Complaint Review: Wachovia Bank - New Bern North Carolina

- Wachovia Bank Main St New Bern, North Carolina U.S.A.

- Phone:

- Web:

- Category: Banks

Wachovia Bank They help theirselves to my bank account and think nothing of it. New Bern North Carolina

*Consumer Comment: I Will Continue to Recommend Credit Unions

*Consumer Comment: Do you know this?

*Consumer Comment: Overdraft Protection

*Consumer Comment: Funniest yet.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

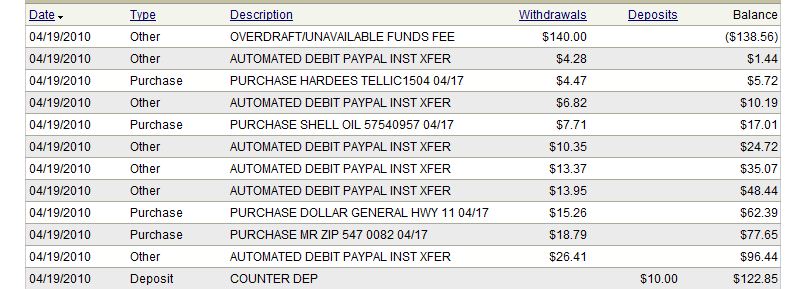

I bank with Wachovia as well. I have Direct Deposit, so they have me where they want me. I was also noticing everytime I would look at my account online, there would be fees of $35.00, $70.00, $105.00. I could never understand where they would come up with the $105.00, but I overlooked it for a while. Yesterday, I saw fees twice, one for $35.00 and another one for $105.00. This doesn't take long to eat your money up and put you in bankruptcy. I called Customer Service and was told the same thing over and over about the Overdraft Protection, etc. I am not disputing the fact that if I overdraw, it's my fault. I am disputing the fact that these fees are outrageous!!!!! It is highway robbery. You can not tell me that it cost Wachovia $105.00 to pay for a transaction when they know for sure they are going to get their money back as soon as my check goes in on payday. Please tell me what work is involved in their computer telling the merchant to authorize a payment without the funds there? I have yet to understand why they charge the $105.00 for a transaction. It makes me mad as h_ll!!! The people that are defending Wachovia, have to be hooked up with the bank in someway, or they are rich and don't have to worry about the fees period. Us people that live from paycheck to paycheck are the ones getting hit the hardest. I say, lets email, write, and phone Wachovia and let them know we don't like it!!! My other question is this. Where I live, we have only one bank, and it's Wachovia, so some of us have no choice but to bank with them. I live in a very small town. I would like to know if anyone can answer this for me. Would I get in trouble if I put a letter to the Editor in my newspaper, or called a news channel, called 9 on your side, or if I put up posters or something to that effect? How far can I go, wothout getting in trouble, in order to advertise Wachovia and warn people about them. My husbband banks with 1st South and my son with Bank Of America, and they have never once had these problems. Right now, my account is -358.23, because of fees. So, when I get paid, I will clear $541.77 out of $900.00. Wachovia gets the rest!!!! I am in the process of changing my direct deposit to another bank, but in the meantime, I am still going to try and warn other people about Walk-all-ova-u. I also did some math on my account and figured my deposits and withdrawals from 8/15 until now. I deposited around 10,000.00 and withdrew around $8500.00 leaving me $1500.00 to the good. So, why am I paying all of these fees? Wachovia, sets their system to make sure they dig into my account and help theirselves. And the sad part is they have been rated #1 in the last 3 yrs. or so, in Customer Satisfaction? Who does these surveys? Must be the rich and famous.

Judyndskies

Vanceboro, North Carolina

U.S.A.

This report was posted on Ripoff Report on 11/08/2007 02:41 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/new-bern-north-carolina/wachovia-bank-they-help-theirselves-to-my-bank-account-and-think-nothing-of-it-new-bern-n-283724. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

I Will Continue to Recommend Credit Unions

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Friday, November 09, 2007

Nikki, if that's the reason not to recommend people go to credit unions - then stop because there aren't enough people using them at this point to get them near the capacity where they have to go to offline banking. Maybe one day, you might have one credit union get to that point, but it isn't going to be anytime soon, and the others will never get to that point because of the membership restrictions some credit unions have.

#3 Consumer Comment

Do you know this?

