHOVIA (922-4684)

Your Case ID is 37258242.

---------------

(MY RESPONSE)

Thank you for your response. I do not dispute that one item bounced. I was charged for both items bouncing. You still have not explained how both items bounced.

According to you, I had a balance of 36.75

There was a hold on the account for 32.48 so the balance = 4.27

The $12 dollar item bounced which I agree to.

How did the 32.48 charge bounce causing a fee of $35? (not $22 as you stated)

Thank you

-------------

I am hoping they can't prove it cause I am going to sue. I don't care about a few dollars, it is about standing up to scams. We will see if they can explain it, but so far over 4 reps can't. Where are all the wachovia employees who hang out here?

#10 Consumer Comment

The Employee Has Already Confirmed This Ripoff

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Thursday, April 23, 2009

Hey John of New Jersey, here's a newsflash for you. Striderq, the employee whom you mention, will AGREE with the Wachovia portion of my example. He CAN and ALREADY HAS confirmed this behavior on past Wachovia reports. He does not dispute that LAST HALF of my example. The ONLY thing that Striderq disagrees with in my example is the FIRST HALF with respect to the first ledger in the example regarding how 99% of OTHER banks do things, including Wells Fargo. Striderq claims that ALL banks charge fees the way Wachovia does, as shown in the LAST HALF on my example. And THAT'S where HE'S wrong.

So, John of New Jersey, I have found a way to CLEARLY show how EXTRA fees are being charged when they shouldn't be. And you don't think this is true because, if it were true, it's an OBVIOUS RIPOFF. So you refuse to believe it's happening. That's your only defense. Well, Striderq has confirmed that NOT ONLY is Wachovia doing it, but he wants to INCORRECTLY claim that ALL banks are doing it. So how does that stike you John of New Jersey?

You know. I remember on numerous past ROR reports how many individuals would make sarcastic and insulting comments that the OP resented. And the OP would claim that all of these individuals must be bank employees with an agenda. Those individuals would respond how they always find it funny how the OP labels everyone as 'bank employees' simply because they make comments or provide FACTS the OP might not want to hear.

Oh my, how the tables have turned. I find it funny how bank employees and their BLINDFOLDED supporters have to RESORT to labeling me a FRAUD, simply because I have documented an INDISPUTABLE argument of how and why these EXTRA fees are a RIPOFF, which..........STILL has not been LOGICALLY explained by ANYONE.

#9 Consumer Comment

No one can explain your imagined 'ripoff' in your mythical land of fraudward.

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, April 23, 2009

You want to try and deal in make believe yet won't face the true facts.

Your stories change from post to post.

You are a proven fraud.

I have watched this with you constantly trying to bait striderq with absolute bullshit.

Yet, you fail every single time to actually help anyone avoid the fees by telling them to keep a register.

Again, there are millions of people who have no problems whatsoever so you and your other 'victims' are quite in the minority.

#8 Consumer Comment

Thanks to John of New Jersey

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

Thank you so much for answering my question. I am indefintely in your debt for helping me to..........confirm what I already knew. The inability of ANYONE to provide a TRUE explanation of these 'real life' RIPOFF policies and procedures being used by Wachova and a handful of other banks.

But take comfort John of New Jersey. You're in good company. Not even the Wachovia employees could explain it either, as John of Dayton reported in the OP. So don't be to hard on yourself.

As the report title says, this is a very 'tricky' and inexplicable Ripoff here.

#7 Consumer Comment

You can sit there and play make believe all you want.

AUTHOR: John - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

It is mathematically impossible for a bank to make anyone overdraft. Millions do not overdraft every day. Learn how to do it....you'll be better off in life. Or, go hire an accountant.

#6 Consumer Comment

You can sit there and play make believe all you want.

AUTHOR: John - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

It is mathematically impossible for a bank to make anyone overdraft. Millions do not overdraft every day. Learn how to do it....you'll be better off in life. Or, go hire an accountant.

#5 Consumer Comment

You can sit there and play make believe all you want.

AUTHOR: John - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

It is mathematically impossible for a bank to make anyone overdraft. Millions do not overdraft every day. Learn how to do it....you'll be better off in life. Or, go hire an accountant.

#4 Consumer Comment

The TRUE Scam Here

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

To John of New Jersey, no strings attached, I sincerely invite you to help me understand the result in this sample scenario below.

