Complaint Review: Wachovia Bank - Winchester Virginia

- Wachovia Bank wachovia.com Winchester, Virginia U.S.A.

- Phone: 800-922-4684

- Web:

- Category: Banks

Wachovia Bank NO FEES = BIG FAT LIE. Ripoff Winchester Virginia

*UPDATE Employee: Incorrect information

*Consumer Suggestion: All Banks Seem to Operate the Same

*UPDATE Employee: Register Register Regster

*Author of original report: DID NOT KITE NOR FLOAT

*Consumer Comment: No Kiting Here

*Consumer Suggestion: Kiting checks is against the law

*Consumer Comment: If you spend it before you get it, of course there is a fee.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Wachovia Bank is a BIG FAT LIAR when it comes to "NO FEE CHECKING". Further, they process debits before credits, and their customer services are NONEXISTENT. You are actually CHARGED to speak to a human at Wachovia! Yay!

My husband's paychecks are direct-deposited into our Wachovia Bank "Free Checking" Account. They are to be credited at 12 am each Friday.

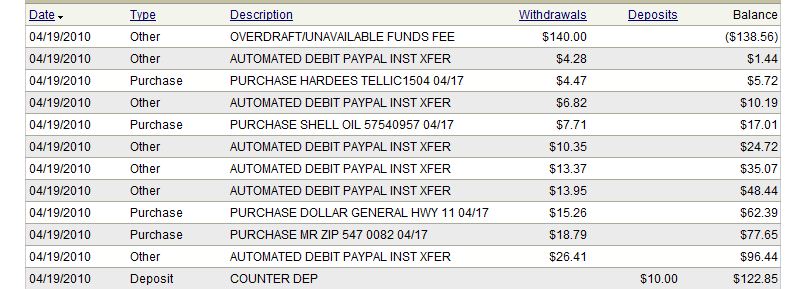

However, Wachovia is processing the direct deposit AFTER they process other transactions. This means that transactions made at 10 pm Thursday are BOUNCED by Wachovia - even though they didn't get the info about the transaction until AFTER they were supposed to credit the direct deposit.

We have been hit with $100+ fees on the past 3 Friday mornings. :)

When my extremely frustrated husband sent them the last email, he unfortunately included ONE (1) four-letter word. Wachovia responded by stating that he could not use profanity or they wouldn't talk to us - at all. Wachovia ended their email stating "I look forward to serving you again" although they completely failed to address a SINGLE customer service issue my husband raised. They performed NO SERVICE. It is typical that they claim they did! Oh, because he didn't sign the email, even though it's a joint account, Wachovia's Customer Service Rep intelligently thought I had sent the email and I was the one chastised...

DO NOT USE THIS BANK! For YEARS we have tried working with these jerks and it's IMPOSSIBLE! If you want to actually TALK to a human, it'll cost you $10.00 a month! They will smack you with fee, after fee, after fee and not explain a single thing! The last time I spoke to them about the fees, I was told that the transaction occurred prior to Friday (late in the day on Thursday) and thus "happened" prior to the direct deposit. However, they didn't get notice of the transaction until AFTER they should have processed the direct deposit. When I mentioned that fact, they completely blew me off. DO NOT USE THIS BANK.

Wachovia Bank is an opportunistic THIEF of customer funds.

Lauren

Berkeley Springs, West Virginia

U.S.A.

This report was posted on Ripoff Report on 11/06/2006 08:40 AM and is a permanent record located here: https://www.ripoffreport.com/reports/wachovia-bank/winchester-virginia/wachovia-bank-no-fees-big-fat-lie-ripoff-winchester-virginia-219263. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 UPDATE Employee

Incorrect information

AUTHOR: Amanda - (U.S.A.)

SUBMITTED: Tuesday, December 12, 2006

To Cory in San Antonio

I won't even wait until the end to reveal to you that I work for Wachovia, so we can get that out of the way. Anyway...

The account that you are speaking of is actually a Crown account and not the Free checking account. Or possibly it may be the Money Market account which also has a minimum balance requirement of $2500. Additionally there are actually several types of Crown accounts that can accomodate customers of many income levels. The Crown accounts range from minimum balances of $1,000 to $10,000 but that balance does not necessarily mean cash.

You can have an equity line, credit card, or another account linked to that Crown account to substitute having actual cash to maintain the balance. And if you can't tell from the balance requirements, these accounts are reserved for those customers that are beyond trying to beat a direct deposit posting. The Free accounts are non interest bearing accounts and they do not require a minimum balance. They have a $100 opening deposit (maybe even $0 if you work for many participating local/ nationwide companies). They ARE free until you mishandle your funds by not keeping accurate records of the money you are spending. Although I see customers come in almost on a daily basis inquiring about fees and such, I can tell you that close to all of them do not keep an accurate account of what they are spending.

Once and for all, you can not depend upon ATM's or Automated systems to track your funds. They are only as good as your combined record keeping and merchant processing practices. It is by no stretch of the imagination that the bank is responsible for checks, checkcard purchases, and automatic drafts that you perform on your own behalf and forget about until the next week.

Furthermore, there is no exact science as to what time at night a deposit is posted. It is only required that funds from a direct deposit are available on the business day that the check would normally be issued. That doesn't mean start spending at 12am. If there are no charges to be posted to the account before money is there, how could there ever be fees to be posted to the account for non sufficient funds? Simple suggestion is if it is not available when you are looking at your register (that you should be keeping) then you do NOT have it to spend. Banks are not for everyone. There are numerous companies that now offer check cashing debit cards.

