Complaint Review: Wachovia Bank - Virginia Beach Virginia

- Wachovia Bank Lynnhaven Parkway Virginia Beach, Virginia U.S.A.

- Phone:

- Web:

- Category: BBB Better Business Bureau

Wachovia Bank Overdraft fees Class Action Lawsuit, I am in! Wachovia Got Me too Like Everyone Else. Virginia Beach Virginia

*Consumer Comment: I'm in too

*Consumer Comment: Everyone cries ripoff so I guess...

*Consumer Suggestion: The moral of the story ....

*Consumer Suggestion: When will people...

*Consumer Comment: You can't be serious

*Consumer Comment: Unfortunately Jenny - this was on you

*Consumer Comment: That doesn't make sense...

*UPDATE Employee: Question for you...

*Author of original report: Wachovia did it again

*UPDATE Employee: Exactly how...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

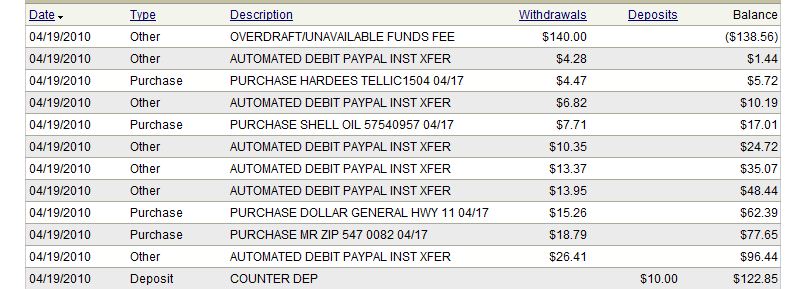

Like most stories, on checked my account on December 7, 2008, had a balance of $32.67 to the good. Went to the store made a purchase of $15.00 still leaving my account in the good. I knew a direct deposit was going in that night so I was not worried. Woke up this morning looked at my balance I was $309.00 in the red.

What they did was posted a check that went in yesterday for $150.00 and put that before all the other charges that have already cleared the bank, moving those all back causing all the others to go into overdraft fees.

I went from being in the black to being in the red in a 8 hour period. My direct deposit didn't even clear the bank yet because its being processed. The fact is I know that check was deposit yesterday because the boss told he was heading to the bank. How in the world do one check go through so fast when a direct deposit does not clear the bank until the next day?

If they would have done things in order they recieved them I would still be in the black and have money left over. This is not the first time this as happen, I got the matter cleared up before but they always go back and look at the computer and say you got a refund already. Well Yeah it's not my fault you computer system does such things to the customer.

I am all for the lawsuit count me in and tell me what we have to do now.

Jenny

Virginia beach, Virginia

U.S.A.

This report was posted on Ripoff Report on 12/09/2008 06:01 AM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/virginia-beach-virginia-23462/wachovia-bank-overdraft-fees-class-action-lawsuit-i-am-in-wachovia-got-me-too-like-ever-399459. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#10 Consumer Comment

I'm in too

AUTHOR: Mad As Hell - (U.S.A.)

SUBMITTED: Thursday, December 18, 2008

I agree Wachovia and other banks are extremely dishonest. I don;t write checks I always use my debit card so riddle me this.... How is it that my debit transactions are over the limit. In the age of computer technology this is CRAZY!!! I don't process any transactions as credit they are all processed as debit so that they post to my account immediately. So why was I hit with 208. in OD fees??? I put in a deposit on a Thursday afternoon., my first transaction didn't happen until Saturday. on Monday I saw my that my account had a pending transaction that would have put it into the negative by 12.82 so I went to the bank and made an ATM deposit at 4pm for $13. Did it help? NOPE!!! that night I was hit with 3 unavailable Funds charges and 3 OD fees on 3 transactions.

#9 Consumer Comment

Everyone cries ripoff so I guess...

AUTHOR: Bankworker - (U.S.A.)

SUBMITTED: Wednesday, December 17, 2008

I'm in for the class action! I want something for nothing just like all the other crybabies on here that overspend, miscalculate, or flat out kite or fraud the banking system and then want to sue the bank for all the fees they've accumulated. Everyone thinks they're entitled to something for nothing. Grow up, become an adult and manage your finances and you wouldn't have to be on ripoffreport.com every other week crying foul....

#8 Consumer Suggestion

The moral of the story ....

AUTHOR: Grimlock - (U.S.A.)

SUBMITTED: Tuesday, December 16, 2008

Never, ever, try to float a check. There was a time when you could safely float a check for a couple of days, but those days are long gone. Don't write a check for money that you don't have in your account. You took a chance and you got burned. It has happened to me too, and I switched banks because of it. I made a debit card transaction. They put a hold on the funds. Another transacation came through, and because of the hold, I was assessed a NSF fee. So when the debit card transaction came through, they charged me an NSF on that too, even though they had a hold on those funds. I was VERY upset, but in the end, I caused it by not having enough money in the account in the first place. Was it fair? NO WAY. The banks have these things set up to create as many fees as possible, but if you manage your account carefully, you can avoid giving them free money.

#7 Consumer Suggestion

When will people...

AUTHOR: Ed - (U.S.A.)

SUBMITTED: Tuesday, December 16, 2008

who keep complaining about overdraft fees realize that they can avoid all these problems by simply keeping enough money in the account to cover their debits.

#6 Consumer Comment

You can't be serious

AUTHOR: Stop_playing - (U.S.A.)