Let's say you have a customer who opens a NEW account with Wachovia and deposits $500 cash for the OPENING BALANCE. Wachovia has buckets that it uses for transactions that are on hold. For each debit card transaction made and placed on hold, Wachovia takes that amount from the customer's account and sets it aside in one of the HOLD BUCKETS. So this new account holder begins his spending.

Walmart $100, Posted Balance=$500, Hold Bucket #1=$100, Available Balance=$400

Home Depot $300, Posted Balance=$500, Hold Bucket #1=$100, Hold Bucket #2=$300, Available Balance=$100

Best Buy $125, Posted Balance=$500, Hold Bucket #1=$100, Hold Bucket #2=$300, Hold Bucket #3=$125, Available Balance=($25).

Based on the stipulation the transactions arrive and post in the same order they were made, here's what SHOULD happen and what DOES happen at 99% of banks:

1. Debit $100

2. Debit $300

3. Debit $125

4. Overdraft Fee $35. Posted Balance=($60), Available Balance=($60)

But instead, here's what ACTUALLY happens at these VERY FEW banks who use the Unavailable Funds Fee:

1. Opening Balance=$500, Hold Bucket #2=$300, Hold Bucket #3=$125, Posted Minus Holds=$75, Debit Post $100, Overdrawn by ($25)

2. Posted Balance=$400, Hold Bucket #3=$125, Posted Balance Minus Holds=$275, Debit Post $300, Overdrawn by ($25)

3. Unavailable Funds Fee $35 (For transaction #1, $100 Debit), Posted Balance=$65, Available Balance=($60)

4. Unavailable Funds Fee $35 (For transaction #2, $300 Debit), Posted Balance=$30, Available Balance=($95)

5. Posted Balance=$30, Total on Hold=ZERO, Debit Post $125, Overdrawn by ($95)

6. Overdraft Fee $35 (For transaction #3, $125 Debit), Posted Balance=($130)

The Walmart transaction arrives, ready to POST first. This means the Home Depot and Best Buy funds totalling $425 are still on hold. These held funs are UNAVAILABLE for spending and everyone knows that. But at these few banks, that money is ALSO unavailable for posting and MANY people are NOT AWARE of this because hardly any banks do this. These bank take the $500 account balance, subtract the $425 on hold, leaving a balance of $25, which is not enough to cover the $100 Walmart debit when it posts. Fee #1. The same thing happens with the Home Depot transaction resulting in Fee #2. Then the Best Buy transaction arrives last, Fee #3 and the ONLY fee that should have been rightfully assessed.

To John of New Jersey, here's what I sincerely need you to explain and this is the VERY IMPORTANT KEY to understanding this Ripoff. The Walmart transaction was made first. Its money was HELD FIRST and set aside FIRST in its own separate HOLDING BUCKET #1. So how can that money be UNAVAILABLE to cover it when it arrives to post? Simply walk over to Holding Bucket #1, remove the $100 and use it to cover the $100 Debit Post for Walmart (as shown in the first ledger). No Fee! That's what the money was held for to begin with, right John of New Jersey? And it was HELD FIRST.

To the all wise John of New Jersey in all of your infinite wisdom, please explain this to a fraud like myself.

#3 Consumer Comment

No deception in not spending money you don't have fraudward.

AUTHOR: John - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

And you still fail to try and educate the people on how to avoid fees.

You are quite the fraud like your boyfriend professional victim chuckie.

You two really need to deal with the fact you have been proven wrong time and time again.

The jealous venom in your posts stick out like a sore thumb.

#2 Consumer Suggestion

That Was Their Intent

AUTHOR: Edward - (U.S.A.)

SUBMITTED: Wednesday, April 22, 2009

John, Wachovia didn't want you to realize there was a difference between NSF, Overdraft, and Unavailable Funds Fee. This is evident by the deceptive and deliberately misleading wording of their Deposit Agreement. First of all VERY FEW banks even use this fee. And by VERY FEW, I mean less than TEN banks out of the hundreds and thousands of banks out there. But of that very few who use it, Wachovia is the ONLY BANK that I've seen where the fee is not CLEARLY explained in their Deposit Agreement.

No worries though. Wells Fargo just bought Wachovia and Wells Fargo has never used this new Unavailable Funds Fee. So depending on the outcome of the integration, this RIPOFF fee may or may not go away.

#1 Author of original report

additional info

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, April 21, 2009

I didn't realize there was a difference between nsf and overdraft and unavailable funds.

For reference, I got a mailed unavilable funds notice, then a day later I got an overdraft notice.

Anyway you do the math, it still does't make sense.

Advertisers above have met our

strict standards for business conduct.