AUTHOR: Nikki - (U.S.A.)

SUBMITTED: Thursday, November 08, 2007

You said you have direct deposit. Say you get paid on Friday and your direct deposit goes in on Thurday night. Are you making purchases on Thursday figuring your direct deposit will go in at midnight to cover the charges? You do know you cannot do that, don't you? Your direct deposit will not cover charges made on Thursday if the direct deposit goes in Thursday night.

Of course, with computers and everything, it probably does not "cost" them $35 to pay each of those purchases and charge you. However, that is what their fees are. They my not seem fair, but they are legal.

To the poster who keeps telling everyone to go to a credit union, please stop. Do you know why credit unions can do things in real time instead of waiting for nighttime to post deposits? Because they are not innundated with so many customers and can keep their computers online. The big banks had to go to offline computing to avoid a crash because of so many customers, in so many states, with so many branches at one time. If the credit unions become too innundated with customers, they will have to resort to offline banking too.

#2 Consumer Comment

Overdraft Protection

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Thursday, November 08, 2007

"I called Customer Service and was told the same thing over and over about the Overdraft Protection, etc. I am not disputing the fact that if I overdraw, it's my fault. I am disputing the fact that these fees are outrageous!"

First, I'm not with Wachovia - never worked in a bank EVER nor will I.

It's sort of irrelevant whether you think the fees are outrageous; you agreed to pay those fees when you signed up for the account. The fees are meant to be punitive and all banks have their fees set at $35 for every NSF transaction, so $105 from your account means 3 overdraft transactions. You ought to be outraged every time you incur that fee - but you should be outraged at yourself for doing it, and not the bank. The bank is doing what you agreed to accept.

But you ask another interesting question:

'Would I get in trouble if I put a letter to the Editor in my newspaper, or called a news channel, called 9 on your side, or if I put up posters or something to that effect? How far can I go, wothout getting in trouble, in order to advertise Wachovia and warn people about them.'

You have the freedom to express yourself, but you're good to temper that expression with the potential consequence associated with free expression. A letter to the Editor is harmless when Wachovia is the only bank in town. You can call a news channel and they might send a junior reporter to look into this, but you won't be happy when the reporter comes back and won't do the report because the bank didn't do anything wrong and the fees are in line with BofA, and other major banks.

TV reporters like legit victims - you are not one in this particular case. You can put up posters if you want to express your displeasure, though I would be careful not to place it on Private Property other than your own. I think you begin to tread on interesting ground if you were to protest in front of the branch - you might want to consult a lawyer on that one because I won't touch that one. I've seen things like that done with a car dealership, but you need to find out whether your protest will be done on the bank's property - if it is, they have the right to escort you off the property and disturbing the peace (even if peaceful), could be a consequence. As I said, talk to a lawyer about that.

I am sorry to say this, but you're right to say it's your fault. Checking your account online is one of the reasons why you're running into the problems you are, not because of the bank; your online balance is not always accurate because the merchants you buy from (and use your debit card) or write checks to, don't immediately cash their checks.

The thing I always tell clients is the importance of keeping a checkbook, because it will pay off in the end. If you knew you might overdraft, you might not want to buy one thing or another. Only your written record of transactions will give you an accurate assessment of your account. If you add up all of the fees you paid to Wachovia you will quickly understand how much money you save by deciding to track your transactions in writing.

Am I rich? Yes. Did I get to be this way because I understand how financial institutions work? Not because of, but I do know. I don't care whether you stay with Wachovia, move to BofA, or better yet - find a Credit Union. You will be treated much better if you can find a Credit Union. Best of Luck to you.

#1 Consumer Comment

Funniest yet.

AUTHOR: Bart - (U.S.A.)

SUBMITTED: Thursday, November 08, 2007

This is by far the funniest ignorant post I have read.

First you state:

"I would look at my account online, there would be fees of $35.00, $70.00, $105.00. I could never understand where they would come up with the $105.00, but I overlooked it for a while."

then it's suddenly:

"I am not disputing the fact that if I overdraw, it's my fault. I am disputing the fact that these fees are outrageous! It is highway robbery."

It wasn't outrageous or robbery when you nonchalantly said screw it and "overlooked" them for awhile. Your account is in the negative because you admittedly overdraft and then blow it off to boot.

Advertisers above have met our

strict standards for business conduct.