SUBMITTED: Tuesday, December 16, 2008

You wrote the check on the account for $150 knowing the money was not there despite the fact it was written before your direct deposit and you want to sue the bank. Your balance was $32 and change and knowing you have a chedk outstanding for $150 you were still doing other purchases. Do you have direct deposit or does your boss go to the bank to make your deposit? Direct deposit come into your account for a specific day which is listed by your employer. It is your employers responsibility to get your deposit into the account by the date they state you are going to be paid. It is the banks responsbility to pay your debits according to the balance you have available. Untill the items are listed as posted to the account they will pay in any order. Most banks pay from largest to smallest. Not to cause you fees but to pay larger items because they may be of more importance. Most banks from what I have seen work this way. I fail to see the point in getting in on a lawsuit because I fail to see where the bank has charged you fees that were not due to you overspending your account. Lawsuit, you can't be serious.

#5 Consumer Comment

Unfortunately Jenny - this was on you

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Saturday, December 13, 2008

Jenny, you admitted to overdrafting your account. You had $32.67 balance to the good - that was the online balance, right? The problem is that was not your balance in the account. In reality, your balance in the account was substantially less than that. This is one of those events where keeping an accurate register would have saved you a lot of money.

Your online balance is not the balance in your account; the reason banks put that out there for you is for you to monitor the account for fraud, charges going through, and for you to make certain you record everything in your check register. It is not intended for you as the account holder to stop keeping a register. Keep an accurate register and it won't matter what order checks or debits clear.

While you're at it, if you really want this nonsense to stop, you'll stop using your debit card. It's not helping you hold onti your money.

Finally, the bank has the right to rearrange the transactions in any order they wish to; its in the account agreement you signed. I'm afraid it's not BS, it's reality. The banks can do it because they not only can, but the courts agreed in a lawsuit that they can - as long as it's disclosed in the agreement. Since it is, it's legal and no court would ever rule in your favor.

#4 UPDATE Employee

Question for you...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Saturday, December 13, 2008

If the other bank didn't let us know the check had been deposited, how would we have known about the check? I believe that you'll find the other bank put through the elctronic information on your check on Monday to be paid. But again, if you have the money available in your account before you spend it you won't get any fees. Basically you're saying you wrote a check on Monday when you knew you wouldn't have the money until Wednesday.

#3 Consumer Comment

That doesn't make sense...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Saturday, December 13, 2008

>>But I was not done, I tracked the check that put my account into overdraft and found out that the other bank did not process my check until tuesday, which means wachovia could not have processed that check on Monday like they did, it should have been processed on Wednesday but if they did that my account would have been in the good because my paycheck went into the bank on Tuesday.

Clearly the other bank had submitted the check to Wachovia. How else could Wachovia have processed it? I'm guessing the other bank submitted the check electronically and Wachovia received it on Monday and paid it. The other bank would have considered that a Tuesday transaction.

Let's put this in a timeline...

Sometime prior to December 7th- You wrote a check for $150. On December 7th, you used either the online banking feature or the hotline and thought you had a balance of $32.67. Your balance was actually (117.33) plus one overdraft fee because of that check.

You then made a $15 purchase and I'm guessing that you used your debit card. That now puts your balance at (132.33) plus two overdraft fees. Since you indicated a balance of (309), it appears that you had two or three more transactions that were still pending.

This is clearly not embezzlement. I understand that you're angry, I wouldn't want to pay $300 in fees either. However, this is a case of user error and not the fault of the bank.

#2 Author of original report

Wachovia did it again

AUTHOR: Jenny - (U.S.A.)

SUBMITTED: Saturday, December 13, 2008

Well I have been fighting with Wachovia about how they rearranged my checking so that it will go into overdraft fees. When I spoke to the manager of the bank and her supervisor (who by the way hung up on me), they both said that Wachovia always takes the biggest amount before the smaller amount. In the end, they feel they can do this.

But I was not done, I tracked the check that put my account into overdraft and found out that the other bank did not process my check until tuesday, which means wachovia could not have processed that check on Monday like they did, it should have been processed on Wednesday but if they did that my account would have been in the good because my paycheck went into the bank on Tuesday.

When I asked the lady if I was the only customer that has this problem, she said "Yes you are" I told her bull sh**!!, there are hundreds of people that the bank has done this too, what you are doing is just another form of embezzlement and feel that we can not do anything about it because we have no money. that is when she hung up on me. Who and where is the lawsuit so that we can do something about it? contact me and let's get the ball rolling.

#1 UPDATE Employee

Exactly how...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Thursday, December 11, 2008

is any of this the bank's fault. You claim you had a balance of $32.67 in your account and yet you had a check out for $150. seems like right there you would know you had overspent your account.

If the check is presnted against your account on Thursday and your direct deposit is for Friday, then your direct deposit is not available to cover the check. As for how the check could go through so fast, here's a few ways: your boss cashed it at a Wachovia branch; your boss deposited it in his Wachovia account; your boss deposited it into his account at another bank and his bank used Check 21 to send an electronic representation of the check for payment. Any of these puts the check in for processing on the night before your direct deposit is available.

The real question is why did you write a check for $150 when you didn't have the money available in your account? This report like the vast majority on this site, involves an OP that does not take financial responsibilty of their account and then cries when they get fees accessed. No ripoff, just not keeping a register.

Advertisers above have met our

strict standards for business conduct.