This is an alternative to having an actual bank account if you are only using it for purchases, bill pay, etc. But, I promise you that you are hanging by a wing and a prayer if you refuse to keep accurate records of what is actually in your account and not what SHOULD be there in a couple days. If there is a bank error in any of this, or even a first time screw up with evidence of reasonable record keeping, it can be brought to a manager's attention and handled promptly.

I love it when people ask if we say this just because we work at the bank, not thinking that we also have our own funds to manage. It's quite a simple concept. You can not spend what you don't have. One last note, I am truly sorry that our original poster has had such unpleasant experiences with our customer service lines and branch employees. I can only say that they do not represent the entire company and if you have ever had a chance to get names, then they should definitely be reported so that they can be reprimanded.

We do pride ourselves on #1 customer service and if you feel that you have not been given such, you have every right and responsibility to report it to a higher manager. We realize that there are many choices out there and incidents like these only push us into the background.

#6 Consumer Suggestion

All Banks Seem to Operate the Same

AUTHOR: M - (U.S.A.)

SUBMITTED: Saturday, November 25, 2006

I banked with BB&T for several years until I got smart and closed out with them. Please do a search on BB&T and read all the stuff about them. For some reason, banks love to run unauthorized fees up in accounts and then respond with "Well, do you keep a checkbook balance, are you spending more than what you have and blaming the bank, etc.". They do everything, but admit to wrongdoings.

Well, I took the advice of filing a complaint with the FDIC in my situation. Since then BB&T has closed my file out with a note "do not contact and do not attempt to collect". Also, don't bother to deal with the local offices of the bank. Always deal strictly with the main office and a head person.

I know one fact -- when you have a direct paycheck deposit in your account the funds are to be made available immediately. But, BB&T was holding my funds for 2-3 days.

There are a lot of things that banks don't disclose to the consumer. When you file a complaint with the FDIC, even if they don't find in your favor, they keep all complaints on file. And when the bank is investigated all the complaints are taken into consideration.

As I stated in my complaint with BB&T -- I didn't change the way I was banking, I JUST CHANGED BANKS. And, I don't have fees being run up in my new account. I do everything online and never keep a checkbook record.

#5 UPDATE Employee

Register Register Regster

AUTHOR: Josua - (U.S.A.)

SUBMITTED: Wednesday, November 22, 2006

Well i know a simple mistake will cause a domino effect in your checking account. But thats what the register is for. Its hard but a little time can avoid a lot of overdraft fees. Now you say that we process debit before credit no sorry we do the opposite credit befor debits. Now in situations like your were we pay things that post for thursday and then after that we process your auto credit for friday. So theres no way we can make your direct deposit available a day before its not possible. Thats why it may seem like we process debit before credit but we dont. Oh and 1 more thing we have 1# customers service . So remember this you attract more bees with honey be nice and everyone will be nice. any other questions write back.

#4 Author of original report

DID NOT KITE NOR FLOAT

AUTHOR: Lauren - (U.S.A.)

SUBMITTED: Wednesday, November 08, 2006

In reply to "If you spend it before you get it," while I acknowledge that our account had a low balance, do you think we deserve a $105 "insufficient funds fee" when - prior to that fee - we had $106.36 in the account and the SUBSEQUENT transaction was the posting of the direct deposit? WHAT BOUNCED? According to our statement, NOTHING BOUNCED. We should have had $106.36 in the account when the direct deposit was supposed to be posted. WE DIDN'T FLOAT ANYTHING.

It also took Wachovia Bank NINE (9) days to send anything on paper about this "insufficient funds fee," thus causing a nasty s****.>

I stand by my statement that Wachovia is opportunistic about their fees. Wachovia has been unable to give me a clear answer about this and I therefore filed this RipOff Report.

#3 Consumer Comment

No Kiting Here

AUTHOR: Cory - (U.S.A.)

SUBMITTED: Monday, November 06, 2006

"Kiting" is transferring funds from one empty account to another empty account, ie. "representing fictitious financial transactions used temporarily to sustain credit or raise money". With check 21, kiting and the 2 or 3 day float is just about gone. Some checks "hit" the bank within hours. The OP doesn't say HOW the transactions were made at 10 pm Thur. You would think that if it happened once or twice, she'd get the hint but she states that it has happened THREE times.

How about conducting the transactions FRIDAY MORNING? There is no FREE BANKING out there. Got an ad in the mail the other day. To get their "free" checking, you had to maintain a MINIMUM BALANCE of AT LEAST $2000. If you maintain a minimum balance of $2000 and get 5.5% interest, which they don't pay interest, that's about $110 per year interest or $9.17 per month. IF YOU GO UNDER $2000 at any time, they hit you with a $10 service charge. The real funny part was the first 50 people who signed up for their "free" checking get a TV/radio. At the end of the year they issue you a 1099 for it for $75. On top of all this BS is that they'll nickel and dime you to death for every other service you require.

#2 Consumer Suggestion

Kiting checks is against the law

AUTHOR: C - (U.S.A.)

SUBMITTED: Monday, November 06, 2006

Can't speak to your State laws, but every State I've ever heard of has "check kiting" laws. What is kiting? Writing checks before there is money in the account. Why should Wachovia not refer yopu to the local DA? Yea, I don;t have that answer either.

#1 Consumer Comment

If you spend it before you get it, of course there is a fee.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, November 06, 2006

If the transactions occured on Thursday and the direct deposit doesn't credit until Friday, you are spending money you don't have. Why do people have such a difficult time grasping that simple concept?

So the simple solution is, spend it after it gets credited to your account.

Advertisers above have met our

strict standards for business conduct.